Higher Report Introduction and Arguments Example

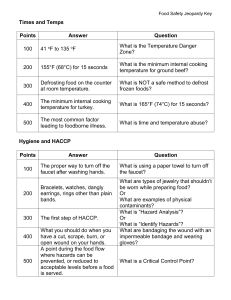

advertisement

Introduction I have chosen to investigate the issue of obesity in Scotland. This issue needs to be addressed at this time because there is a growing concern over obesity as many believe it is having a negative impact upon society. It is my belief that it causes a strain on health services and leads to premature death due to its association with severe chronic conditions such as diabetes. I also feel that in the current political climate and at a time when the Welfare State and NHS are undergoing changes, it is essential that such issues of public health do not fall out of the public eye. Scotland is known as the ‘sick man of the UK’ and I strongly believe that the Scottish Government should be doing more to rid us of that shameful title. By carrying out this assignment I hope to provide a practical and workable solution to the problem of obesity in Scotland. I have three suggested courses of action. My first suggested action is a tax on fatty foods and drinks. The world’s first so called ‘fat tax’ was introduced in Denmark in 2011 and foods containing over 2.3% saturated fats are subject to more charges. I want to propose this idea in Scotland. Like any proposal, I do foresee there being social and political implications with this idea. For example, economically it could be a regressive tax for many low income families and cause more financial strain. However, it could lead more people to make healthier choices overall. My second solution is free healthy school meals for all children. Currently in Scotland all children in P1-P3 are entitled to this but I propose that this should be extended to all children in education. Obviously this could have an enormous social impact as all children would be entitled a more balanced meal on a daily basis and in turn this could impact upon educational attainment. However, economically some would advise it’s not viable as many children may opt not to take the lunch. Finally, my final idea is to encourage the uptake of sport in schools and local areas. Again, in Denmark they have various school sports programmes as they believe it advances public health. I think Scottish people enjoy sports and this was demonstrated recently when the Commonwealth Games came to Glasgow and many people were inspired to get fit and healthy. Using the facilities that were created by the Commonwealth Games should be encouraged and economically it would mean that these arenas would be put to good use and those in the East End of Glasgow would benefit. However, this may be viewed as a step too far with government interventions and the individualist would argue that choice to exercise is a personal responsibility. 1. Tax on fatty foods and drinks There are various arguments for and against the introduction of a so-called “fat-tax” on foods which are high in substances such as fat, salt or sugar. It is of course widely recognised that obesity is at dangerous levels in the UK and so numerous analysts argue that if other harmful products such as cigarettes and tobacco can be taxed then why not tax harmful foods. (K) Arguments for introducing a fat tax Save money One argument in favour of introducing such a tax would be that it would save the government a significant amount of money. According to a recent article available on the website of Blackwell Synergy, obesity costs the UK government between £6.6 and £7.4 billion annually (reference) (K). The NHS produced its own figures estimating that in 2007 the cost of obesity to the UK economy was £15.8 billion per year, $4.2 billion of which was in costs to the NHS, 4% of the entire NHS budget (reference) (S). The Daily Mail estimates that if nothing is done, the cost to the taxpayer will be £50 billion per year by 2050 (reference). It is arguably unfair that the financial burden of treating and coping with obesity should be the responsibility of British taxpayers and that is why a separate “fat tax” should be introduced to compensate for this (A). Perhaps it is unfair that there are different standards for people who eat unhealthily and people who drink or smoke excessively. (A) Tax is imposed already on smokers and drinkers. Tobacco taxes raise £9.3 billion a year for the Treasury — more than three times the £2.7 billion which the NHS annually spends treating smoking-related diseases. (K) Alcohol taxes raise £8.3 billion a year, nearly three times the £3 billion annual cost of treating alcohol-related diseases (reference) (K). Therefore, perhaps a tax on certain foods will save the taxpayer money AND discourage citizens from indulging in foods they know are unhealthy (A). Arguments against introducing a fat tax Poorest suffer most A major argument against the tax however is that it would affect the poorest in society disproportionately. For various reasons, poorer people are more likely to eat fatty foods than those from more affluent backgrounds. Because foods which are high in fat, salt and sugar are often cheaper than fresh “healthy” food, they are often the most affordable option for families on a budget. A study by the Institute of Fiscal Studies in 2004 concluded that a tax similar to that now imposed in Denmark would cost the poorest 2 per cent of the population 0.7 per cent of their income. For the richest 10 per cent of the population, on the other hand, there would be virtually no impact (Institute of Fiscal Studies, 2004) (K). This is backed up by a survey I conducted in the East End of Glasgow, an area with deprivation rates much higher than the UK average (S). I asked 250 people whether they thought introducing a tax on fatty foods was a good idea. 75% of respondents said they disagreed with the proposed tax (reference). (K) It could therefore be argued that because a tax on unhealthy foods would penalise the poor it is unfair and against the principles of the welfare state (A). Perhaps it is wrong that the poorest in society should be taxed further. There are perhaps more worthwhile responses to the obesity epidemic in the UK which do not put more of a financial burden on the poorest in society (A).