Hale & Twomey Report

advertisement

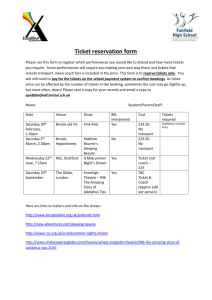

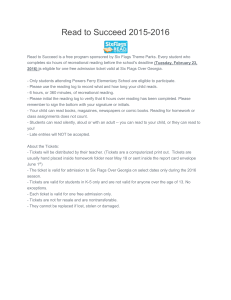

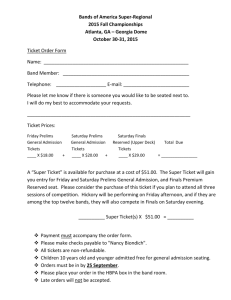

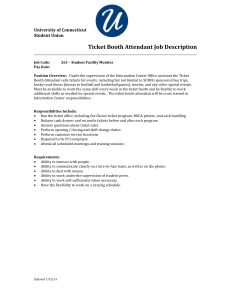

TICKET MARKET PRICING UPDATE Prepared for Department of Industry, Canberra 10 April 2014 This report was produced using data, forecasts and price information current at the time of writing (2014). It should be noted that these inputs are likely to change over time and users of this report should refer to report updates where available or consider the age of the report when reviewing the results presented. Hale & Twomey Limited is an energy consultancy specialising in strategic issues affecting the energy sector. With a comprehensive knowledge of local and international energy markets, we provide strategic advice, comprehensive analysis and services across the entire sector. Hale & Twomey prides itself on being able to analyse and interpret the detail, then translate the implications into strategic directions for our clients. We provide expertise to a broad range of companies and government departments. Hale & Twomey has established a strong reputation in the sector by producing timely, high quality, value-adding work. Authorship This document was written by: Ian Twomey ............... Phone: +64 4 471 1109, e-mail: ian@haletwomey.co.nz Please phone or e-mail for further information. A discussion was also held with Jon Swatton of Connect Oil to help inform the market update and the possible impact of Australia's volume on market prices. Connect Oil is a UK based company that brokers deals in the European ticket market. Jon's contact details are: Jon Swatton ............... Phone: +44 1865 338011, e-mail: jonswatton@connectoil.co.uk Disclaimer Hale & Twomey Limited, its contributors and employees shall not be liable for any loss or damage sustained by any person relying on this report, whatever the cause of such loss or damage. P +64 4 471 1155 F +64 4 471 1158 Level 14, St John House, 114 The Terrace, PO Box 10 444, Wellington 6143, New Zealand www.haletwomey.co.nz 1.0 Introduction In 2013 Hale & Twomey (H&T) provided a report on Ticket Markets to the Department of Industry (the Department)1. This followed an initial report in 2012 covering options for Australia to meet its International Energy Agency (IEA) stock holding commitment. The 2013 Report was written in July/August 2013 following a period of disruption in the ticket market due to changes in European Union (EU) compulsory stock regulations that were introduced at the end of 2012. Since that report was written the impact of the new regulations has worked through the market and, along with other developments, there has been some significant softening of ticket prices. Therefore the Department has asked H&T to provide an update on the ticket market and give an indication of the possible impact on the market if Australia was to attempt to fully cover its IEA stock requirement with tickets to ensure compliance2. 2.0 2013 Report A key assumption in the 2013 Report was that if Australia's ticket requirement is very large it will overwhelm the market and ultimately increase prices to the cost of building new tanks and holding stock over a long period. The prices shown in Table 1 were informed by ticket prices published by stock agencies and information provided by the New Zealand Government on levels seen in its 2012 and early 2013 tenders. Table 1: 2013 report ticket cost assumptions 2012 report 2013 Update (USD/tonne/month) (USD/tonne/month) Up to 300,000 tonnes 1.00-2.00 2.75 300,000-500,000 tonnes 3.50 3.50 500,000-1,000,000 5.50 5.50 1,000,000+ 7.50 (5.00-9.00) 9.00 Hale and Twomey report: Australia's Emergency Liquid Fuel Stockholding Update 2013: Ticket Markets was prepared for the then Department of Resources Energy and Tourism, Canberra 23 October 2013. This parent report provided a detailed description of ticket market definitions, operation and issues as well as case studies and considerations for policy makers which are not repeated in this short update on ticket market prices. 2 Ticketed stock (tickets) is the name given to a stockholding arrangement under which the seller agrees to hold (or reserve) an amount of oil on behalf of the buyer in return for an agreed fee. The buyer is purchasing an option to purchase physical oil that can only be exercised in an oil supply emergency declared by the International Energy Agency (IEA). The purchaser of the ticket gets the right to count the reserved stock as part of its IEA stockholding commitment, and the seller of the ticket does not count the stock in its commitment. Tickets were developed in Europe as a flexible way for companies to manage volatility in their compulsory stock obligations. 1 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 1 3.0 Ticket market update 3.1 Prices During the July - September 2013 period the ticket market was largely trading for tickets to cover the 4th quarter 2013 (October-December). Based on broker3 provided market data, between July and September crude tickets were trading in the USD2.00-3.00/tonne/month range in line with the base level assumption in the 2013 report. Product tickets were a little more expensive (petrol, jet and diesel) or at a similar level (fuel oil). Over the 4th quarter 2013 prices declined significantly with crude tickets dropping to the USD1.001.50/tonne/month range. This is shown in Figure 1, which charts the cost of securing crude tickets for the 1st quarter 2014 during the 3rd and 4th quarters of 2013. The reasons behind this drop are discussed in the next section. Figure 1: Crude oil ticket price trading level in 4Q 2013 In recent months some tickets (crude, fuel oil) have traded under USD1.00/tonne/month. At these levels some companies have indicated it is not worth their while to participate in the ticket market. 3.2 Market Changes Besides the market getting used to the new EU regulations, there were two significant market developments over this period. One was COVA, the Netherlands Stock Agency, usually a buyer of tickets, moved to sell 800-1,000 ktonnes of tickets for 4Q 2013/1Q 2014, and the other was the rise in use of the "Any Oil" ticket. The COVA ticket sale was in response to a significant decline in the Netherlands stock target (daily net imports) between 2012 and 2013. It would appear that COVA had purchased tickets assuming the target would be in line with previous years and then found with the decline it had a lot more stock than needed. This is an interesting example as it demonstrates how much price impact a volume change of up to 1 million tonnes can have on the market. Market advice is that COVA has not been a significant market presence in recent months (either as a buyer or seller) and we note Connect Oil (a UK based ticket broker) provides market data to the New Zealand Government and has agreed to the New Zealand Government sharing some historic data with the Australian Government. 3 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 2 that the IEA reports an increase in the Netherlands daily net import of 23.4% 4 between 2013 and 2014. This may mean COVA's seller status may have been a temporary occurrence. The other development, which is also part of the market adjusting to the new EU regulations, is the rise of the use of the "Any Oil"5 ticket. Unlike the IEA where the stock target only covers total stock, the EU regulations have stock requirements for individual product categories. Under the old regulations there were three main categories (gasoline, middle distillates (jet/diesel) and fuel oil) with crude stock able to be credited against those products based on deemed yields. Under the new regulations there are now 14 specific stock categories (listed in Appendix 1) and crude is no longer able credited as product using deemed yields. This has resulted in a lot more tickets now been traded as crude oil directly and a rise of a ticket known as “Any Oil” to cover the spread of different products. "Any Oil" is essentially any of the fourteen products on the list so it could be gasoline but it also could be fuel oil. Given that fuel oil is cheaper than gasoline, "Any Oil" tickets tend to use lower cost black products (e.g. fuel oil, bitumen, petroleum coke) for the stock. For bilateral trades between countries the product type needs to be stated but within countries this is not necessarily the case. Companies have realised that quite substantial stocks of products such as bitumen and petroleum coke can be used as part of their stock commitments. This has resulted in significant additional volume of stock able to be used for tickets trading as “Any Oil”. “Any Oil” also has a yield advantage over a crude oil ticket as it is counted as a product (positive yield) rather than crude (negative yield) in the IEA stock reporting. Some European countries do not consider "Any Oil" provides real security so do not allow their companies and stock agencies to purchase "Any Oil" tickets as part of their obligations. A smaller subset of these countries (e.g. Netherlands, Germany, Denmark, France, Sweden) either refuse or severely restrict their companies' ability to sell it to other countries. However the UK and Italy are large traders of "Any Oil" tickets which is having an impact on all ticket prices. As “Any Oil” is essentially a black product ticket, New Zealand has excluded “Any Oil” tickets from its tender as they provide limited energy security. Prior to the availability of the “Any Oil” ticket, New Zealand’s tenders have generally excluded fuel oil tickets for the same reason, as it is unrealistic to think that fuel oil would be shipped to New Zealand in a major supply disruption (in a previous tender a fuel oil ticket was secured but only in the same proportion to the total ticket stock as fuel oil’s share is of the total New Zealand demand). Excluding fuel oil and “Any Oil” tickets removes a source of low cost tickets for the tenderer. However, the availability of these tickets in the market has reduced the price of all tickets, particularly crude oil tickets which have a lower yield than product tickets (including "Any Oil") when reported in the IEA stock system. 4 IEA/SEQ(2014)1 Called Any Oil in the UK and Any Oil Products in Italy 5 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 3 4.0 Entry of Australia into the ticket market 4.1 Australia's stock requirement The IEA reports that Australia's current additional stock requirement is 2,296 ktcoe6 as at December 2013, but it is expected to increase to around 3,000 ktcoe when the new daily net import target is applied from 1 April 2014. In order to meet a 3,000 ktcoe of additional stock through tickets Australia would need to secure 3.5 million tonnes of crude tickets (slightly less if product tickets due to the yield difference). Australia's 2013 forecast had the requirement increasing to around 4,200 ktcoe by 2020 and 6,500 ktcoe by 2030. This volume is substantial and a different order of magnitude to that traded by other countries' stock agencies. As noted above COVA has traded up to 1,000 ktonnes of tickets, and before increasing physical storage the Irish Stock Agency, NORA, was buying around 700 ktonnes (it now buys around 200 ktonnes). The largest ticket volume New Zealand has secured has been 500 ktonnes, with the current volume around 200 ktonnes. To illustrate the scale of Australia’s requirement, the impact of one country supplying this volume is shown against three of the larger ticket sellers in the European market. Figure 2: Impact on key European countries if supplying Australia's current ticket requirement6 Host country 2013 Net daily impact (ktcoe) Reduction in days cover in host country if supplying Australia Netherlands 49.24 61 Spain 125.05 24 United Kingdom 65.04 46 Based on end December 2012 stocks, this reduction in days would make Spain non-compliant and while on an IEA measure it would not make Netherlands and the UK non-compliant, it is possible it would make them non-compliant against the EU targets they are required to meet. 4.2 New Zealand tender response The New Zealand Government has informed the Australian Government that responses to its tenders often have tiered pricing offers from companies. That means the tickets get more costly the more volume is taken. In its recent tender, New Zealand noted that if its volume requirement had been double, the cost of the second 200 ktonnes would have been about 33% higher than the cost of the tickets accepted. On average, the tickets not accepted were 50% more expensive than those accepted. Therefore even at moderate levels (volumes below 1,000 ktonnes) the volume required has a significant impact on cost of tickets. 6 Based on data from IEA/SEQ(2014)1 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 4 4.3 Possible market response If Australia aimed to become compliant with its IEA commitment against its new 2014 target using tickets, it would need between 3.2 and 3.5 million tonnes of ticket stock (depending on split between crude and product tickets). This will have a substantial impact on the market. The level of impact will be affected by whether Australia accepts "Any Oil" tickets. Some countries (e.g. the Netherlands) are likely to exclude this option anyway in the bilateral agreement as they don't allow their companies to sell "Any Oil". For this report we assume Australia follows New Zealand's position and either excludes "Any Oil" and Fuel oil, or puts a limit on it to match that component of its domestic energy supply (~4%)7. Based on discussions, the market would struggle to meet such a large incremental requirement if sought at one time. Certainly the prices would rise substantially from the current level. How much they would rise is uncertain but in the past ticket prices have traded in the USD5-10/tonne/month range (jet tickets are known to have traded at USD10/tonne/month). As with any market, there is likely to be a supply response to the new demand. Before covering this some background on the European petroleum market is required as Europe is likely to be the prime source of any ticket stock for Australia in the short to medium term. Petroleum demand in Europe has been falling for a number of years. Stock levels have also been falling although overall the days cover has been rising. The declining market has had a severe impact on refining profitability with many refineries closing and those still operating under significant financial pressure. As a result refineries have actively been reducing stock levels to the absolute minimum to keep costs down. This has resulted in a number of normal suppliers of ticket volumes having lower availabilities (the impact has been offset from the rise in volumes from "Any Oil" in terms of the overall market). At current levels, the income from selling tickets provides little incentive for companies to hold anything above minimum stock levels. However if ticket prices rise, particularly into the USD510/tonne/month range, then companies are likely to seriously consider holding more stock and selling tickets as an additional income stream (both refiners and traders) particularly if they secure relatively low cost financing for the stock cost. Therefore there is likely to be a balance between the additional demand and the supply response impacting on the resulting price level. The only non-European country that is currently an option for Australia to secure ticket stock is Japan8. Japanese companies have a high stock obligation so holding stock for another country means holding additional stock above their obligation. New Zealand has found only two companies in Japan have been prepared to do this to date and typically only at low volumes (<100 ktonnes). In the short to medium term it is unlikely that Japan will be a source of much volume to meet Australia's requirement although, as with Europe, a rise in the prices being paid could encourage more Japanese companies to get involved in the ticket market. 7 Based on 2012/13 demand data from the Australian Petroleum Statistics The other non-European IEA countries have been unwilling or unable to meet the requirements of a bilateral agreement with New Zealand (no impediment to releasing stock in an emergency) so we assume the same will be the case for Australia. 8 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 5 4.4 H&T updated pricing assumptions The market prices for tickets have declined since the last update in 2013. It is also likely with the rise of "Any Oil" volumes and the decline in COVA ticket purchases there is more volume available than previously assumed. Therefore the prices for moderate requirements (up to 1 million tonnes) are now lower that assumed in 2013. However the assumption that, with the ticket volume Australia requires (>3,000 million tonnes), the price will trend up to the equivalent cost of building tanks and holding stock is still reasonable. Over the period the 2013 Report analysed (to 2033), where Australia’s volume requirement is expected to grow to more than 7 million tonnes, this is definitely expected to be the case unless there is a substantial increase in countries participating in the ticket market. In the short to medium term, if Australia entered the market looking for 3 to 4 million tonnes it is likely that in time the volume will be available, although it will require a substantial increase in price to make the volume available (and it would make sense to build the volume over a period of a few years to give the market time to adjust). Based on the above discussion, H&T has updated its ticket price assumption. While informed by discussions with market participants, the prices are estimates of what is likely to happen in a dynamic and somewhat opaque market. The ticket market is also influenced by policy decision in individual IEA member countries and the European Commission on stockholding regulations and, for buyers outside the EU, the decisions by individual IEA member countries as to whether they allow their companies to sell tickets. The estimate is also based on an average of crude (40%) and product (60%) tickets as was done in the 2013 Report. As noted we assume Australia either excludes or restricts the volume of fuel oil and “Any Oil” tickets it accepts on energy security grounds. Table 2: Ticket cost estimate 2012 report 2013 Report 2014 Update (USD/tonne (USD/tonne (USD/tonne /month) /month) /month) Up to 300,000 tonnes 1.00-2.00 2.75 1.50 300,000-500,000 tonnes 3.50 3.50 1.50 500,000-1,000,000 5.50 5.50 3.00 1,000,000-1,500,000 7.50 9.00 5.00 1,500,000+ 7.50 (5.00-9.00) 9.00 7.50 (5.00-9.00) 4.5 Impact on total estimated costs The modelling used in the 2013 Report for the total cost of meeting IEA compliance using tickets built the expected cost up using tiered pricing, so the average cost of tickets increased with the volume requirement. This principle is also used for this update estimate (therefore if Australia required 2 million tonnes, the cost will be the average of the price tiers building up to 2 million tonnes, rather than assuming all tickets at USD7.50/tonne/month). Hale & Twomey: TICKET MARKET PRICING UPDATE Page 6 Table 3: Compliance cost estimate using 100% ticket stock for additional reserves 2014 target (3,000 ktcoe)9 2013 report assumptions Updated assumptions Cost in 2014 AUD 328 million AUD 239 million Cumulative cost from 2014 AUD 328 million AUD 239 million Ticket volume 3,258 ktonnes 3,258 ktonnes Average ticket cost USD7.55/tonne/month USD5.50/tonne/month 2020 target (4,177 ktcoe) 2013 report Updated assumptions Annual cost in 2020 AUD 481 million AUD 367 million Cumulative cost 2014 to 2020 AUD 2,672 million AUD 1,988 million Ticket volume 4,537 ktonnes 4,537 ktonnes Average ticket cost USD7.86/tonne/month USD6.07/tonne/month 2024 target (5,184 ktcoe) 2013 report Updated assumptions Annual cost in 2024 AUD 613 million AUD 476 million Cumulative cost 2014 to 2024 AUD 4,930 million AUD 3,732 million Ticket volume 5,630 ktonnes 5,630 ktonnes Average ticket cost USD9.07/tonne/month USD7.05/tonne/month Figure 3: Trend in annual cost The 2014 target of 3,000 ktcoe is updated from that used in the 2013 Report to match that currently being reported by the IEA, All other annual demand numbers are as in the 2013 Report. 9 Hale & Twomey: TICKET MARKET PRICING UPDATE Page 7 5.0 Summary The prices of tickets in the international ticket market have reduced since the 2013 Report was completed for the Department. This is due to a combination of factors including the market in Europe (the source of virtually all ticket stock) adjusting to new European Union regulations introduced in 2012; the Netherlands central stock agency reducing its ticket buying and for a period becoming a ticket seller; and the increase in availability of ticket stock through the development of an “Any Oil” ticket which as well as traditional products (petrol, jet fuel, diesel, fuel oil) allows tickets to be sold for products such as bitumen, petroleum coke and lubricants. The net effect is a drop in the market price of tickets of USD1.00-2.00/tonne/month between early 2013 and early 2014. The volumes required by Australia to fully meet its additional stock requirement through tickets are substantial. It is unrealistic to assume that these volumes are readily available at the current price levels. However if Australia entered the market, the potential for higher prices may result in a supply response as companies are encouraged to hold higher levels of stock in order to participate in the ticket market. How high a price signal is needed to provide that encouragement is uncertain but it is likely to be well above the current levels of around USD1.50/tonne/month (where some companies are choosing not to participate) and possibly into the USD5.0010.00/tonne/month range. Australia’s requirement is forecast to increase year on year so the market will need to continually develop more supply. The assumed rise in prices may be mitigated if more IEA countries were willing to consider entering the ticket market as sellers or if countries outside the IEA (possibly those closer to Australia) were able to participate in the market. Based on the updated price assumptions, the estimated cost for Australia’s compliance using 100% ticketed stock over the period 2014 through 2024 would be approximately $3.7 billion (24% less than calculated in the 2013 Report). Hale & Twomey: TICKET MARKET PRICING UPDATE Page 8 Appendix 1: List of EU Product Categories 10 — Ethane — LPG — Motor gasoline — Aviation gasoline — Gasoline-type jet fuel (naphtha-type jet fuel or JP4) — Kerosene-type jet fuel — Other kerosene — Gas/diesel oil (distillate fuel oil) — Fuel oil (high sulphur content and low sulphur content) EN 9.10.2009 Official Journal of the European Union L 265/15 — White spirit and SBP — Lubricants — Bitumen — Paraffin waxes — Petroleum coke 10 European Union Council Directive 2009/119/EC (Article 9) Hale & Twomey: TICKET MARKET PRICING UPDATE Page 9