3.02 Steps to Calculate Ending Inventory Using the Gross Profit

advertisement

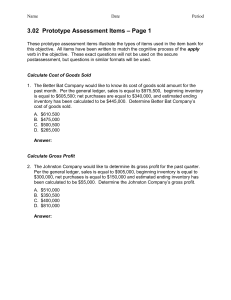

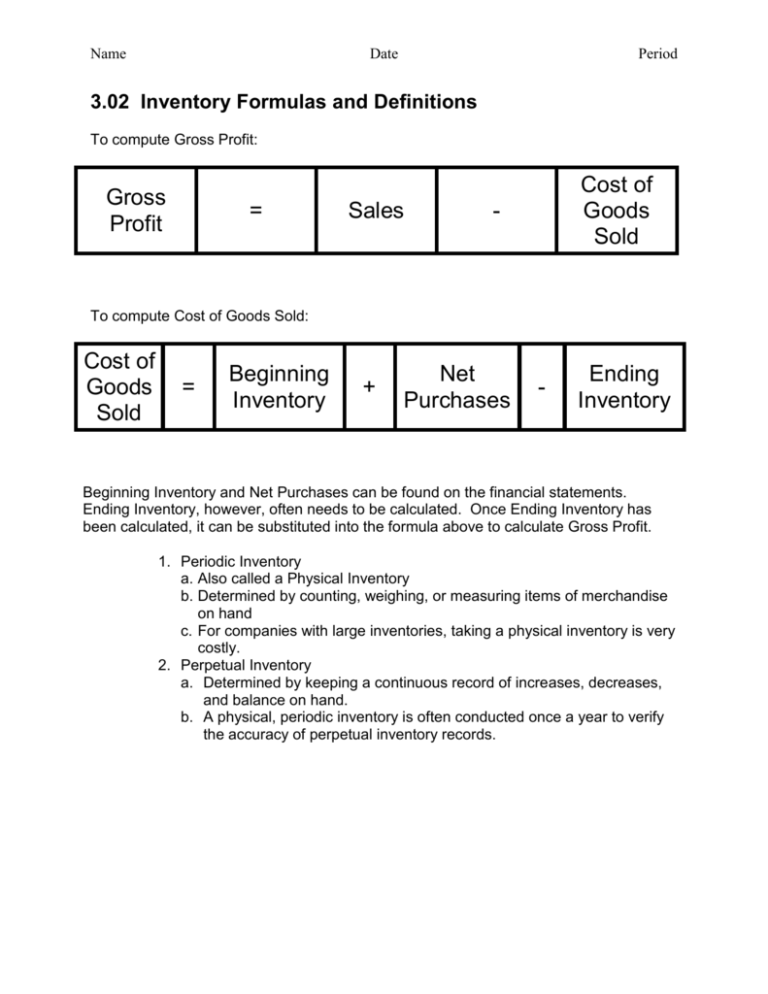

Name Date Period 3.02 Inventory Formulas and Definitions To compute Gross Profit: Gross Profit = Sales Cost of Goods Sold - To compute Cost of Goods Sold: Cost of Goods Sold = Beginning Inventory + Net Purchases - Ending Inventory Beginning Inventory and Net Purchases can be found on the financial statements. Ending Inventory, however, often needs to be calculated. Once Ending Inventory has been calculated, it can be substituted into the formula above to calculate Gross Profit. 1. Periodic Inventory a. Also called a Physical Inventory b. Determined by counting, weighing, or measuring items of merchandise on hand c. For companies with large inventories, taking a physical inventory is very costly. 2. Perpetual Inventory a. Determined by keeping a continuous record of increases, decreases, and balance on hand. b. A physical, periodic inventory is often conducted once a year to verify the accuracy of perpetual inventory records. Name Date Period 3.02 Steps to Calculate Ending Inventory Using the Gross Profit Method This method uses the percentage of gross profit to estimate the cost of the ending inventory for interim financial statements, or in situations where an ending inventory cannot be obtained (usually because of fire or theft). Gross Profit Method of Valuing Inventory Beginning Inventory, Jan 1 1 Plus: Net Purchases to Date 2 Equals: Merchandise Available for Sale Net Sales to Date 3 4 1 $ + $ $ Less: Estimated Gross Profit (Net Sales x Estimated Gross Profit ____) Less: Estimated Cost of Merchandise Sold (Net Sales to Date Less Estimated Gross Profit) Equals: Estimated Ending Inventory 5 6 7 $ To Calculate Ending Inventory under the GP Method: 1. List _________________________________________. 2. Determine ____________________________________. 3. Calculate _____________________________________. 4. Determine ____________________________________. 5. Calculate _____________________________________. 6. Calculate _________________________________________________________. 7. Calculate _____________________________________.