the unite group plc

advertisement

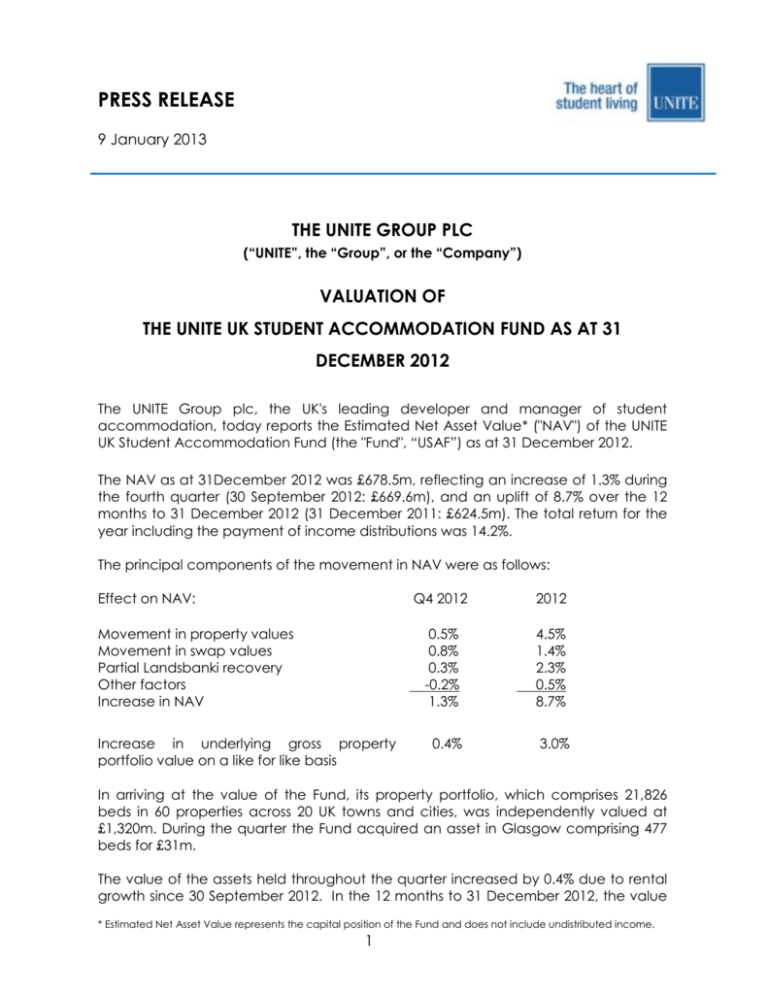

PRESS RELEASE 9 January 2013 THE UNITE GROUP PLC (“UNITE”, the “Group”, or the “Company”) VALUATION OF THE UNITE UK STUDENT ACCOMMODATION FUND AS AT 31 DECEMBER 2012 The UNITE Group plc, the UK's leading developer and manager of student accommodation, today reports the Estimated Net Asset Value* ("NAV") of the UNITE UK Student Accommodation Fund (the "Fund", “USAF”) as at 31 December 2012. The NAV as at 31December 2012 was £678.5m, reflecting an increase of 1.3% during the fourth quarter (30 September 2012: £669.6m), and an uplift of 8.7% over the 12 months to 31 December 2012 (31 December 2011: £624.5m). The total return for the year including the payment of income distributions was 14.2%. The principal components of the movement in NAV were as follows: Effect on NAV: Movement in property values Movement in swap values Partial Landsbanki recovery Other factors Increase in NAV Increase in underlying gross property portfolio value on a like for like basis Q4 2012 2012 0.5% 0.8% 0.3% -0.2% 1.3% 4.5% 1.4% 2.3% 0.5% 8.7% 0.4% 3.0% In arriving at the value of the Fund, its property portfolio, which comprises 21,826 beds in 60 properties across 20 UK towns and cities, was independently valued at £1,320m. During the quarter the Fund acquired an asset in Glasgow comprising 477 beds for £31m. The value of the assets held throughout the quarter increased by 0.4% due to rental growth since 30 September 2012. In the 12 months to 31 December 2012, the value * Estimated Net Asset Value represents the capital position of the Fund and does not include undistributed income. 1 of the property portfolio held by the Fund increased, on a like for like basis, by 3.0%, again driven principally by rental growth. The increase in the value of the property portfolio in the quarter, after taking account of lifecycle expenditure and gearing resulted in 0.5% growth in the NAV as outlined in the table above. Average valuation yields increased by 1bps during the quarter to 6.68%. In October, the Fund received a further payment of £1.76m from Landsbanki, representing the second instalment of repayment of the £30m deposit it placed with the bank in 2008. The Fund provided for the full amount of the deposit in 2008 and, therefore, the recovery added to the growth in NAV by 0.3% in the quarter. During 2012 the Fund received a total of £14.23m of cash from Landsbanki, adding 2.3% to the annual total return. Commenting on the Fund’s valuation, Joe Lister, UNITE’s Chief Financial Officer, said: “USAF has delivered another strong performance in 2012 with a total return of 14.2%. These consistently strong results, against a challenging economic backdrop, demonstrate the continued attractiveness of USAF and the student accommodation sector to UK and overseas investors.” ENDS For further information, please contact: The UNITE Group plc Joe Lister, Chief Financial Officer Paul Harris, Communications Director Sophie Joyce, Corporate Communications Tel: 0117 302 7004 FTI Consulting Stephanie Highett Dido Laurimore Faye Walters Tel: 020 7831 3113 About The UNITE Group The UNITE Group is the UK’s leading developer and manager of student accommodation, with a business model that focuses on two core areas: 1. Development and Asset Management: UNITE undertakes the acquisition, planning and development of purpose-built student accommodation in the UK. Through the continuous assessment of quality and location of its investment portfolio, UNITE is well positioned to deliver value-adding strategies to those assets where further opportunities are identified. Working on behalf of its partners, UNITE acts as Fund Manager for the UNITE UK Student Accommodation Fund in which it owns a 16.3% share. UNITE also manages a number of Joint Venture partnerships. 2 2. Professional property management: UNITE is home to 42,000 students in over 130 properties across 23 of the UK’s strongest university cities, and has consistently proven high occupancy levels across its portfolio. The Group works closely with higher education institutions in order to deliver high quality, well-located student accommodation at affordable prices in strong higher education markets. In 2012 UNITE won the South West Business in the Community Carbon Reduction Award for its environmental initiatives and the Global Real Estate Sustainability Benchmark (GRESB) named UNITE as a regional sector leader for sustainability. Founded in 1991, UNITE is a FTSE 250 company listed on the London Stock Exchange (UTG). For more information, please visit www.unite-group.co.uk or www.unitestudents.com. 2