Manual

advertisement

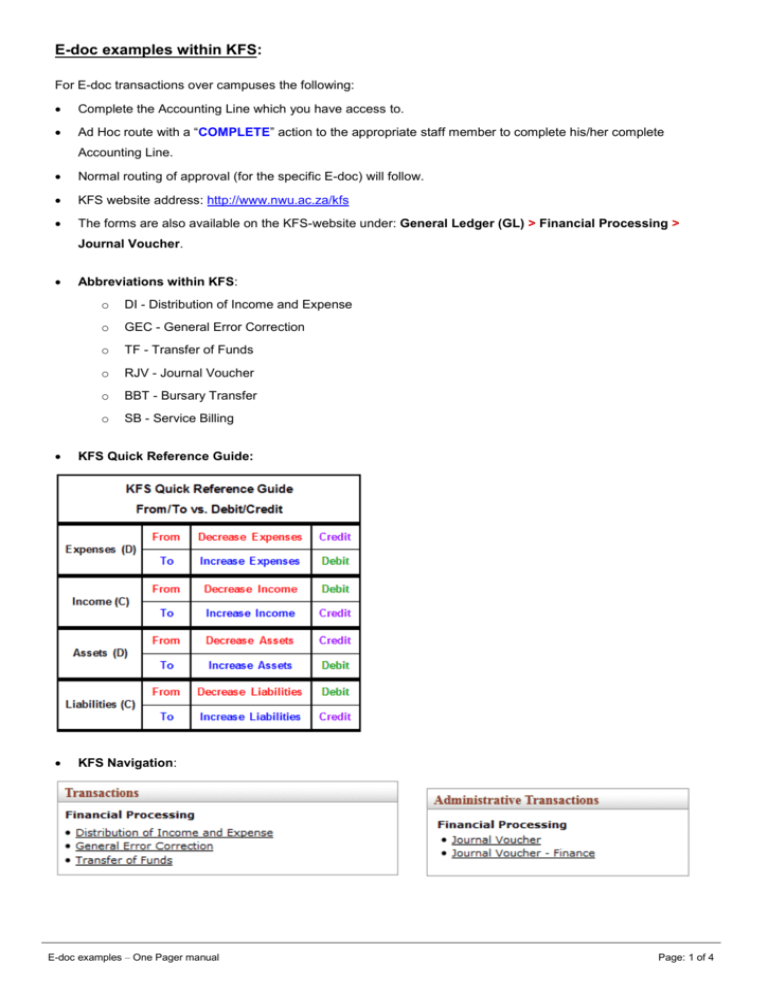

E-doc examples within KFS: For E-doc transactions over campuses the following: Complete the Accounting Line which you have access to. Ad Hoc route with a “COMPLETE” action to the appropriate staff member to complete his/her complete Accounting Line. Normal routing of approval (for the specific E-doc) will follow. KFS website address: http://www.nwu.ac.za/kfs The forms are also available on the KFS-website under: General Ledger (GL) > Financial Processing > Journal Voucher. Abbreviations within KFS: o DI - Distribution of Income and Expense o GEC - General Error Correction o TF - Transfer of Funds o RJV - Journal Voucher o BBT - Bursary Transfer o SB - Service Billing KFS Quick Reference Guide: KFS Navigation: E-doc examples – One Pager manual Page: 1 of 4 Example: Type of E-doc within KFS: 1 Staff Development Fund RJV 2 Facilities RJV 3 Bank Reconciliation RJV 4 Printing work done by another department and paid on your DI JV - Finance (complete the Funds behalf. 5 Corrections of receipts in another Financial year. The Transfer Journal Request – object type corrections must be made on the designated funds. FB form and sent the original signed form back to Tanja Badenhorst) 6 Salary corrections Contact HR (Complete the GL Payroll Journal Request form and send it back to Mthobisi Baloyi) 7 Overspending corrections TF 8 Control account journals RJV 9 Attorney collection journals RJV 10 Expenses paid out of the wrong Object or Account, for GEC (Detail Report as reference) TF BBT (use a bursary transfer to the example: 11 Refreshments (2852) instead of Entertainment (2851) Account A paid for the expense instead of Account B Account A paid partly for a computer (Asset) purchase against Account B. Remember to complete the asset information! 12 Move bursary expenses paid from Account A to Account B, because the budget reflects on Account B. 13 If you make a contribution for Bursaries. Account A reflects only Designated Funds; you need to Bursary office) TF JV - Finance (complete the Funds journalize the amount to Account B so that Account A is Transfer Journal Request - object type zero (0) but should not be closed. FB form and sent the original signed form back to Tanja Badenhorst) 14 An expense is paid from the correct Account, but the GEC (Ad Hoc route with a “COMPLETE” wrong object code was used, so it must be corrected, action to André Fourie to complete the but VAT is involved OR there could be a correction VAT line on your behalf) between two (2) accounts with different VAT rules. When you need to correct only the VAT amount on an RJV (Ad hoc route with a “COMPLETE” action to André Fourie to complete the asset for example, object code 4104, but not the asset. VAT line on your behalf) 15 Donation funds should be transferred from Account A to TF Account B to use for specific projects. E-doc examples – One Pager manual Page: 2 of 4 16 Account A (VTC) paid for an expense, but the expense should have been paid out of Account B (PC). 17 Account A incurred expenses on behalf of Account B due to action to the staff member on the PC) the fact that Account B was not created at that stage. 18 How do we pay for internal services, for example GEC (Ad Hoc route with a “COMPLETE” GEC (Ad Hoc route with a “COMPLETE” action to the responsible staff member) SB TF (Remember that funds cannot be psychometric tests for interviews OR 19 If a VTC staff member attend a course in PC. Account A is overspend; you need to correct the overspending on Account A from Account B. transferred from a SOF 1 to a 3, but you can transfer from SOF 3 to a 1) 20 Expenses incurred in Account A (SOF 1), but a portion of RJV the expenses was paid by someone else for example the Chamber. We have to invoice the Chamber, but we cannot invoice from a SOF 1, so the Invoice can be captured in SOF 3 Account and when the amount was paid, should the amount be offset against the income towards the expense. 21 Skills Development funds for staff members. DI 22 Reimbursement of postage from one Account to another DI DI DI Account. 23 Half-year journals for example, Replacement Provision Expense (Jan-Jun 2015). 24 The purchase of air tickets for a professor against the Deans funds, but should be against the ITUN-Account. 25 Contributions made regarding a prestige function. DI 26 To close-off one Account to another Account. DI for expenses and income GL Payroll Journal Request form for salaries. Journal Voucher Finance for internal interest and reserves. 27 ITEA - Claim form for ITEA funds (object 2804) code 2804) IREA - Awards (object 2804) 28 Transfer seed funding to a specific staff member for DI (funds must be received on object TF attending a conference/seminar. 29 Transfer funds for Post-Doctoral awards. TF 30 Payment for Top Lecturer’s Award marketing process. TF 31 Transfer funds from Deputy Vice-Chancellor research for TF RJV example to a professor for innovation. 32 To correct a receipt received against the income object E-doc examples – One Pager manual Page: 3 of 4 6003 to the correct expense object, for example object 2053. 33 Payment of a Director’s credit card for expenses incurred. RJV 34 Petty cash closure. RJV 35 To finalize an advance, where the reimbursement voucher RJV GEC cannot be used. 36 A Service Billing was created and the Status shows “Final”, but the Service Billing should no longer occur. E-doc examples – One Pager manual Page: 4 of 4