Land Development Grant Program - Municipal District of Opportunity

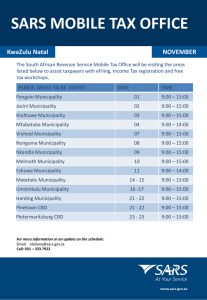

advertisement

M.D. of Opportunity No. 17 LAND POLICY TITLE: LAND DEVELOPMENT GRANT PROGRAM EFFECTIVE DATE: MARCH 25, 2015 POLICY NUMBER: L.7 Purpose of Policy: The purpose of this Policy is to establish the Land Development Grant Program (“the Program”) in order to encourage the subdivision, servicing and improvement of raw / vacant land in the M.D. and increase the number of lots that can be sold on the open market for residential, commercial and industrial land uses. POLICY STATEMENTS: The Municipal District of Opportunity No. 17 (“the Municipality”) is committed to encouraging low, medium and high density residential, commercial and industrial development within the hamlets of the Municipality to accommodate future balanced growth. To this end, Council has established a Land Development Grant Program for new land development projects to encourage the subdivision, servicing and improvement of raw / vacant lands into buildable and saleable lots for residential, commercial and industrial land uses. 1. Application Area, Effective Date and Program Timeline a) This Program applies to all projects proposing to develop raw and/or vacant land located within a hamlet of the Municipality that can be rezoned for residential, commercial or industrial purposes in accordance with the Municipality's Land Use Bylaw. b) For the purpose of this Program, the definition of “raw / vacant land” specifies the following: (i) Raw Land – Any land in its natural state with no man-made improvements including survey and infrastructure, such as municipal water and sewer mains, roads, and franchise utilities. (ii) Vacant Land – Any parcel of land that requires further man-made improvements, such as subdivision, servicing and/or utilities, in order to become saleable lots on the open market. | MD of Opportunity No. 17 – March 25, 2015 1 Land Policy – Land Development Grant Program (L.5) 2. c) For the purpose of this Program, the land tax rate includes the total municipal, school, seniors and housing portions of the tax rate. The total tax rates for residential and non-residential lands are set by Council on yearly basis. d) This Program becomes effective upon approval by Council. e) Once approved, the Program shall run for an initial four (4) year period for application submissions. At the end of the four-year trial period, Administration shall evaluate the overall effectiveness of the Program and report its findings to Council. Council can then determine whether to continue the Program. f) All Program funding is subject to Council approval within the Municipality's operating budget and all applications for grants shall be processed on a first come, first serve basis subject to the availability of funding as approved by Council. Eligibility a) The grant outlined in this Policy is effective and eligible to developers proposing new land development projects after the date on which this Policy comes into effect. b) To be eligible for grant approval, the applicant must propose to subdivide from a raw / vacant land, and enter into a development agreement with the Municipality. The subdivision, servicing and local improvements to be planned and constructed per the development agreement must result in at minimum five (5) new serviced and buildable lots ready to be sold in open market for residential, commercial or industrial purposes. c) The subdivision, servicing and local improvements work must all comply with all planning and development regulations, including the Municipality’s Design Guidelines and Construction Standards, any relevant policy or statutory plan which applies to the area, the Land Use Bylaw and other relevant bylaws. Applicants will be responsible for securing all required permits, and all work must comply with all applicable Provincial and Federal legislations. d) Specific requirements of subdivision, servicing and local improvements shall be defined in the development agreement between the Municipality and the developer. Under this Program, the following general definitions shall apply: (i) Subdivision shall include any required re-zoning, adoption of new bylaws, utility right-of-way planning, and the surveying and | MD of Opportunity No. 17 – March 25, 2015 2 Land Policy – Land Development Grant Program (L.5) registration as outlined in the Municipal Government Act R.S.A. 2000, c. M-26, as amended, Subdivision and Development Regulations AR 43/2002; (ii) Servicing shall include the provision of municipal water and sewer servicing to private lot boundaries, franchise utilities, and registration of utility right-of-ways required by these services; and (iii) Local improvements shall include, but are not limited to any public and private roads and accesses required to access the lots, stormwater management systems, water and sewer systems and franchise utilities within private and public properties, and all other specifications required by the Municipality. e) The Program is limited to one grant application per land development project. f) The applicant must be the registered property owner, and/or his or her designate, of the final completed lots. g) The Municipality shall inform all eligible land development project proponents that they are eligible to apply for a grant under this Program. The applicant will only be eligible to receive the grant once the Municipality has received verification that the servicing and local improvements have been completed to the Municipality's satisfaction per the development agreement, and have paid the current tax year’s outstanding land tax balance. The Municipality reserves the right to consider grant applications from applicants with outstanding arrears. Grant funding will be applied to outstanding payments prior to issuance. h) All land development projects approved under this Program must be completed in a timely manner. All projects must be completed within thirtysix (36) months of the approval of project proposal by the Council. Failure to complete the project in a timely manner will result in cancellation of the application under this Program at the discretion of the Municipality. i) Applicants must be in good standing with the Municipality in order to qualify under this Program. Applicants that have outstanding utilities and taxes, including tax arrears, may not qualify for this Program at the discretion of the Municipality. Applicants with any litigation with the Municipality will not qualify for this Program. j) The applicant is not eligible for a grant under this Program if they have already been approved for a Subdivision Grant under the L.2 – Subsidized Subdivision Grant Program. Conversely all applicants approved under this Program shall not be eligible to apply for a Subdivision Grant. | MD of Opportunity No. 17 – March 25, 2015 3 Land Policy – Land Development Grant Program (L.5) 3. 4. k) All contractors must be licensed by the Province of Alberta. l) Grants will be awarded to the original applicant/developer and will not be awarded to subsequent land owners. Land Development Grant a) The applicant shall apply for the land development grant upon signing of a development agreement between the applicant and the Municipality. b) All applications must be reviewed by Council for approval. c) The grant is a onetime payment made to the developer, and shall be 100% of the total increase in tax assessment as the result of all improvements made to the raw lands. d) If application is approved by Council, the grant shall be paid in the same tax assessment year, and upon the receipt of the total tax payment outstanding for that year. e) Grants will be awarded upon the receipt of a construction completion certificate as defined in the development agreement. Application Requirements a) Applications submitted under this Program must include the following components: (i) A project proposal for a residential, commercial or industrial subdivision specifying the zoning and land use; (ii) A detailed written explanation, with plans/drawings, of the proposed subdivision showing lot lines, roads, servicing and utilities; (iii) A detailed list of work planned, and a complete timeline; (iv) The legal description of the property and legal name of the developer; (v) Any additional information the Chief Administrative Officer may reasonably require. | MD of Opportunity No. 17 – March 25, 2015 4 Land Policy – Land Development Grant Program (L.5) 5. 6. Application Process a) In conjunction with or prior to filing an application, the applicant shall review this Policy and consult with the Lands, Planning and Development Department regarding the application process, requirements, criteria, rules of eligibility, project design and other relevant details of the proposed project. b) In order to ensure adequate, consistent review and evaluation, the project proposal shall be prepared in accordance with the format established by the Chief Administrative Officer. c) Applications for grants under the Program will be accepted throughout each calendar year subject to available funding for the Program. Complete applications shall be submitted to the Municipality’s Lands, Planning and Development Department. d) The Municipality reserves the right to accept, reject or modify any application and render decisions in regards to complete applications as approvals, approvals with conditions, and refusals. General Program Conditions a) The general conditions and requirements of the Program are not necessarily exhaustive and the Municipality reserves the right to include other conditions, considerations and requirements as deemed necessary on a property specific basis. All grant pursuant to this Program are subject to the following general conditions and requirements: (i) If an applicant is in default of any of the Program’s requirements or conditions, or any other requirement of the Municipality, the Municipality may delay, reduce or terminate an approved grant; (ii) The Municipality may discontinue the Program at any time but applicants with approved applications but unpaid grant will receive the said grant, subject to meeting the Program’s conditions and requirements, for that tax assessment year; (iii) The Municipality may inspect the property that is subject to an application under this Program at any time; (iv) Outstanding work orders, and/or orders or requests to comply, and/or other charges from the Municipality must be satisfactorily addressed prior to any grant being issued at any time; and | MD of Opportunity No. 17 – March 25, 2015 5 Land Policy – Land Development Grant Program (L.5) (v) 7. If the post-development tax assessment is appealed by any party for the properties that are the subject of an application under this Program and the post-development tax assessment is reduced, the Municipality will recalculate payments made to the applicant that were based on the higher assessment and any overpayment shall be repaid to the Municipality by the applicant. Responsibilities a) b) c) Council (i) Approves changes to this Program and Policy; (ii) Approves Program funding for implementation of this Program; and (iii) Evaluates the Program upon completion. Chief Administrative Officer (i) Recommends to Council the application of this Program; (ii) Recommends to Council the Program funding for implementation of the Program; (iii) Recommends changes to the Program to Council; (iv) Provides administrative evaluation of the Program upon completion; (v) Identifies a funding source for the recommendations to Council accordingly; (vi) Renders decisions regarding the approval, approval with conditions or refusal of grant applications pursuant to this Program; (vii) Administers the funding source; and (viii) May delegate the Chief Administrative Officer’s authority under this Policy as deemed appropriate. Program and makes The Lands, Planning and Development Department (i) Recommends to the Chief Administrative Officer the Program funding for implementation of the Program; (ii) Recommends changes to the Program to the Chief Administrative Officer; | MD of Opportunity No. 17 – March 25, 2015 6 Land Policy – Land Development Grant Program (L.5) 8. (iii) Recommends a funding source for the Program to the Chief Administrative Officer; (iv) Evaluates the Program annually, provides reports to the Chief Administrative Officer regarding its performance and makes appropriate recommendations regarding its ongoing implementation; (v) Serves as the Municipality’s contact for receipt of applications for Program grants issued pursuant to this Program; (vi) Evaluates applications for completeness; (vii) Coordinates the administrative review of applications throughout the period between submission of the application and project completion; (viii) Prepares a written report to the Chief Administrative Officer on each application with a recommendation to approve, conditionally approve or refuse an application; and (ix) Conducts on-site pre-construction, post-construction and periodic inspections of the subject project. Measurements for Program Effectiveness a) In order to measure the effectiveness of the Program at the end of the four-year trial period, the Municipality shall establish starting benchmarks and final evaluation criteria which may include such measurements as: (i) 2015 baseline figures; (ii) Assessment impacts upon the Municipality; (iii) Review of the number of serviced and saleable residential, commercial and industrial lots created through participation in the Program; and (iv) Review of new employment opportunities created through the Program. | MD of Opportunity No. 17 – March 25, 2015 7 Land Policy – Land Development Grant Program (L.5) SCHEDULE "A" EXAMPLES Scenario 1: A developer proposes to develop 10 industrial one-acre lots within a quarter section adjacent to a municipal road with water and sewer mains. Zoning is M1 – Industrial District, and non-residential land tax rate is 2.44%*. Raw land assessment is $20,000/acre, therefore total annual tax for 10 acres of this raw land is $4,880. Developer is on a 3-year timeline to develop, but must continue to pay for annual taxes during these 3 years. Development was completed in October 2018. The lands were reassessed by June 2019, at $200,000/acre, for total annual tax of $48,000 for 10 acres. Eligible grant amount is $48,000 - $4,800 = $44,000. Scenario 2: A developer proposes to develop 30 residential 0.5-acre lots, for total of 15 acres, within a raw land adjacent to a municipal road with water and sewer mains. Zoning is currently UR – Urban Reserve District, but will be rezoned to R1A – Residential District. Residential land tax rate is 0.53%, with annual minimum of $400*. Raw land assessment is $1,000/acre, therefore total annual tax rate for 15 acres of this raw land is $440.50. Developer is on a 3-year timeline to develop, but must continue to pay for annual taxes during these 3 years. Development was completed in April 2018. The lands were reassessed by June 2018, at $60,000/acre, for total annual tax of $4,770 for 15 acres. Eligible grant amount is $4,770 - $440.50 = $4,329.50. * Based on the 2014 land tax rate as approved by Council. Table: Land Development Grant Examples Scenario Tax Rate No. 1 Industrial = 2.44% 2 Residential = 0.53%, minimum $400 Raw land (predevelopment) market value Area to be developed by applicant Total predevelopment land tax $20,000 / acre 10 acres $4,880 $200,000 / acre $48,800 $43,920.00 15 acres $440.50 $60,000 / acre $4,770 $4,329.50 $1,000 / acre Postdevelopment market land value Total postdevelopment land tax Total grant amount APPROVED: March 25, 2015 – MOTION 0215-2015-17MDC | MD of Opportunity No. 17 – March 25, 2015 8