MS Word - Securities Commission of Malaysia

advertisement

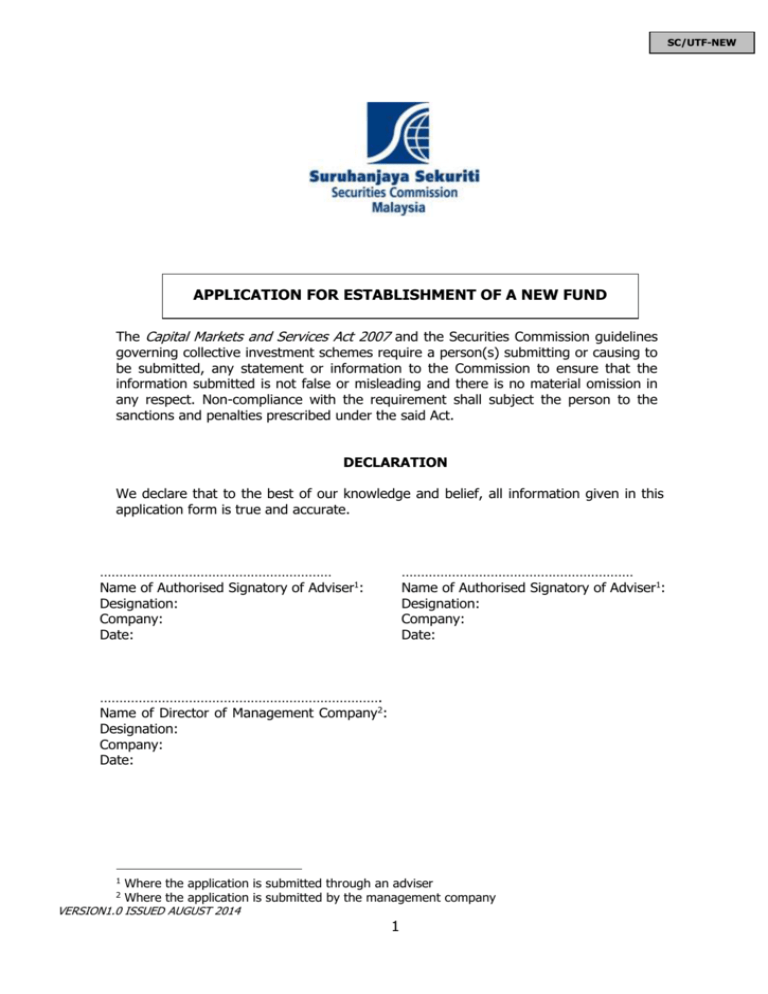

SC/UTF-NEW APPLICATION FOR ESTABLISHMENT OF A NEW FUND The Capital Markets and Services Act 2007 and the Securities Commission guidelines governing collective investment schemes require a person(s) submitting or causing to be submitted, any statement or information to the Commission to ensure that the information submitted is not false or misleading and there is no material omission in any respect. Non-compliance with the requirement shall subject the person to the sanctions and penalties prescribed under the said Act. DECLARATION We declare that to the best of our knowledge and belief, all information given in this application form is true and accurate. …………………………………………………… Name of Authorised Signatory of Adviser1: Designation: Company: Date: …………………………………………………… Name of Authorised Signatory of Adviser1: Designation: Company: Date: ………………………………………………………………. Name of Director of Management Company2: Designation: Company: Date: 1 Where the application is submitted through an adviser Where the application is submitted by the management company VERSION1.0 ISSUED AUGUST 2014 2 1 SC/UTF-NEW A. General (1) Details of the Management Company Management Company (1) Name of company (2) Company registration no. (3) Capital Markets Services Licence Date of issue Date of anniversary (2) Note 1 Details of the Trustee Trustee (1) Name of company (2) Company registration no. (3) Registration status Date of registration Date of expiry (3) Is the trustee a related-party trustee Note 2 Yes No ? B. Fund Management Function (1) Will the fund management function be delegated? Yes (2) No Please provide details of the personnel performing the fund management function. Designated Fund Manager Note 3 (i) Name (ii) Capital Markets Services Representative’s Licence Note 4 Date of issue Date of anniversary VERSION1.0 ISSUED AUGUST 2014 2 Note 1 SC/UTF-NEW (3) Where the fund management function of any portion of the proposed fund is being delegated Note 5, please provide details of the fund management company and the personnel responsible for managing the proposed fund. Delegate - Fund Management Company (1) Name of company (2) Date of incorporation (3) Registration no. (4) Capital Markets Services Licence Date of issue Date of anniversary (5) Note 1 Portfolio being delegated Note 6 Designated Fund Manager Note 4 (1) Name of person (2) Capital Markets Services Representative’s Licence Date of issue Date of anniversary C. Features of the Proposed Fund Fund Information (1) Name of fund Note 7 (2) Fund category (3) Fund type (4) Investment objective (5) Investment strategy Note 9 (6) Asset allocation (in percentage) (7) Performance benchmark (8) Income distribution policy and mode of distribution Note 10 (9) Distinctive / special feature Note 11 Note 8 Note 9 VERSION1.0 ISSUED AUGUST 2014 3 Note 1 SC/UTF-NEW Fees and Charges (10) Sales charge (11) Redemption charge (12) Management fee (13) Trustee fee (14) Other fees, if any General Information (15) Initial offer price (16) Initial offer period (17) Investor profile C. Additional Information (1) Please provide any other pertinent information not specifically requested in this form to support the application Note 12. Instructions 1. Please fill up one application form for each fund. 2. Please tick ( ) in the relevant boxes, where appropriate. 3. If a section is not applicable, please state “N/A” in the space provided. 4. If the space provided is insufficient for your requirements, please continue on a separate sheet of paper. Please indicate which section your additional information relates to. 5. If the proposed fund has multiple classes of units, please provide the name and features of each class of units on a separate sheet of paper. In addition, please submit a declaration by the management company that it has the capacity to manage and administer multiple classes of units for a unit trust fund. VERSION1.0 ISSUED AUGUST 2014 4 SC/UTF-NEW Notes 1. Please insert the date for submission of the Anniversary Reporting for Authorisation of Activity (“ARAA”) as required under the Licensing Handbook. 2. A “related-party trustee” is a person referred to under Section 290(1)(a) to (c) of the CMSA. A separate application must be made for approval of the appointment of a related-party trustee (refer to Guidelines on the Appointment of a Related-party Trustee). 3. Please note that a management company should appoint an individual as a designated person responsible for the fund management function of the proposed fund, whether the function is undertaken internally within the management company or externally. 4. Please insert name as per NRIC, or passport (for foreign nationals). 5. Where the fund management function is delegated to a person not licensed by the SC, please submit an application to appoint such delegates as required under the Guidelines on Unit Trust Funds and fill the relevant items. 6. Please describe the portfolio being delegated, e.g. entire fund portfolio, equity portfolio. 7. Please explain the meaning of the fund name chosen if it is not self-explanatory. 8. Please comply with the following (where applicable): 9. If the proposed fund is an Umbrella Fund or sub-fund of an Umbrella Fund, please submit application forms for the Umbrella Fund and each of the sub-funds. For the Umbrella Fund, only relevant information needs to be filled up in the application form. Additionally, the application forms for the sub-funds must clearly state under item 1 of Section C which Umbrella Fund it belongs to; If the proposed fund is a Feeder Fund, please attach detailed information of the target fund (item 1-14 of Section C) on a separate sheet of paper and a copy of the target fund’s offering document (e.g. prospectus, information memorandum); and If the proposed fund is a Guaranteed Fund, please attach an independent legal opinion on the enforceability of the guarantee by the trustee. Please state the investment strategy and asset allocation of the proposed fund to achieve the stated investment objective. Sufficient detail should be provided on the characteristics of the investments proposed including any distinctive or special feature or risk profile. For example, where there are proposed investments in derivatives, sufficient detail should be provided on the underlying of the derivatives and the impact on the fund’s volatility. 10. Please state the income distribution policy (eg. incidental, annual) and mode of distribution (ie. cash or reinvested into additional units) of the proposed fund. 11. Please state any distinctive or special feature of the proposed fund in terms of its structure, limitation of investors’ rights or liabilities, limited offer period, fixed maturity of fund, special fees/charges or any other features that may reasonably be expected to have a material impact on investors. 12. Pertinent information would include if there is a viable size for the proposed fund. VERSION1.0 ISSUED AUGUST 2014 5