Economic Impact

advertisement

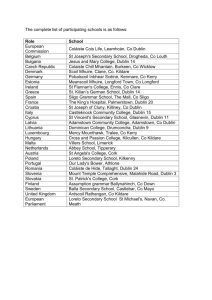

Dun Laoghaire Cruise Berth Facility – An Bord Pleanala Submission - August 2015 Economic Impact 1. Need There is no need for a second cruise berth in Dublin Bay. While there is business and even potentially a growing business in a highly competitive market, there is not sufficient business to support two viable competing multi million euro cruise liner hubs in the Dublin region in such close proximity for just a 22 week cruise season (about 150 days). The concentration in up to 50% of cruise ship calls in only one month (August) creates a material risk of lost business for Dun Laoghaire if these ships go directly to Dublin, particularly in adverse weather conditions. The EIS does not present any sustainable business case to spend in excess of €18 million on a Cruise berth in Dun Laoghaire when Dublin Port already has approval for a state of the art facility as part of its €230 million Alexandra Basin Development. Dublin Port will be capable of accommodating all currently projected capacity per the DKM report for the next 20 years. This proposal is in clear breach of the criteria set out in Section 37A(2)of the Planning & Development Acts 2000 in terms of regional importance where another similar development in such close proximity to Dun Laoghaire has already been granted planning permission. Dun Laoghaire is designated as a Tier 3 Port in the National Ports Policy (NPP) 2012, along with Drogheda, Galway, New Ross & Wicklow, and specifically designated as a marine leisure harbour – see extract from NPP attached. The entire Dublin region is just one Port of Call for these ships on a normal cruise itinerary of 7-10 Ports of Call. Dublin, just like any other main city, is competing for this worldwide cruise traffic as a single region. An average of just seven cruise ships has visited Dun Laoghaire Harbour each year over the last 3 years (2012 – 2015). That is no economic basis for an investment of Government Funds of €18 million. This “Build it and they will come” philosophy is dead in Ireland in 2015. 2. Impact of Dublin Port Cruise Facility on Dun Laoghaire Dublin Port is the primary port in the Dublin region. The NPP policy is very clear on that. Dublin Port has secured planning permission in July 2015 for a €230 million Alexander Basis Development (ABD) & extension of the Dublin port facilities to include 3 kilometres of new quay walls to accommodate all types of cruise and commercial shipping. This includes specifically a dedicated berth for Cruise ships capable of taking up to 5 ships together with “state of the art” shore side facilities to enhance the passenger experience. It is to be located beside the 3 Arena, the Point Depot and the planned Point Depot shopping centre. It is within easy walking distance, taxi and LUAS ride of Dublin City Centre. Passengers want to visit Dublin City Centre’s attractions and excursions, including Dublin’s retail offerings in Grafton Street, Henry Street and the Department Stores . Dublin Port is capable of meeting Cruise Industry Standards in 2015 and beyond and can simultaneously accommodate two or more of these new generation 65m high, 340m long (and 380m long) cruise ships with ease, without affecting the other uses and users of the Port. 1 Dublin (Dublin Port and Dun Laoghaire) is just a small player in the Port of Calls for the Cruise Business market. Establishing a presence on cruise itineraries is an enormous task for new entrants. Liverpool is just 50 miles away. Competition is intense. Expansion is a long and slow process. Dun Laoghaire is proposing nebulous off season (October – April) usage for this expensive infrastructure, including helicopter landing, RNLI Lifeboat drop off and berthing for visiting Navy ships and Tall Ships. Dublin Port’s plans is to use (and reuse) the cruise berth infrastructure for other year round commercial shipping uses Dun Laoghaire is not Dublin City Centre – Dun Laoghaire is not the preferred Port of Call for these cruise ships. It is too far from Dublin City centre. Passengers with limited time do not want to land in Dun Laoghaire and spend two hours, in rush hour traffic, commuting into and out of Dublin City. Restrictions in Dun Laoghaire Harbour - These commercial and competitive realities must be reconciled with the significant number of engineering and physical restrictions to be encountered by the cruise ships accessing the narrow harbour mouth at Dun Laoghaire. There are restrictions on these enormous ships manoeuvring in the bay and in the harbour area. Restrictions caused by the timing of low & high tides, windage, wind strengths & wind directions, sea state, wave heights and wave flow directions. Restrictions on availability of tugs to assist ships. There are additional shore side restrictions including no shore power electricity, no adequate water supply, no fire fighting capability, no mains sewerage connection and insufficient waste disposal provision. These ships are mini towns with over 5,000 passengers and crew. They need these essential services and facilities. Cruise Company Standards – The berth will not be able to accommodate the Quantum (348)and Oasis (362m) new generation of cruise ships. The berth is obsolete before it is built. Cruise companies want a safe & secure environment for both passengers and vessel. The proposed Dun Laoghaire cruise berth facility will not fully provide the proper facilities to meet current cruise industry requirements and standards. Traffic plans are not fully considered or permanent – they are just temporary. The use of the Carlisle pier for bus marshalling is also short term and temporary. 3. Business Case - Speculative Development, High Risk Unlike Stena & the HSS, these Cruise Companies do not sign contracts with visiting Ports of Call to guarantee cruise ship business. Port of Call authorities, at their own cost and at their own risk, provide the cruise berth infrastructure & supporting tourism facilities. DLHC propose to build this project, costing €18 million of taxpayer’s money, entirely speculatively. The residual spend from the few remaining passengers from the few ships that call to Dun Laoghaire does not warrant this €18m level of expenditure. There is no secure & sustainable income from cruise ships to underwrite or guarantee the capital cost of the cruise berth infrastructure. 2 The business case seems to be based on discussions with Cruise Company executives that “if you build it we will come”. This philosophy is dead in Ireland in 2015. The cruise ships may or may not come. Cruise companies alter their itineraries to minimise their costs. Cruise Companies thrive on competition between ports. This competition will only undermine the economic viability for both Dun Laoghaire Harbour and Dublin Port. Dublin City Centre is the preferred destinations for visitor excursions, attractions and City Centre retail, not Dun Laoghaire. If ships do not come, this permanent and irreversible cruise infrastructure becomes redundant & disused, forcing Port Authorities to scramble for inappropriate commercial alternatives to reuse their redundant infrastructure. This outcome would be a disaster for Dun Laoghaire harbour, it’s uses and users. For the good of Dun Laoghaire, this proposal cannot be allowed to happen. 4. Income from Cruise Ship visits to Dun Laoghaire Harbour is minimal There is no secure & sustainable income from cruise ships to underwrite or guarantee the capital cost of the cruise berth infrastructure. Cruise Ships pay port charges of just €3,000 - €5,000 per ship at Port of Call stops, equivalent to €0.80 cents per embarking passenger. In addition they may pay for pilotage, provisions and stevedoring costs depending on the port. With “all-in” cruise packages including excursions from Cruise Companies, it is acknowledged – even in Copenhagen - that cruise passengers spend very little money when in Port. The economic benefits from cruise ships are far less than anticipated while costs in terms of their impact on the Harbour are very significant. DLRCC Rate payers will be expected to carry any deficit. 5. Impact of Economic Mis-Match of design for Dublin Port over Dun Laoghaire No matter what the indirect revenue rewards are from residual passengers (or crew) staying back in Dun Laoghaire during a cruise ship visit to Dublin, the underlying mis-match between the proposed limited cruise berth infrastructure to be offered by Dun Laoghaire Harbour Company and the scale of the “state of the art” two tier cruise berth infrastructure & facilities to be offered by Dublin Port, will only prejudice Dun Laoghaire in the longer term. Dublin Port will completely undermine & dominate Dun Laoghaire as the preferred Port of Call for Dublin. Dublin Port has proven capacity for large ships (4 in one day on 23 July 2015).Dublin Port will continuously extend its capacity to absorb any increased cruise ship visits and visitor numbers, irrespective of ship size. Dun Laoghaire does not have the scale. Dun Laoghaire will never survive from the excess “overflow” of capacity from Dublin Port. There will be none. Dun Laoghaire will eventually flounder and that will be a disaster for Dun Laoghaire. Given the current state of the Government finances in 2015, there is no need or commercial logic for the Government to fund both the Dublin Port ABD infrastructure project at €230 million and the Dun Laoghaire project at €18 million. 3 6. A Word of Caution Prudence says, it is better to develop one viable cruise facility in Dublin Port for the Dublin Region, that fully meets the industry requirements, and review the need for a further facility in Dun Laoghaire Harbour in future years. Due to scale, Dun Laoghaire Harbour will always the “poor relation” secondary facility to Dublin Port. 7. The Cost of Failure would be catastrophic for Dun Laoghaire Harbour Uses and Users If this cruise project fails, the consequences for Dun Laoghaire harbour would be catastrophic - just like the HSS and the ferries before them. Dun Laoghaire Harbour Company, or anybody replacing them, would be far better served by investing this €18million in developing the beautiful waterfront, consistent with what DLRCC have done on infilling the Metals across the seafront from Marine Road to the Peoples Park, including the controversial Lexicon Library project. 8. DKM Economic Impact Report does not support any sustainable Business Case in the EIS The DKM Report does not fully and comprehensively assess the cost / benefit analysis of this proposal in the EIS. It does not present or support any viable business case for this proposal in the EIS. There is no budget for capital and running costs shown in the EIS. There are no assessments of the economic impacts of any displacement on other uses and users of the Harbour included in the EIS. It is clearly one sided, it is confusing and lacks transparency on assumptions and methodology. Surprisingly, for such an eminent economic consultancy, the DKM report is not reliable. It lacks adequate survey or research data to support its conclusions. The baseline numbers quoted for the DKM Model for Dublin Bay commencing in 2017 just do not add up. A 24% increase in visitor numbers (passengers and crew) and a 69% increase in spend per visitor within 2 years from 2015 to 2017 is just not credible. The baseline numbers are highly questionable and the model lacks credibility. The reality is that just 7 ships and 15,235 visitors to date (to 25 August 2015) actually visited Dun Laoghaire in 2015 out of a total of 104 ships and 182,000 visitors visiting DUBLIN (Dun Laoghaire & Dublin Port. Of them, 97 ships went directly to Dublin Port. This is no justification for an €18m speculative development. Further, both Dun Laoghaire and Dublin Port expect about 500,000 visitors to DUBLIN by 2036. Dublin Port expects these to arrive on fewer large ships (140) with a larger numbers of Visitors per ship (av 3,500) by 2033. DLHC expect the same number of passengers, but on smaller ships (212 in the central scenario) with lesser visitors per ship (2,500) by 2036. This KEY anomaly places further uncertainty over the accuracy of the economic benefits in the DKM report. The DKM Revenue forecasts are based on their assumptions of growth of passengers and crew and total revenues assumptions of a spend of €120/ per visitor, against €71/visitor in 2015, under the three scenarios from 2017-2046. 4 These numbers – numbers of ships, size of ships, numbers of passengers per ship and the actual net spend per passenger (outside of pre booked excursions) are fundamental to the outcome of the economic impact of this proposal. This has not been fully and comprehensively researched, surveyed or addressed in the EIS as was required by ABP. It is now impossible to have the berth operational now by 2017, as this project is already one year late in making the planning application. The Central Scenario – at best, this might be possible but Dublin Port has all the necessary capacity. The Copenhagen Scenario - Copenhagen is unlikely to be possible. We contend that the Copenhagen Scenario is the wrong comparison. Dublin Port is more akin to Copenhagen than Dun Laoghaire. In any event, in either scenario, Dublin Port will have the capacity to absorb expected capacity. The DKM Report does not address key financial viability issues in the EIS: The impact of the Dublin Port facility on DLHC, displacement of existing uses and users in DLH, cost/benefit analysis of the proposal, capital & running costs of the proposal. There is no clarity on the key assumptions or visibility on how the economic impacts are calculated. Key financial drivers, growth rates and spending rates per passenger per visit, are not properly surveyed or researched. There is no sensitivity, no competition analysis or market share analysis over time. Employment statistics are misleading at best. Copenhagen is entirely the wrong comparison. It is an established hub and spoke Originating Port for cruise ships, located in the centre of the established Northern European & Baltic cruise itineraries. Dublin is the “already established cruise destination”, not Dun Laoghaire. Survey Data - The applicant has admitted that “there is no survey information as yet on where cruise passengers and crew spend their money while they are disembarked. We are advised that passengers spend significantly less than projected. Crew do not disembark in any numbers. What if this is correct? The Applicant should have included proper & comprehensive surveys n the EIS. The Board needs to undertake a full cost / benefit analysis of this proposal, in light of the Dublin Port proposal before making any decision on Dun Laoghaire. 9. Economic Impact from Displacement of Existing Uses and Users Sailing and Marine Leisure uses already contributes a minimum of €10.0million per annum, and over 50 full time jobs within the clubs alone, to the economy of Dun Laoghaire. This is substantially more than the €4 million proposed economic impact in year 10 (2026) to be received by Dun Laoghaire from the cruise ship pier project. If this project goes wrong or the numbers do not materialise – like the HSS – the impact from the permanent and irreversible structure in the harbour will be devastating for Dun Laoghaire. 10. Economic Impact of Sailing The economic impact to Dun Laoghaire and to the national economy, from a sailing footfall of 300,000 – 350,000 each year is estimated at €10 million per annum.. 5 In addition, The Volvo Dun Laoghaire Regatta contributes over €2.5million - €3.0million to the local & national economy every 2 years. The Four Star Pizza ISAF World Youth Championships contributed in excess of €1 million directly to the Local and National economy in 2012 and over €2.5million in indirect benefits (free advertising) from international exposure for Dun Laoghaire. Recent ISAF International Events have each attracted over 100,000 visitors & spectators to Dun Laoghaire for each of these events, contributing in excess of €2 million to the Local and National Economy. There is a list of major world and European events included in our submission. The potential from World Sailing events in Dun Laoghaire is immense. Each event can contribute €500,000 in economic value and €2.5 million in media coverage per annum. The very spectacle of all these boats sailing in Dun Laoghaire harbour and in Dublin Bay are themselves the attraction for millions of other Dubliners to visit Dun Laoghaire to walk the piers, enjoy the water, see the boats and watch the sunset. These are the core visitors to Dun Laoghaire. 11. Sailing Impact Dun Laoghaire is Ireland’s (and Dublin’s) largest yacht & powerboat centre. Dun Laoghaire is home to the 840 berth public marina, 1,500 dinghies, 4 waterfront yacht clubs (for over 180 years with over 5,000 members), over 1,000 junior, special needs and disabled sailors. It is the Hub of the marine leisure industry in Dublin. The displacement of such a large cohort of marine leisure sailors of every kind from Dun Laoghaire Harbour will have a profound effect on the sport of Sailing in Dublin (and in Ireland). 12. Project Build Costs DLHC proposes to build a cruise pier & shore-side infrastructure for €18m, which is substantially less than the €30 million (IR£24million) the HSS terminal cost, when built 20 years earlier in 1996. DLHC’s cost estimate cannot be credible for the extent of works involved. 13. Copenhagen and the Copenhagen Scenario The Copenhagen model is not an equivalent Harbour to Dun Laoghaire. Copenhagen is a “Hub and Spoke” port. It is an established Originating Port (OP) for Baltic and Nordic Cruises. Ships entering and exiting the Baltic pass through Copenhagen. Copenhagen features in nearly every Northern Europe Cruise itinerary. We examine Copenhagen comparisons and enclose maps and photos of the cruise facility in Copenhagen. Topographically, Copenhagen Harbour is nothing like Dun Laoghaire harbour. Copenhagen is physically very different. The sea conditions in the Øresund are completely different. The Øresund is narrow. It is more or less tideless and storm free. It has plenty of open water. It is not an enclosed Harbour like Dun Laoghaire. The natural deep water Cruise Dock “Langelinie” dating from 1894 is just 1 kilometre from the medieval core of the City of Copenhagen. Even in Copenhagen, it is accepted that Cruise ships (generally) give NOTHING to the local economy. 6