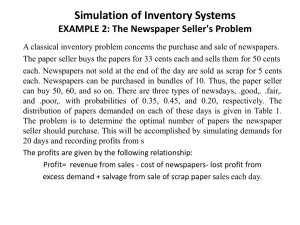

NEWS: 25.09.2013 Top Head Lines for the Day *** Japan`s H2 scrap

advertisement

NEWS: 25.09.2013 Top Head Lines for the Day *** Japan’s H2 scrap average price slide *** Japan’s H2 scrap export prices to Korea remain flat *** Posco makes world's thickest stainless steel slabs *** Auto parts makers report sales growth of over 6% in the June quarter *** Royalty hike to further hit iron ore sector *** Pig iron prices hold steady in northern Brazil *** European noble alloys prices continue to slip *** US magnesium price edges higher on fourth quarter business *** US silicon metal pushes higher on demand pick up and tighter supply *** Indian Ferro alloy market sees prices climb *** Slender transactions in Indian magnesium ingot market *** Decreasing prices in Indian cerium oxide market *** Indian cadmium ingot prices increase *** Russian selenium market activities slow down *** Aluminium ingot markets in Turkey remain strong *** European steel scrap price decline slows *** European ferrovanadium prices drop as confidence evaporates *** European ferromolybdenum market showing no signs of recovery *** European ferrotungsten market silent *** Metallurgical grade silicon carbide price remains flat in the European market *** Chinese ferrosilicon inventory short *** Chinese zinc ingot prices increase *** Chinese ferromolybdenum market to soften further *** South Korean traders keeping watching magnesium alloy market *** Tellurium demand dull in China *** Chinese manganese flake export market quiet *** South Korean ferromanganese quotations flat *** South Korean silicomanganese market fairly active *** South Korean ferrosilicon traders reporting higher import quotations Indian Ferro alloy market sees prices climb The Indian alloy market is seeing increasing enquiries, and exports have picked up along with prices for exports to Europe and East Asia. The domestic market prices too jumped in tune with that with the revival of steel sector but the Ferrous sector is slow in pace but defenitely out from the slow mode as the stock levels both at the customers and traders end have depleted which resulted in increases. Ferrous foundries who monitor the movement of price and the status of the trading pattern are sitting comfortable with the stocks are safe. Indian scrap metal prices witness weak trend on Index The scrap prices in India mostly trended lower as on September 23rd Monday on the ScrapMonster Price Index. Aluminum Ingot prices remained unchanged. The price of Aluminum utensil scrap also saw no variation in prices. The prices of Brass sheet cuttings were down by INR 1000 per Ton at 342,000, when compared with prices the previous day. Brass utensil scrap prices too remained unchanged from the previous day. Copper Armeture prices were down by INR 2,000 per Ton at 470,000 as on September 23rd. Copper cable scrap and copper heavy scrap prices both fell by INR 2,000 per Ton. Copper utensil scrap prices witnessed a down move of INR 1,000 per Ton. The prices of copper sheet cuttings have also decreased by INR 2,000 per Ton. The price of Copper wire bars declined sharply by INR 2,000 per ton. Lead ingot prices remained unchanged at INR 134,000 per Ton as on September 23rd. Nickel Cathode prices fell 0.21% during the day, falling by INR 2,000 per Ton. Tin slab and Zinc slab prices witnessed no change in prices over the day. Japan’s H2 scrap average price slide It's reported that the average prices of Japanese H2 scrap in Kanto, Central and Kansai region were at ¥32,646/ton in the third week of September, falling by ¥83/ton from a week ago. Among them, the average price of H2 scrap in Kanto region was at ¥33,667/ton, remaining flat; that in Central region was at 30,520/ton, keeping unchanged and that in Kansai regions was at ¥33,750/ton, falling by ¥250/ton, all compared to the prices in the previous week. Japan’s H2 scrap export prices to Korea remain flat It’s reported that Japan ’s H2 scrap export prices to Korea are at ¥32,500~¥33,000/ton FOB recently. Last week, Hyundai Steel purchased H2 scraps from Japan with prices of ¥32,500~¥33,000/ton FOB. It’s estimated that Hyundai Steel purchased around 28,000 tons of scraps from Japan . Meanwhile, the H2 scrap prices remained at ¥32,500~¥33,000/ton FAS in the Tokyo Bay region on September 19th. Japan’s scrap exports increase by 11.5% in Jan-Jul Japan’s scrap exports totaled 5.36 million tons in the first seven months of this year, increasing by 11.5% year on year, according to data released by Japan 's Ministry of Finance. In the given period of time, Korea was the largest importer to Japan with 3.5 million tons, increasing by 14%; China was the second largest one with 1.63 million tons, falling by 6.5% and Vietnam was the third largest one with 297,712 tons, more than double, all compared to those figures in the same period of a year ago. In July, the country’s scrap exports totaled 598,362 tons, decreasing by 10.5% from a month ago and falling by 18.4% year on year. Auto parts makers report sales growth of over 6% in the June quarter Economic Times reported that India's automobile industry may be going through one of its worst phases, including original equipment manufacturers, but auto-ancillary companies such as Amara Raja Batteries, Exide Industries, Motherson Sumi, Balkrishna Industries, MRF, Bosch, Ceat, Goodyear India and JK Tyres appear to have bucked the trend on the back of strong demand from the replacement market for tyres and batteries. These auto-ancillary companies jointly reported an average sales growth of over 6% in the quarter to June over the past year and clocked earnings before interest depreciation and tax margins of close to 12% over the past couple of quarters. In fact, except for the March 2013 quarter, when revenue growth for these companies was flat over the previous year, the average revenue growth of these companies has been consistently healthy at over 20% over a year ago since the September 2011 quarter. In contrast, India 's carmakers reported an average sales growth of 4.2% in the quarter to June over the past year which is lower than the year-on-year sales growth of 8.3% reported by these companies in the March 2013 quarter and the YoY sales growth of close to 8.1% in the December 2012 quarter. While the strong and ongoing demand from the replacement market for tyres and batteries is positive for companies such as Amara Raja, Exide, MRF, Ceat and JK Tyres, others such as Motherson Sumi and Balkrishna Industries have reported healthy financials, given their strong presence in the global markets. The replacement demand for vehicle tyres and batteries is expected to remain strong, given a large base of vehicles sold in the past couple of years. There is a huge business and growth opportunity for tyre and battery manufacturing companies such as Amara Raja, Exide, MRF, JK Tyres, Goodyear India and Ceat despite the ongoing slowdown in the automotive industry. For companies such as Motherson Sumi and Balkrishna Industries, their strong presence in international markets gives them an edge over competition in terms of geographic diversification and new business opportunities. Motherson Sumi, for instance, is one of the key suppliers of various automotive parts to many global carmakers such as Volkswagen, Audi and Hyundai and also supplies various automotive parts to other auto makers such as BMW, Renault Nissan, Ford, MercedesBenz, Tata MotorsBSE 0.15 %, Volvo, Toyota and Porsche. Similarly, Balkrishna Industries, which specialises in off-road tyres and caters largely to the replacement market, derives almost 88% of its total sales from international markets, largely from Europe . The company is poised to gain not only because of global exposure, but also because of a weak rupee which boosts its realisations. With clear earnings visibility for these select auto-parts makers, there is a visible institutional investment interest in these companies. Source - Economic Times