Principles of Cost Accounting, 16th Edition, Edward J. VanDerbeck, ©2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Chapter 2

Accounting for Materials

Learning Objectives

Recognize the two basic aspects of

materials control.

Specify internal control for materials.

Account for materials and relate materials

accounting to the general ledger.

Account for inventories in a just-in-time

(lean production) system.

Learning Objectives (cont.)

Account for scrap materials, spoiled goods,

and defective work.

A cost control System

• The major function of a cost control

system is to keep expenditures within the

limits of a preconceived plan.

• An effective cost control system is

designed to control the actions of people

responsible for expenditures because

people control costs. Costs do not control

themselves.

A cost control system

• An effective cost control system should

include the following:

1. A specific assignment of duties and

responsibilities.

2. A list of individuals who are authorized to

approve expenditures.

3. An established plan of objectives and

goals.

A cost control system

4. Regular reports showing the differences

between goals and actual performance.

5. A plan of corrective action designed to

prevent unfavorable variances from

recurring.

6. Follow-up procedures for corrective

measures.

Materials Control

• The two basic aspects of materials control

are :

(1) the physical control or safeguarding of

materials

(2) control over investments in materials

Physical Control of Materials

• Limited Access – only authorized

personnel should have access to material

storage areas.

• Segregation of duties- segregation of

employee duties to minimize opportunities

for misappropriation of assets.

• Accuracy in recording – accurate

recording of the purchase and issuance of

materials.

Investment Control of

Materials

• Maintaining the appropriate level of raw

materials is one of the most important

objectives of materials control.

• An inventory of sufficient size and variety

for efficient operations must be

maintained.

• Management should consider other

working capital needs in determining

inventory levels.

Investment Control of

Materials

• Adequate planning and control is required.

• Management must determine:

1. When orders must be placed

2. How many units should be ordered

• Order point must be determined; order point

is a minimum level of inventory that should

be determined for each type of raw material,

and inventory records should indicate how

much of each type is on hand.

Investment Control of

Materials

• Order point is based on the following data:

1. Usage – the anticipated rate at which the

material will be used.

2. Lead time – the estimated time interval

between the placement of the order an the

receipt of the material.

3. Safety Stock - estimated minimum level of

inventory needed to protect against

stockouts

Economic Order Quantity

(EOQ

• The optimal quantity to order at one time.

• Minimizes the total order and carry costs

over a period of time.

Calculating EOQ

• EOQ = Economic

•

•

•

Order Quantity

C = Cost of placing

an order

N = Number of units

required annually

K = Annual carrying

cost per unit of

inventory

EOQ =

2CN

K

Materials Control Procedures

• Materials control procedures generally

related to the following functions:

1. Purchase an receipt of materials

2. Storage of materials

3. Requisition and consumption of materials

Materials Control Personnel

• Personnel involved in materials control

usually include

1. Purchasing Agent

2. Receiving Clerk

3. Storeroom Keeper

4. Production Department Supervisor

Control During Procurement

• Documents commonly used in procuring

materials include:

1. Purchase requisitions

2. Purchase Orders

3. Vendor’s invoices

4. Receiving reports

5. Debit-credit memoranda

Control During Procurement

Control During Storage and

Issuance

• Materials Requisition

• Returned Materials Report

Accounting for Materials

• A company’s inventory records should

show (1) the quantity of each kind of

material on hand and (2) its cost.

• The materials accounting system must be

integrated with the general ledger.

• Purchases of materials on account are

recorded as a debit to Materials in the

general ledger.

Accounting for Materials

• Materials account is a control account that

is supported by a materials ledger.

Flow of materials and costs

• Flow of materials is the order in which

materials are actually issued for use in the

factory.

• Flow of costs is the order in which unit

costs are assigned to materials issued.

Cost Flow Methods

• First-In, First Out (FIFO) Method – the

materials issued are assumed to be taken

from the oldest materials in stock.

• Last-In, First Out (LIFO) Method – the

materials issued are assumed to be taken

from the most recent purchase prices.

• Moving Average Method – assumes that the

materials issued at any time are simply

withdrawn for a mixed group of materials.

Interrelationship of Materials

Documents and Accounts

Just-in-Time Materials Control

• In a just-in-time inventory system (lean

production system), materials are

delivered to the factory immediately prior

to their use in production.

Just in Time Materials Control

Just in time and Cost Control

• Throughput time – the time it takes a unit

to make it through the manufacturing

system.

• Velocity – speed at which units are

produced in the system.

• Nonvalue-added activities – operations

that add costs but do not add value to the

product for its customers, such as moving,

storing, and inspecting the inventories.

Just in Time and Cost Flows

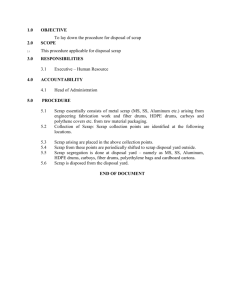

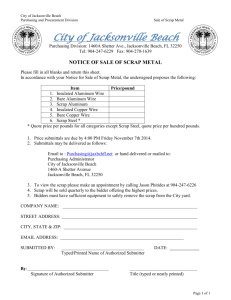

Scrap, Spoiled Goods, and

Defective Work

• Scrap materials may result naturally from

the production process.

• Spoiled units have imperfections that

cannot be economically corrected. The

loss can be treated as part of the job or

charged to factory overhead.

• Defective work has imperfections that are

correctable. The extra costs are either

charged to the job or factory overhead.

Accounting for Scrap

Materials

• If the scrap value is small:

Cash……..XXX

Scrap Revenue XXX

• If the scrap value is relatively high:

Scrap Materials XXX

Scrap Revenue

Cash XXX

Scrap Materials XXX