EECat_MEMS_Trends

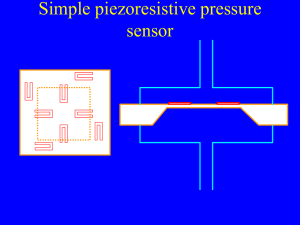

advertisement

Editor's notes: 1. Remove "Table 1" text from Figure 1. 2. In title, "everywhere" in italics . 3. All images herein are low-res. High res will be sent or posted on Basecamp. Title: MEMS Trends: Smaller, Cheaper, Everywhere. Deck: They've been around in various forms since the 1970s in accelerometers and ink jet nozzles, but are now in nearly every consumer gadget you've got at home. With more on the way. By: Chris A. Ciufo, Senior Editor When asked about the market for MEMS, most technologists cite the boring accelerometer sensor that tells the airbags to fire before a crash. More savvy technologists recall that MEMS are used to steer droplets in HP-style inkjet printers. And visionaries may recall white papers showing little Tinker Toy-like gears and levers moving on a semiconductor die, conjuring images of Star Trek Borg or Matrix nanobots permeating the galaxy – little machines that do big things and portend doom. The reality is that micro electro mechanical systems (MEMS) really are permeating the earth in everyday consumer gadgets from smartphones and digital cameras, to overhead projectors and game consoles, to medical devices and GPS modules. There's nothing doomish about it: the positive growth trend is 10% year-over-year, faster than the overall semiconductor market. Here's what's new with MEMS. Markets, and Getting Your Position The Top 10 MEMS players are shown in Figure 1. The market for MEMS is growing dramatically, according to iSupply (which was acquired by IHS), returning $7.9B in 2011 including MEMS actuators, switches and micro mirrors. That grows to over $12.5B in 2016 and for the next two to three years the consumer electronics market – primarily mobile phones, tablets, game sensors, cameras and projectors will be the biggest driver. The predominant MEMS sensor in most markets, including automotive, is the solid state accelerometer. Where early non-MEMS accelerometers were simple contact switches that used a mechanical rolling ball bearing, solid state MEMS have a microscopic silicon die-based beam or orthogonal series of them that deflect under acceleration/deceleration. The beam is either a simple normally open switch, or it provides a torque measurement upon deflection which is useful for determining the rate of deceleration in slow or fast crashes. Regulation in some countries requires firing airbags less aggressively for slow-speed crashes to minimize airbag-related occupant injuries. Figure 1: Top 10 MEMS 2011 suppliers by revenue, out of a total MEMS market of $7.9B. HP primarily supplies MEMS actuators in inkjet printheads. (Source: IHS iSupply.) The largest accelerometer suppliers are Bosch GmbH, which grew MEMS shipments 15 percent to $742.2M in 2011, and STMicroelectronics which shipped more than $650M of MEMS in 2011 (up 82 percent); STMicro ships 50 percent of the world's MEMS accelerometers for handsets, tablets, laptops and gaming. But beyond automotive, accelerometers are the devices that orient the screen from portrait to landscape on mobile phones like the iPhone or tablets like the iPad. MEMS are also used in the Nintendo Wii's Remote and Sony's PS3 remote, where accelerometers are coupled with MEMS single- or three-axis gyroscopes to provide reference to the ground for "steering" motion. In fact, according to iSupply, gyroscopes represent 55 percent of STMicro's sales growth as "the golden age for consumer accelerometers" wanes, says iSupply's Jeremie Bouchard, director and senior principal analyst for MEMS and sensors. Still, 40 percent of all mobile phones use MEMS accelerometers. But add in a MEMS gyro, and cool things can happen in your consumer device. Not only can you orient the device relative to the ground or magnetic north (yes, there are MEMS compasses), but the rate of movement can be measured and provide more finely-grained relative positions in three-space. If an Android phone is to replace a high-end Sony Vita game console, more precise motions and angular acceleration need to be detected. Accelerometer plus gyro plus compass equals very accurate motion movements and position orientation. According to Chipworks MEMS Sector Analyst St. J. Dixon-Warren, "the iPhone 4 is the first portable device to feature full nine degree-of-freedom inertial sensing." After a complete tear-down, Chipworks discovered that the phone uses an STMicro three-axis accelerometer, an AKM three-axis electronic compass, and an STMicro three-axis gyro. The accelerometer, shown in Figure 2, utilizes "interdigitated" finger capacitors for XY, offset with a vertical deflection mass on a MEMS torsion spring that changes capacitance when moved in the Z direction. The packaged gyro is an ASIC plus MEMS stacked die, where the MEMS sensor uses tuning fork mass structures to measure pitch, roll and yaw (Figure 3). An isometric view of the gyro shown in Figure 4 clearly shows the mechanical nature of the die. Lastly, the electronic compass, says Chipworks, is the same as the iPhone 3GS and uses four Hall effect sensors surrounding a metal solenoid coil (Figure 5). Figure 2: STMicroelectronics' 3-axis accelerometer is used in Apple's iPhone 4s, as discovered by Chipworks. 3-axis isn't very common yet. (Courtesy: Chipworks.) Figure 3: A 3-axis MEMS gyro is used in the iPhone 4s. The gyro resolves pitch, roll, and yaw when coupled with an ASIC stacked die. (Courtesy: Chipworks.) Figure 4: This is a more detailed view of the iPhone 4s 3-axis gyro. The multi-level MEMS structures are clearly visible. (Courtesy: Chipworks.) Figure 5: The electronic compass used in the iPhone 4s surrounds four Hall effect sensors with a magnetic concentrator coil. This same compass was first used in Apple's 3GS phone. (Courtesy: Chipworks.) With all three MEMS sensor devices aboard, the iPhone 4 has unheard-of accuracy for navigation, inhand gesture recognition (think Microsoft Kinect spatial knowledge, but holding the device itself), and dead-reckoning orientation. Couple these with the consumer-grade GPS accuracy already in the device, and indoor navigation becomes a reality. Who cares about that? First-responders such as police and fire fighters could navigate in dark or smoky buildings, or consumers could precisely find their way to an exact shelf in a grocery store. Future MEMS pressure sensors will act as altimeters, providing vertical navigation up and down buildings, caves, or mountains when GPS is inaccessible. I Can See and Hear You According to Figure 1, Texas Instruments was the largest captive MEMS supplier in 2011 by selling digital light processing (DLP) chips into overhead projectors. DLPs are MEMS micro mirrors used to "paint" three color images onto a screen – first onto rear projection TVs up until about 2009 until the market dried up, and then into overhead projectors in the last three years. Says iSupply's Bouchard, "TI is also enjoying success in pico-projectors...such as those found in the Beam handset from Samsung." The pico projector in phone handsets, camcorders and digital cameras is a growing market that allows consumers to display an image onto a wall or screen immediately after recording – perfect for the "right now" Internet generation. Without MEMS DLPs, it wouldn't be possible in a small, battery-powered handheld. MEMS are also starting to appear in digital cameras to focus tiny lenses. Though unnecessary on a larger point-and-shoot camera with motorized mechanical auto-focus and zoom, the fixed lenses on smartphones omit focus or zoom unless done digitally. As more smartphone CMOS sensors pass 10 Mpixel resolution, manufacturers are encouraging consumers to ditch the separate camera and rely exclusively on the phone in their pocket. Sony-Ericsson phones that previously had a moving lens adjusted by the consumer are prime candidates for a MEMS-based autofocus/zoom system, perhaps using a MEMS-based linear actuator. Miniature electronics supplier Tessera Technologies paid $15M in 2010 to acquire Siimpel's MEMSbased autofocus and shutter technologies, along with a portfolio of 65 patents. ISupply's Bouchard is predicting a migration to XY motion lenses controlled by MEMS which could potentially pan and scan the lens. If one had to guess the application for this, it might make panoramic photos easier by alleviating the need for the consumer to "stitch" two photos together. Or a moving lens might expand the camera's field of view by one to three times in all directions, allowing a better shot than is visible in the viewfinder or on the screen. The possibilities are compelling, but all point to making the smartphone smarter while replacing a standalone still camera. On the audio side, MEMS microphones are now standard on many smartphones and recorders. In 2010, only 38 percent of smartphones had them; one year later over 50 percent employed MEMS mics. MEMS suppliers are a bit more esoteric here than those shown in Figure 1, and include Knowles, Analog Devices, and Chinese supplier AAC Acoustic. The devices are obviously small, offer high quality audio and, because of their price, vendors can add several of them to a handset to resolve spatial direction and provide echo cancellation. Multiple mics coupled with chipset DSPs can "widen" the audio to a stage panel discussion, or isolate a single speaker. MEMS expert analyst Dr. Alissa Fitzgerald of AMFitzgerald & Associates asserts that when MEMS prices fell below the $3.00 barrier the overall market took off. iSupply recorded 64 and 32 percent increases from 2009 to 2010, and then into 2011 as revenue topped $493.5M. By 2015, the industry is forecast to consume 2.9B units and the market will have shifted from analog MEMS microphones to digital ones like those found in Apple's iPad and iPad 2. Digital microphones don't require external passives, have higher audio quality and are more EMI resistant. Future Trends As the "Internet of things" connects everyone and everything, mobile intelligence, M2M connectivity and carrying your entire life in your pocket all portend good things for MEMS sensors. New pressure sensors from Bosch act as altimeters that provide height information. Start-up company InvenSense introduced in 2011 its 6-axis MotionFusion 3-axis gyroscope and accelerometer optimized for use with 8-bit (read: low cost) MCUs; Atmel immediately added the product to the AVR Studio MCU development tool suite. And it's only a matter of time before the MEMS device is resident monolithically on the same die with digital logic, further wringing cost and footprint out of size-constrained consumer platforms like smartphones. "Start-up" company WiSpry spent 11 years perfecting its tunable MEMS capacitor (Figure 6) that can change capacitance by up to 20x and when ganged together on-chip offers 1/8, 1/4, and 1/2 pF increments. When coupled with digital controller on the die (Figure 7), the device can digitally "tune" a smartphone's antenna impedance to match a power amplifier's characteristics. Remember the problems with Apple's iPhone 4 "Antenna-Gate" when one's hand covered the lower part of the phone's body and inadvertently changed the case-mounted antenna's impedance? Problem solved with WiSpry's device. In fact, iSupply's Jeremie Bouchard discovered that Samsung started shipping phones using it in September 2011. More importantly, WiSpry's MEMS/digital die can be extended to other parts of the phone's RF system, getting a device several steps closer to the holy grail of software-defined programmable radios. Analyst Simone Severi, MEMS and heterogeneous system team leader at IMEC sees many more MEMS opportunities on the horizon, from MEMS-based timing oscillators to tire pressure monitors. Figure 6: WiSpry's tunable capacitor "bit." showing normal position (rear) and fully deflected position (front). As the plate moves downward the capacitance changes. (Courtesy: WiSpry.) Figure 7: WiSpry's die shows MEMS capacitors ganged together along with a digital controller at the top of the die to form tunable RF devices. This monolithic MEMS/digital logic die represents the future of MEMS as applied to software-defined radios (SDR). (Courtesy: WiSpry.) But it's not all rosy, as you'd expect. MEMS don't follow Moore's Law and don't double in performance every 18 months because they're not based upon transistors. It takes years to refine the fabrication steps to carve out mechanical devices and it'll be essential, says IMEC's Severi, that MEMS co-exist with and move to standard digital process technologies like 0.18 micron CMOS. This will also allow form factor scaling, which is critical to future MEMS growth in some markets. As well, some markets are saturating. iSupply's Bouchard expects smartphone shipments to drop from "double- to single-digit growth in the 2014/2015 timeframe." Even though the consumer markets are growing fast, some – like gaming – are also saturating. "The MEMS market needs some new killer app to grow," says Bouchard. Three years ago no one could've reasonably predicted the affect of the iPhone or the iPad on MEMS. In fact, it took ten years for MEMS microphones to get popular. Still, in this market, there's always the next big thing. One possibility? MEMS speakers. Even though iSupply is forecasting zero percent growth for them by 2016. Well, eventually we'll hear it and believe it. Add C2 bio?