Abstract - NUS Business School

advertisement

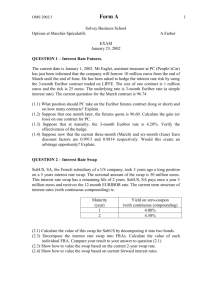

A Study of Decentralized Portfolio Optimization with Coordination by Swap Contracts Yu Qian Abstract It is well known that decentralized portfolio optimization often leads to suboptimal asset allocation for the firm. The efficiency loss caused by multiple portfolio managers trading on their own proprietary models is a major issue especially if the clients or owners of the firm are interested in the firm’s overall performance rather than the performance of individual portfolios. Despite its inefficiency, decentralization is usually preferred in practice because it allows portfolio managers to specialize in their own markets. This study shows that the appropriate use of a set of specifically designed swap contracts can better align decentralized portfolio manager’s goals with that of the firm. Decentralized portfolios coordinated by these swap contracts can achieve the same risk adjusted return as that of a centrally managed portfolio. Experiments using both simulated and real market data are used to demonstrate the efficiency gain of coordination by swap contracts.