Present Value On-Line Notes

advertisement

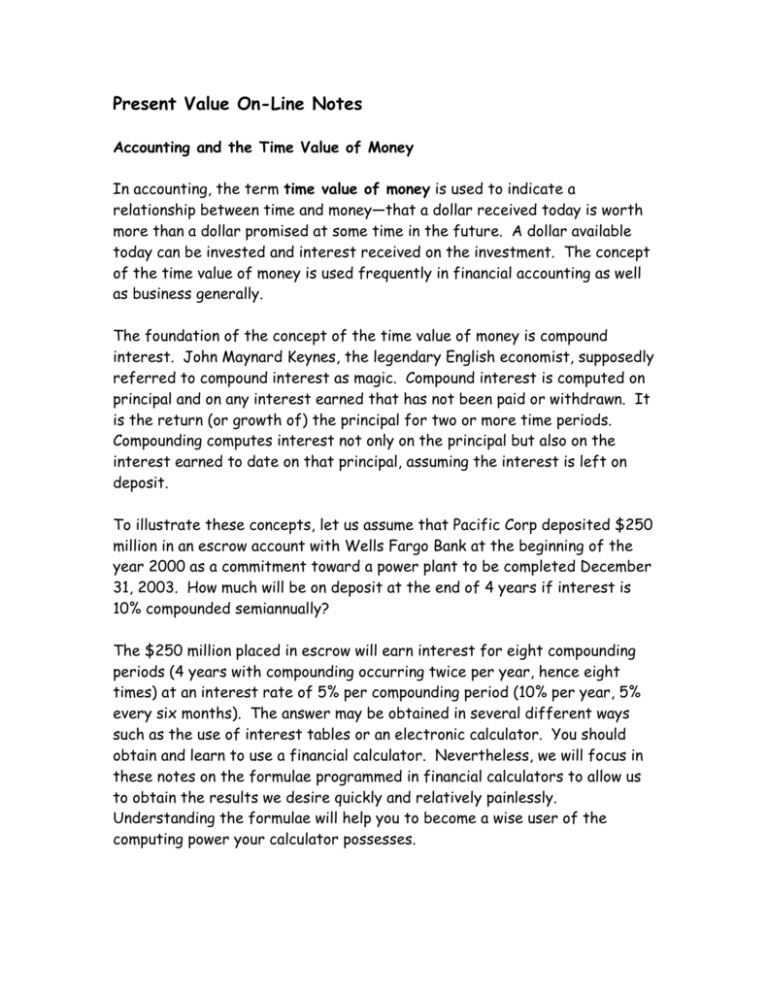

Present Value On-Line Notes Accounting and the Time Value of Money In accounting, the term time value of money is used to indicate a relationship between time and money—that a dollar received today is worth more than a dollar promised at some time in the future. A dollar available today can be invested and interest received on the investment. The concept of the time value of money is used frequently in financial accounting as well as business generally. The foundation of the concept of the time value of money is compound interest. John Maynard Keynes, the legendary English economist, supposedly referred to compound interest as magic. Compound interest is computed on principal and on any interest earned that has not been paid or withdrawn. It is the return (or growth of) the principal for two or more time periods. Compounding computes interest not only on the principal but also on the interest earned to date on that principal, assuming the interest is left on deposit. To illustrate these concepts, let us assume that Pacific Corp deposited $250 million in an escrow account with Wells Fargo Bank at the beginning of the year 2000 as a commitment toward a power plant to be completed December 31, 2003. How much will be on deposit at the end of 4 years if interest is 10% compounded semiannually? The $250 million placed in escrow will earn interest for eight compounding periods (4 years with compounding occurring twice per year, hence eight times) at an interest rate of 5% per compounding period (10% per year, 5% every six months). The answer may be obtained in several different ways such as the use of interest tables or an electronic calculator. You should obtain and learn to use a financial calculator. Nevertheless, we will focus in these notes on the formulae programmed in financial calculators to allow us to obtain the results we desire quickly and relatively painlessly. Understanding the formulae will help you to become a wise user of the computing power your calculator possesses. The formula used to determine the future amount to which the deposit at the beginning of 2000 will accumulate is as follows: Present amount x (1 + i)n = Future amount In the above formula, i = the interest rate and n = the number of periods. The solution (rounding the value for the future amount to five places)would therefore be: $250,000,000 x (1 + .05)8 = $369, 365,000. The deposit of $250,000,000 will accumulate to $369,365,000 by December 31, 2003. Suppose we reverse the problem. Suppose Pacific Corp wants to know the amount that must be deposited at the beginning of year 2000 in order to accumulate the required $369,365,000 by December 31, 2003. We solve this problem by taking the present value of the amount to be accumulated by the end of 2003 using the following formula: Future amount x 1 = Present amount (1 + i)n Inserting the numbers into the formula we have: $369,365,000 x 1 = $250,000,000 8 (1 + .05) Pacific Corp may decide to deposit $75,000 at the end of each 6-month period for the next 3 years to accumulate money for the purchase of equipment. The annual interest rate is 10%. The term annuity can be used to describe the $75,000 semiannual deposits. An annuity is an equal periodic payment. An annuity requires that the periodic payment (or receipt) always be the same amount, the interval between payments (receipts) always be the same, and the interest be compounded once each interval. How much would Pacific Corp accumulate by depositing $75,000 every six months for the next 3 years? The answer can be obtained using the following formula: Periodic payment x [(1 + i)n –1]/i = Future value Inserting the numbers into the formula we have: $75,000 x [(1 + .05)6 – 1] /.05 = $510,143.25. Six 6-month deposits of $75,000 earning 5% per period will grow to $510,143.46. Now suppose that Pacific Corp wants to deposit an amount today so that a series of withdrawals of $75,000 at the end of every six months could be made for three years, again assuming the interest rate to be 10%. This represents the present value of an ordinary annuity. The present value of an ordinary annuity is the single sum that, if invested at compound interest now, would provide for an annuity (a series of withdrawals) for a certain number of future periods (or the present value of a series of equal rents to be withdrawn at equal intervals). The solution to this problem is obtained using the following formula: Periodic withdrawal x [((1 – 1/(1 + i)n))]/i = Amount to be deposited Inserting the numbers into the formula we have: $75,000 x [((1 – 1/(1 + .05)6))]/.05 = $380,676.75 Is this really the correct amount? Try it! Do the following: The $380,679.75 is deposited on January 1, 2000. At the end of the first six months of the year 2000, the $380,679.75 will have earned $380,679.75 x .05 = $19,034 of interest. The total principal and interest is now $380,679.75 + $19,034 = $399,713.75. Now subtract the first $75,000 withdrawal from the $399,679.75 available, leaving $324,713.75. The $324,713.75 earns interest for the last six months of 2000 in the amount of $324,713.75 x .05 = $16,235.69. The amount available is $324,713.75 + $16,235.69 = $340,949.44. Subtract the second $75,000 payment from $340,949.44 and $265,949.44 is left. All of this can be shown in a table called an amortization table as follows: DATE PAYMENTS INTEREST PRINCIPAL REDUCTION Jan. 1, 2001 June 30, 2001 Dec. 31, 2001 June 30, 2002 Dec. 31, 2002 June 30, 2003 Dec. 31, 2003 $75,000 $75,000 $75,000 $75,000 $75,000 $75,000 $19,034.00 $16,235.69 $13,297.47 $10,212.35 $ 6,972.96 $ 3,567.78 $55,966.00 $58,764.31 $61,702.53 $64,787.65 $68,027.04 $71,432.22 PRINCIPAL BALANCE $380,679.75 $324,713.75 $265,949.44 $204,246.91 $139,459.26 $ 71,432.22 - Note: Rounding errors necessitate rounding the interest for the period ended 12/31/03 from $3,571.61 to $3,567.78, a difference of $3.83. The amortization table above also could be applied to another situation with which you might be more familiar. Suppose you bought a house the total cost of which is $380,679.90. You would need to pay $75,000 every six months in order to pay off the loan at the end of three years with 10% annual interest. Although the time and the payment amounts are not realistic for the purchase of a home, the process would be similar in determining the amount of your monthly payments required to pay off the loan over fifteen years or thirty years at a given interest rate. Notes Payable and Capital Leases Another application of present value relates to notes payable and capital leases. Notes payable are written promises to pay a certain sum of money on a specified future date and may arise from purchases, financing, or other transactions. A lease is a contractual agreement between an lessor and a lessee that gives the lessee the right to use specific property, owned by the lessor, for a specified period of time in return for stipulated, and generally periodic, cash payments (rents). Plant assets frequently are purchased on long-term credit contracts through the use of notes payable. Assets purchased on long-term credit contracts should be accounted for at the present value of the consideration exchanged between the contracting parties at the date of the transaction. For example, a company may purchase on January 2, 2001, a piece of equipment by paying $5,000 down and issuing a 10% note payable in four equal annual installments of $2,755 beginning December 31, 2001. Assume that the market value of the equipment is not readily determinable. The annual payment amount includes both principal and interest. How would this transaction be recorded? The equipment should be valued at the amount of the cash payment plus the present value of the payments on the note. The historical cost principle requires that assets be valued at their current cash equivalent price irrespective of the method of financing. Interest charges should not be included as part of the recorded cost of the asset except under special circumstances beyond the scope of the course. Accordingly, the equipment would be valued as follows: Cash down payment Present value of note payments: $2,755 x [((1 – (1 + i)n))/i] = $2,755 x [((1 – (1 + .10)4))/.10 Total cost of equipment $ 5,000 8,733 $13,733 The entry to record the purchase would be: Equipment ................................................................13,733 Cash ............................................................... Note Payable ............................................... 5,000 8.733 The entry to record the first payment on December 31, 2001, would be: Interest Expense ($8,733 x .10) ....................... 873 Note Payable ........................................................... 1,882 Cash ............................................................... 2,755 The amortization table for this note would be as follows: DATE PAYMENTS INTEREST PRINCIPAL REDUCTION Jan. 1, 2001 Dec. 31, 2001 Dec. 31, 2002 June 30, 2003 Dec. 31, 2004 $2,755 $2,755 $2,755 $2,755 $873 $685 $478 $251 $1,882 $2,070 $2,277 $2,504 PRINCIPAL BALANCE $8,733 $6,851 $4,781 $2,504 -0- A capital lease is really a long-term purchase agreement. The lessor transfers substantially all the benefits and risks of ownership to the lessee. The lessor recognizes a sale by removing the asset from the balance sheet and replacing it with a receivable. The lessee records an asset and a liability generally equal to the present value of the rental payments. The accounting by the lessee for the acquisition of the equipment in the previous example under the same terms under a lease agreement would result in the same dollar amounts. The account title “notes payable” would be replaced by the title “obligations under capital leases”.