Business Economics - Loughborough University

advertisement

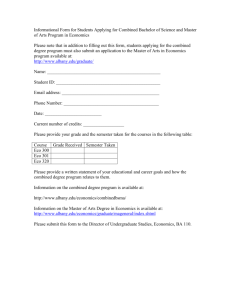

LOUGHBOROUGH UNIVERSITY Programme Specification B.Sc. BUSINESS ECONOMICS AND FINANCE ECUB02 Please note: This specification provides a concise summary of the main features of the programme and the learning outcomes that a typical student might reasonably be expected to achieve and demonstrate if full advantage is taken of the learning opportunities that are provided. More detailed information on the learning outcomes, content and teaching, learning and assessment methods of each module can be found in Module Specifications and other programme documentation and online at http://www.lboro.ac.uk/ The accuracy of the information in this document is reviewed by the University and may be checked by the Quality Assurance Agency for Higher Education. Awarding body/institution; Loughborough University Teaching institution (if different); Details of accreditation by a professional/statutory body; Name of the final award; B.Sc. (Honours) Business Economics and Finance Programme title; Business Economics and Finance, ECUB02 UCAS code; L1NK Date at which the programme specification was written or revised. Sept 2010 1. Aims of the programme: To provide specialised training in the aspects of economics particularly relevant to industry, commerce and financial services. To provide training in the principles of economics and their application. To stimulate students intellectually through the study of economics and to lead them to appreciate its application to a range of problems and its relevance in a variety of contexts. To provide a firm foundation of knowledge about the workings of the economy and to develop the relevant skills for the constructive use of that knowledge in a range of settings. To develop in students the ability to apply the knowledge and skills they have acquired to the solution of theoretical and applied problems in economics. To equip students with appropriate tools of analysis to tackle issues and problems of economic policy. To develop in students, through the study of economics, a range of transferable skills that will be of value in employment and self-employment. To provide students with analytical skills and an ability to develop simplifying frameworks for studying the real world. To develop in students the ability to appreciate what would be an appropriate level of abstraction for a range of economic issues. To provide students with the knowledge and skill base, from which they can proceed to further studies in economics, related areas or in multi-disciplinary areas that involve economics. To generate in students an appreciation of the economic dimension of wider social and political issues. 2. Relevant subject benchmark statements and other external and internal reference points used to inform programme outcomes: QAA Subject Benchmark Statements: Economics. http://www.qaa.ac.uk/academicinfrastructure/default.asp Framework for Higher Education Qualifications. International links with a network of eleven European Universities within the Erasmus exchange programme. University Learning and Teaching Strategy. http://www.lboro.ac.uk/admin/ar/policy/learning_and_teaching/index.htm Departmental learning and teaching policies. Links, both formal and informal, with external examiners. Staff research specialisms and professional involvement in the discipline. 3. Intended Learning Outcomes 3.1 Knowledge and Understanding: On successful completion of this programme, students should be able to demonstrate knowledge and understanding of: A coherent core of economic principles. The understanding of these might be verbal, graphical or mathematical. These principles cover the microeconomic issues of decision and choice, the production and exchange of goods, the interdependency of markets, and economic welfare. They also include macroeconomic issues, such as employment, national income, the balance of payments and the distribution of income, inflation, growth and business cycles, money and finance. The understanding should extend to economic policy at both microeconomic and macroeconomic levels. In all these, students should show understanding of analytical methods and model-based argument and appreciate the existence of different methodological approaches. Relevant quantitative methods and computing techniques. These cover mathematical and statistical methods, including econometrics. Students will have exposure to the use of such techniques on actual economic, financial or social data. A knowledge and appreciation of economic data, both quantitative and qualitative. Students should also have some knowledge of the appropriate methods that the economist might use to structure and analyse such data. The applications of economics. Students should have the ability to apply a core of economic principles and reasoning to a variety of applied topics. They should also be aware of the economic principles that can be used to design, guide and interpret commercial, economic and social policy. As part of this, they should have the ability to discuss and analyse government policy and to assess the performance of the UK and other economies. Specific applications to financial economics. Students should have the ability to analyse financial markets and the industrial organization of firms. The above implies that the attainments of students should show: Ability to apply core economic theory and economic reasoning to applied topics. Ability to relate differences in policy recommendations to differences in the theoretical and empirical features of economic analyses which underlie such recommendations. Ability to discuss and analyse government policy and to assess the performance of the UK and other economies. Understanding of verbal, graphical, mathematical and econometric representation of economic ideas and analysis, including the relationship between them. Understanding of relevant mathematical and statistical techniques. Understanding of analytical methods, both theory- and model-based. Appreciation of the history and development of economic ideas and the differing methods of analysis that have been and are used by economists. Understanding of the appropriate techniques to enable manipulation, treatment and interpretation of the relevant statistical data. Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: Learning and teaching is provided through lectures, tutorials, seminars, computer-based laboratory workshops, group work, web-based guided study, presentations, and guided independent study. Contact and feedback is typically provided through projects, coursework assessment (essays, short answer and multiple choice), lectures, tutorials, presentations, seminars, computer-based laboratory workshops, group work, web-based guided study/self tests, guided independent study, and one to one contact with staff within the personal tutoring system and office hours with lecturers and subject tutors. Students receive departmental handbooks detailing procedures, how to contact staff, how to get help, assessment criteria, programme outlines, module specifications, essay writing and presentation of coursework note taking and potential prizes awarded for academic achievement. This information is also available to students on the University intranet. All programmes taught within the Division of Economics within the School of Business and Economics contain a common core of modules. As students progress through each part of the programme they will develop more programme specific skills, knowledge and understanding with greater contact with staff in that specialism. In the final year students are given the option of a 40 credit weighted project. 3.2 Skills and other attributes: a. Subject-specific cognitive skills On successful completion of this programme, students should be able to: Know and understand the core of economic theory and applied economics, with a particular application to the world of business and finance. Know and understand the behaviour of agents in financial markets, and the behaviour of firms and consumers in the national and international economy Discuss in an informed manner the major policy directions and regulations to implement economic policy Know and understand the nature of incentives in economic decision making by agents in the economy Evaluate the outcomes of market and policy changes in all spheres of the economy, with special emphasis on business and finance Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated: The skills listed above are developed heterogeneously throughout the modules of the degree programme. For example, in Parts A, B and C, Macroeconomics and Microeconomics modules develop ideas of incentives, economic behaviour and static and dynamic equilibrium, and they emphasize the key ideas of optimization subject to constraints. Part A of the programme builds these foundations through modules in Quantitative Economics, Microeconomic Principles and Macroeconomic Principles. In further years the key skills are enhanced by the Part B modules in core economic theory, and the Part C modules that bring together different applications of economics and finance. Examinations indicate how well the student can demonstrate their mastery of an area by selecting appropriate material from memory and applying it using their key and transferable skills, outlined above, to a typically unseen question in a limited period of time. Coursework may take many forms, for example presentations, multiple choice tests, short answer tests through to timed essays, short projects, and group work. In all cases learning is encouraged, enhanced and feedback given in order to help the student assess and review their subject specific cognitive skills. b. Subject-specific practical skills On successful completion of this programme, students should be able to: Construct economic models using verbal, diagrammatic, mathematical, statistical and econometric techniques and reasoning. Access, search for and evaluate relevant data sources for validation of economic models Apply and use specialised software including spreadsheets for the analysis of economic models and financial calculations. c. Generic skills On successful completion of this programme, students should be able to demonstrate the key skills of, Analysis and decision making. Communication. Numeracy and computation. IT, information handling and retrieval, including library skills. Independent study and group work. Time management. More specifically students should be able to demonstrate the following rigorous transferable skills: Abstraction. From the study of economic principles and models, students see how one can abstract the essential features of complex systems and provide a useable framework for evaluation and assessment of the effects of policy or other exogenous events. Through this, the typical student will acquire proficiency in how to simplify while still retaining relevance. This is an approach that they can then apply in other contexts, thereby becoming more effective problem-solvers and decision-makers. Analysis, deduction and induction. Economic reasoning is highly deductive, and logical analysis is applied to assumption-based models. However, inductive reasoning is also important. The typical student will have been exposed to some or all of these and be able to use some of them. Such skills also enhance their problem-solving and decision-making ability. Quantification and design. Data, and their effective organization, presentation and analysis, are important in economics. The typical student will have some familiarity with the principal sources of economic information and data relevant to industry, commerce and government, and have had practice in organising it and presenting it informatively. This skill is important at all stages in the decision-making process. Framing. Through the study of economics, a student should learn how to decide what should be taken as given or fixed for the purposes of setting up and solving a problem, i.e. what the important 'parameters' are in constraining the solution to the problem. Learning to think about how and why these parameters might change encourages a student to place the economic problem in its broader social and political context. This `framing' skill is important in determining the decision-maker's ability to implement the solutions to problems. 4. Programme structures and requirements, levels, modules, credits and awards: Full details can be found in the Programme Regulations at: http://www.lboro.ac.uk/admin/ar/lps/progreg/year/1011/index.htm 5. Criteria for admission to the programme: The up-to-date criteria for admission to this programme can be found at: http://www.lboro.ac.uk/prospectus/ug/courses/dept/ec/bef/index.htm 6. Information about assessment: Most modules are assessed by a mixture of written exam and coursework, although there are exceptions in Year 1 (Part A) where some modules are assessed purely by coursework. Typically, though, coursework counts 20-30 percent and examinations 70-80 percent to the final module mark. First year assessment is for progression to the second year. Second and third year results are weighted 30 and 70 percent respectively for calculation of the final degree classification. Students follow 120 credits of modules each year. This is normally counted as 60 credits per semester, but students may opt for a 70:50 or 50:70 split. In order to gain credit for a module, students must achieve a pass mark of 40%. In each of the first and second year students must accumulate 100 credits and obtain a minimum of 30% in the remaining modules in order to progress to the second/third year (Part B/C). Part C students who commenced their studies prior to 2010 must pass modules weighted at a total of 100 credits and obtain a minimum mark of 20% in remaining modules. Students registering onto a programme from 2010 onwards will be required to pass Parts A, B and C with 100 credits in each year and a minimum mark of 30% in the remaining modules. The Degree of Bachelor (Honours) is awarded if 300 credits are accumulated with no less than 100 from Part C in not less than 6 semesters. Reassessment is permitted during the Special Assessment Period (SAP) only if a student has achieved at least 60 credits in that year. Full details of these arrangements are contained in the official programme regulations. 7. What makes the programme distinctive: The Business Economics and Finance degree allows students to study modules in finance and law together with those areas of economics that are directly relevant to the business world. Loughborough’s internationally-recognised expertise means that we are able to offer a broad range of modules in the areas of banking and finance. Students also acquire the skills necessary to appraise alternative investment opportunities, evaluate and devise an optimal portfolio of assets, obtain business forecasts and understand the implications of current and future changes in the domestic and international economic environment. Part A is identical to the Single Honours programme in Economics with the exception of an additional module in law. In Part B, the student takes four core modules (where (2) denotes a double module) in Macroeconomics (2), Microeconomics (2), Introduction to Finance (2) and Econometrics (2) combined with optional modules taken from the following list; Economics of the Financial System (2), International Economic Relations (2), Economics of the Welfare State (2), Energy and the Environment (2), Economics of Leisure and Tourism (2), Economics of Transport (2), Operations management and Company Law. Part C has a core that consists of Financial Economics and Asset Pricing, Economics of Industry and the Firm and Corporate Finance and Derivatives plus a choice of options from the list: Project, International Money and Finance, Public Finance, Economic modelling 1, International Trade, Monetary Theory and Policy, Developments in Macroeconomics, Developments in Microeconomics, Comparative Banking, Development Economics, Environmental Economics, Economics of Transition. All modules are double modules (20 credit weighting) except the Project which has a 40 credit weight. 8. Particular support for learning: Up-to-date information can be found at: http://www.lboro.ac.uk/admin/ar/templateshop/notes/lps/index.htm 9. Methods for evaluating and improving the quality and standards of learning: The University’s formal quality management and reporting procedures are laid out in its Academic Quality Procedures Handbook, available online at: http://www.lboro.ac.uk/admin/ar/policy/aqp/index.htm