House ways and means talking points

advertisement

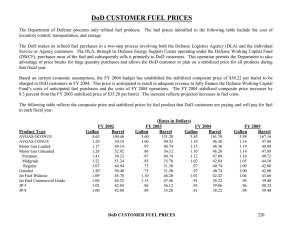

House Bill 617 (Gas Tax) Bill explanation, background and facts Over the road gasoline and diesel fuel are currently taxed at $0.36/gallon ($0.18 federal tax and $0.18 state tax). HB 617 proposes to raise the state gasoline and diesel fuel (over the road) tax $0.15 over 6 years (the diesel fuel increase will be $0.025/gallon/year). Once fully implemented the NHTOA estimates this tax will increase the annual logging truck operating cost $2,500/truck. Over the next ten years HB 617 is projected to raise an additional $980,593,866 in taxes ($850,075,019 -gasoline; $130,518,848 -- diesel fuel). Of this increase municipalities will see $117,671,264 (12 percent of the funds raised) N.H. Department of Transportation’s (NHDOT) top three funding priorities for the next ten years are; I93 widening ($22 million/year), repair red list bridges ($15 million/year) pavement preservation ($12 million/year). Based on these figures 22 percent of the tax increase goes to widening I-93. Diesel fuel is a significant expense to our industry. Within the past three years diesel fuel has gone from $2.90/gallon to $4.19/gallon (NH Office of Energy and Planning fuel price statistics). This is a 44 percent increase in the price of diesel fuel. Weight restricted bridges (state and municipal) are impacting our industry’s ability to access woodlots and move timber to mills and lumber to markets. This inability to access woodlots is also impacting our ability to practice forestry on certain parcels. Rural infrastructure, in particular bridges need more funding (more than HB 617’s 12%). Talking points We recognize roads and bridges will not repair themselves and funding is needed to do repair them but we cannot support HB 617’s $0.15/gallon increase. FYI -- The NHTOA did testify earlier this session we were willing to pay an additional $0.02 to $0.03/gallon if it was dedicated to fixing weight restricted and municipal bridges, not I-93 projects. We are not engaging in the casino for road funding debate. Tax revenue is collected on each gallon of fuel sold whether it goes in the tank of a truck, automobile, boat or ATV. Because the ATV or boat is not using the highway a portion of the total statewide fuel tax collected (based on a formula) is diverted to fund the N.H. Fish and Game Department and the Trails Bureau within the Department of Resources and Economic Development (DRED). Any new fuel tax revenues collected must be dedicated to bridge and road repair and not diverted to other agencies. Action (next steps) House bill 617 is scheduled to have a hearing in the House of Representatives Ways and Means Committee on Thursday, March 14, 1:30 in the State House. Please try to attend the hearing. If you cannot attend, email or fax me your testimony and I will submit it. In the meantime, call or email the Ways and Means Committee members and let them know you oppose HB 617’s $0.15/gallon increase (member list attached). It is best if you can show what this increase will do to your company and ability to operate. Please take a minute and explain your company, how many people you employ and money you spend in your community.