FUEL & EXCISE TAX EXEMPTIONS

advertisement

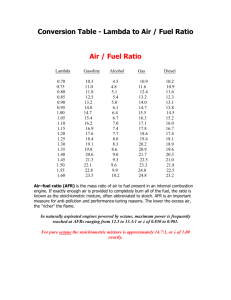

FUEL & EXCISE TAX EXEMPTIONS BY TWW ASSOCIATES LLC DECEMBER 1, 2011 Theodore Williford, CPA Managing Member twilliford@twwassociatescpa.com www.twwassociatescpa.com Phone & Fax (301) 871-5407 1 ANOTHER TAX? • Like everything in business these days, there is another tax to deal with. • Is it complicated? Yes • Is it required? Maybe • Is there a form? Yes, several. • Is it a cost of doing business? Yes. 2 THE FUEL EXCISE TAX • • • • • • See IRS Publication 510 61 pages long Includes fuel tax credits and refunds Chapter 1 – Fuel Taxes Chapter 2 – Fuel tax credits and refunds Part 2 does not apply. It covers taxes other than fuel taxes. 3 Pub. 510 Chapter 1 • Form 720 Quarterly Federal Excise Tax Return • Form 720X Amended Federal Excise Tax Return • Form 4136 Credit for Federal Tax Paid On Fuels (filed with your income tax return) • Form 8849 to claim a refund. 4 Federal Fuel Tax • Taxed in the same manner as gasoline. • Includes tax on diesel fuel. • Diesel fuel is any liquid suitable for use as a fuel in a diesel-powered highway vehicle, and transmix. • A diesel-powered highway vehicle is a self-propelled vehicle designed to carry a load over public highways and powered by diesel fuel. 5 Pub. 510 Chapter 2 • • • • • • • • Fuel Tax Credits and Refunds Nontaxable uses of fuel = a credit or refund Includes farm use, Off-highway business use, Intercity and local buses, By a school bus, By a qualified local bus, Exclusive use by a nonprofit educational organization, including churches. 6 Form 720 • Filed each quarter to report fuel taxes on fuel purchased. • If liable for diesel fuel tax on removal at the terminal rack, use line 60a to report gallons purchased, • Tax rate is $.244 per gallon. 7 Form 720 Schedule C Claims • Claims – nontaxable use of undyed diesel fuel. • Line 3 would be used to claim the credit for diesel fuels during the first quarter following the last quarter of your tax year. • Claim must exceed $750 so you may have to aggregate several quarters into one claim. • Only one claim for any quarter by the ultimate purchaser. • Do not use Schedule C if no tax liability on Form 720, line 3, page 2. • Use Form 4136 to claim a credit on your income tax return or Form 8849 to claim a refund. 8 Nontaxable Uses Defined • Farm use in a trade or business of farming. • Off-highway business use is basically where the equipment is for construction (a bulldozer), industrial use such as power generation, cleaning, moving stuff (a forklift), a sawmill, etc. • Intercity and local buses – a transit bus. • By a school bus or local bus ( private transit bus). • By a nonprofit educational organization. 9 Will you have a valid claim? • Question to answer – what constitutes your nontaxable use during the quarter? • Check your facts and circumstances. You may be audited and have to prove your claim. • Possible nontaxable use for UMA members – your claim is disclosed using codes established for the form. • Code 5, intercity and local buses? $.17 / gallon. • Code 6, qualified local bus? $.243 / gallon. • Code 7, a bus transporting students & faculty? $.243 / gallon. • Code 13, exclusive use by a nonprofit educational organization? $.17 / gallon. 10 Intercity and Local Buses @ $.17 per gallon • Code 5 – if you are running buses providing scheduled transportation along a regular route for the general public, or • Nonscheduled transportation for more than 20 adults for the general public including • Charter operations for hire by the general public, not specifically for one person, group, or organization. • Credit will be $.17 per gallon of fuel. 11 Qualified Local Bus @ $.243 per gallon • Code 6 – a qualified local bus is similar to Code 5 except • It is one under contract or receiving a subsidy from any state or local government to furnish the transportation. • Credit is $.243 per gallon. • Be sure you have documentation to show the tie to a state or local government agency, the contract. 12 School Bus or Nonprofit Hire • Code 7 – a school bus transporting students or faculty for a qualified school. • Credit is $.243 per gallon. • Code 13 – a credit of $.17 per gallon for fuel used to provide exclusive use to a nonprofit educational organization that has a regular faculty and curriculum, enrolled student body, receiving instruction at a regular location. • Code 13 - Includes schools operated by churches or other IRC 501(c)3 organizations. 13 Documenting Your Claim • Generally IRS will accept any reasonable method of calculating taxable vs. nontaxable fuel use. • Maintain records to back up your claim – trip tickets, mileage logs, contract files, fuel bills and invoices, etc. • Use common sense – would you accept what you are given if you were the auditor? Does it pass the “smell” test? 14 Documenting Your Claim #2 • Do not give the auditor a “shoe box” of paper. Conduct this part of your business as a business activity, like any other aspect of your business. • Consider using a computer program to provide tracking – this can be a spreadsheet, database, etc. • A manual system (notebook, 3 ring binder, etc.) is perfectly ok if neat, legible, and 15 consistent in use. Documenting Your Claim #3 • Most important – understand what your claim is all about, why it is due you, what is needed to document the claim, how your system (computer or manual) works, and – • Be able to intelligently answer the questions posed by an auditor and be able to walk the auditor through the documentation process, “a to z”. 16 This is the end of our presentation. Thank you. Ted 17