Financial Ratio Analysis

advertisement

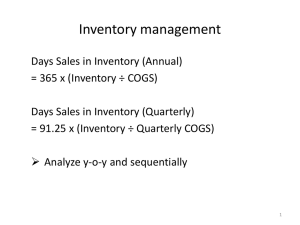

Financial Ratio Analysis Assignment # 2 Course Instructor: Ayesha Zaman Submitted by: Dated: Assignment # 2 Financial Management Instructions You are supposed to answer all the questions, fill in all the blank spaces and give comments where required. Submit this assignment via email. Send your emails to ayeshazaman.bu@gmail.com I will stop checking emails and marking assignments the day your finance mid-term exam commences. Additional Information No. of shares outstanding Market value of share Total dividends paid 2010 41,442,743 68.49 49,731,291.60 2009 33,154,194 79.40 82,885,485.00 Page 2 * For calculating EPS multiply NI by 1000 since each figure is less 3 zeros for making IS and BS easier to understand. * Inventory is equal to Stores, spare parts and loose tools and stock in trade. * Receivables equal trade debts and other receivables. Assignment # 2 Financial Management National Foods Comparative Balance Sheet (Vertical Analysis) For the year ended 31.12.2010 Long term deposits CURRENT ASSETS Stores, spare parts and loose tools Stock in trade Trade debts Advances Trade deposits and prepayments Other receivables Cash and bank balances 654,835 824,968 5,432 846,977 274,556 29,044 6,660 2,632 15,205 5,360 1,502,232 253,050 43,867 10,118 20,664 14,101 Total Current Assets 1,180,506 1,849,392 Total Assets 1,835,341 2,674,360 331,542 323,844 414,427 327,518 655,386 741,945 60,000 13,700 59,999 6,780 140,479 20,000 2,260 72,621 10,707 105,588 460,626 17,764 485,536 530,063 28,319 1,189,769 40,000 12,510 8,397 14,643 40,000 10,238 12,407 16,031 Total Current Liabilities 1,039,476 1,826,827 Total Liabilities and Equity 1,835,341 2,674,360 SHARE CAPITAL AND RESERVES Issued, subscribed and paid up capital Unappropriated profits NON CURRENT LIABILITIES Long term financing Liabilities against assets subject to finance lease Deferred tax Retirement benefits obligations CURRENT LIABILITIES Trade and other payables Accrued interest/markup Short term borrowings Current maturity of: Long tem financing Liabilities against assets subject to finance lease Taxation-Provision less payment Due to government % 2010 794,771 25,688 4,509 % 3 2009 614,004 35,668 5,163 Page ASSETS NON CURRENT ASSETS Property, plant and equipment Intangibles Assignment # 2 Financial Management National Foods Comparative Income Statement (Vertical Analysis) For the year ended 31.12.2010 2010 4,489,946 -3,163,199 1,326,747 Distribution Costs Administration Expenses Other Operating Expenses Other Operating Income -665,664 -149,802 -20,448 17,006 -818,908 -909,818 -164,303 -17,295 23,214 -1,068,202 EBIT/Operating Profit Finance Costs EBT/Net Profit Before Tax Taxation Profit After Taxation Other Comprehensive Income Total Comprehensive Income 307,543 -86,841 220,702 -81,241 139,461 258,545 -99,364 159,181 -72,622 86,559 139,461 86,559 4 2 Earnings Per Share % 4 % Page Sales COGS Gross Profit 2009 3,758,706 -2,632,255 1,126,451 Assignment # 2 Financial Management National Foods Comparative Income Statement (Index Analysis) For the year ended 31.12.2010 Base Year % 2010 4,489,946 -3,163,199 1,326,747 Distribution Costs Administration Expenses Other Operating Expenses Other Operating Income -665,664 -149,802 -20,448 17,006 -818,908 -909,818 -164,303 -17,295 23,214 -1,068,202 EBIT/Operating Profit Finance Costs EBT/Net Profit Before Tax Taxation Profit After Taxation Other Comprehensive Income Total Comprehensive Income 307,543 -86,841 220,702 -81,241 139,461 258,545 -99,364 159,181 -72,622 86,559 139,461 86,559 4 2 Earnings Per Share Indexed % 5 2009 3,758,706 -2,632,255 1,126,451 Page Sales COGS Gross Profit Assignment # 2 Financial Management National Foods Comparative Balance Sheet (Index Analysis) For the year ended 31.12.2010 Long term deposits CURRENT ASSETS Stores, spare parts and loose tools Stock in trade Trade debts Advances Trade deposits and prepayments Other receivables Cash and bank balances 654,835 824,968 5,432 846,977 274,556 29,044 6,660 2,632 15,205 5,360 1,502,232 253,050 43,867 10,118 20,664 14,101 Total Current Assets 1,180,506 1,849,392 Total Assets 1,835,341 2,674,360 331,542 323,844 414,427 327,518 655,386 741,945 60,000 13,700 59,999 6,780 140,479 20,000 2,260 72,621 10,707 105,588 460,626 17,764 485,536 530,063 28,319 1,189,769 40,000 12,510 8,397 14,643 40,000 10,238 12,407 16,031 Total Current Liabilities 1,039,476 1,826,827 6 Total Liabilities and Equity 1,835,341 2,674,360 SHARE CAPITAL AND RESERVES Issued, subscribed and paid up capital Unappropriated profits NON CURRENT LIABILITIES Long term financing Liabilities against assets subject to finance lease Deferred tax Retirement benefits obligations CURRENT LIABILITIES Trade and other payables Accrued interest/markup Short term borrowings Current maturity of: Long tem financing Liabilities against assets subject to finance lease Taxation-Provision less payment Due to government 2010 794,771 25,688 4,509 Indexed % 2009 614,004 35,668 5,163 Page Base year % ASSETS NON CURRENT ASSETS Property, plant and equipment Intangibles Assignment # 2 Financial Management PROFITABILITY RATIOS 1. INCREASE/DECREASE IN SALES PERCENTAGE 1. Sales (Increase/decrease) Percentage Increase/decrease= S1-So/So where S1= and So= Percentage Increase/decrease COMMENTS: 2. GROSS PROFIT MARGIN 2010 2009 2010 2009 Gross Profit Sales 2. Gross Profit/Sales COMMENTS: 3. NET PROFIT MARGIN Net profit after tax Sales 3. Net Profit after tax/Sales Page 7 COMMENTS: Assignment # 2 Financial Management 4. RETURN ON ASSETS 2010 2009 2010 2009 2010 2009 Net profit after tax Total assets 5. ROA=Net profit after tax/Total assets COMMENTS: 5. RETURN ON EQUITY Net profit after tax Owner's equity 6. ROE=Net profit after tax/Owner's equity COMMENTS: 6. RETURN ON CAPITAL EMPLOYED EBIT Capital Employed 7. ROCE=EBIT/Capital Employed Capital Employed=Total assets-Current liabilities Page 8 COMMENTS: Assignment # 2 Financial Management LIQUIDITY AND ASSET MANAGEMENT RATIOS 1. WORKING CAPITAL 2010 2009 2010 2009 Current Assets Current liabilities 1. Working capital= Current assets-Current liabilities COMMENTS: 2. CURRENT RATIO Current Assets Current liabilities 2. Current Ratio=Current Assets/Current Liabilities COMMENTS: 3. QUICK RATIO 2010 2009 Current Assets (Excluding inventory and prepaid exp.) Current liabilities 3. Quick Ratio=Current Assets (Excluding inventory and prepayment)/Current Liabilities Page 9 COMMENTS: Assignment # 2 Financial Management 4. ACCOUNT'S RECEIVABLE TURNOVER 2010 2009 2010 2009 Sales Account's Receivable 4. Account's Receivable turnover (times)=Sales/ Account's receivable Account's Receivable turnover (days) COMMENTS: 6. INVENTORY TURNOVER COGS Inventory 6. Inventory turnover (times)=COGS/Inventory Inventory turnover (days) COMMENTS: 7. WORKING CAPITAL CYCLE 2010 2009 7. Working Capital Cycle Account's receivable turnover (days) Inventory turnover (days) Page COMMENTS: 10 Account's payable turnover (days) Cash conversion (days) Assignment # 2 Financial Management DEBT RATIOS 1. INTEREST COVERS 2010 2009 2010 2009 2010 2009 EBIT Interest 1. Interest covers (times)=EBIT/Interest COMMENTS: 2. LONG TERM DEBT TO TOTAL CAPITALIZATION Long term liabilities Total Capitalization 2. LTD to TC ratio=long term liabilities/Total capitalization COMMENTS: 3. DEBT RATIO Total liability Total assets 3. Debt ratio=Total liability/Total assets Page 11 COMMENTS: Assignment # 2 Financial Management MARKET VALUE RATIOS 1. EARNING PER SHARE 2010 2009 NI cs # of shares out. 5. EPS = NI cs / # of shares out. COMMENTS: 2. EARNING YIELD RATIO 2010 2009 EPS Market value of share 1. Earning yield ratio=EPS/Market value of share COMMENTS: 3. DIVIDEND YIELD RATIO 2010 2009 Dividend per Share Market value of share 2. Dividend yield ratio=DPS/Market value of share Page 12 COMMENTS: Assignment # 2 Financial Management 4. DIVIDEND PAYOUT RATIO 2010 2009 Total Dividend paid NI cs 3. Dividend payout ratio= Total Dividend paid / NI cs COMMENTS: 5. PRICE/EARNING RATIO 2010 2009 Market value of share Earning per share 5. P/E ratio (times)= Market value of share/EPS Page 13 COMMENTS Assignment # 2 Financial Management Match your Answers for the Ratios 2009 GPM 29.97% 29.55% NPM 3.71% 1.93% ROA 7.60% 3.24% ROE 21.28% 11.67% ROCE 38.64% 30.51% WC 141,030 22,565 CR 1.135674128 1.012352018 QR 0.315636917 0.187100366 AR (x) 13.56013247 16.40378643 AR (days) 26.91714117 22.25096026 IT (x) 3.08801878 2.098179746 IT (days) 118.198763 173.9603104 64.29% 72.26% TD/TA LTD/LTD+Equity 17.65% 12.46% EBIT/Interest 3.541449315 2.601998712 EPS 4.206436145 2.088640706 EYR 3.05% 5.30% DPS 2.50 1.20 DPS/MV 3.15% 1.75% DPR=Divid./N.I 59.4% 57.5% 18.87619763 32.79166197 P/E ratio 14 19.45% Page Inc. dec. in sales % 2010