Final Examination, Econ 457, Spring 2015 Name: UID ______ All

advertisement

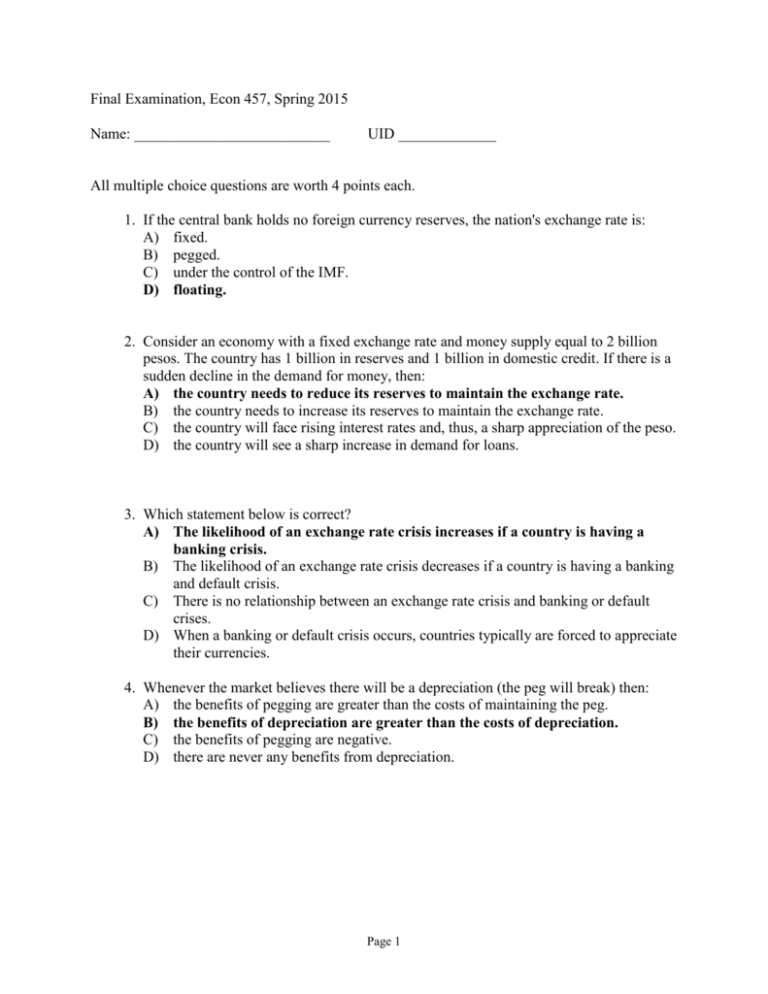

Final Examination, Econ 457, Spring 2015 Name: __________________________ UID _____________ All multiple choice questions are worth 4 points each. 1. If the central bank holds no foreign currency reserves, the nation's exchange rate is: A) fixed. B) pegged. C) under the control of the IMF. D) floating. 2. Consider an economy with a fixed exchange rate and money supply equal to 2 billion pesos. The country has 1 billion in reserves and 1 billion in domestic credit. If there is a sudden decline in the demand for money, then: A) the country needs to reduce its reserves to maintain the exchange rate. B) the country needs to increase its reserves to maintain the exchange rate. C) the country will face rising interest rates and, thus, a sharp appreciation of the peso. D) the country will see a sharp increase in demand for loans. 3. Which statement below is correct? A) The likelihood of an exchange rate crisis increases if a country is having a banking crisis. B) The likelihood of an exchange rate crisis decreases if a country is having a banking and default crisis. C) There is no relationship between an exchange rate crisis and banking or default crises. D) When a banking or default crisis occurs, countries typically are forced to appreciate their currencies. 4. Whenever the market believes there will be a depreciation (the peg will break) then: A) the benefits of pegging are greater than the costs of maintaining the peg. B) the benefits of depreciation are greater than the costs of depreciation. C) the benefits of pegging are negative. D) there are never any benefits from depreciation. Page 1 5. Which of the following statements is correct? A) Exchange rate crises typically impose larger costs on advanced countries than on emerging-market countries. B) Exchange rate crises typically impose larger costs on emerging-market countries than on advanced countries. C) Exchange rate crises typically impose the same costs on advanced countries and on emerging-market countries. D) Exchange rate crises typically do not impose any costs on advanced countries. 6. Criteria used to predict the benefits of fixed exchange rates can be applied to benefits from an optimum currency union. Generally, benefits are higher whenever: A) the home country has balanced trade with its union partners. B) the home country's economy is dissimilar to that of its union partners. C) the home country's economy is similar to that of its union partners and it suffers similar types of economic "shocks." D) the home country has large and growing trade imbalances with its union partners. 7. A significant bank crisis in one Eurozone country is a problem for the ECB because: A) it will violate its money supply growth rule if it tries to provide liquidity to that country's banks. B) it has no mandate to be a lender of last resort to financial institutions in the Eurozone. C) it has no ability to affect the money supply in Eurozone countries. D) its consensus decision-making process may prompt too rapid a reaction to a crisis in one country. 8. In the Eurozone, labor market integration (including labor mobility) between member nations is: A) far ahead of the United States. B) on par with the United States. C) less than in the United States. D) structured differently because in the Eurozone workers have better benefits. 9. Once a nation "runs out" of reserves to back the currency, the peg cannot be maintained because: A) the supply of money grows uncontrollably at the same rate that the central bank monetizes deficits. B) the central bank cannot raise or lower the supply of money. C) the IMF will refuse to lend reserves to such a nation. D) the nation's currency is overvalued so that its exports diminish. Page 2 10. Expected depreciation threatens a peg because of all the following except: A) When investors expect the peg to fail it will fail in multiple equilibrium situations. B) Market sentiment will raise the currency premium and lower confidence. C) Economic fundamentals are crucial to whether a peg holds or fails. D) Investor confidence may wane and cause a rise in interest rates. 11. In general, when there is a large shock to domestic output, the government finds that: A) it is less difficult to maintain the peg. B) maintaining the peg carries a higher present and future cost, especially if credibility is low. C) it is impossible to maintain the peg. D) central bankers are insensitive to the concerns of the population. Use the following figure, which shows hypothetical OCA economic criteria for several South American countries, to answer the question(s). Figure: Shocks and Integration 12. (Figure: Shocks and Integration) Which countries best satisfy the OCA criteria for forming a monetary union? A) Peru and Colombia B) Peru and Uruguay C) Venezuela and Uruguay D) Colombia and Venezuela 13. Which would be easier to reverse? For Denmark, which now pegs its national currency to the euro, to choose monetary autonomy and abandon its peg, or for Italy to switch back from the euro to the lira? A) Italy because all it has to do is cash euros for lire. B) Italy because it can change over to an electronic payments system. C) Denmark because it would only have to return all the euros in its treasury. D) Denmark because it would not have to change its currency, accounting structure, nor reprint domestic currency. Page 3 14. A nation whose labor market is highly integrated with other nations in a currency union is more ______ to join because ______. A) unlikely; workers would suffer real wage declines if they have competition from foreign workers B) unlikely; firms would find it expensive to hire workers if they have to pay in the common currency C) likely; labor market integration means that when there are asymmetric demand shocks the adjustment can be eased by migration of workers D) likely; labor force rules and policies can be harmonized more easily 15. When nations enter into currency unions, their fiscal affairs continue to be separate. The exception to this situation is whenever a confederation of states has: A) a system whereby monetary policy is decided by consensus rather than centrally. B) a system of government subsidies for firms exporting outside the union. C) a system of fiscal mechanisms that permit interstate transfers. D) a system of common tax policies and regulatory rule. 16. Criticisms of the ECB center on its primary focus on ______ with less (but perhaps more needed) focus on _______. A) unemployment and GDP growth; exchange rates B) exchange rates; inflation problems C) price stability; unemployment and GDP growth D) political cohesiveness; price stability 17. The ECB, like the U.S. Federal Reserve, is ______, and unlike the U.S. Federal Reserve, is not ______. A) independent; a lender of last resort B) subject to scrutiny by the legislature; able to lend to large corporations C) dependent on congressional approval for its policies; committed to price stability D) able to lend to member governments; able to lend directly to banks 18. After the financial crisis of 2008, how did some Eurozone governments finance the bailout of their financial sectors? A) by raising taxes B) by issuing new government bonds, which were purchased by private banks, funded by ECB lending C) by printing more domestic currency to accompany infusions of euros from the ECB D) by selling foreign currency reserves and gold 19. (Bonus question) Which one of the following countries currently has the presidency of the European Union council of ministers? A) Germany B) France C) Netherlands D) Latvia Page 4 20. Table: Mexico's Central Bank Balance Sheet Simplified Central Bank Balance Sheet (millions of pesos) Assets Liabilities 750 Reserves R Money supply M Foreign assets (dollar reserves) Currency in circulation 1,500 Domestic credit B Domestic assets (peso bonds) 2,250 (Table: Mexico's Central Bank Balance Sheet) If the country sells 325 million pesos of foreign assets and issues domestic credit worth 425 million pesos, then how much will be its money supply? [6 points] Its assets increase in the net by 100. So does liabilities. The new money supply is 2350. 21. Suppose that the one-year forward price of euros in terms of dollars is equal to $1.1 per euro. Further, assume that the spot exchange rate is $1 per euro, and the interest rate on dollar deposits is 21 percent and on euro it is 10 percent. Show that the Covered Interest Parity condition holds in this case. [6 points] Answer: One has to plug in the numbers to check whether 1 + i_US = (1/spot rate)* (1+i_euro) * Forward rate holds or not. It does indeed. Page 5 22. Discuss graphically (using the return schedules for dollar and euro deposits) the impact on the spot exchange rate of an expected dollar depreciation while the dollar and euro deposit interest rates are kept fixed. [6 points] Answer: See Figure 13 – 6 that graphically exhibits how an expected Euro appreciation shifts the Euro rate of return schedule to the right and therefore Euro spot rate appreciates. 23. Suppose Russia's inflation rate is 10% over one year but the inflation rate in Switzerland is only 2%. According to relative PPP, what should happen over the year to the Swiss franc's exchange rate [i.e., appreciation/depreciation] against the Russian ruble? Be precise in your calculations. [5 points] Answer: The Ruble should depreciate against SFr by 10 – 2 = 8 percent, by relative purchasing power parity 24. Suppose the price of a big mac in China is 16 Yuan, while in the US its price is $4. If the Yuan dollar exchange rate is 8 Yuan/dollar, by how much is the Yuan under/overvalued? Show your work. [5 points] Answer: The price of Big Mac in China is 16/8 = 2$, whereas in US it is $4. Had the exchange rate been 4 Yuan/dollar, the law of one price would hold. Thus, Yuan is undervalued by 100% = (8-4)/4, if you take 4 (the “correct” exchange rate) as the base. If you instead take the prevailing exchange rate 8 as the base then Yuan is undervalued by 50% = (8-4)/8. [Note: Full credit for both answers.] Page 6