S O E

advertisement

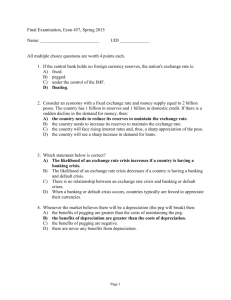

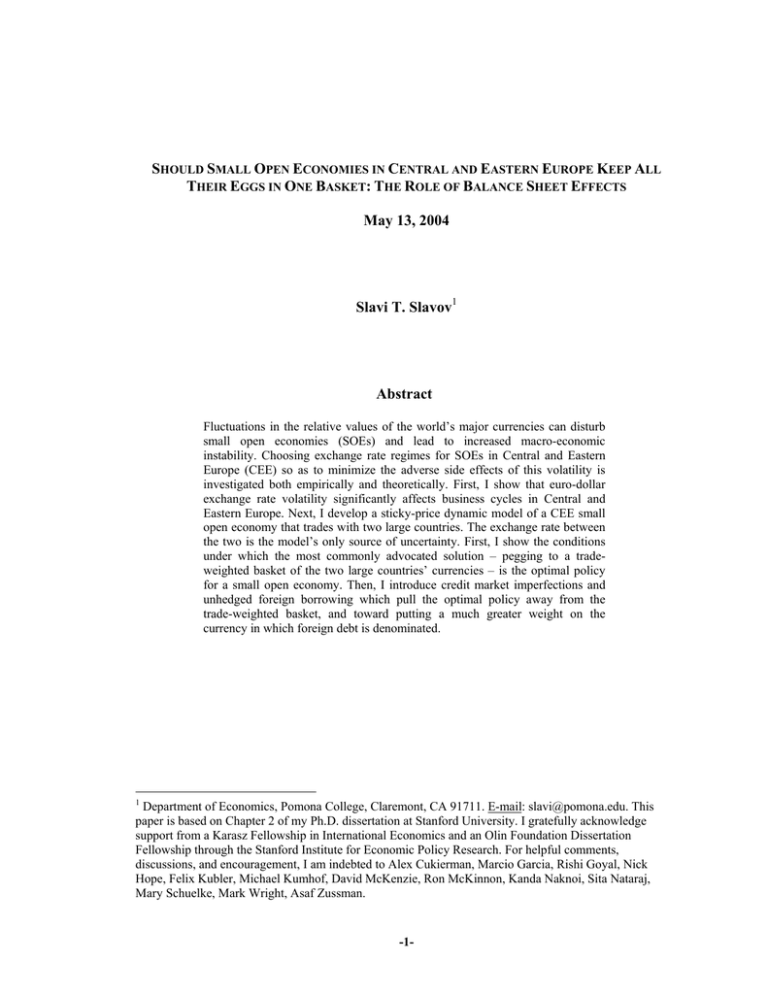

SHOULD SMALL OPEN ECONOMIES IN CENTRAL AND EASTERN EUROPE KEEP ALL THEIR EGGS IN ONE BASKET: THE ROLE OF BALANCE SHEET EFFECTS May 13, 2004 Slavi T. Slavov1 Abstract Fluctuations in the relative values of the world’s major currencies can disturb small open economies (SOEs) and lead to increased macro-economic instability. Choosing exchange rate regimes for SOEs in Central and Eastern Europe (CEE) so as to minimize the adverse side effects of this volatility is investigated both empirically and theoretically. First, I show that euro-dollar exchange rate volatility significantly affects business cycles in Central and Eastern Europe. Next, I develop a sticky-price dynamic model of a CEE small open economy that trades with two large countries. The exchange rate between the two is the model’s only source of uncertainty. First, I show the conditions under which the most commonly advocated solution – pegging to a tradeweighted basket of the two large countries’ currencies – is the optimal policy for a small open economy. Then, I introduce credit market imperfections and unhedged foreign borrowing which pull the optimal policy away from the trade-weighted basket, and toward putting a much greater weight on the currency in which foreign debt is denominated. 1 Department of Economics, Pomona College, Claremont, CA 91711. E-mail: slavi@pomona.edu. This paper is based on Chapter 2 of my Ph.D. dissertation at Stanford University. I gratefully acknowledge support from a Karasz Fellowship in International Economics and an Olin Foundation Dissertation Fellowship through the Stanford Institute for Economic Policy Research. For helpful comments, discussions, and encouragement, I am indebted to Alex Cukierman, Marcio Garcia, Rishi Goyal, Nick Hope, Felix Kubler, Michael Kumhof, David McKenzie, Ron McKinnon, Kanda Naknoi, Sita Nataraj, Mary Schuelke, Mark Wright, Asaf Zussman. -1- 1. Introduction In the three decades since the end of the Bretton Woods system of fixed exchange rates, the world’s major currencies have fluctuated widely against one another. Many small open economies have chosen to peg to one of them, usually the one which dominates their trade and financial flows. By pegging to a single currency, those small economies with a more diversified direction of trade have exposed themselves to fluctuations against the other major currencies. This has brought sharp fluctuations in their effective exchange rates and has led to increased macroeconomic instability. A solution explored since the 1970s, both in practice and in theory, is to peg to a basket of currencies. This stabilizes a country’s effective exchange rate and smoothes the impact of instability in major currency exchange rates. The number of countries practicing currency basket arrangements peaked in the 1980s and has declined since then.2 Theoretical models proliferated in the early 1980s. Most of them were reducedform real models, focusing on trade in goods and neglecting money and capital flows. Turnovsky (1982) is one exception: the paper offers a reduced-form general equilibrium model with capital mobility. While basket pegs have waxed and waned in academic and policy fashion, the problem they sought to redress has persisted. Small open economies continue to seek an external nominal anchor in a world where the major currencies fluctuate widely against one another. In a recent revival, the literature on basket pegs has focused on the small emerging economies in East Asia, most of which have been on a de facto dollar peg for the past two decades, excluding several turbulent years after the 1997 Crisis. Various authors – Ito, Ogawa, and Sasaki (1998), Williamson (2000), Kwan (2001), Kawai (2002) – have argued that the small East Asian economies ought to put a greater weight on the Japanese yen, given the extensive trade and financial linkages with Japan. A tradeweighted basket, in particular, has emerged as the most commonly advocated solution (Mussa et al (2000)). Slavov (2003) uses a VAR model to extend the already available econometric evidence that the “loose cannon” of the yen-dollar exchange rate contributes to a common business cycle for the small East Asian economies. That paper also finds 2 See Mussa et al (2000), p. 27. -2- evidence that fluctuations in the euro-dollar rate affect business cycles in the transitional economies of Eastern Europe. Section 2 of this paper takes a closer look at the three Baltic countries in Eastern Europe where the dollar competes with the euro. The main focus is on justifying the modeling assumptions employed later in the paper. In Section 3, I apply some basic statistical tests to data for the Baltic countries to show that a country’s choice of an exchange rate anchor matters for inflation and output volatility. Furthermore, business cycles are also affected: pegging to a weakening major currency increases rates of price inflation and output growth, presumably due to the depreciation of the nominal effective exchange rate. Section 4 develops a dynamic sticky-price model of a small open economy which trades with two large countries and is vulnerable to fluctuations in the exchange rate between the two. First, I show the conditions under which the optimal policy for a small open economy is to peg to a trade-weighted basket of the two large countries’ currencies. Then, I introduce credit market imperfections a la Bernanke, Gertler, and Gilchrist (1998) and unhedged foreign borrowing, which pull the optimal policy away from the trade-weighted basket and toward placing a substantially higher weight on the currency of borrowing. The paper’s main result is that the currency structure of debt is quite important in deciding how to manage the exchange rate in response to fluctuations in major currency exchange rates. Small economies in Eastern Europe should aim for consistency between the exchange rate regime and the currency structure of their foreign debt. The paper’s chief methodological contribution is that it updates on older literature on the optimal basket (which lacked explicit micro-foundations), and merges it with a current literature on credit market imperfections and balance sheet effects. Section 5 concludes. 2. Building blocks This section discusses the building blocks for the model developed in Section 4, with special emphasis on the three Baltic countries in Eastern Europe and their vulnerability to fluctuations in the euro-dollar exchange rates, respectively. -3- 2.1 The currency structure of trade and debt, and the exchange rate regime Selecting the currency structure of trade and debt, and the exchange rate regime is a joint exercise in optimal risk management by the private sector and by the government. Subject to certain constraints, domestic households and firms choose the currency structure for trade and debt. At low frequencies, governments choose the exchange rate regime with a view on maintaining competitiveness and/or providing the economy with a nominal anchor. At high frequencies, governments of emerging markets subject to “original sin” often choose to maintain exchange rate stability in order to minimize payments risk and provide an informal hedge to the private sector (McKinnon (2001)). There are tangible benefits when the exchange rate regime is consistent with the currency structure of trade and debt. Frankel and Rose (2002) estimate that belonging to a currency union triples trade. Empirical work by Devereux and Lane (2001b) shows the link between the exchange rate regime and the currency structure of debt – using cross-section data they find that for developing countries bilateral exchange rate volatility is strongly negatively affected by the stock of net bilateral debt. This section looks at the three Baltic countries in Eastern Europe and seeks to uncover disparities among the three factors outlined above: the exchange rate regime and the currency structure of trade and debt. Such disparities play a key role in the theoretical model of Section 4. The three Baltic countries in Eastern Europe – Estonia, Latvia, and Lithuania – are by far the best natural experiment the real world offers on the effects of exchange rate instability among the major currencies on small open economies with pegged currencies. As Table 1 illustrates, the three are very similar in terms of population, economic size, level of economic development, and sectoral composition of output. The three countries share a broadly similar pattern and direction of trade. They are equally vulnerable to certain types of external shocks – for example, Russia’s default and devaluation in 1998 caused an across-the-board recession in the region. Finally, all three countries joined the European Union on May 1, 2004. This background of similarities helps bring into sharp relief one important difference. While all three countries have maintained hard exchange rate pegs as a way to anchor their domestic monetary policy, they differ in the anchor chosen. Estonia has -4- maintained a currency board with the German mark (and later the euro) since 1992. Between 1994 and early 2002, Lithuania has been on a currency board with the dollar.3 Latvia has opted for a conventional peg to the SDR, the IMF-maintained basket of currencies.4 Latvia’s exchange rate with the SDR has not budged since the peg was introduced in February 1994. Furthermore, the Latvian central bank has usually backed the monetary base at least 100% with foreign reserves, thus making the country’s peg a quasi-currency board arrangement. The three countries’ direction of trade offers an explanation for the different exchange rate regimes they have adopted (see Tables 2 and 3). Estonia’s foreign trade has always been most heavily tilted toward the EU, Lithuania’s trade has been least so, with Latvia an intermediate case. Lithuania has maintained the highest share of trade with other countries in Eastern and Central Europe. Estonia’s trade share within the region has consistently been the lowest. In the absence of any direct evidence on the currency structure of trade, indirect evidence suggests the following rule of thumb: trade with the EU is invoiced in euros, while most of the remaining trade (with other countries in Eastern Europe and with the Middle East) is overwhelmingly dollar-invoiced. Note then that the three Baltic states have a fairly diversified currency structure of trade. Note also that both Latvia and Lithuania have gradually re-directed their trade flows toward the EU over the years. The need for consistency between the direction of trade and the exchange rate regime prompted Lithuania to re-peg to the euro in early 2002. Latvia has announced its intention to do the same in the near future. The currency structure of debt is also broadly consistent with the chosen exchange rate regime (see Table 4). Most of Estonia’s long-term debt is in German marks (now euros). The dollar share of Lithuania’s debt increased through 1998 and decreased afterwards, when it became obvious that the country will re-peg to the euro in the near future. Overall, data confirm the importance of consistency between the exchange rate regime and the currency structure of debt. 3 4 In February 2002, Lithuania re-pegged to the euro. The SDR’s current composition is: 45% USD, 29% EUR, 15% JPY, 11% GBP. -5- Lithuania’s decision to re-peg to the euro in early 2002 provides an interesting natural experiment. Flow data indicate that in 2002 new loans in euros dramatically exceeded new loans in dollars. The stock of private domestic loans was re-denominated from dollars to euros very fast. On the other hand, the stock of euro deposits still lags behind the stock of dollar deposits.5 The model of Section 4 underscores the importance of consistency between the exchange rate regime and the currency structure of firm debt. 2.2 Exchange rate pass-through (ERPT) The amount of pass-through from exchange rates to domestic prices is a key variable in the theoretical model. The choice of an optimal exchange rate regime crucially depends on the amount of ERPT. In particular, if pass-through is high and fast, then the exchange rate regime is irrelevant at the macroeconomic level.6 This is just a special case of nominal neutrality when prices are completely flexible. In the model of Section 4, risk comes from the combination of random exchange rate shocks and incomplete ERPT to domestic prices. In particular, incomplete exchange rate pass-through makes balance sheet effects due to unhedged foreign borrowing more dangerous. As pointed out by Calvo and Reinhart (2000, p. 42): “a high pass-through . . . helps cushion the effects of a devaluation (or depreciation) when there is extensive liability dollarization.” Recent papers by Goldfajn and Werlang (2000) and Choudhri and Hakura (2001) estimate pass-through for a large cross section of 71 countries over two decades, at time horizons ranging from 1 month to 5 years. At short horizons (1-3 months), they find that pass-through is very low, both for industrial and developing countries. For developing countries, pass-through is quite high at long horizons. However, for industrial countries and the US, in particular, ERPT stays very close to zero even at long horizons. ERPT is also quite low for most of the larger members of the EU and will probably be even lower for the Euro-zone as a whole, when data become available. 5 This information is available on the web site of the Bank of Lithuania. There is also a fairly large stock of dollar deposits in Estonia, testifying perhaps to the dollar’s reputation as a store of value, even in a country which floats freely against it. 6 However, the exchange rate regime still matters in its microeconomic consequences. -6- Finally, a 1996 survey of the pricing-to-market literature by Goldberg and Knetter has argued that when shocks to exchange rates are perceived to be temporary, ERPT tends to be low empirically. The model in Section 4 incorporates all these empirical findings about ERPT. 2.3 Nominal effective exchange rates and the real economy Kwan (2001) has outlined four plausible transmission channels through which changes in a country’s nominal effective exchange rate (NEER) can have short-run effects on the real economy. First, a NEER appreciation reduces inward foreign direct investment since the country’s cost advantages diminish. Second, a NEER appreciation causes a general loss of international competitiveness and lowers exports. Third, a NEER appreciation lowers the domestic currency price of imported intermediate goods which means lower input prices and higher profits for domestic producers. Finally, a NEER appreciation eases the burden of foreign debt repayment by reducing the ex post real rate of interest. Note that the first and second channels have a contractionary effect on the economy, while the third and fourth ones should be expansionary. Which set of channels prevails in reality is an empirical question. Slavov (2003) offers some econometric evidence on the issue. The model in Section 4 incorporates the second, third, and fourth transmission channels. 3. Empirical analysis of the Baltics Buiter and Grafe (2001, p. 13) have quipped that “identifying and measuring the shocks perturbing the [Eastern European] accession countries in the past is an exercise undertaken only by the brave.” Samples are too short; data are either missing or of suspect quality; the economies involved have been hit by tremendous shocks and have experienced large structural changes. Nevertheless, in this section I present evidence that the euro-dollar exchange rate is one of the important external shocks hitting the three Baltic states, all of whom have chosen hard pegs for their currencies. I apply some basic statistical tests to data from Eastern Europe to show that a country’s choice of an exchange rate anchor matters for inflation and output volatility. Furthermore, business cycles are also affected: pegging to a weakening major currency -7- increases rates of price inflation and output growth, presumably due to the depreciation of the nominal effective exchange rate. The primary purpose of Section 3 is to uncover data restrictions which the theoretical model of Section 4 will match and explain. As a first pass at the data, I look at simple summary statistics on the volatility of inflation and real GDP growth for the three Baltic states. All data come from IMF’s International Financial Statistics. I use monthly PPI data (in log-differences) to measure inflation. Relative to the CPI, the PPI contains a higher fraction of internationally traded goods and is more sensitive to external shocks. I also use quarterly GDP data (at constant prices) to measure GDP growth. To produce series free of seasonal fluctuations, I take the sum of the most recent four quarters and then log-difference the resulting series. 3.1 The euro-dollar rate and volatility of domestic inflation and output Table 5 shows summary statistics on monthly PPI inflation in the Baltic countries for the period 1995-2001. I chose to start in 1995 – presumably by that time, the price levels in all three countries were securely anchored by their newly-adopted exchange rate regimes. To get an idea about units, Estonia’s average inflation is approximately 0.5% per month, or about 6% per annum. Latvia’s PPI inflation rate has been less volatile than either Estonia’s or Lithuania’s. An F-test reveals that both differences are highly statistically significant (with p-values of less than 0.01). A possible criticism here is that inflation in all 3 countries was systematically declining over time, and the results reported above could be tainted by the trend in the data.7 As a robustness check, I regressed each time series (logged and first-differenced) on a constant and a linear time trend. Then I looked at the volatility of the residuals from these three regressions. The results (not reported here) were almost identical numerically to those in Table 5. Table 6 shows summary statistics on quarterly GDP growth in the Baltics over the period 1995-2001. Once again, quarterly volatility in Latvia’s GDP growth rate has been lower than in the other two countries. However, only the difference between Latvia and Lithuania is marginally significant (p-value = 0.0573). 7 I thank Patricia Dillon for bringing up this point. -8- From these two tables, whether a country pegs to the euro, the dollar, or a basket of the two appears to matter for inflation and output volatility. The results from this section can serve as a benchmark and be directly compared to these in the theoretical model in Section 4 – see, in particular, Section 4.4. 3.2 The impact of the euro’s long slide on the average levels of domestic inflation and output growth It would be interesting to see if the long slide of the German mark and the euro against the US dollar between 1996 and 2001 had an effect on the average levels of inflation and output growth in the Baltic countries. For PPI inflation, it is useful to split the discussion into two equal sub-periods: 1996-1998 and 1999-2001, in order to isolate the impact of an inflationary oil price spike in 1999-2000. The top portion of Table 7 displays summary statistics for 1996-98. Consistent with my priors, pegging to a weakening currency (see Estonia) leads to higher inflation, because it amounts to a depreciation in the nominal effective exchange rate. Lithuania’s case illustrates that pegging to a strengthening currency (the dollar) leads to deflation. Latvia, being pegged to a basket, is boxed in between. Only the difference between Estonia and Lithuania is statistically significant, with a one-sided p-value of 0.0173. The middle portion of Table 7 shows the 1999-2001 data. First, note that Estonia has an average PPI inflation rate well above Latvia’s (the difference is highly statistically significant). Second, surprisingly, Lithuania’s average inflation rate is also very high. In fact, it is even higher than Estonia’s. This is at odds with my priors. A shock to world oil prices explains this aberration. Lithuania is the only country in the region with a large oil refinery; oil-related products occupy a much larger share in Lithuania’s PPI. It is plausible to believe that had it not been for the oil price shock, inflation rates in the three Baltic countries would have ranked exactly the way they did over the period 1996-1998. Finally, the bottom portion of Table 7 offers a look at GDP growth rates in 19962001, the period of persistent depreciation of the euro against the dollar. Lithuania’s growth rate has been the lowest, as expected, while Latvia and Estonia have enjoyed about equal rates of growth – 1.25% per quarter, or about 5% annually. None of the differences are significant, perhaps due to small sample sizes. -9- 4. The model A seminal contribution by Bernanke, Gertler, and Gilchrist (1998) offered a tractable way of merging the business cycle literature with that on credit market imperfections. Cespedes, Chang, and Velasco (2000) and Devereux and Lane (2001a, 2001b) have applied this framework to small open economy models. The central issue in these papers is the optimal monetary policy for a small open economy, in particular, the time-honored question of whether the exchange rate should be fixed or floating. While I follow these contributions in using many of the same building blocks, this paper moves past the issue of “anchor, float, or abandon ship?” (Buiter and Grafe (2001)) and on to the next stage by asking the question “anchor to what?” In the model, there are three countries in the world: two large economies A and B (for concreteness, think of the US and the EU) and a small open economy (which I will refer to as “Home”). The relative sizes of countries A and B will be γ and 1-γ, respectively.8 Nominal exchange rates (in units of Home’s currency per unit of foreign currency) will be denoted by StA and StB. By triangular arbitrage, we have StA = StBStBA, where StBA is the exchange rate between B’s and A’s currencies (“euros per dollar”). The small open economy produces a couple of goods which get exported to A and B, respectively. None is consumed domestically. Domestically-owned retailers import a homogeneous good from A and another such good from B. They re-package, differentiate, and re-sell imports to domestic households who consume them, and to entrepreneurs who consume some and re-sell some to the exporting firms. Firms use these re-packaged imports as inputs in the production of exports. The only source of uncertainty in the model is the euro-dollar exchange rate StBA. StBA is a stationary variable: it always reverts to its constant steady-state level. Since I am concerned with deviations from the steady state, I do not model drift in the steady-state value of StBA. There are no other sources of uncertainty in the model. In particular, there are no domestic nominal shocks. Therefore, unlike most small open economy models, domestic monetary control is not at issue here. 8 One could also think of A and B as a “dollar area” and a “euro area” in the sense that the dollar or the euro is the dominant currency for invoicing trade flows. I do not distinguish between the direction of trade and the currency structure of trade – they are the same thing in the model. -10- The model has the features necessary to generate both the “good” and “bad” aspects of exchange rate depreciations. The “good” side of depreciations is modeled through the beneficial mercantile effect they have on exports, output, and consumption. In the model, the “bad” side of depreciations is due to higher domestic prices of imports and due to volatility-enhancing balance sheet effects on capital investment and future output. These assumptions can be traced back to three of the transmission channels identified in Section 2.3. All the action in the model is generated by instability in StBA, combined with financial market incompleteness and imperfect pass-through to the domestic price level. One can think of imperfect pass-through as a form of price stickiness, which is addressed by monetary policy in the model below. Devereux and Lane (2001a) have found that financial frictions generate an amplification effect to shocks, without altering the welfare ranking of alternative monetary policy rules for a small open economy. In contrast, in the model below financial market imperfections not only amplify shocks but also affect the choice of the optimal exchange rate regime. 4.1 Households, retailers, exporting firms, government In Home, there are households, retailers, exporting firms, a government, and entrepreneurs. I discuss each sector in turn. 4.1.1 Households Households consume and supply labor to firms. Their utility function over consumption and effort is: ∞ (1 − γ )κ A 2 γκ B 2 U t = Et ∑ β s − t log(Cs ) − Ls − Ls , 2 2 s =t ( ) ( ) where LA and LB denote labor supplied to the two types of firms who export to A and B, respectively. κ is the disutility of effort parameter. The disutility from labor supplied to the two types of firms is weighted in a very particular way in order to generate a steadystate direction of trade in which a fraction γ of exports goes to country A and 1-γ goes to B. Ct is an index of differentiated goods (which households purchase from monopolistically competitive retailers) and is given by: -11- υ υ −1 1 υ −1 Ct = ∫ Ct ( z ) υ dz , υ > 1 0 (1) The elasticity of substitution between brands is given by υ. Following standard DixitStiglitz math, demand for brand z is given by: −υ P ( z) Ct ( z ) = t Ct , Pt where the consumer price index Pt is defined as: 1 1 1−υ Pt = ∫ Pt ( z )1−υ dz 0 Households do not have access to financial markets and must spend all of their labor and dividend income within the current period. Their period budget constraint is: Pt Ct = Wt A LtA + Wt B LBt + Π t , (2) where Wt i is the nominal wage paid in sector i (i = A, B), and Πt denotes lump-sum dividends from retailers. A wage differential between the two sectors is necessary to compensate households for the varying disutility of effort in each sector. The household’s allocation problem is a static one. Households play a passive role in this model – that is why the household sector is modeled as simply as possible. The same assumption is employed in Krugman (1999), Cespedes, Chang, and Velasco (2000), and Devereux and Lane (2001b). The first-order conditions guiding labor-leisure choice as well the allocation of effort between the two sectors are: 1 (1 − γ )κLtA γκLBt = = B Pt Ct Wt A Wt (3) 4.1.2 Retailers Retailers are monopolistically competitive and are owned by the households. They purchase imports from both countries A and B and assemble them costlessly to produce a brand of the consumption good, using a Cobb-Douglas production function: (C C ( z) = t A t )( γ ( z ) CtB ( z ) γ γ (1 − γ )1−γ ) 1−γ , (4) -12- where CtA(z) and CtB(z) denote imports of homogenous goods from countries A and B used in the production of brand z. Note that the weights above coincide with the relative sizes of the two large countries. Once again, this will generate a steady-state direction of trade under which a fraction γ of imports will come from country A. By solving a standard expenditure minimization problem, we can derive retailers’ nominal marginal cost (in Home currency units): ( MCt = M tA StA ) (M γ B t StB ) 1− γ , (5) where MA and MB are the foreign-currency prices of imports. Note that the nominal marginal cost equation will be identical for all retailers. In log-linear terms, it becomes: ∧ MC t = γSˆtA + (1 − γ ) SˆtB + γMˆ tA + (1 − γ ) Mˆ tB = NEEˆ Rt + γMˆ tA + (1 − γ ) Mˆ tB , (6) dZ where Zˆ t ≡ t denotes percentage deviation from the constant steady state. A retailer’s Z choice of inputs will be driven by the following first-order condition: 1 − γ CtA M tB StB M tB 1 = = γ CtB M tA StA M tA StBA The last term above is a time-varying real exchange rate. An increase in SBA, combined with sticky MB and MA, would amount to a real depreciation of the euro against the dollar and will relocate retailers’ demand for imports from US toward EU goods. In modeling retailers’ price-setting decisions, I follow the tradition of Calvo (1983) and Yun (1996). Retailers update their prices infrequently. Independently of past history, each period a fraction 1-ϕ of them gets a chance to adjust prices. Due to the law of large numbers, there is no aggregate uncertainty or income uncertainty for the representative household. The consumer price index Pt will evolve according to: [ 1−υ t −1 Pt = ϕP ( ) + (1 − ϕ ) Pt ] 1 new 1−υ 1−υ In log-linear terms, the equation becomes: new Pˆt = ϕPˆt −1 + (1 − ϕ ) Pˆt (7) A profit-maximizing retailer can be shown to follow a log-linear price-setting equation whose derivation is standard (see, for example, Monacelli (2001)): -13- ∞ ∧ Pˆt new = (1 − βϕ ) Et ∑ ( βϕ ) k MC t + k , k =0 (8) ∧ where MC t is given by (6). If prices are completely flexible (ϕ=0), retailers will set prices according to the standard static monopolistic pricing condition: Pt = υ υ −1 MCt (9) Combining equations (7) and (8), we get the model’s endogenous exchange rate passthrough equation: ∞ ∧ Pˆt = ϕPˆt −1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k MC t + k k =0 (10) Following a permanent shock to the nominal effective exchange rate γSˆtA + (1 − γ ) SˆtB , and hence to nominal marginal cost, pass-through will be low in the very first period, but will reach unity eventually (as it should). If Home unilaterally devalues its currency vis-à-vis the rest of the world (that is, it increases both StA and StB by the same percentage amounts), its domestic price level will increase proportionately in the long run. Imperfect pass-through is crucial in generating the model’s results – if ERPT was instantaneously unity, the impact of shocks to StBA on Home will be completely independent of the exchange rate regime. The behavior of StA and StB will depend on Home’s exchange rate regime. Below I will assume that the government sets StA and StB as simple functions of StBA. Retailers’ profits each period are given by the equation: Πt = (Pt - MCt)(Ct + Kt) (11) Note that equation (11) keeps track of the profits retailers generate from selling to both households and entrepreneurs. I will assume that MA and MB are affected by volatility in the euro-dollar exchange rate SBA, according to the following set of (loglinear) forward-looking equations: [ ( )] ∞ Mˆ tA = ϕMˆ tA−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k − (1 − γ ) SˆtBA +k k =0 [ ( )] ∞ Mˆ tB = ϕMˆ tB−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k γ SˆtBA +k , k =0 -14- (12) (13) The persistence parameter ϕ will be calibrated to a value close to 1 to capture the idea that both prices are sticky in the producer’s currency and are relatively unaffected by shocks to StBA in the short run. This is consistent with the evidence presented in Section 2.2 that pass-through to domestic prices in large closed industrialized economies is very close to zero, especially in the short run. Therefore, shocks to StBA will cause substantial fluctuations in the relative prices of goods produced in countries A and B at shorter horizons. Engel (1999) has documented persuasively that most of the volatility in real exchange rates among industrialized countries is accounted for by fluctuations in the relative prices of traded goods. These fluctuations, in turn, are largely driven by a combination of sticky prices and volatile exchange rates. According to equations (12)-(13), in the very long run domestic prices will adjust to restore the real exchange rate to its equilibrium level. The division of “effort” between the two price levels will be according to the relative sizes of countries A and B. For example, if the euro permanently depreciates against the dollar by 1%, then US (country A) prices will eventually fall by 1-γ percent, while EU (country B) prices will eventually rise by γ percent. The microeconomic foundations behind equations (12)-(13) are sketched out in the Appendix. 4.1.3 Exporting firms Exporting firms in both sectors purchase labor from households and capital from entrepreneurs in order to produce their export good, according to identical CRS technologies: ( ) (K ) , Yt i = Lit 1− α i α t i = A, B (14) I assume that capital depreciates completely each period. Domestic firms are competitive price-takers in world markets. Prices in dollars and euros for Home’s exports goods are denoted by XA and XB, respectively. These prices will be affected by fluctuations in the euro-dollar exchange rate similarly to the prices of imported goods: [ ( )] ∞ Xˆ tA = ϕXˆ tA−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k − (1 − γ ) SˆtBA +k k =0 -15- (15) [ ( )] ∞ Xˆ tB = ϕXˆ tB−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k γ SˆtBA +k k =0 (16) A firm solves the following problem: ( ) max Sti X tiYt i − Wt i Lit − Rt K ti , i i Lt , K t i = A, B Rt denotes the nominal price of capital, which is completely mobile between sectors. The first-order conditions are standard: i i (1 − α ) St Xit Yt Lt i = Wt i , Sti X tiYt i α = Rt , K ti i = A, B (17) i = A, B (18) 4.1.4 Government The government’s only role in this model is to set the two exchange rates StA and StB as a function of StBA. I allow for a continuum of exchange rate regimes which can be generalized as a basket peg with weights ω and 1-ω on the dollar and the euro, respectively: (S ) (S ) A ω t B 1−ω t =1 By triangular currency arbitrage we get: StA = (StBA ) (1−ω ) and StB = (StBA ) . By varying ω, −ω we get the following three special cases: 1. A euro peg (ω=0): StB = 1 and StA = StBA 2. A dollar peg (ω=1): StA = 1 and StB = 1 StBA ( ) 3. A trade-weighted basket peg (ω=γ). Then: StA = StBA 1−γ ( ) and StB = StBA −γ . The table below summarizes the behavior of the percentage deviations from the constant steady state of the two bilateral exchange rates and of the nominal effective exchange rate, as functions of the euro-dollar exchange rate, under the three exchange rate regimes defined above: -16- Exchange rate regime Euro peg Basket peg 0 ω= γ Home’s exchange rate with A (1 − γ )ŜtBA SˆtA = (1 − ω )SˆtBA = ŜtBA Home’s exchange rate with B 0 SˆtB = −ωSˆtBA = − γŜtBA Home’s nominal effective exchange rate 0 NEEˆ Rt = γSˆtA + (1 − γ )SˆtB = (γ − ω )SˆtBA γŜtBA Dollar peg 1 0 − ŜtBA − (1 − γ )ŜtBA One can think of the trade-weighted basket as aimed at stabilizing Home’s nominal effective exchange rate γSˆtA + (1 − γ )SˆtB . A quick look at equations (6) and (10) shows that we can also think of the trade-weighted basket peg as a policy targeting nominal marginal cost MCt and hence the domestic consumer price index Pt. As you might notice, nominal money balances do not enter the representative household’s utility function nor its budget constraint. In other words, money in this model is non-distortionary and exists simply as a unit of account. The model does not have a demand function for real money balances. Monetary policy is specified in terms of simple exchange rate rules. This is a common modeling strategy in the recent literature on monetary policy – see, for example, Gali and Monacelli (2002). 4.2 Equilibrium without net worth constraints – the “naive optimal basket” It is instructive to derive the model’s solution for the case in which there are no financial market imperfections in the entrepreneurial sector. Entrepreneurs buy re-packaged imports from retailers and re-sell these imports to firms (which then use them as capital in producing exports). Capital is completely fungible with the composite consumption good (see equation (4)) and therefore the purchase price entrepreneurs pay is Pt. For now, I will assume away any frictions. Entrepreneurs simply re-sell to firms and make zero profits in the process: Rt = Pt . A quick discussion is in order for the constant steady-state solution of the model described by equations (2)-(3), (9), (11), (14), and (17)-(18), assuming that in steady state we have Si = Mi = Xi = 1, for i = A, B. The exogenous cost of capital will equalize the -17- capital-labor ratios in both exporting sectors. That, in turn, will make sure that wages in both sectors will also be equal. Finally, equation (3) reveals that when wages are equal, the ratio of labor supplied by households to sectors A and B will be exactly γ 1− γ . Due to equal capital-labor ratios and constant-returns-to-scale technologies in the two sectors, the ratios of capital and output in both sectors will also equal γ 1− γ . In other words, in the constant steady state, a fraction γ of output gets exported to country A and a fraction 1-γ gets exported to B. The flex-price constant steady state values of the model’s variables are: P= υ υ −1 MC α α 1−α W = W = W = (1 − α ) P υ −1 L ≡ LA + LB = α υ + γ (1 − γ )κ 1−α A B LA = γL LB = (1 − γ )L K A = γK K B = (1 − γ )K 1 α 1− α K ≡ K A + K B = L P α α 1−α Y ≡ Y A + Y B = L Y A = γY Y B = (1 − γ )Y P α υ+ WL 1−α C= P υ −1 α 1 υ+ PL α 1−α W 1 − α Π= + υ P P υ − 1 It is easier to analyze the model, as described in equations (2)-(3), (11), (14), and (17)-(18), in log-linear form: ( ) ( ) ˆt, Pˆt + Cˆt = γ (1 − f ) Wˆt A + LˆtA + (1 − γ )(1 − f ) Wˆt B + LˆBt + fΠ where f = -18- 1 υ (1 − α ) + α − Cˆ t − Pˆt = Lˆit − Wˆt i , i = A, B ( ) ∧ ∧ ˆ t = Pˆt + Cˆ t − υ − 1 MC t + Cˆ t + f + g − 1 Pˆt + Kˆ t − g MC t + Kˆ t , fΠ υ υ where g = Yˆt i = (1 − α )Lˆit + αKˆ ti , α (υ − 1) 2 υ [υ (1 − α ) + α ] i = A, B Sˆti + Xˆ ti + Yˆt i = Wˆt i + Lˆit , i = A, B Sˆti + Xˆ ti + Yˆt i = Pˆt + Kˆ ti , i = A, B The endogenous variables of this model are Ki, K, Li, L, Yi, Y, Wi, Π, C. On the other hand, MC and P are set according to equations (6) and (10). The dynamics of Xi are given by equations (15)-(16). The government sets the exchange rates Si. The solutions are: Sˆ i + Xˆ ti − αPˆt Wˆt i = t , 1−α i = A, B ∧ EPI t − Pˆt 1 gυ ∧ gυ ∧ 1+α NEER t − Pˆt MC t − Pˆt = Cˆ t = − − + 1−α 2 2 ( 1 ) 2 ( 1 ) 2 ( 1 ) υ α υ − − − ∧ ∧ ˆ t = Pˆt + 1 f EPI t − Pˆt + ( f − 2 ) 1 + gυ MC t − Pˆt = Π 2 2(υ − 1) f 1 − α 1 gυ ∧ 1 f NEERt − Pˆt = Pˆt + + ( f − 2) + υ f 1 − α 2 2 ( 1 ) − 1 gυ ∧ gυ ∧ 1 NEER t − Pˆt MC t − Pˆt = + Lˆt = γLˆtA + (1 − γ ) LˆBt = + 2 2(υ − 1) 2 2(υ − 1) ∧ EPI t − Pˆt 1 gυ ∧ − + Kˆ t = γKˆ + (1 − γ ) Kˆ = MC t − Pˆt = 1−α 2 2(υ − 1) 3−α g υ ∧ NEER t − Pˆt = + 2(1 − α ) 2(υ − 1) A t B t -19- α EPI t − Pˆt ∧ Yˆt = γYˆt A + (1 − γ )Yˆt B = 1−α ∧ + 1 + gυ MC ˆ t − Pt = 2 2(υ − 1) 1+α gυ ∧ NEER t − Pˆt = + 2(1 − α ) 2(υ − 1) (19) ( ∧ ) ( ) Above, EPI t ≡ γ SˆtA + Xˆ tA + (1 − γ ) SˆtB + Xˆ tB is the export price index. I also repeatedly ∧ substituted for MC t using equation (6). Finally, a quick look at equations (12)-(13) and (15)-(16) shows that the terms γXˆ tA + (1 − γ ) Xˆ tB and γMˆ tA + (1 − γ ) Mˆ tB will not be affected by shocks to SBA. Equation (19) is one of the crucial equations of the model. It illustrates the “competitiveness channel” for a depreciation in Home’s nominal effective exchange rate γSˆtA + (1 − γ )SˆtB . When the nominal effective exchange rate γSˆtA + (1 − γ )SˆtB rises relative to P̂t , Home’s output is up, according to equation (19). It is easy to see that a trade-weighted basket peg (with ω=γ) will completely stabilize Ŷt and all other variables of the system. Therefore, in the context of this simple model without financial market imperfections in the entrepreneurial sector, the tradeweighted basket peg is the optimal monetary policy. However, as I will show in the next section, the presence of net worth constraints in the entrepreneurial sector will pull away from this basket peg and toward a greater weight on the foreign currency in which entrepreneurial debt is denominated. Under a euro peg (ω=0), a depreciation of the euro against the dollar (StBA↑) causes a depreciation in Home’s nominal effective exchange rate, and, by equation (19), a jump in real output. Capital, labor, and consumption all go up as well. A depreciation has an expansionary effect on the economy, consistent with the empirical results from Slavov (2003). Under a dollar peg (ω=1), a euro depreciation has the exact opposite effects – a nominal effective appreciation leads to contraction in real output and all other domestic variables. -20- 4.3 Entrepreneurs Entrepreneurs play a crucial role in the model. They purchase the index consumption good at a price Pt from retailers and re-sell it to firms at price Rt. Firms use it as capital in producing exports. Capital purchases are financed by entrepreneurs’ net worth and by their borrowing in A’s currency (dollars). Entrepreneurs cannot borrow in the domestic currency and are forced to take on unhedged foreign currency debt. This form of market incompleteness was dubbed “original sin” by Eichengreen and Hausmann (1999) and has been discussed in numerous papers since. Dollars-only borrowing is an institutional constraint in the model. It is meant to capture the role of the dollar as “international money,” especially in international capital flows. Borrowing in dollars only will make the contrast between the solution here and the one in the previous section even more dramatic. At the end of each period t, entrepreneurs combine their nominal net worth Nt with dollar-denominated borrowing Bt+1 to finance purchases of imports which will be used in next period’s production of exports by firms: N t + S tA Bt +1 = Pt K t +1 , where K ≡ K A + K B (20) As a result of this timing convention, equation (11) should be modified to: Πt = (Pt - MCt)(Ct + Kt+1) (11-A) The gross interest rate on Bt is (1+i*)(1+ρt+1), where i* is the (exogenous and constant) world interest rate, and ρt+1 is a risk premium which is increasing in the entrepreneur’s leverage: µ 1 + ρ t +1 PK = t t +1 , µ > 0 Nt (21) Above, ρt+1 = 0 when PtKt+1 = Nt, that is, when investment is entirely financed out of net worth. Alternatively, ρt+1 is decreasing in real net worth Nt/Pt, holding investment Kt+1 constant. Kt+1 and ρt+1 are part of time t’s information set.9 At the beginning of each period, after observing the realization of StBA, entrepreneurs receive payment RtKt from firms for the services of capital that 9 Here, it is important to state that I will only consider small temporary shocks to StBA, in order to rule out a scenario in which Nt falls to zero and ρt explodes to infinity. -21- entrepreneurs secured for them at the end of t-1. They also repay the dollar debt they incurred at t-1. Finally, they consume a fraction 1-δ of their net income. Entrepreneurs consume the same index of differentiated goods as households (see equations (1) and (4)). Their net worth is then given by: ( N t = δ Rt K t − (1 + i * )(1 + ρ t ) StA Bt ) (22) Equation (22) shows that, ceteris paribus, a depreciation against the dollar will increase the ex post debt burden, reduce entrepreneurial net worth and, thus, reduce future investment and output. It is another key equation of the model (in addition to (19)) since it generates the “balance sheet channel” which makes a depreciation against the dollar contractionary and provides the rationale for paying more attention to StA than would have been the case with a frictionless entrepreneurial sector, as in Section 4.2. Entrepreneurs are assumed to be risk-neutral. Free entry in the entrepreneurial sector will ensure that: R K Et t +1 A t +1 St +1 = 1 + i* (1 + ρ ) ⇔ t +1 Pt K t +1 StA ( ) R P Et tA+1 = tA 1 + i* (1 + ρt +1 ) St +1 St ( ) (23) A closer look would reveal that the above arbitrage condition is really a special case of uncovered interest parity. The setup of the entrepreneurial sector is standard in the literature started by Bernanke, Gertler, and Gilchrist (1998). The economy-wide current account equation in dollar terms is:10 ( Pt K t +1 + δPt Ct δ StA X tAYt A + StB X tBYt B + Π t Bt +1 = δ (1 + i )(1 + ρt ) Bt + − StA StA * ) Note that B denotes foreign debt, not foreign assets. Using equations (2)-(3), (9), (11-A), (14), (17)-(18), (20)-(23) we can compute the flex-price constant steady-state equilibrium values for Ki, K, Li, L, Yi, Y, Wi, P, Π, C, R, N, B, ρ as functions of all the other parameters of the model, under the assumption that 10 Use (22) to substitute for Nt in (20). Then combine (17) and (18), and use that to substitute out for RtKt. Finally, use (2) to substitute for WAtLAt+WBtLBt, and rearrange. -22- Si = Mi= Xi = 1, for i = A, B. The solutions for the constant steady state are deferred to the Appendix. The Appendix also offers the equations of the log-linearized system and sketches out the solution. 4.4 The optimal exchange rate regime This section simulates numerically the log-linear model solved in the Appendix. The time unit of the model is one quarter. I set α to 0.35, the consensus value in the business cycle literature. The monopolistic pricing parameter υ is set to 6. I set the price stickiness parameter ϕ to 0.75, also a standard value. Setting i*=0.01 implies a per annum world interest rate of 4%, which is also common. Correspondingly, I set β=0.99. Combining i* with a value of 0.985 for δ implies a steady-state risk premium of 200 basis points per annum, as in Bernanke, Gertler, and Gilchrist (1998). Finally, I set µ to 0.0075 in order to obtain a steady-state entrepreneurial leverage ratio SAB / PK of 50%. The steady-state debt-to-output ratio is then around 17%. ∧ The behavior of MC t and P̂t is pinned down by equations (6) and (10). The dynamics of X̂ ti are given by equations (15)-(16). The behavior of Ŝti was described in Section 4.1.4. Now suppose that the euro depreciates against the dollar by 10% (SBA jumps up from 1 to 1.1). The shock is temporary and gradually fades away. Figures 1 through 3 describe the response of the system to this shock under the three alternative exchange rate regimes outlined in Section 4.1.4. The simulation assumes the symmetric case of γ=0.5. The figures plot one additional variable of interest. Total exports are defined as: EXPOt ≡ StA X tAYt A + StB X tBYt B ∧ ( ) ( ) EXPO t = γ SˆtA + Xˆ tA + Yˆt A + (1 − γ ) SˆtB + Xˆ tB + Yˆt B = ∧ = NEER t + γXˆ tA + (1 − γ ) Xˆ tB + Yˆt Note that a euro depreciation is expansionary under a euro peg and contractionary under a dollar peg (Figures 1 and 3). Financial frictions play an amplification role – the expansionary effect under a euro peg is sharper than the contractionary effect under a dollar peg. The dollar price of investment goods (P/SA) plays an important role in the -23- amplification mechanism. Under a dollar peg, it stays largely unchanged, due to slow pass-through. Under a euro peg it falls, due to the increase in SA relative to P. Since purchases of imports for capital investment are partially financed by dollar borrowing, the drop in (P/SA) makes it cheaper, in dollar terms, for entrepreneurs to buy investment goods. A euro depreciation reduces real net worth N/P in all three diagrams, for different reasons. Under a euro peg (Figure 1), Home depreciates against the dollar and that hurts nominal net worth through entrepreneurs’ balance sheets. Price inflation contributes further to the drop in N/P. Under a dollar peg (Figure 3), N/P falls due to Home’s appreciation against the euro and the resulting fall in real output. Deflation smoothes somewhat the drop in real net worth. Under a basket peg (Figure 2), P stays constant. However, Home both depreciates against the dollar and appreciates against the euro. Both effects reduce nominal net worth N. As a next step, the log-linear model was simulated for a large number of periods, with an AR(1) stochastic process for ŜtBA : ˆ BA + u , SˆtBA +1 = ηS t t +1 η = 0.5, ut+1 ∼ N(0,1) One should think of the standard deviations computed below as measured relative to the standard deviation of ŜtBA , since StBA is the model’s only source of uncertainty and the standard deviation of ut+1 is normalized to 1. I pick an intermediate value for η. Later, I will explore the sensitivity of the results to the value of the persistence parameter. Figure 4 plots the standard deviations of consumption and output as functions of the trade share with the US, under the three exchange rate regimes considered earlier in Section 4.1.4: a euro peg, a dollar peg, or a trade-weighted basket (ω=γ). The tradeweighted basket is superior to a single-currency peg for any value of γ. However, there could be reasons, not captured in this model, why single-currency pegs might be superior to basket pegs. Single-currency pegs are easier to administer and offer higher transparency and credibility relative to baskets. Basket pegs reduce the microeconomic and informational benefits of pegging (Mussa et al (2000)). Also, basket pegs involve some degree of exchange rate volatility against all currencies in the basket and this might discourage trade and investment flows, per Frankel and Rose (2002). Furthermore, note -24- how close a dollar peg is to the trade-weighted basket in terms of minimizing consumption volatility. If we restrict our attention to single-currency pegs, an interesting result arises (see Figure 4): if the share of trade with the US exceeds 7%, a dollar peg is superior to a euro peg, if the policymaker’s objective is to minimize consumption volatility. For output volatility, that threshold value is 31%. Credit market imperfections and unhedged foreign borrowing create an asymmetry in favor of the currency of debt denomination. In Figure 5, I plot the simulated standard deviations of consumption and output as functions of the weight on the dollar in the country’s basket peg. That is, I no longer restrict ω to the three values analyzed earlier – (0, γ, 1) – but consider instead the entire interval [0,1]. I set γ to 0.5 in order to study the symmetric case in which trade shares are equal. It turns out that consumption volatility is minimized by putting a weight on the dollar of ω=0.73. For output volatility, the optimal dollar weight is 0.64. These weights are much higher than the trade share. Due to net worth constraints and unhedged borrowing in dollars in the entrepreneurial sector, it is optimal to place a higher weight on StA than the one suggested by the frictionless model studied in Section 4.2. Note that even under the optimal exchange rate regime, there is some residual risk – consumption and output volatility are not reduced to zero. Next, Figure 6 plots the optimal weight on the dollar ω* as a function of γ, the share of Home’s trade with country A (the US). When there are no financial market imperfections in the entrepreneurial sector (as in Section 4.2), the mapping from γ to ω* is simply the 45° line. The lines above the 45° line give the values of ω (for each value of γ) which minimize consumption and output volatility in the model with credit constraints. Even if there is no trade whatsoever with country A, it is optimal to put a weight of 47% on its currency in order to minimize consumption volatility! For output volatility, the optimal weight is 27%. Finally, Figure 7 illustrates the dramatic sensitivity of these results to the value of the persistence parameter η. It assumes that γ = 0; that is, it takes the extreme case when there is no trade with country A. (In the model of Section 4.2, the optimal value on the dollar would have been zero.) I then plot the optimal weight on A’s currency as a function of the persistence of the exchange rate shock. -25- Note that for very low values of the persistence parameter, the optimal weight on the dollar is very high – slightly above 100% for consumption volatility, and around 60% for output volatility. As persistence increases, the optimal weight on A’s currency declines and, for very high values of η, it is quite close to zero for both consumption and output volatility. Intuitively, when η is high, the innovations to the euro-dollar rate are small relative to the existing deviation from the steady state. As a result, balance sheet effects are relatively unimportant and there is no reason to pay attention to the dollar exchange rate. In a sense, the high persistence of shocks plays a stabilizing role. A quick reality check shows that deviations of G-3 exchange rates from their steady state paths tend to be very highly persistent. Using quarterly data for the yen-dollar or euro-dollar exchange rate, a ballpark estimate for η would be anywhere between 0.7 and 0.95, depending on how the “steady state” is defined – as a linear trend, a moving average, or Hodrick-Prescott-filtered series. For such high values of η, the optimal extra weight on the dollar would be quite small. The model of this paper is not quantitative but illustrative in spirit. It is not meant to match real-world data but to provide an illustration of the importance of the currency structure of debt in choosing how to manage the exchange rate. 5. Conclusion This paper has shown that the choice of an exchange rate regime by small open economies facing G-3 monetary instability is complicated by credit market imperfections involving unhedged foreign borrowing and net worth constraints. In general, these frictions pull the optimal policy away from the trade-weighted basket, and toward putting a greater weight on the currency in which foreign debt is denominated. Small economies in Eastern Europe should aim for consistency between the exchange rate regime and the currency structure of their foreign debt. In a sense, the optimal exchange rate policy for a small open economy discussed in this paper is a second-best solution. The first-best would be restoring stability to the relative values of the world’s major currencies, as under the Bretton Woods system. -26- Clearly, this is beyond the reach of small open economies. Unfortunately, the issuers of the world’s major currencies do not seem particularly interested in such an arrangement. -27- REFERENCES Bernanke, Ben, Mark Gertler, and Simon Gilchrist. The financial accelerator in a quantitative business cycle framework. NBER Working Paper 6455, March 1998. Blanchard, Olivier, and Charles M. Kahn. “The solution of linear difference models under rational expectations.” Econometrica 48 (1980): 1305-1311. Buiter, Willem H., and Clemens Grafe. Anchor, float, or abandon ship: exchange rate regimes for the accession countries. Working Paper, EBRD, December 2001. Calvo, Guillermo A. “Staggered prices in a utility-maximizing framework.” Journal of Monetary Economics 12 (1983): 383-398. Calvo, Guillermo A., and Carmen M. Reinhart. Fixing for your life. NBER Working Paper 8006, November 2000. Cespedes, Luis F., Roberto Chang, and Andres Velasco. Balance sheets and exchange rate policy. NBER Working Paper 7840, August 2000. Choudhri, Ehsan U., and Dali S. Hakura. Exchange rate pass-through to domestic prices: does the inflationary environment matter? IMF Working Paper WP/01/194, December 2001. Devereux, Michael B., and Philip R. Lane. Exchange rates and monetary policy in emerging market economies. Manuscript, University of British Columbia, 2001a. Devereux, Michael B., and Philip R. Lane. Understanding bilateral exchange rate volatility. Manuscript, University of British Columbia, 2001b. Eichengreen, Barry, and Ricardo Hausmann. Exchange rates and financial fragility. NBER Working Paper 7418, November 1999. Engel, Charles. “Accounting for U.S. real exchange rate changes.” Journal of Political Economy 107 (1999): 507-538. Frankel, Jeffrey A., and Andrew K. Rose. “An estimate of the effect of common currencies on trade and income.” Quarterly Journal of Economics 117 (2002): 437-466. Gali, Jordi, and Tommaso Monacelli. Monetary policy and exchange rate volatility in a small open economy. NBER Working Paper 8905, April 2002. Goldberg, Pinelopi K., and Michael M. Knetter. Goods prices and exchange rates: what have we learned? NBER Working Paper 5862, December 1996. -28- Goldfajn, Ilan, and Sergio R. C. Werlang. The pass-through from depreciation to inflation: a panel study. Working Paper, Department of Economics, PUC-Rio (Pontificia Universidade Catolica do Rio de Janeiro), April 2000. Ito, Takatoshi, Eiji Ogawa, and Yuri Nagataki Sasaki. How did the dollar peg fail in Asia? NBER Working Paper 6729, September 1998. Kawai, Masahiro. Exchange rate arrangements in East Asia: lessons from the 1997-98 currency crisis. Manuscript, Japanese Ministry of Finance, September 2002. Krugman, Paul. 1999. “Balance sheets, the transfer problem, and financial crises,” in International finance and financial crises: essays in honor of Robert P. Flood, Jr. Assaf Razin and Andrew K. Rose, eds. Norwell, MA: Kluwer Academic Publishers, pp. 31-44. Kwan, C.H. Yen bloc: toward economic integration in Asia. Washington, DC: Brookings Institution Press, 2001. McKinnon, Ronald I. The world dollar standard and the East Asian exchange rate dilemma. Economic Affairs Committee, House of Lords. London, 11 December 2001. Monacelli, Tommaso. A dynamic neo-Keynesian model with imperfect competition. Manuscript, Boston College, March 2001. Monacelli, Tommaso, and Fabio Natalucci. Solving non-singular systems of expectational difference equations: an application. Manuscript, NYU, 2002. Mussa, Michael, et al. Exchange rate regimes in an increasingly integrated world economy. IMF Occasional Paper 193, August 2000. Obstfeld, Maurice, and Kenneth Rogoff. Foundations of international economics. Cambridge, MA: MIT Press, 1996. Obstfeld, Maurice. “International Macroeconomics: Beyond the Mundell-Fleming Model.” IMF Staff Papers 47 (2001, Special Issue): 1-39. Slavov, Slavi. A brave exercise in measuring the effects of G-3 exchange rate volatility on pegging small open economies in Eastern Europe and East Asia. Working Paper, Department of Economics, Stanford University, August 2003. Turnovsky, Stephen J. “A determination of the optimal currency basket: a macroeconomic analysis.” Journal of International Economics 12 (1982): 333-354. Williamson, John. Exchange Rate Regimes for Emerging Markets: Reviving the Intermediate Option. Washington, DC: Institute for International Economics, 2000. -29- Yun, Tack. “Nominal price rigidity, money supply endogeneity, and business cycles.” Journal of Monetary Economics 37 (1996): 345-370. -30- APPENDIX A. The microeconomics behind equations (12)-(13) Here I sketch out the microeconomic foundations from which equations (12) and (13) in the main text are derived. These two equations provided the linkage between the euro-dollar exchange rate SBA and price levels in the US and the EU (Country A and Country B, respectively). Both US and EU households consume the same index of differentiated goods Ct, which they purchase from monopolistically competitive producers, and which is defined by: υ υ −1 1 υ −1 Ct = ∫ Ct ( z ) υ dz , υ > 1 0 Demand for variety z is given by: −υ M ti ( z ) Ct , Ct ( z ) = i M t i =A, B The consumer price index in each country, Mi, is then defined as: 1 i 1−υ M = ∫ M t ( z ) dz 0 i t 1−υ , i =A, B Monopolistically competitive producers in each large economy update prices infrequently. A fraction 1-ϕ of them gets a chance to adjust prices each period. The price index Mi will evolve according to: ( M = ϕ M i t ) i 1−υ t −1 ( + (1 − ϕ ) Mˆ ) i , new 1−υ t 1 1−υ , i =A, B In percentage deviations from the steady state, this becomes: Mˆ ti = ϕMˆ ti−1 + (1 − ϕ ) Mˆ ti , new , i =A, B (A1) Monopolistically competitive producers can be shown to adhere to the following forward-looking price-setting equation: ∞ ∧ Mˆ ti , new = (1 − βϕ ) Et ∑ ( βϕ ) k MCti+ k , k =0 -31- i =A, B (A2) Combining (A1) and (A2), we get: ∞ ∧ Mˆ ti = ϕMˆ ti−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k MCti+ k , k =0 i =A, B (A3) To pin down marginal costs, each variety z is assembled from two intermediate goods, each of which is exclusively available in country A or country B. Variety z is then produced with the following Cobb-Douglas production function: (C C ( z) = A t t )( γ ( z ) CtB ( z ) γ γ (1 − γ )1−γ ) 1−γ Then marginal costs in A and B can be shown to equal, respectively: ( ) MC = Q A t A γ 1− γ QB BA St ( MCtB = StBAQ A ) (Q ) γ B 1− γ , where QA and QB are prices in dollars and euros, respectively, of the two input goods. QA and QB are assumed constant – perhaps because they are targeted by domestic monetary policy in each large country. In log-linear terms, the above can be re-written as: ∧ ∧ MCtA = −(1 − γ ) SˆtBA MCtB = γSˆtBA Plugging these two expressions into (A3), we arrive at equations (12) and (13): [ ( )] ∞ Mˆ tA = ϕMˆ tA−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k − (1 − γ ) SˆtBA +k k =0 [ ( )] ∞ Mˆ tB = ϕMˆ tB−1 + (1 − ϕ )(1 − βϕ ) Et ∑ ( βϕ ) k γ SˆtBA +k k =0 B. Steady state for the model with credit market imperfections The solution for the flex-price constant steady state of the model of Section 4.3 assumes that Si = Mi = Xi = 1, for i = A, B, and is given by: P= υ υ −1 MC α αδ 1−α W = W = (1 − α ) P A B -32- L ≡ LA + LB = υ −1 αδ υ + γ (1 − γ )κ 1−α LA = γL LB = (1 − γ )L K A = γK K B = (1 − γ )K Y A = γY Y B = (1 − γ )Y 1 αδ 1−α K ≡ K A + K B = L P α αδ 1−α Y ≡ Y + Y = L P A B αδ υ+ WL 1−α C= P υ −1 αδ 1 α + υ 1 − α 1 − α PL αδ 1 − α αδ 1−α Π= + υ P P P υ − 1 R 1 = P δ 1+ ρ = 1 δ (1 + i * ) [ ] 1 B = PK 1 − δ (1 + i* ) µ [ N = PK δ (1 + i* ) ] 1 µ Note that we need 1/δ > 1+i* in order to have ρ > 0 in steady state. Note also that the steady-state gross markup R/P charged by entrepreneurs to firms equals the inverse of entrepreneurs’ saving rate. C. The log-linear model and its solution Next, I log-linearize equations (2)-(3), (11-A), (14), (17)-(18), (20)-(23) around the constant steady state: ( ) ( ) ˆt, Pˆt + Cˆt = γ (1 − f ) Wˆt A + LˆtA + (1 − γ )(1 − f ) Wˆt B + LˆBt + fΠ -33- where f = − Cˆ t − Pˆt = Lˆit − Wˆt i , ˆ t = Pˆt + Cˆ t − fΠ i = A, B ( ) 1 υ −1 ∧ ∧ MC t + Cˆ t + f + g − Pˆt + Kˆ t +1 − g MC t + Kˆ t +1 , υ υ where g = Yˆt i = (1 − α )Lˆit + αKˆ ti , i = A, B Sˆti + Xˆ ti + Yˆt i = Rˆt + Kˆ ti , i = A, B ( ) ( − Nˆ ) ) [ Nˆ t + (a1 − 1) SˆtA + Bˆt +1 = a1 Pˆt + Kˆ t +1 , ( (1 + ρt +1 ) = µ Pˆt + Kˆ t +1 ( αδ (υ − 1) 2 υ [υ (1 − α ) + αδ ] i = A, B Sˆti + Xˆ ti + Yˆt i = Wˆt i + Lˆit , ∧ 1 − α + αδ υ (1 − α ) + αδ where a1 = δ (1 + i * ) ] − 1 µ t ) ∧ Nˆ t = a1 Rˆt + Kˆ t − (a1 − 1)(1 + ρ t ) + SˆtA + Bˆt ( ) ( ) ∧ Et Rˆt +1 = Pˆt + Et SˆtA+1 − SˆtA + 1 + ρt +1 ∧ In general, Ẑ t ≡ dZt/Z, with the exception of (1 + ρ t ) ≡ log(1 + ρ t ) − log(1 + ρ ) . MC and P are set according to equations (6) and (10). The dynamics of Xi are given by equations (15)-(16). The government sets the exchange rates Si. In the above system, Bˆ t , Kˆ t , and ∧ (1 + ρ t ) are predetermined variables. Most of the variables of the system can be easily substituted out: Sˆti + Xˆ ti − αRˆt i ˆ Wt = , 1−α i = A, B ∧ EPI t − αRˆt ˆ ˆ Lˆt = γLˆ + (1 − γ ) Lˆ = − Pt − Ct , 1−α A t B t ∧ ( ) ( where the export price index (EPI) is defined as: EPI t = γ SˆtA + Xˆ tA + (1 − γ ) SˆtB + Xˆ tB -34- ) 2α ˆ ˆ ˆ 1+ α ∧ Yˆt = γYˆt A + (1 − γ )Yˆt B = Rt − Pt − Ct EPI t − 1−α 1−α 2(1 − f ) ∧ 1 υ −1 ∧ 1 + g MC t − − f Kˆ t +1 EPI t − αRˆt − 1 − 2 f − g + Pˆt − 1−α υ υ υ Cˆ t = ν −1 + (1 − f ) ν ( ∧ (1 + ρt ) = µ Pˆt −1 + Kˆ t − Nˆ t −1 ( ) ) a Pˆ + Kˆ t +1 − Nˆ t ˆ A − St Bˆt +1 = 1 t a1 − 1 For the remaining 3 variables – the rental price of capital R, net worth N, and the capital stock K – one can write the following system of 3 first-order difference equations: Et ( Rˆt +1 ) Nˆ t = ˆ K t +1 Rˆt A Nˆ t −1 + B , ˆ Kt where: A(1,1) = µ[ A(3,1) − A(2,1)] A(1,2) = µ[ A(3,2) − A(2,2)] A(1,3) = µ[ A(3,3) − A(2,3)] A(2,1) = a1 A(2,2) = µ (a1 − 1) + 1 A(2,3) = − µ (a1 − 1) υ −1 (1 + α ) + (1 − α )(1 − f ) υ A(3,1) = 1 − f (1 − α ) υ A(3,2) = 0 A(3,3) = 2− 1 υ 1 υ −f −f ( ) B(1,1) = Et SˆtA+1 − SˆtA + (1 + µ ) Pˆt + µ[ B(3,1) − B(2,1)] -35- a B (2,1) = −(a1 − 1) µ + 1 Pˆt −1 + SˆtA − SˆtA−1 a1 − 1 ∧ υ −1 ∧ 2 υ −1 − + g (1 − α ) MC t − 2 EPI t + (1 − α )1 + f + g − Pˆt υ υ υ B(3,1) = 1 − f (1 − α ) υ To solve this system, I followed the method outlined in Monacelli and Natalucci (2002), which is a simplified version of Blanchard and Kahn (1980). Of the 3 eigen values I computed for matrix A, using the parameter values of Section 4.4, one is outside and two are inside the unit circle. Given that I have one unstable (R) and two stable (N and K) variables in the system, the solution is unique. D. Log-linearizing equation (23) Equation (23) is the hardest one to log-linearize because it contains the expectation of a non-linear function of two random variables on its left-hand side. Because of Jensen’s inequality, a first-order Taylor approximation is inappropriate. I use a trick from Obstfeld and Rogoff (1996, p. 504), where they show how to linearize a stochastic Euler equation. The right-hand side is easy – just take logs to get: ( ) log Pt − log StA + log 1 + i* + log(1 + ρt +1 ) For the left-hand side, assume that the random variable Rt+1/ StA+1 is lognormally distributed with a conditional variance which is constant over time. This is consistent with the assumption (adopted in Section 4.4) of Normal shocks to ŜtBA . Then: R R 1 R Et tA+1 = Et exp log tA+1 = exp Et (log Rt +1 ) − Et log StA+1 + Var log tA+1 St +1 2 St +1 St +1 ( ) Take logs to get: R 1 Et (log Rt +1 ) − Et log StA+1 + Var log tA+1 St +1 2 ( ) Since I am interested in the system’s dynamic response to shocks, and not in trend movements, I omit (as do Obstfeld and Rogoff) the constant variance term. In logs, -36- equation (23) is approximated by: ( ) ( ) ( ) ( ) Et (log Rt +1 ) − Et log StA+1 = log Pt − log StA + log 1 + i* + log(1 + ρt +1 ) Re-arrange to get: Et (log Rt +1 ) = Et log StA+1 − log StA + log Pt + log 1 + i* + log(1 + ρt +1 ) Use the steady-state relationship: R 1 = = (1 + i * )(1 + ρ ) ⇔ log R = log P + log(1 + i * ) + log(1 + ρ ) P δ Subtract the log equation above from the preceding one to finally arrive at: ( ) ( ) ∧ Et Rˆt +1 = Et SˆtA+1 − SˆtA + Pˆt + 1 + ρt +1 Note that ρt+1 is not a random variable – it is pre-determined at time t. -37- Table 1: Some basic statistics for the three Baltic countries Estonia Latvia Lithuania 1.4 mln. 2.4 mln. 3.6 mln. Population (July 2001) $14.7 bln. $17.3 bln. $26.4 bln. GDP (PPP, 2000) $10,000 $7,200 $7,300 GDP per capita (PPP, 2000) 3.6% 5% 10% GDP composition by sector: agriculture 30.7% 33% 33% industry 65.7% 62% 57% services Source: CIA, The World FactBook 2001 -38- Table 2: Share of trade with the European Union for the three Baltic states (% of total trade) Exports 1992 1993 1994 1995 1996 1997 1998 1999 2000 Estonia (€) 87 48 48 55 51 49 55 63 69 Latvia (SDR) 50 32 39 44 44 49 57 63 65 Lithuania ($) 88 67 30 36 33 33 38 50 48 Imports 1992 1993 1994 1995 1996 1997 1998 1999 2000 Estonia (€) 85 60 63 66 65 59 60 58 56 Latvia (SDR) 40 27 41 50 49 53 55 54 52 Lithuania ($) 83 50 32 37 43 44 47 47 44 Source: IMF, Direction of Trade Statistics Table 3: Share of trade within Eastern and Central Europe11 for the three Baltic states (% of total trade) Exports 1992 1993 1994 1995 1996 1997 1998 1999 2000 Estonia (€) n.a. 45 46 39 41 43 37 28 22 Latvia (SDR) 42 57 54 51 50 44 35 27 25 Lithuania ($) 7 26 65 58 62 62 55 41 43 Imports 1992 1993 1994 1995 1996 1997 1998 1999 2000 Estonia (€) n.a. 29 26 25 23 23 21 23 25 Latvia (SDR) 51 68 51 43 43 38 36 37 39 Lithuania ($) 7 42 62 56 48 43 39 38 44 Source: IMF, Direction of Trade Statistics Table 4: Currency composition of long-term debt for the three Baltic countries (%) Country Currency 1992 1993 1994 1995 1996 1997 1998 1999 2000 Estonia (€) DEM 0 4 9 15 30 64 68 56 61 Latvia (SDR) DEM 8 4 4 9 8 10 18 8 8 Lithuania ($) DEM 0 5 11 17 9 6 5 3 2 Estonia (€) USD 93 42 33 27 21 19 16 18 17 Latvia (SDR) USD 53 68 55 45 44 44 41 19 20 Lithuania ($) USD 35 41 30 34 50 62 59 41 33 Source: World Bank, Global Development Finance 11 I looked at trade with countries in “Europe,” which, in IMF’s definition, closely proxies for Eastern and Central Europe. -39- Table 5: Summary statistics on monthly PPI inflation in the Baltics, 1995-2001 Estonia (€ peg)Latvia (SDR peg)Lithuania ($ peg) 0.54 0.30 0.44 Mean (%) 1.10 0.78 2.03 Standard deviation (%) 84 84 84 Observations Source: IMF, International Financial Statistics Table 6: Summary statistics on quarterly GDP growth in the Baltics, 1995-2001 Estonia (€ peg)Latvia (SDR peg)Lithuania ($ peg) 1.23 1.05 0.71 Mean (%) 1.01 0.95 1.38 Standard deviation (%) 28 28 28 Observations Source: IMF, International Financial Statistics Table 7: Summary statistics on monthly PPI inflation and quarterly GDP growth in the Baltics, 1996-2001 Monthly PPI inflation, 1996-1998 Estonia (€ peg)Latvia (SDR peg)Lithuania ($ peg) 0.46 0.25 -0.05 Mean (%) 0.78 0.74 1.18 Standard deviation (%) 36 36 36 Observations Monthly PPI inflation, 1999-2001 Estonia (€ peg)Latvia (SDR peg)Lithuania ($ peg) 0.24 0.05 0.56 Mean (%) 0.41 0.37 2.21 Standard deviation (%) 36 36 36 Observations Quarterly GDP growth, 1996-2001Estonia (€ peg)Latvia (SDR peg)Lithuania ($ peg) 1.25 1.26 0.92 Mean (%) 1.01 0.84 1.14 Standard deviation (%) 24 24 24 Observations Source: IMF, International Financial Statistics -40- Figure 1: Impact of a 10% depreciation of the euro against the dollar under a euro peg -41- Figure 2: Impact of a 10% depreciation of the euro against the dollar under a tradeweighted basket peg -42- Figure 3: Impact of a 10% depreciation of the euro against the dollar under a dollar peg -43- Figure 4: Consumption and output volatility as functions of the share of trade with the US under three exchange rate regimes -44- Figure 5: Consumption and output volatility as functions of the basket weight on the dollar (γ=0.5) -45- Figure 6: Optimal weight on the dollar as a function of the share of trade with the US -46- Figure 7: Optimal weight on the dollar as a function of the persistence in the exchange rate shock (γ=0) -47-