cenvat credit rules,2004

advertisement

CENVAT CREDIT RULES,2004

Introduction

→

In India, prior to introduction of CENVAT, the concept of MODVAT (Modified

Value added Tax) was there where the Concept of “Value Added Tax “was

restricted up to

Manufacturing Staff of goods (Credit of only Excise duty paid on impact was

available

→

But CENVAT Scheme was introduced with effect from 10 th September, 2004

with the following benefits(i)

Credit of Service tax paid on Input Service available

(ii)

Credit of Excise duty paid on impacts is allowed to be used for paying

service tax on output Services

(iii)

Introduction of input Services distribution

(iv)

Inter Sectorial Credit is allowed

(v)

many other procedural Benefit

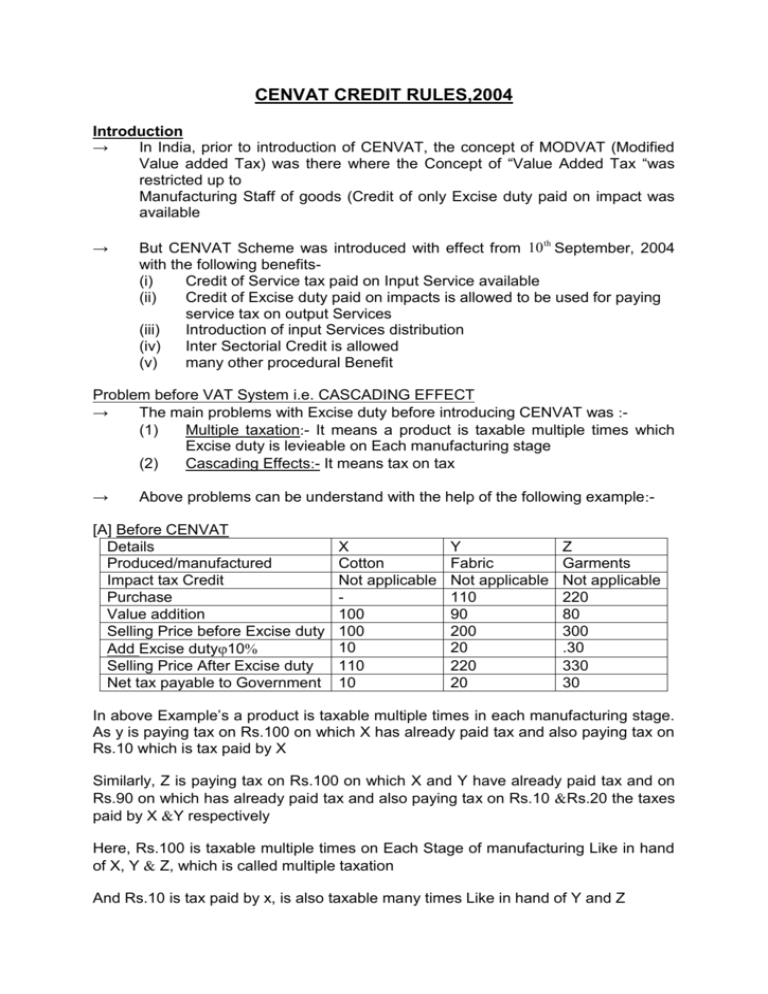

Problem before VAT System i.e. CASCADING EFFECT

→

The main problems with Excise duty before introducing CENVAT was (1)

Multiple taxation- It means a product is taxable multiple times which

Excise duty is levieable on Each manufacturing stage

(2)

Cascading Effects- It means tax on tax

→

Above problems can be understand with the help of the following example-

[A] Before CENVAT

Details

Produced/manufactured

Impact tax Credit

Purchase

Value addition

Selling Price before Excise duty

Add Excise duty10

Selling Price After Excise duty

Net tax payable to Government

X

Cotton

Not applicable

100

100

10

110

10

Y

Fabric

Not applicable

110

90

200

20

220

20

Z

Garments

Not applicable

220

80

300

.30

330

30

In above Example’s a product is taxable multiple times in each manufacturing stage.

As y is paying tax on Rs.100 on which X has already paid tax and also paying tax on

Rs.10 which is tax paid by X

Similarly, Z is paying tax on Rs.100 on which X and Y have already paid tax and on

Rs.90 on which has already paid tax and also paying tax on Rs.10 Rs.20 the taxes

paid by X Y respectively

Here, Rs.100 is taxable multiple times on Each Stage of manufacturing Like in hand

of X, Y Z, which is called multiple taxation

And Rs.10 is tax paid by x, is also taxable many times Like in hand of Y and Z

(B)After CENVAT

Details

Produced/manufactured

Input tax Credit

Purchase

Value addition

Selling price before Excise duty

Add Excise duty-10

Selling price after Excise duty

Net tax payable to Government

X

Cotton

100

100

10

110

10

Y

Fabric

10

100

90

190

19

209

19-109

Z

garments

19

190

80

270

27

297

27-198

In Such above example, a product is taxable on value addition made in Each

manufacturing stage

As X is paying tax of Rs.10 on only value addition of Rs.100 made by him in

manufacturing

Similarly y is paying tax of Rs.9 on only value addition of Rs.90 made by him in

manufacturing

Similarly z is paying tax of Rs.8 on only value addition Rs.80 made by him in

manufacturing

So, this CENVAT system eliminate the effects of Multiple taxation and CASCADING

Here, the final price of Government i.e. Rs.330 before CENVAT System

CENVAT CREDIT

(A)Manufacturing of Goods

If the manufacturer manufactures a dutiable goods then he has to pay Excise duty

bribable on such finished goods after deducing the following(i)

Excise duty paid on inputs [Raw material, Consumable stores, packing

materials etc.

(ii)

Excise duty paid on Capital Goods used for manufacturing of dutiable goods

(iii)

Service tax paid on Input Services used for manufacturing of dutiable goods

(B) Providing of ServicesIf Service provider is providing dutiable services then he has to pay Services tax

livable on Such Services after dedicating the following(i)Excise duty paid on inputs used providing the dutiable services

(ii)Excise duty paid on Capital goods used for providing dutiable services

(iii)Services tax paid on Input services used for providing dutiable services

Author’s Notes1.

If Excise duty paid on Capital goods are used or adjusted against Excise duty

payable on finished goods them no depreciation is allowed on Excise duty

portion in the value of Capital goods under Section 32 of Income Tax act,

1961

2.

If the final/ finished product or Services provided are not dutiable then CENVA

Credit of Excise duty paid on Inputs and Capital Goods and Services tax paid

on Input Services are not allowed because there are no. multiple taxation and

Cascading effects involved in it.

But Export of goods or Services as a Special Case enables the manufacturer to take

and avail CENVAT Credit though no. Excise duty/Service tax is paid on goods /

Service exported

IMPORTANT DEFINITIONS.

1. CAPITAL GOODS

Capital Goods means(A)the following goods, namely(i) All goods, namely-chapter 82 [Tools, hand, tools, knives]

-chapter84 [Machinery]

-chapter 85 [Electric Machinery]

-chapter 90 [Measuring, checkingTesting Machinery]

-heading no.6805 [Polishing Abrasive Powder or garnish]

-heading no.6804 [grinding wheels and parts thereof]

(ii)

Pollution Control equipment;

(iii)

Components, spares and accessories of the goods specified (i) (ii)

(iv)

Molds and dies, jigs and fixtures

(v)

Refractories and refractory materials

(vi)

Tubes and pipes and fittings thereof;

(vii) Storage tank and

(viii) Motor vehicles other than those falling under tariff headings 8702, 8703, 8704,

8711 and their chassis but including dumpers and tippers under(1)

in the factory of the manufacturer of the final Products, but does not

include any equipment or appliance used in an office; or

(1A) Outside the factory of the manufacturer of the final products for

generation of Electricity for Capture use within the factory or

(2)

for providing output service

(B)

Motor Vehicles falling under tariff headings 8702,8703,8704,8711 Motor vehicle designed for transportation of goods including their

chassis registered in the name of service provider, when used for(i) Providing an output service of renting of such motor vehicle; or

(ii) Transportation of inputs and capital goods, used for providing an

output service; or

(iii) Providing an output services of courier Agency

Motor vehicle designed to carry passengers including their chassis,

registered in the name of the provider of service, when used for

providing output service of(I) transportation of passenger; or

(ii) Renting of such motor vehicle; or

(iii)Imparting Motor driving skills

(C) Components, spares and accessories of Motor vehicles which are capital goods

for the Assurers

2. Input

Input means(i)

All goods used in the factory by manufacturer of the final products or

(ii)

Any goods including accessories, cleared along with the final product, the

value of which is included in the value of final product and goods used for

providing free warranty for the final products ; or

(iii)

All goods used for generation of electricity or steam for captive use; or

(iv)

All goods used for providing any output service;

But excludes

(A)

Light diesel oil, high speed diesel oil or motor spirit, commonly known as

petrol,

(B)

Any goods used for(a)Construction or execution of works contact of a building or a civil Structure

or a part thereof; or

(b) Laying of foundation or making of structures for support of capital goods,

Except for the provision of services portion in the execution of a works

Contact or Construction service as listed under clause (b) of section66e of the

Act

(C)

Capital goods except when used as parts or components in the manufacturer

of a final product;

(D)

Motor vehicles;

(E)

Any goods, such as food items, goods used in a guest house, residential

colony, club or a recreation facility and clinical establishment, when such

goods are used primarily for personal use or consumption of any Employee;

and

(F)

Any goods which have no relationship what so ever with the manufacture of

the final product

Explanation-Free warranty” means a warranty provided by the manufacturer, the

value of which is included in the price of the final product and is not charged

separately from the customer;

Analysis1

Light diesel oil, high speed diesel and petrol are not at all treated as inputs

2.

Goods used in construction, works contract or any civil work or laying of

foundation are not inputs

3.

Motor vehicles is no case are treated as ’Input

4.

Any goods having no relationship with the manufacture of a final product are

not inputs

3. Input Service

‘“Input Services” means any services

(i)

Used by a provider of output service for providing an output service; or

(ii)

Used by a manufacturer, whether directly or indirectly, in or in relation to the

manufacture of the final product and clearance of final products up to place of

removal, and includes services used in relation to

𝑎 𝑓𝑎𝑐𝑡𝑜𝑟𝑦 𝑜𝑟

→ 𝑀𝑜𝑑𝑒𝑟𝑛𝑖𝑠𝑎𝑡𝑖𝑜𝑛,

𝑟𝑒𝑛𝑜𝑣𝑎𝑡𝑖𝑜𝑛, 𝑜𝑟 ] 𝑜𝑟 {𝑃𝑟𝑒𝑚𝑖𝑠𝑒𝑠 𝑜𝑓 𝑝𝑟𝑜𝑣𝑖𝑑𝑒𝑟 𝑜𝑓 𝑜𝑢𝑡𝑝𝑢𝑡 𝑠𝑒𝑟𝑣𝑖𝑐𝑒𝑠, 𝑜𝑟

𝑟𝑒𝑝𝑎𝑖𝑟𝑠

𝑂𝑓𝑓𝑖𝑐𝑒 𝑟𝑒𝑙𝑎𝑡𝑖𝑛𝑔 𝑡𝑜 𝑠𝑢𝑐ℎ 𝑓𝑎𝑐𝑡𝑜𝑟 𝑜𝑟 𝑝𝑟𝑒𝑚𝑖𝑠𝑒𝑠

Advertisement or sales promotion or marketing research

Storage up to the place of removal,

Procurement of inputs,

Accounting,

Auditing,

Financing,

Recruitment

Quality control

Coaching and training

Computer networking,

Credit rating

Share registry

Security,

Business exhibition,

Legal services,

Inward transportation of inputs or capital goods, and

Outward transportation up to the place of removal.

But Excludes

(A) Service portion in the Execution of a works contact and construction services

including services listed under clause (b) of Section 66E of the finance Act (here in

after referred as specified services ) in so far as they are used for (a)

Construction or execution of works contract of a building or a civil

structure or a part there of:

(b)

Laying of foundation or making of structures for support of Capital

goods.

Note:Services listed under clause (b) of Section 66E are: Architect Services

Port Services

Other Port Services

Airport services

Commercial or Industrial construction

Construction of Residential complex

Works contract services

(B)

Services provided by way of renting of a Motor Vehicle, in so far as they relate

to a motor vehicle which is not a capital goods: or

(BA) Service of general insurance business, Servicing or repair and maintenance,

in so far as they relate to a motor vehicle which is not a capital goods, Except

when used by:(a)

a manufacture of a motor vehicle in respect of a motor vehicle

manufactured by a such person ; or

(b)

(c)

an insurance company in respect of a motor vehicle insured or

reinsured by such person ; or

Such as those provided in relation to

Outdoor catering

beauty treatment

Health services

Cosmetic and Plastic services

Membership of Club, health and fitness center,

Health insurance and travel benefits extended to Employees on

vacation such as Leave or home travel concession.

When such above services are used primarily for personal use or

consumption of any employee.

4. Final Products:“Final Products” means excisable goods manufactured or produced from

input, or using input services.

5.Output Services

“Output service” means any services provided by a provider of service located

in the taxable territory.

6. Exempted Goods

“Exempted Goods” means excisable good which are except from the whole of the

duty of excise leviable thereon and includes goods which are chargeable to

Net”

rate of duty goods.

7. Exempted Services:

“Exempted Service” means

(1)

Taxable services which is exempt from the whole of the service tax

leviable thereon: or.

(2)

Service, on which on service tax is leviable under Section 66B of the

Finance Act,. 1994.

8.First Stage Dealer

“First Stage Dealer” means a dealer, who purchases the goods directly from

(i)

The manufacturer, his depot, premises of his consignment agent or any

other place where the goods are sold on behalf of

manufacturer

under cover of invoice.

(ii)

An importer, his depot, premises of his consignment agent under

cover of Invoice.

9. Second Stage Dealer:“Second stage Dealer” means a dealer who purchases the goods from a first stage

dealer.

CENVAT CREDIT, UTILIZATION, LIMITATIONS AND CONDITONS (RULE-3)

RULE 3(1):- Duties on which Credit can be Taken

Rule 3(1) Provides the following types of duties in respect of which credit can be

taken:(i)

Basic excise duty (BEW) is Levied at the rates specified in the first Schedule

to CETA, 1985.

(ii)

Special Excise Duty(SEW) is Levied at the rates specified in the second

schedule to the CETA, 1985.

(iii)

Additional Excise duty (AEW) on textiles articles levied under Additional

Duties of Excise [Textile and Textile Articles), Act, 1978.

(iv)

Additional Excise Duty on goods of special importance Levied under

Additional Duties of Excise [Goods of Special importance) Act, 1957.

(v)

National Calamity Contingent duty [NCCD] Leviable under section 136 of the

finance Act, 2001 on Cigrattes and Pan Masala etc.

(vi)

Additional duty of Excise Leviable under Section 157 of the Finance Act, 2003

for development of tea.

(vii) Additional duty of excise Leviable under Section 85 of the Finance Act, 2005

as Health cess.

(viii) Countervailing duty [CVD] Leviable under Section 3 of the customs Tariff Act.

This duty is leviable on imported articles and is equal to the duties of excise if

the same article is produced or manufactured in India.

However, the CENVAT credit Shall not be allowed in excess of Eighty-five

percent of the additional duty of customs paid under Section3(1) of the

customs Tariff Act, on ships, boats and other floating structure for breaking up

falling under tariff item 8908 00 00 of the first Schedule to the Customs Tariff

Act.

(ix)

Special CVD also known as SAD[Special Additional duty] is payable under

Section 3(5) of customs Tariff Act at 4%. This is in Lieu of Sales Tax.

Note:- Only a manufacturer is eligible to take this credit on imported goods.

Service provider is not eligible as he has no connection with sales tax.

(x)

Education Cess [EC] and secondary and higher education Cess [SHEC] on

Excisable Goods Leviable under Section 11 read with Section 93 of Finance

Act, 2004 and under Section 136 read with Sectoion 138 of the Finance Act,

2007 respectively.

(xi)

Service tax Leviable under Section 66B of Financial Act, 1994.

(xii) Education Cess [EC] and Secondary and higher education cess [SHEC] on

Taxable Services Leviable under Section 91 read with Section 95 of Finance

Act, 2004 and Leviable under Section 136 read with Section 140 of the

Finance Act, 2007 respectively.

AND which are paid on

(I)

any input or capital goods received in the factory of manufacturer of

final product or by the provider of output services on or after the 10th

day of September, 2004, AND

(II)

Any input services received by the manufacture of final product or by

the provider of output service on or after the 10th day of September,

2004.

RULE 3(7)(B)

RESTRICTION ON UTILIZATION OF CREDIT FOR PAYMENT OF DUTY.

Table showing the utilization of CENVAT CREDIT

CREDIT OF

UTILISATION FOR

Basic excise duty

All except health cess

Special excise duty

Goods of special importance

Service tax

Additional duty on textile Articles

Additional duty on textile Articles

National Calamity contingent duty

National Calamity contingent duty

Education cess & SHEC ON Excisable Education cess &SHEC

goods

-On excisable goods

-On taxable Services

Additional duty of excisable Leviable All except Health cess and Service tax

under Section 3(5) of Custom tariff Act.

Additional duty of excisable Leviable Additional duty of excise Leviable under

under Section 157 of the finance Act, Section 157 of the finance, Act, 2003 for

2003 for development of tea.

development of tea.

Education cess & SHEC on taxable Education cess & SHEC

services

- On Excisable Good

- On taxable Services

Health cess

Health cess

CENVAT CREDIT on inputs lying in stock used in the Final Products which

cease to be exempted Rule 3(2).

The manufacturer of producer of final products shall be allowed to take CENVAT

Credit of the duty paid on inputs lying in Stock or in process or inputs contained in

the final products lying in stock on the date on which any goods manufactured by

the said manufacturer or producer cease to be exempted goods or any goods

become excisable.

CENVAT Credit on inputs lying in Stock used in the output services which

cease to be exempted Rule 3(3).

The provider of the output service shall be allowed to take CENVAT credit of the

duty paid on the inputs lying in the stock on the date on which any services

ceases to be an exempted service and used for providing such services.

UTILIZATION OF CENVAT CREDIT RULE 3(4).

The CENVAT Credit may be utilized for payment of:(a)

any duty of excise on any final product; or

(b)

Service tax on any output services

(c)

An amount equal to Cenvat credit taken on input if such inputs are removed

as such or after being partially processed; or

(d)

an amount required to be paid where goods processed does not amounts to

manufacture under sub-rule (2) of rule 16 of Central Excise Rules, 2002; or

(e)

an amount equal to the CENVAT credit taken on capital goods if such Capital

goods are removed as such.

Note:1.

While paying duty of excise or service tax, as the case may be, the CENVAT

credit shall be utilized only to the extract such credit is available on the last

day of the month or quarter, as the case may be, for payment of duty or tax

relating to that month or the quarter.

2.

CENVAT credit cannot be used for payment of service tax in respect of

services where the person liable to pay tax is the service recipient.

Capital Goods or inputs removed as such Rule 3(5)

When inputs or capital goods, on which CENVAT credit has been taken, are

removed as such from the factor, or premises of the provider of output service,

the manufacturer of the final products or provider of out put service, as the case

may be shall pay an amount equal to the credit availed in respect of such inputs

or capital goods and such removal shall be made under the cover of an invoice

referred to in Rule 9.

However, such payment shall not be required to be made where any inputs or

capital goods are removed outside the premises of the provider of output service

for providing the output services.

It is further provided that payment should not be required to be made where any

inputs are removed outside the factory for providing for warranty for final

products.

Capital goods cleared as waste and Scrap Rule3(5A)

If the Capital goods on which CENVAT credit has been taken, are removed

after being used, whether as capital goods or as scrap or waste the

manufacturer or provider of output services shall pay on amount equal to the

CENVAT credit taken on the said capital goods reduced by the percentage

points calculated by straight line method as specified below for each quarter

of a year or part thereof from the date of taking the CENVAT credit, namely:(a)

(b)

for computers and Computer peripherals.

for each quarter in the first year

For each quarter in the Second year

For each quarter in the third year

For each quarter in the fourth and fifth year

@ 10%

@ 8%

@ 5%

@ 1%

For capital goods, other than computers and computer peripheral@2.5 for

each quarter

Note- However, if the amount so calculated is less than the amount equal to the

duty leviable on tans action value, the amount to be equal to the duty leviable

on transaction value.

Example-Mr. Manufacturer Purchased Machinery for 100000Rs.@10Excise duty

but After 5 years, he sold for RS.70,000. So As per Calculation he has to give

10000-(2.5of 10000x4x5yrs)

2.5

x10000x4x5yrs]

100

10000-5000

5000Rs

But duty calculated on transaction value of Rs.70000@10is 7000

So, duty calculated is less than duty on transaction value then he has to give duty

on transaction value i.e. 7000 Rs.

[10000-

Taken CENVAT Credit on input or Capital Goods Written Off Rule 3[5B]

→

If the Value of any

(i)

Input or

(ii)

Capital Goods

Before being put to use, on which CENVAT credit has been taken is written off fully

or partially or where any provision to write off fully or partially has been made in the

books of accounts then the manufacturer shall pay an amount equivalent to the

CENVAT Credit taken in respect of the said input or capital goods.

→

→

However, if the said input or capital goods is subsequently used in the

manufacture of final products or the provision of output services, the

manufacturer or output service provider, as the case may be, shall be entitled

to take the credit of the amount equivalent to the CENVAT credit paid earlier

subject to the other provisions of these rules.

If the manufacturer of goods or the provider of output service fails to pay the

amount payable under sub-rules (5), (5A) and (5B), it shall be recovered, in

the manner as provided in rule 14, for recovery of CENVAT credit wrongly

taken.

Remission of duty Rule 3(5C)

→

Where on any goods manufactured or produced by an assessee, the payment

of duty is ordered to be remitted under Rule 21 of central Excise Rules, 2002,

the CENVAT Credit taken on the inputs used in the manufacturer or

production of said goods shall be reversed.

REVERSAL OF DUTY IS CONSIDERED AS PAYMENT OF DUTY RULE 3(6)

→

The amount of duty written off or reversed under sub-rule(5) or sub rule(5A),

shall be eligible as CENVAT credit as if it was a duty paid.

CENVAT credit in case of Marble tiles:→

On imported marble slabs and marble tiles, CENVAT credit can be take at a

fixed Rate of Rs. 30 per square meter.

→

The CENVAT credit constitutes CVD & Special CVD if any.

Credit in respect of goods purchased from 100% EOU [Rule 3(7) (a)]

→

CEVAT credit in respect of inputs or capital goods produced or manufactured,

by a 1000% export-oriented undertaking [EOU] or by a unit in an electronic

Hardware Technology Park [EHTP] or in a software Technology Park (STP)

and used.

(i) in the manufacturer of the final products or

(ii)

in providing an output service, shall be admissible equivalent to the

amount calculated in the following manner:-

CENVAT

BCD CVD

sale price x 1

x

200 100

Example:Purchased 1000 units from EOU at Rs. 400 (before taxes) BCD 10% and CVD 16%.

Find out the CENVAT Credit eligible to the buyer.

[study material ICSI]

ANSWER:CENVAT Credit=

10 16

210 16

400 1

x

400

x

Rs. 67.20

200 100

200 100

Credit

For 100 units 67.2x1000 67, 200 Rs.

Alternatively , the CVD amount can be calculated as follows:

Assessable value

Rs.400

Add

1

1

50% of BCD[i.e. [2 𝑥 100 𝑥400]

20

After BEW

420.00

16

CVD on 420 @ 16% = 420x

Rs.67.20

100

For 1000 units

Rs. 67.20x1000

Rs. 67,200

CONDITIONS FOR ALLOWING CREDIT (RULE 4)

___________________________________________________________________

Credit on input [Rule 4(1)

→

The CENVAT credit user is allowed to take 1005 credit on inputs immediately

on bringing them into the factory.

Credit on capital goods [Rule 4(2)

→

As per Rule 4(2)(a), in case of capital goods brought into the factory or in the

premises of the provider of output services or outside the factory of the

manufacturer of the final for generation of electricity for captive use within the

factory only 50% is allowed in the financial year of purchase and the rest in

the subsequent financial year

.

→

However, 100% credit is allowed on capital goods in the following 3 cases:1.

If the capital goods are cleared as such in the same financial year, full

credit can be taken on removal.

2.

Special CVD paid by a manufacturer on imported capital goods

3.

SSI units.

2.

3.

Special CVD paid by a manufacturer on imported capital goods

SSI units.

Notes:1,

The CENVAT credit of the additional duty leviable u/s 3(5) of customs Tariff

Act. 1985, in respect of capital goods shall be allowed immediately on receipt

of the capital goods in the factory of a manufacturer.

2.

But such capital goods must be in possession in the subsequent financial

years. This has an exception.

“Spares, components, accessories, refractories, moulds, dies and specified

goods falling under chapter 68 need not be in possession in the subsequent

financial year, CENVAT credit can be taken even if they are consumed in the

first year itself [Rule 4(2)(b)].

3.

CENVAT credit can be taken on capital goods even if they are acquired on

lease, hire purchase or loan arrangement. It is therefore not necessary that

the goods must be purchased [Rule 4(3)]

4.

Depreciation under section 32 of Income Tax Act, 1961 shall not be claimed

on excise duty portion in the event of availing CENVAT credit or capital

goods. [Rule 4(4)]

5.

The CENVAT credit user can taken credit on inputs sent to Job worker for

further processing/repair reconditioning. But he has to reverse/pay the credit

amount if the goods are not received back from the job worker within 180

days of sending.

It means, he can enjoy the credit upto 180 days only. Beyond that he has to

forgo the benefit till he actually receives them back from the Job Worker.

Credit is also allowed in respect of Jigs, fixtures moulds and dissent to Job

worker[Rule 4(5)].

6.

Goods may also be allowed to be removed from the premises of the job

worker by taking permission from the Assistant Commissioner. Such an order

7.

permitting the removal by the Assistant Commissioner is valid for a financial

year. Such an order may specify the conditions for the removal. [Rule 4(6)].

The CENVAT credit in respect of capital goods may be taken by the provider

of output service when the capital goods are delivered to such provider,

subject to maintenance of documentary evidence of delivery and location of

the capital goods.

Conditions for availing credit on input services [Rule 4(7)]

→

CENVAT credit in respect of input service is allowed on or after receiving the

invoice, bill or challan.

Proviso 1:- Where service receiver is liable to pay service tax directly

reverse charge, he is eligible to take credit only after payment of service

charge and service tax.

Proviso 2:- If the beneficiary of CENVAT credit [manufacturer or service

provider] does not pay the service charge and the service tax with 3 months of

the date of invoice etc to the provider of Input services, he has to pay/reverse

the credit taken on the basis of the documents received. He becomes eligible

to take credit only after the payment of the said amounts.

Proviso 3:- The beneficiary of CENVAT credit is also required to

pay/reverse the credit to the extent of refund or credit not received form the

provider of input service.

Proviso 4:- For the documents received before 1st April, 2011, the

beneficiary is entitled to credit only after the required payment is made.

CENVAT CREDIT TO SERVICE PROVIDING SERVICES TAXED ON

REVERSECHARGE BASIS-RULE 5B

→

A provide of service

Providing services notified under Sections 68(2) of Finance Act 1994

[i.e. Reverse Charge Basis]

And being unable to utilise the CENVAT Credit availed on inputs and

input services

For payment of service tax on such output services

Shall be allowed refund of such unutilized CENVAT credit

Subject to procedure, safeguards, conditions and Limitations, as may

be specified by the Board by notification in the official Gazette.

OBLIGATION A MANUFACTURER OR SERVICE PROVIDER

RULE 6

Rule 6 deals with the fundamental principle of taking CENVAT credit.

Rule 6(1)

→

the CENVAT credit can not be taken on those inputs whose final product is

exempt.

→

similarly in case of services, the CENVAT credit also can not be taken on

those inputs whose output services is exempt.

→

Because, the facility of CENVAT credit is available mainly to remove

(i)

The effect of cascading i.e. tax on tax, and

(ii)

The effect of multiple taxation

Hence, if final product or output service is exempt, then input credit is denied.

Rule 6(2)

→

Where inputs or Input services are used for both taxable and non-taxable

goods or services, then CENVAT credit can be taken only on that quantum of

inputs used for dutiable goods or taxable services provided that separate

accounts have to be maintained.

→

Example:_

Leather is used for exempted as well as dutiable footwear, say chappals and

shoes. Chappals are exempted and shoes are dutiable. The manufactures

paid the duty of Rs. 30000 on Leather 60% of Leather was used for shoes.

CENVAT credit can be taken for Rs. 18,000 [60% of Rs. 30000] by

maintaining separate accounts.

Rule 6 (3)

→

Rule 6(3) is an extension of Rule 6(2) which provides for following options to

the assessee who prefers not to maintain accounts separately:Option I:As per Rule 6(3)(i), take full credit but pay 6% on the value of exempted

goods/exempted services, or

Option II:As per Rule 6(3)(ii), take full credit and pay back the amount of credit attributable to

exempted goods or exempted services by following the procedure specified in Rule

6(3A); or

Option III:As per Rule 6(3)(iii) maintain separate accounts for inputs and pay the amount on

input services as per Rule6(3A). [This is a hybrid system newly introduces budget

2011].

NOTE:Provided that in case of transportation of goods or passenger by rail, the amount

required to be paid under clause (i) shall be an amount equal to 2 percentage of the

value of the exempted services.

Rule6(3A):- Procedure and Conditions:The manufacturer of goods or the provider of output service shall follow the following

procedure & conditions are prescribed for determination and payment of amount

payable under Rule 6(3)(ii):(a)

Intimate to the Superintendent of Central Excise in writing the details of:Name and address and registration number

Date of commencement of the option

Description of dutiable goods/exempted goods or output

services/exempted services.

CENVAT credit lying in balance on the date of exercising the option.

(b)

Determine and pay, provisionally every month the amount of credit attribute to

the exempted goods or exempted services.

Determine finally the amount of CENVAT credit attributable to exempted

goods or exempted services for the whole financial year.

Pay the amount of difference in the provisionally and finally determined

CENVAT credit by 30th June of succeeding financial year.

If the difference amount is paid beyond 30th June, pay with interest @ 24%

per annum for the period after June 30.

If the amount paid is in excess of what is payable self-adjustment can be

made.

Intimate to the Jurisdictional superintendent of Central Excise within 15 days

of payment or adjustment with the details.

(c)

(d)

(e)

(f)

(g)

Important Notes:No credit is allowed on those inputs and input services which are used exclusively

for exempted goods or exempted services.

Rule 6(3B):- Availment of CENVAT credit in case of Banking Company and NBFC

→

A banking Company and a financial institution including a non-banking

financial company, engaged in providing services by way of extending

deposits, loans or advances shall pay for every month an amount equal to fifty

percent of CENVAT credit availed on inputs and input services in that month.

Rule6(4):→

If capital goods are exclusively used for exempted goods or exempted

services, then CENVAT credits on duty paid on such capital goods cannot be

taken. Here SSI units are an exception.

→

If capital goods are partly used for exempted goods or exempted services, full

credit on them can still be taken.

Rule6(5):-

Omitted

Rule6(6):→

All clearance made to

an EOU

SEZ units, or

SEZ developer, or

EHTP, or

STP, or

-

-`

→

UN agencies, or

Supplied for the use of foreign diplomatic missions. Diplomatic agents or an

international organisation for their official use or supplied to projects funded by

them, or

for export under bond or

removal of gold or silver arising in manufacture of copper or zinc by smelting

and supplies made for setting up of solar power generation projects or

facilities.

No excise duty is leviable on such clearance but CENVAT credit can taken on

such removals.

Rule6(7):→

The provisions of sub-rules (1), (2), (3) & (4) shall not be applicable in case

the taxable services are provides without the payment of service tax, to a unit

in Special economic zone or to a developer of a special economic zone for

their authorised operations or when a service is exported.

Rule6(8)

→

For the purpose of this rules a service provided or agreed to be provided

shall not be an exempted service when:(a)

The service satisfies the conditions specified under rule 6A of the

Service tax Rules, 1994 and the payment for the service is to be

received in convertible foreign currency; and

(b)

Such payment has not been received for a period of six months or such

extended period as may be allowed from time to time by the Reserve

Bank of India, from date of Provision.

MANNER OF DISTRIBUTION OF CREDIT BY INPUT SERVICE DISTRIBUTOR

[RULE 7]

A manufacturer or service provider may have head office and regional office

[Branch Office] at different places.

The services may be received by such head office or regional office under a

invoice but these services are used by head office or regional offices

So, the head office or Regional office who receive such invoice [called Input

Service distributor] and paid service tax on services received, shall distribute

the credit of such input service tax paid to its Head Office or Regional Office

subject to following condition:(a)

The credit distributed shall not exceed the amount of service tax paid.

(b)

No credit amount can be transferred to that unit which is exclusively

manufacturing exempted goods or provider of exempted services.

(c)

Credit of service tax attributable to services used wholly in a unit shall

be distributed pro rate on the basis of the turn over during the relevant

period of the concerned unit to the sum total of the turnover of all the

units to which the services relates during the same period.

Notes:1.

The relevant period shall be the month previous to the month during which the

Cenvat credit is distributed.

Clarification:1.

Every head office or regional office or factory of manufacturer or service

provider has different registration number [i.e. excisable control code STP

CODE].

PROCEDURE FOR REFUND OF CENVAT CREDIT

The Government has prescribed the procedure for claiming refund of the unutilized

CENVAT credit:(i)

The manufacturer has to file a declaration with his AC/DC describing the

finished goods, duty rate, manufacturing formula with reference to quantity

and quality of the raw materials.

(ii)

A monthly statement by the 7th of the month has to be filed giving details of

opening balance, receipts, value, duty, amount of credit taken & quantity of

inputs used during the month, final products manufactured, inputs lying in

stock , credit utilised and the amount of credit lying in the balance.

(iii)

The AC/DC after verification will refund the un utilized credit within three

months from the date of receipt.

(iv)

If there is likely to be any delay in grating the refund, the AC can grant 80% of

the amount claimed on a provisional basis.

DISTRIBUTION OF CREDIT ON INPUTS BY THE OFFICE OR ANY OTHER

PREMISES OF OUTPUT SERVICE PROVIDER RULE 7A

A output service distribute may have head office and regional office [Branch

Office at different places.

The inputs or capital goods may be received by such head office or regional

office under a Invoice or challan or bill but these inputs or Capital Goods are

used by head office or regional offices.

So, the head office or Regional office who receive such invoice [called Input

distributor] and paid excise duty on inputs or capital goods received. Shall

distribute the credit of such input excise duty paid to its Head office or regional

office subject to following conditions:(a)

The credit distributed shall not exceed the amount of excise duty paid.

(b)

No credit amount can be transforced to that unit which is exclusively

providing exempted services.

(c)

Credit of excise duty attributable to inputs or capital goods used wholly

in a unit shall be distributed only that unit.

(d)

Credit of excise duty attributable to inputs or capital goods used in

more than one unit shall be distributed pro-rata on the basis of the

turnover during the relevant period of the concerned unit to the sum

total of the turnover of all the units to which the inputs or capital goods

relates during the same period.

Note:1.

The relevant period shall be the month previous to the month during

which the CENVAT credit is distributed.

Clarification:1.

Every head office or regional office of service provider has different

registration number [i.e. service tax payer code [STP CODE]].

Difference:The main difference between input service distributor under Rule 7 & Input

distributor under Rule 7 A are:_

1.

The input service distributor may be a manufacturer or service provider

whereas input distributor is service provider.

2.

The input service distributor distributes credit on service tax paid but

the input distributor distributes excise duty paid on inputs and capital

goods.

STORAGE OF INPUT OUTSIDE THE FACTORY OF THE MANUFACTURER

[RULE 8]

→

Storage of goods outside the factory may be allowed by Additional

Commissioner/Deputy Commissioner in exceptional cases subject to certain

conditions and Limitations.

DOCUMENTS AND ACCOUNTS

→

RULE 9

The manufacturer or service provider can claim the CENVAT credit on the

strength of the following documents:-

(a)

(b)

Invoice obtained from various sources of Local purchase. The local

suppliers may include manufacturers, importers, dealers or their

depots, branches, agents etc.

supplementary invoice issued by the manufacturer or importer of inputs

or capital goods or by provider of output service in addition to the

invoice on various counts. The amount paid under this is also eligible

for taking CENVAT credit but subject to the condition that such issue of

supplementary invoice was NOT

necessitated by fraud, willful

misstatement, suppress of facts etc on the part of the supplier.

Note:Supplementary invoice by service provider is also eligible for taking CENVAT credit.

(c)

Bill of entry in case of direct imports

(d)

Certificate issued by appraiser of customs in case of imports by post

(e)

A challan evidencing the payment of Service tax by the person liable to

pay service tax.

(f)

An invoice, bill or challan issued by provider of Input service

(g)

An invoice, bill or challan issued by provider of input service distributor.

Particulars to be mentioned on the invoice for the purpose of CENVAT credit

Rule 9(2)

→

According to Rule 9(2) of CENVAT credit Rules, all the Particulars mentioned

in the central excise Rules 2002. Should be mentioned on the invoice.

→

However, if an invoice contains the details of :Payment of duty or service tax.

description of the goods or taxable service

assessable value,

name & address of the factory or warehouse or provider of taxable

services.

And the jurisdictional Deputy commissioner/ Assistant Commissioner of

Central Excise is satisfied that the goods or services covered by the said

documents have been received or accounted for in the books of accouts of

the receiver, he may allow the CENVAT Credit.

Requirement relating to maintenance of Records

The following records are required to be maintained in context of CENVAT Credit: Records to be kept by dealer of input goods/Capital goods

The CENVAT credit in respect of first stage dealer or second stage dealer is

allowed only if such of first stage dealer or second stage dealer, as the case

may be, has maintained records indicating the fact that the input or capital

goods were supplied from the stock on which duty was paid by the producer

of such input or capital goods [Rule 9(4)].

Records regarding inputs/capital goods to be kept by the output service

provider.

The provider of output service is required to maintain proper records for the

receipt, disposal, consumption and inventory of the input and capital goods in

which the relevant information regarding;The value

duty paid

CENVAT credit taken & utilized,

-

the person from whom the input or capital goods have been procured is

recorded [Rule 9(5)].

Records regarding input services to be kept by the output service Provider

The provider of output services is required to maintain proper records for the

receipt and consumption of the input services in which the relevant

information regarding.

The value

tax paid

CENVAT credit taken & utilized,

the person from whom the input or capital goods have been procured is

recorded [Rule 9(6)].

Note:The maintenance of proper records become absolutely necessary

because the burden of proof regarding the admissibility of the CENVAT credit shall

lie upon the provider of output service taking such credit.

Returns:Periodical returns on the utilization/transfer of CENVAT credit have to be submitted

by various parties as indicated below:(i)

The manufacturer to file return within 10 days in the following months.

Note:The SSI units shall file Return within 10 days of the close of the quarter.

(ii)

The FSD/SSD [dealer] to file within 15 days of the close of the quarter. The

return shall be filed electronically.

(iii)

The service provider to file half yearly return by the close of the month.

(iv)

The input service distributor shall file the half year return by the Last of the

month following the half year period.

Note:1.

The returns are to be submitted to the Superintendent of Central excise.

2.

A revised Return can be submitted by a service provider or input distributor

within 60 days of submission of the return.

Information relating to Principal Inputs [Rule 9A]

1.

A manufacturer of final products shall furnish to the superintendent of central

excise, annually by 30th April of each financial year, a declaration in the form

specified, by a notification, by the Board, in respect of each of the excisable

goods manufactured or to be manufactured by him, the principal inputs and

the quantity of such principal inputs required for use in the manufacture of unit

quality of such final products.

2.

If a manufacturer of final products intends to make any alteration in the

information so furnished under Rule 9A(1), he shall furnish information to the

superintendent of the Central Excise together with the reasons for such

alteration before the proposed change or within 15 days of such change in the

form specified by the Board under Rule 9A(1).

3.

A manufacturer of final products shall submit, within ten days from the close of

each month, to the superintendent of central excise, a monthly return in the

form specified, by a notification, by the Board, in respect of information

regarding the receipt and consumption of each principal inputs with reference

to quantity of final products manufactured by him.

4.

The Central Government may, by notification and subject to such conditions

or limitations, as may be specified in such notification, specify manufacturers

or class of manufacturers who may not be required to furnish declaration

mentioned in sub-rule(1) or monthly Return mentioned in subrule (3).

5.

Every Assesse shall file electronically, the declaration or the return as the

case may be specified in this rule.

Explanation:1.

“Principal Inputs” means any input which is used in the manufacturer of the

final product where the cost of such input constitutes not less than 10% of the

total cost of raw-materials for the manufacturer of unit quantity of a given final

products.

TRANSFER OF CENVAT CREDIT RULE 10

→

The manufacturer or service provider can transfer the credit taken by him in

case of transfer of business by way of sale, lease, merger etc.

→

Such a transfer must be supported by physical transfer of goods/Assets

→

And this must be done by taking into confidence Additional

Commissioner/Deputy Commissioner and on their satisfaction that everything

was done properly.

TRANSFER OF CENVAT CREDIT OF SPECIAL CVD- RULE 10A

→

The manufacturer having more than one registered premises can transfer the

credit taken on special CVD paid on imported goods to other units quarterly

by making entries in the records and issuing a transfer challan with details.

→

The transfer unit is entitled to take and utilize the credit based on the transfer

challan.

→

This above facility is not available to the units enjoying area based exemption

under various notifications like a unit in special economic zone.

→

Both transfer and transferee units have to submit monthly returns separately

regarding transfer and receipt of such credit.

TRANSITIONAL PROVISIONS- RULE 11

→

Credit taken under the old rules can be utilized under the new Rules 2004,

But such utilization is subject to the current rules in operation.

→

If an SSI following Scheme II i.e. paying duty after availing CENVAT credit but

he switch over to Scheme –I i.e. no excise duty pay & also no CENVAT credit

availed. But on date of switch over from scheme II to scheme –I it has to

reverse the credit taken on the inventory lying which follows two situation:(1)

If it does not have enough CENVAT credit balance, then It has to pay

to that extent which been deficient.

(2)

If any CENVAT credit amount still lies in the credit after the reversal,

then it shall automatically Lapse forever. [Rule 11(2)]

→

Similarly, when there is dutiable goods but it got exempted. So the

manufacturer is required to reverse the credit attributable to inputs etc lying in

stock on the date of exemption which follows two situation:-

1.

→

If it does not have enough CENVAT credit balance, then it has to pay

to that extent which been deficient.

2.

If any CENVAT credit amount still lies, in the credit after the reversal,

then it shall automatically Lapse forever. [Rule 11(3)]

Similarly, a service provider is also required to reverse the credits on inputs

when his services become fully exempt. [Rule 11(4)].

SPECIAL DISPENSATION TO NORTH EASTERN STATES ETC RULE 12

→

Certain units in the specified states in North Eastern under get preferential

treatment through notification issued Government of India.

→

These above units get exemption benefits of duty paid on value addition in

following special manner: Such above units pays duty on their final product by availing the input credit.

But such units will get the refund of the net amount paid by them on the

removal of their final products through Rule 5A of CENVAT credit Rules,

2004.

→

The following are the benefits of such above special procedure:1.

The final product of such above units are not at all treated as exempted

goods. By which such above units can avail CENVAT credit.

2.

The buyer manufacturer who purchases inputs or capital goods from

such above units, will get CENVAT credit normally as if nothing was

exempted.

DEEMED CREDIT- RULE 13

→

This Rule 13 is an exception to Rule 3, where Government notifies deemed

credit, the amount of credit eligible to be taken is as per the rates notified by

the Government, not on actual Basis.

→

At present deemed credit is not in vogue or popular.

PENAL PROVISION - RULE 14& RULE15

(I)Rule 14- Recovery of CENVAT credit wrongly taken or erroneously refunded

→

Where CENVAT credit has been taken and utilized wrongly or has been

erroneously refunded, the same shall be recovered from the manufacturer

and Service Provider with interest as per the provisions of the recovery of the

amount and interest

Note- The interest is payable with the amount of CENVAT credit only when such

CENVAT credit was taken wrongly and also utilized that wrong CENVAT

credit. Therefor interest is not payable if the credit taken wrongly not utilized.

II.Rule 15:- Confiscation and Penalty.

(A) Take or utilize wrong CENVAT credit other than reason of fraud, collusion or any

willful misstatement etc.

→

If any person, takes or utilize CENVAT credit in respect of input or capital

goods or input services, wrongly or in contravention of any of the provisions of

these rules, then, all such goods shall be liable to confiscation and such

person, shall be liable to a penalty:- an amount not exceeding the duty or service tax on such goods or services

or

- two thousand

Which ever is greater.

(B)

Take or utilize wrong CENVAT credit by the reason of fraud, collusion or any

willful misstatement etc.

(i)

In case of manufacturer.

→

In a case, where the CENVAT credit in respect of input or capital goods

or input services has been taken or utilised wrongly by reason of fraud,

collusion or any willful mis-statement or suppression of facts, or

contravention of any of the provisions of the excise acts or of the rules

made there under with intent to evade payment of duty, then

manufacturer shall also be liable to pay penalty in terms of the

provisions of section 11AC of the Excise Act.

(ii)

In case of service provider

→

In a case, where the CENVAT credit in respect of input or capital goods

or input services has been taken or utilised wrongly by reason of fraud,

collusion or any willful mis-statement or suppression of facts, or

contravention of any of the provisions of these rules or of the Finance

Act or of the rules made thereunder with intent to evade payment of

service tax, then the provider of output service shall also be liable to

pay penalty in terms of the provisions of section 78 of the Act.

III.

Rule 15A:- General Penalty:→

Rule 15A provides a general penalty upto Rs. 5000 in case of

contravention of any of the provisions of the CENVAT credit rules for

which no specific penal provisions exists.

(IV)

Other Relevant Points Under Case Law

→

CENVAT credit is provided even if there is no co-relation of inputs and

final products, according to Dai Ichi Karkaria Ltd, 1999(SC).

→

CENVAT credit is available even on inputs lost or destroyed during the

process. But if there is loss or shortage during transit, no CENVAT

credit is available on such lost goods as they were not used in the

manufacture.

→

No CENVAT credit is allowed on inputs and capital goods lost during

storage as they can not be said to be used in relation to manufacture

as per Maruti Udyog Ltd, 2000.

CASE STUDIES

1.

FLEX ENGINEERGIN LTD. 2012-CENVAT CREDIT

The assesse is a manufacturer of packaging machines tailor made to meet

the requirements of the customer. These machines are called F & S

machines.

Flexible plastic films are used for testing the F & S Machines before delivering

the machines to the customers. The marketability of the said machines is

dependent on passing the test.

Hold that the testing is essential for marketing the machines and materials

used for the testing qualifies for CENVAT credit. Hence the material is input

under CENVAT credit Rules, 2004.

2.

GNFC Ltd, 2012 (HC)- CENVAT credit on cylinders Issue:Whether the empty cylinders used for transportation of chlorine and also for

storage within the factory are eligible for CENVAT credit.

The department contended that these cylinders were used only for transport

and not for use in the factory. Hence not eligible.

The Assessee argued that the cylinder is used not only for carrying chlorine

but also for connecting to the machine which is fed from the cylinder. It is

also used for storage within the factory. Therefore It is an accessory to the

machine for production since chlorine is fed from the cylinder directly.

The Ahmedabad High Court held that Cylinder is elgible for credit as it has

dual purpose of transport and storage tank.

3.

Refund under Rule 5 of CENVAT credit Rules, 2004

The Madras High Court held in GTN Engineering Ltd. that the relevant date

for claiming refund under Rule 5 of CENVAT Credit Rules is date of Export of

goods made.

4.

A.P. Paper Mills Ltd, 2011 (HC)- CENVAT credit available on unutilized

chlorine gas.

Facts:The manufacturer is using chlorine gas in cylinder for the manufacture of

paper. Some chlorine is left over in the cylinders and he returns them to the

supplier. The department demanded reversal of CENVAT credit on the

amount attributable to the chlorine returned unused.

Held:No need to reverse the credit.

Reason:The chlorine in the cylinder is not possible to be used in toto. Hence it is to be

treated as deemed use or deemed process loss.

5.

TATA Advanced Material Ltd, 2011 (H.C.)- No Reversal of CENVAT credit

on insurance claim:Facts:The assessee purchased capital goods and used in the manufacture of

excisable goods. He claimed CENVAT credit also. After 3 years, the capital

goods were destroyed by fire. He got insurance claim including the excise

duty paid. The department demanded reversal of CENVAT credit on the

ground that the assessee got the double benefit of excise duty paid.

Hold:No need to reverse

Reasons:- Reversal arises when the credit is wrongly or irregularly availed.

There is no question of double benefit as the claim was because of insurance

premium incurred separately by the assesse.

6.

PRIME HEALTH CASE PRODUCTS-2011(HC)- CENVAT credit available

on bought out tooth brush attached and sold in combo pack.

Facts:The assessee is manufacturing tooth paste. He added bought out tooth brush

and sold the combo pack having tooth paste and tooth brush. Obviously, he

availed CENVAT credit on bought out tooth brush.

Issue:Whether he can avail CENVAT credit on bought out brush when he has not

added the cost of brush in the price of the combo pack.

Hold:Yes, the bought out tooth brush is an accessory supplied along with the tooth

paste and hence it is input as per “defection of inputs” and price is the policy

of the manufacturer and it has no nexus with the eligibility.

7.

Rajasthan Spinning & Weaving Mills Ltd [SC] 2010.

The assessee engaged in the manufacturer of yarn availed CENVAT credit on

“Capital Goods” in respect of steel plates and M.S. Channels used by them for

erection of chimney for the diesel generating set.

The tribunal concluded that since the chimney is used as an accessory to the

diesel generating set, and steel plates and M.S. Channels were used in the

fabrication of chimney, therefore CENVAT credit on these items could not be

denied.

The Supreme Court upheld the decision of the tribunal.

8.

Alok Enterprises 2010 (HC)

The issue in this case was whether the process of purification & filitration

done to make the products (hydro chloric acid & Sulphuric acid) marketable is

a manufacturing process.

Facts:The assessee was availing CENVAT credit on inputs used for purifying &

filtering hydrochloric acid & Sulphuric Acid to make them marketable.

The department rejected CENVAT on the ground that the said process is not

a manufacturing process as the end product after filtration and purification is

same with same entry [Classification Number].

The tribunal hold that the process is a manufacturing process. The tribunal

observed that it is well settled law that even if the goods belong to same entry,

manufacture takes place if new identifiable/marketable goods known in the

market emerge due to operation conducted and the nature of technology used

is not relevant.

The High Court confirmed the order of Tribunal and held that the assessee is

entitled to take CENVAT credit on inputs used in the process.

IMPORTANT QUESTIONS

Question:Write a short notes on “CENVAT on capital goods”?

[June -1999] [5 marks]

Question:Is CENVAT credit admissible on inputs that are used up in waste, scrap or refuse?

Explain?

[June -1999] [5 marks]

Question:What is the procedure to be followed by an assessee to avail of the benefits under

CENVAt for inputs?

[Dec -1999] [4 marks]

Question:Is the CENVAT credit admissible on inputs if final products are exempt?

[Dec -1999] [4 marks]

Question:Enumerate the documents on the basis of which CENVAT credit can be claimed?

[June -2001] [8 marks]

Question:Explain the penalty provisions as applicable to CENVAT?

[June -2001] [8 marks]

Question:Elcidate the concept of CENVAT Scheme, How does it reduce the CASCADING

Effects?

[Dec-2001] [8 marks]

Question:In respect of which duties CENVAT credit is allowed?

[June -2002] [4 marks]

Question:What are the documents on which CENVAT credit can be taken?

[June -2002] [4 marks]

Question:When can the CENVAT credit in respect of Input service be availed under the

CENVAT credit Rules, 2004?

[June -2005] [3 marks]

Question:Define the following terms under CENVAT credit Rules 2004.

(i)

Input Service distributor

(ii)

Output service

[Dec-2005] [3 marks each]

Question:What are the conditions for taking the CENVAT credit under CENVAT credit rules

2004?

[Dec-2005] [5 marks]

Question:Discuss whether the CENVAT credit is required to be reversed in following cases:(i)

where on any goods manufactured or produced by an assessee the payment

of duty is ordered to be remitted under Rule 21 of Central excise Rules 2002.

(II)

If inputs or capital goods before being put to use are written off fully or

provision is made in books of accounts to write off fully.

[Dec-2008] [2 marks each]

Question:What are the provisions of CENVAT credit on capital goods? [June-2010] [3 marks]

Question:Discuss whether a manufacturer excisable goods is digible to take the CENVAT

credit of excise duty paid on Motor Vehicles?

[Dec-2012] [5 marks each]

Question:Can an assessee use CENVAT credit for payment of interest, penalty and fine in lieu

of confiscation?

[June-2007][2marks]

Answer:Under rule 3(4) of CENVAT credit Rules, 2004, the CENVAT credit may be utilized

for payment of excise duty levied on manufacture of final product in respective

manner.

But such CENVAT credit can not be utilized for payment of interest, penalty & fine in

lieu of confiscation.

Question:State, with reasons, whether the CENVAT credit is available or not on the following

items:(i)

storage tank

(ii)

Inputs used in manufacture of capital goods which are further used in the

factory.

(iii)

Components, spares and accessories of the pollution control equipment, or

(iv)

building material used for factory building

[June -2003] [2marks each]

Answer:(i)

Yes, storage tank used in the factory of the manufacturer of the final product

is capital goods eligible for CENVAT credit

(II)

Inputs used in manufacture of capital goods which are further used in the

factory, are capital goods eligible for CENVAT credit

(iii)

Components, spares & accessories of pollution control equipment are capital

goods because these are covered under definition of capital goods, hence

eligible for CENVAT credit

Question:State whether the following goods are ‘inputs’ as per Rule 2(k) of the CENVAT credit

Rules, 2004:(i)

All goods used for generation of Electricity for captive use:

(ii)

Light diesel Oil

(iii)

Motor Vehicles

(iv)

Goods used for making of structures for support of capital goods;

(v)

Goods used for providing for warranty for final products.

[June -2012] [1marks each]

Answer:-

(i)

(ii)

(iii)

(iv)

(v)

Yes, all goods used for generation of electricity for captive use are ‘Inputs’ as

it is covered in definition of “Inputs” and also use for or consumed in

manufacturing of finished product.

No, Light diesel oil is not covered in definition of “Inputs” and also

Government of India not want to give credit on such Light diesel oil, that’s why

excluded from the definition of “Inputs”.

No, Motor Vehicles are not covered in definition of “Inputs” as it is a capital

goods.

No, Goods used for making of structures for support of capital goods are not

covered in definition of “Input” as it is a capital goods.

Yes, Goods used for providing “free warranty” for final products are “Inputs”

as covered in definition of “Inputs”.

Question:Hi-tech company manufactures electric Motors which are exempted from payment of

central excise duty. During the process of manufacture of Electric motors, they

manufacture parts of Electric Motors on which excise duty is discharged by them

after availing of CENVAT credit of duty paid on the inputs. While working out the

manufacturing cost for the purpose of determining the assessable values the

department has taken the entire cost of inputs whereas the company is of the view

that the cost of the inputs should be taken after deducting the amount of CENVAT

credit taken by them. Is the contention of the assessee justified? Give reasons for

your answer?

[June -2003] [5marks ]

Answer:Yes/No:Yes the contention of the assessee is justified as the cost of the inputs should be

taken after deducting the amount of CENVAT credit taken by them.

Explain:Rule 8 of Central Excise Valuation Rules, 2000 and Dai Ichi Karakaria case.

Facts of Question:Relevant facts from question itself

Conclusion:In given case, Hi-tech company are captively consuming parts of electric motors

where parts are dutiable but electric motors are exempted. Hence, here, Excise

Duty shall be levied on assessable value of parts of Electric Motors which shall be

assessed by following Rule 8 of Central Excise Valuation 2000 i,.e.

Assessable value = 110% of cost of Goods

But here as per Dai Ichi Karakaria case, cost of goods shall be taken after deducting

the amount of CENVAT credit taken by them so, the contention of the assessee is

justified.

Question:Link Engineering Ltd, Purchase a machinery for manufacturing of certain mechanical

parts which are exempt from payment of central excise duty. It also parts

occasionally uses the machines for manufacture of small. Quantities of components

which are cleared on payment of duty. Is Link Engineering Ltd. Entitled to take

CENVAT the excise duty paid on the machine? Decide by referring to specific Legal

Provision?

[Dec-2005] [5 marks]

Answer:Yes/No:Yes, Link engineering Ltd. entitled to take CENVAT credit the excise duty paid on

the machine.

Explain:Rule 6(4) of CENVAT credit Rules, 2004.

Facts:Facts from Question itself.

Conclusion:As per Rule 6(4) of CENVAT credit Rules, 2004, the credit on capital goods shall

not be allowed if they are exclusively used in the manufacture of exempted goods.

But if capital goods are used for the manufacturing of exempted as well as dutiable

goods then full credit on capital goods i.e. Machinery can be taken.

So, Link Engineering Ltd. entitle to take CENVAT credit of the excise duty paid on

the Machine.

Question:Krishna, a manufacturer of dutiable as well as exempted goods supplies the

following information for the month of January, 2010:i.

Price of exempted goods cleared from the factory:- Rs. 200 lakh

ii.

Assessable value of dutiable goods cleared [Rate of duty 16%]:- Rs. 150 lakh

iii.

CENVAT credit of inputs ‘P’ [used only in the manufacture of exempted

goods]: Rs. 24 lakhs.

iv.

CENVAT credit of input ‘Q’ [used only in the manufacture of dutiable goods]:Rs. 16 lakh.

v.

CENVAT credit of common inputs ‘R’ [used in the manufacture of exempted

as well as dutiable goods but no separate accounts are maintained in respect

of such input ‘R’] : Rs. 18 lakh.

Compute the amount of Excisable duty payable by Krishna for the month of

January

[June -2008] [5marks]

Answer:Mr. Krishna

Period: January 2010

Computation of Net excise duty payable.

Particular

Basic excise duty payable on Product ‘P’

(16% on 150 Lakhs)

Add:6% tax payable on exempted goods u/s

6(3)(i) [6% on 200 lakhs}

Gross Excise duty payable

Less:CENVAT credit allowed

Amount

24,00,000

12,00,000

36,00,000

On Input “Q”

On Input ‘R”

Net Excise duty payable

(16,00,000)

(18,00,000)

2,00,000

Question:Pawan, a manufacturer, purchased certain inputs from his supplier Binod, the

Assessable value was Rs. 2,00,000 and the Central Excise duty was calculated at

Rs. 32,960. Thus the total purchase invoice was for Rs. 2,32,960. However, Pawan

settled the total invoice by paying Rs. 2,08,000 only to Binod in full settlement. How

much CENVAT credit can be availed by Pawan.

[Dec-2010] [5marks ]

Answer:Pawan can avail CENVAT credit to the extent of Rs. 32,960. CENVAT credit cannot

be reversed just because the supplier Binod has given some discount after removal

of the goods or Pawan paid reduced amount than the invoice price in full settlement.

However, along with reduction in price if the duty paid is also reduced then the

reduced excise duty would only be available as credit.

Question:Star manufacturing Ltd. defaulted in payment of Central excise duty of Rs. 1,00,000

in the month of April, 2012. The company wants to pay this amount of duty in July

2012 out of the CENVAT credit taken in the months of June and July, 2012.

Advise star Manufacturing Ltd in this regards?

[Dec-2010] [6 Marks]

Answer:As per Rule 3(4) CENVAT credit Rules, 2004, only CENVAT credit available as on

Last day of the month can be utilized for payment of duty even if duty is payable by

5th or 6th of following month/quarter or thereafter.

Hence, CENVAT credit in respect of inputs or capital goods or input service received

after end of the Month or quarter can not be utilised for Excise duty on finished

goods payable for such month or quarter.

Hence, in the given situation, Star Manufacturing Ltd, can not pay such amount of

duty related to month April 2012 out the CENVAT credit taken in Months of June and

July 2012.

Question:Smart & Co. took CENVAT credit amounting to Rs. 2 Lakhs on inputs wrongly

included in their RG 23 A Register in the Month of February, 2012. During Audits the

internal audit party pointed out the mistake in August, 2012. Smart & Co.

immediately reversed the amount from balance of Rs. 15 Lakh in their CENVAT

Credit Account lying since February 2012.

Examine whether the company is Liable to pay interest on the amount of CENVAT

credit taken wrongly.

[DEC-2012][ 3 MARKS]

Answer:According to rule 14 of Cenvat credit rules, 2004, if the CENVAT credit has been

taken and utilised wrongly, then the same shall be payable along with interest but

NO CENVAT credit was used for payment of such duty with interest.

Hence the company is labile to pay interest on the amount of CENVAT credit taken

wrongly.