PRESENTATION NAME - Swamy Associates

advertisement

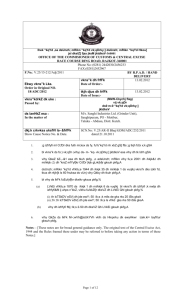

Interactive workshop on Central Excise, Customs & Service Tax by swamy associates your Rights during Raids !!! • What is a Search • It is necessary that you, the person being searched, know the law and procedure relating to a search. Such knowledge-base helps you safeguard your legal rights. Your Rights During a Search Never forget that by searching your premises the officers are carrying out an official duty and are, therefore, bound by certain rules and regulations that are meant not only to further their official purpose but also to safeguard your rights and interests. • It is important to keep it in mind that the only purpose of their visit is to look for and collect evidences of violations. The Raiding officers have no right to: • Mess up with your daily activities like production, sale or clearance; • Stop you from communicating with your legal advisor, business partners, clients, friends or relatives; • Carry out their search in a surreptitious manner without allowing you or your employee to see what they are doing; • Execute their search without identifying themselves individually so as to prevent any complaint of a misconduct; • Prevent you or your employees from leaving the premises. (However, while leaving you might be required to give the phone number or the address of your destination, if asked for, so that they can contact you in case a clarification is required) CENTRAL EXCISE SECTION 2 - MANUFACTURE Section 2(f)(i) - any process incidental or ancillary Section 2 f (ii) - Deemed manufacture - section / chapter notes Section 2 f (iii) - affixing/alteration of RSP , etc SECTION 4 - VALUATION SECTION 4(i)(a) - TRANSACTION VALUE (w.e.f 1.7.2000) SALE PRICE IS THE SOLE CONSIDERATION BUYER TO BE UNRELATED DELIVERY @ TIME & PLACE OF REMOVAL Includes any amount paid / payable during the sale or even anytime thereafter SECTION 4(i)(b) – VAL. RULES RULE 4 - COMPARABLE GOODS FREE SAMPLES / FOC CLEARNCES PRO – RATA VALUE ON COMPARABLE GOODS IDMA vs UOI 2008 (222) E.L.T. 22 (Bom.) SECTION 4(i)(b) – VAL. RULES RULE 5 - FRIEGHT & INSUARANCE CCE, NOIDA vs ACCURATE METERS LTD 2009 (235) E.L.T. 581 (S.C.) Circular No. 827/4/2006-CX., dated 12-4-2006 EQUALISED FRIEGHT & PROFIT ON FRIEGHT SECTION 4(i)(b) – VAL. RULES RULE 6 - ADDITIONAL CONSIDERATION AMORTISATION NOTIONAL INTEREST ON ADVANCES METAL BOX INDIA vs CCE, MADRAS 1995 (75) E.L.T. 449 (S.C.) NEXUS - EXPLANATION 2 SECTION 4(i)(b) – VAL. RULES RULE 7 - DEPOT CLEARANCES NORMAL TRANSACTION VALUE Highest aggregate quantity @ nearest time SECTION 4(i)(b) – VAL. RULES RULE 8 - CAPTIVE CONSUMPTION 110% OF COST OF PRODUCTION (CAS -4) SECTION 4(i)(b) – VAL. RULES • [10A. Where the excisable goods are produced or manufactured by a job-worker, on behalf of a person (hereinafter referred to as principal manufacturer), then,• (i) in a case where the goods are sold by the principal manufacturer … • (ii) in a case where the goods are not sold by the principal manufacturer… • (iii) in a case not covered under clause (i) or (ii), SECTION 4 A Requirement under both : Standards of Weights and Measures Act & notification u/s 4A mandatory EXPORT BENEFITS Exports without payment of duty Exports under claim of rebate. Protection of Cenvat Credit. DEPB/Drawback/EPCG/Adv. Auth JOB WORK Notification 214/86. Rule 4 (5) (a) of CCR, 2004. 180 DAYS TIME LIMIT SAVE TOOLS,DIES, ETC CENVAT CREDIT on job work INTERNATIONAL AUTO vs CCE 2001 (135) E.L.T. 657 (Tri. - Del.) MISCELLANEA INTEREST ON SUPP. INV CCE, PUNE vs SKF INDIA 2009 (239) E.L.T. 385 (S.C.) 11AC PENALTY MANDATORY DHARMENDRA TEXTILE PROCESSORS SSI BRAND NAME – GRASIM 2005 (183) E.L.T. 123 (S.C.) CUM DUTY – MARUTI UDYOG 2002 (141) E.L.T. 3 (S.C.) SERVICE TAX Basic Features Statutory provisions. Levy on service provider - Exceptions. Levy on realisation including Advances Classification of Service Specific description than general description. Essential character. Which occurs first in the definition. NO VIVISECTION - DAELIM INDS 2003 (155) E.L.T. 457 (Tri. - Del.) VALUATION Gross amount. Cum - tax. Abatements. Notification 12/2003. VALUATION Services rendered free. – No ST Consideration in kind. – COMPARABLE OR COST Reimbursement of expenses. Upto 18.04.2006 – No liability. From 19.04.2006 – Concept of pure agent. Malabar Management PROCEDURES IN SERVICE TAX Issue of show cause notice. Adjudication. Appellate remedies: Commissioner (Appeals) (90+90) CESTAT High Court / Supreme Court Procedures in Service Tax Registration – Centralised Registration. Issue of invoice. Maintenance of records. Procedures in Service Tax Payment of service tax. - Due date. - Advance payment. - e payment. - Self adjustment – if service not rendered. - Provisional payment. - Self adjustment of excess payments. Filing of return – ST 3. - Due date / Half yearly. - Revised return. - Fine for delayed return. Penalties in Service Tax. Sec. 76 – Delayed payment of S.Tax. Sec. 77 – General Penalty. Sec. 78 – Suppression, etc. Sec. 80 – Power of waiver. Rule 7 C – Fine for delayed return. • Refunds in service tax • 41/2007-ST and 17/2009-ST • Rule 5 Refund for exporters The sweet sixteen services • Rule 6 (5) of CCR, 2004 Certain Important Services. Business Auxiliary Service. Promotional activities. Customer care services. Procurement of goods or services. Production or processing. Provision of service on behalf of client. Manufacture – excluded. Notification 8/2005. Commercial / Industrial construction Service. Exclusion for roads, airports, railways transport terminals, bridges, tunnels, dams and ports. 67 % Abatement. FOC MATERIALS NOT TO BE INCLUDED ERA INFRA 2008 (11) S.T.R. 3 (Del.) Construction of Residential Complex Service. More than 12 units.. Personal use - exempted. SUB CONTRACTORS NOT LIABLE TILL 23.08.2007 SUNIL HITECH Consulting Engineering Service. Foreign Technological transfers. Novinon Ltd. VS CCE 2006 (3) STR 397 To cover software too. Customs House Agents Service. Erection, Commissioning and Installation Service. Franchise Service. Intellectual Property Service. Management Consultant Service. Manpower Recruitment / Supply Agencies. Goods Transport Agency Service. Reverse Charge. Abatement. Exemption. Payment mode. No SSI exemption. Renting of Immovable Property. Support Services for Business. Works Contract Service. Re-classification. Composition Scheme. Vice of Notification 1/2006. Diebold Systems (P) Ltd Vs CCE 2008 (9) STR 546. Export of Service and Import of Service. INDIAN NATIONAL SHIP OWNERS ASSN 2003 (155) E.L.T. 457 (Tri. - Del.) IMPORT OF SERVICES – REVERSE CHARGE CENVAT CREDIT Basic Features Concept of Cenvat credit. Landmarks – 1986, 1994 & 2004. Cenvat Credit Rules, 2004. Applicability Manufacturers. Service providers. Certain Terms. Input. Capital goods. Input Services. Input Service Distributor. First / Second stage dealer. Cenvattable Duties / Taxes Basic Excise Duty. CVD. NCCD. Education CESS. Addl. Duty of Customs – Sec. 3(5). Service Tax and CESS thereon. Utilisation and Restrictions on Utilisation Payment of Excise duty. Payment of Service tax. Other payments. Cross utilisation. Other Conditions. Capital goods – 50 % restriction. Depreciation / Cenvat Credit. 2.5% depreciation on removal of capital goods. Other Conditions. Removal for job work. Write off. Service Tax Credit - Pay and use. Documents for availing credit. Rule 6 Algebra. Position upto 31.03.2008. Position from 01.04.2008. Rule 6. Protection to certain clearances. Protected Services. Certain Common Disputes… Credit for mobile phone. India Rayon Industries Ltd. Vs CCE 2006 (4) STR 79. Credit for outdoor catering. CCE Vs GTC Industries. 2008 – TIOL – 1634. Certain Common Disputes… Credit for outward transportation. ABB Ltd - 2009 (15) S.T.R. 23 (Tri. - LB) Stayed by Karnataka HC. Master Circular and recent amendments. CUSTOMS • Valuation of imported goods • Inherent contradictions between ‘Deemed Value’ concept of Section 14 and ‘Transaction Value’ concept of Valuation Rules. • Reconciliation by Tribunal decisions and Supreme Court judgment in Eicher Tractor case. • Ispat Industries relating to Barge charges • J.K. Corporation relating to Royalty • Effect of the two Judgments – ‘Deemed Value’ concept of the Act will prevail over ‘Transaction Value’ concept of the Rules. • Main elements in Explanation to Rule 10A – Not a method of determination of value. – Illustrative reasons which might lead to doubts. – Positive assertion to accept value, when satisfied. Section 14 • Complete alignment with Transaction Value concept of the Rules. • Important elements of Valuation Rules conceptually captured in the Section. • Mandates framing of Export Valuation Rules. • Covers non-dutiable goods as well. • Two Explanations added in erstwhile Rule 9 – One regarding Royalty related to post importation process – Other regarding Cost of Transportation relating to barge charges, ship demurrage charges etc. • Explanation added to erstwhile Rule 10A. • Controversies about valuation of export goods – Whether erstwhile Sec. 14 applicable for duty free export goods. – Contradictory judicial pronouncements. • Amended Sec 14 – No clause regarding dutiable goods • It also provides for framing rules for valuation of export goods. • Format similar to that of import valuation rules • Rule 2 provides definition for ‘Goods of like kind and quality’ ‘Transaction Value’ and ‘ Related Persons. • Rule 3 – Transaction Value Method subject to Rule 8 (Rejection of Declared Value) • Rule 4, 5 & 6 are alternative methods of valuation. • Rule 4 - Comparison Method - Main Elements. – Comparison with ‘Transaction Value’ of goods of like kind and quality. – Exported at or about the same time. – To other buyer in same destination country. – To other buyer in another destination subject to certain adjustments. • Rule 5 - Computed Value Method – Main Elements – Cost of Production / processing. – Charge for the Design or Brand – Profit • Rule 6 - Residual Method – Importance of Proviso ‘Local Market Price may not be the only basis • Rule 7 - Format of Declaration. • Rule 8 - Rejection of Declared Value. – Counterpart of Rule 10A. – Clarification through Explanation • Not a method of valuation. • Illustrative Reasons which could lead to doubts. • Positive assertion to accept declared value, if satisfied. THANKS