Nonoperating Revenues (Expenses) - The California State University

advertisement

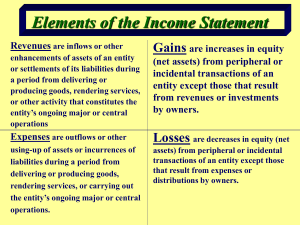

. CHAPTER 4.5.4 GAAP ADJUSTMENTS AND RECLASSIFICATION ENTRIES REVENUES AND EXPENSES: NONOPERATING REVENUES (EXPENSES) 1 GAAP POLICIES AND PROCEDURES In accordance with GASB Statement No. 35, certain transactions are reported as nonoperating revenues and expenses. These nonoperating activities include the University’s capital and noncapital appropriations from the State, financial aid grants, net investment income, noncapital gifts, interest expense, and capital grants and gift. State Appropriations State appropriations, non-capital This category includes amounts received from, or made available to, an institution by legislative acts to support operations. For the CSU, this would include appropriations received for the general funds. SWAT’s (Systemwide Allocation Transfers) to the campus to fund special programs. State appropriations, capital This category includes amounts received from, or made available to an institution by legislative acts for capital purposes. For the CSU, this would include capital outlay appropriations. Grants, Contracts and Gifts Refer to Chapter 4 Grants, Contracts and Gifts for further discussion. Investment income (loss), net Includes investment income or loss, dividends, realized gains or losses and changes in unrealized gains or losses on non-endowment assets. Investment expenses, such as investment service charges and interest payback to the State from no longer remitting the student fees to the State are netted against this revenue. Endowment income (loss) This category includes investment income or loss and any realized gains or losses and changes in unrealized gains or losses on endowment investments. 4.05.4-1 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 . Interest expense This category includes all interest expense related to both noncapital and capital related debts. This includes also amortization of debt premium/discount, gain/loss on debt refunding, debt issuance costs. Other nonoperating revenues (expenses) Any revenues or expenses that do not directly relate to the CSU’s current primary operation should be recorded here. This category includes items that do not fit into one of the operating revenue (expense) categories above. Examples include lottery income, gain (loss) on sales or disposal of assets, CSU Risk Management Authority dividends, revenue from legal settlements, inter-agency revenues (expenses) and other miscellaneous revenues or expenses. Additions (reductions) to permanent endowments This category would include any private contributions received by the University to increase or establish a permanent endowment fund and losses resulting from underwater endowments. For most CSU campuses, campus foundations, not the University, receive contributions for endowments. 2 RELEVANT ACCOUNTING LITERATURE GASB Statement No. 35, Basic Financial Statements and Management's Discussion and Analysis for Public Colleges and Universities (an amendment of GASB Statement No. 34) 3 OBJECTIVE OF GAAP ADJUSTMENTS To record current year state appropriation capital and noncapital as these budget entries in the legal basis ledger. To reclassify payments from discretely presented component unit for capitalized leases or notes receivable (wherein there is an equivalent SRB debt recorded in the books of the University) from Other Nonoperating Revenues as a reduction in the Capital Lease Receivable or Notes Receivable accounts (refer to Chapter 4 Receivables). To record prior period correcting entries as Other Nonoperating Revenues (Expenses). To accrue investment/endowment income if not booked in legal basis ledger. To accrue interest expenses if not booked in legal basis ledger. To record passdown journal entries (relating to Investments and SRB debt) that impacts interest expenses and investment income (refer to Chapter 4 Long-term Obligations and Cash, Cash Equivalent and Investments). 4.05.4-2 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 . 4 GAAP ACCOUNTING T REATMENT AND JOURNAL ENTRIES 4.1 RELATED GAAP ACCOUNT(S) Nonoperating Revenue (Expenses) 723001 – State appropriations, noncapital 723007 – Federal financial aid grants, noncapital* 723008 – State financial aid grants, noncapital* 723010 – Local Financial aid grants, non-capital* 723009 – Nongovernmental and other Financial Aid Grant, noncapital* 723011 – Other Federal nonoperating grants, noncapital* 723002 – Gifts, noncapital* 723003 – Investment income, net 723004 – Endowment income, net 723005 – Interest expense 723006 – Other nonoperating revenues (expenses) Other Revenues (Expenses) 724001 – State appropriations, capital 724002 – Grants and gifts, capital* 724003 – Additions to permanent endowments *These are discussed in Chapter 4 Grants, Contracts and Gifts GAAP ACCOUNTING T REATMENT 4.2 STATE APPROPRIATIONS In legal-basis accounting, state appropriation is recorded to Fund Balance Clearing account, not recognized as revenue for purposes of reporting financial results to the SCO. At June 30, Fund Balance Clearing needs to be zeroed out and state appropriation needs to be recognized in GAAP ledger. Please see Chapter 4 Fund Balance Clearing for additional information regarding current year activities in FBC account to the appropriate account. See also Chapter 4 Receivables for information. 4.3 OTHER NONOPERATING REVENUES (E XPENSES) Currently, object codes 580098, Auxiliary Program Lease Principal Payment and 580099, Auxiliary Loan Principal Payment map to GAAP account 723006, Other nonoperating revenue (expenses). A GAAP adjustment entry is needed at year-end to reclassify derived accounting records for recording payments from discretely presented component unit to the receivable accounts, to reduce the amount due. 4.05.4-3 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 . Please see Chapter 4 Receivables for detailed GAAP adjustments. 4.4 INTER-AGENCY AND INTER-FUND TRANSACTIONS Transfers between CSU Entities (Inter-agency Transfer) Regularly, situations occur in which a campus records a legal basis transfer that involves another campus or the CO. The two situations listed below are examples of common inter-agency transfer transactions that involve transfers between the CO and campuses: 1. Transfers of Lottery Fund revenues to the campuses from the CO 2. Transfers from the campuses to the CO to cover the annual Debt Pool Subsidy Prior to FY2014-15, interagency transfer object codes would derive to GAAP account 724004, Transfers. In both of these situations, the campus would carry in its legal basis accounting records a balance in a transfer account that could not be offset at the campus level, and that could not be eliminated via a GAAP adjustment. A GAAP adjustment entry was required to reclassify the transactions from Transfers to Other non-operating revenues (expenses) within the unrestricted net position category. Effective FY 2014-15, the mapping of all interagency transfers in (object code in the series 5061XX and 571XX, with the exception of 506100, Transfer In-RMP SWAT) and transfers out (object code in the series 671XXX and 6801XX with the exception of 680100, Transfer Out-RMP SWAT) were changed from GAAP account 724004, Transfers to GAAP account 723006, Other nonoperating revenues (expenses). Therefore, campus will no longer need to record the manual GAAP adjustment. For additional discussion, please refer to Chapter 4 Receivables for funds receive Allocation Orders (AO) and Systemwide Allocation Transfers (SWAT). If a campus identifies any other situation in which it has recorded a legal basis transfer, the transfer must be evaluated to determine the proper accounting treatment on a GAAP basis. Inter-fund Interest Revenue/Expense Transactions Effective FY2012/13, campus will no longer need to record a GAAP entry to eliminate interfund interest revenue (recorded in object code 580012) and expense (recorded in object code 660004) if the interfund interest is between two different funds within a campus (intra-agency). The program group code for object code 580012 has been set to program code 14 (interest expense) to match the program code assigned to its expenditure counterpart. This change aligned the derivation of GAAP account and program code so that both interfund interest revenue and expense transactions now map to 723005, Interest Expense and program code 14 and the activities will be self-eliminating in consolidation. In addition, this change will ensure the transactions are correctly presented on the financial statement. 4.05.4-4 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 . Please note that these object codes should be used solely for interfund transactions within the University, not for any transactions with third parties, including discretely presented component unit. For interfund interest between a campus and the CO or another campus (inter-agency), object code 580112 (GAAP account 723003, Investment income net) and object code 660104 (GAAP account 723005, Interest expenses) should be used in legal basis of accounting so that the Chancellor’s Office can eliminate these transactions in GAAP at the systemwide level. 5 REFERENCE TOOLS 5.1 TABLES OF OBJECT CODE AND CSU FUND DEFINITIONS http://www.calstate.edu/SFSR/standards_and_rules/2014/Tables-of-Object-Code-andCSU-Fund-Definitions-Updated-10-30-14.xls 4.05.4-5 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 . REVISION CONTROL Document Title: CHAPTER 4.5.4 – GAAP ADJUSTMENTS AND RECLASSIFICATION ENTRIES – REVENUES AND EXPENSES: NONOPERATING REVENUES (EXPENSES) REVISION AND APPROVAL HISTORY Section(s) Revised General 4.05.4-6 Summary of Revisions New in FY14/15 GAAP Manual | GAAP Adjustments and Reclassification Entries – Revenues and Expenses: Nonoperating Revenues (Expenses) | June 30, 2015 Revision Date April 2015