FTE and Funding Sample Calculations

advertisement

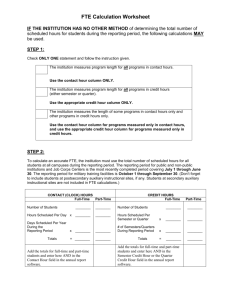

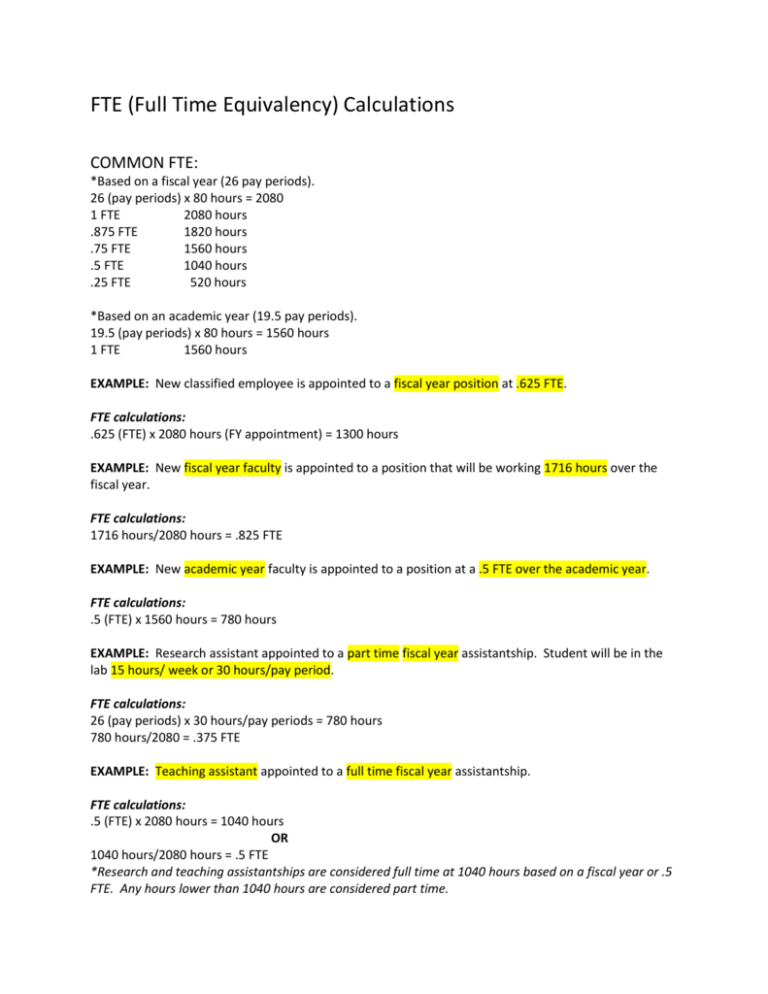

FTE (Full Time Equivalency) Calculations COMMON FTE: *Based on a fiscal year (26 pay periods). 26 (pay periods) x 80 hours = 2080 1 FTE 2080 hours .875 FTE 1820 hours .75 FTE 1560 hours .5 FTE 1040 hours .25 FTE 520 hours *Based on an academic year (19.5 pay periods). 19.5 (pay periods) x 80 hours = 1560 hours 1 FTE 1560 hours EXAMPLE: New classified employee is appointed to a fiscal year position at .625 FTE. FTE calculations: .625 (FTE) x 2080 hours (FY appointment) = 1300 hours EXAMPLE: New fiscal year faculty is appointed to a position that will be working 1716 hours over the fiscal year. FTE calculations: 1716 hours/2080 hours = .825 FTE EXAMPLE: New academic year faculty is appointed to a position at a .5 FTE over the academic year. FTE calculations: .5 (FTE) x 1560 hours = 780 hours EXAMPLE: Research assistant appointed to a part time fiscal year assistantship. Student will be in the lab 15 hours/ week or 30 hours/pay period. FTE calculations: 26 (pay periods) x 30 hours/pay periods = 780 hours 780 hours/2080 = .375 FTE EXAMPLE: Teaching assistant appointed to a full time fiscal year assistantship. FTE calculations: .5 (FTE) x 2080 hours = 1040 hours OR 1040 hours/2080 hours = .5 FTE *Research and teaching assistantships are considered full time at 1040 hours based on a fiscal year or .5 FTE. Any hours lower than 1040 hours are considered part time. Funding Sample Calculations EXAMPLE: Employee is paid $20,009.60 to be paid from multiple budgets. The break down is: $5,500.00 on BZZ000 $10,540.00 on BXZ000 $3,969.60 on BZY000 Funding calculations: $5,500 (budget amount)/$20,009.60 (annual salary) = .2748680633 .28 or 28% on BZZ000 $10,540.00 (budget amount)/$20,009.60 (annual salary) = .52674716 .53 or 53% on BXZ000 $3,969.60 (budget amount)/$20,009.60 (annual salary) = .1983847753 .20 or 20% on BZY000 28% + 53% + 20% = 101% 27% + 53% + 20% = 100% *In some cases due to rounding you may need to adjust one or two of the percentages. EXAMPLE: Employee’s annual salary is $104,998.40 and will need to be paid from the following budgets: $75,542.00 on BZY001 $15,500.00 on BZY000 $5,400.00 on BZZ000 $8,556.40 on BZK000 Funding calculations: $75,542.00 (budget amount)/$104,998.40 (annual salary) = .7194585822 .72 or 72% on BZY001 $15,500.00 (budget amount)/$104,998.40 (annual salary) = .14762129 .15 or 15% on BZY000 $5,400.00 (budget amount)/$104,998.40 (annual salary) = .051429355 .05 or 5% on BZZ000 $8556.40 (budget amount)/$104,998.40 (annual salary) = .08149076557 .08 or 8% on BZK000 72% + 15% + 5% + 8% = 100% EXAMPLE: Employee’s annual salary is $45,510.40 and is reporting 25% effort on one grant, BZK000 and 15% on BZK001. The employee is permanently budgeted and currently paid on BZC000 at a 100%. Funding calculations: $45,510.40 (annual salary) x .25 = $11,377.60 on BZK000 $45,510.40 (annual salary) x .15 = $6,826.56 on BZK001 $11,377.60 + $6,826.56 = $18,204.16 $45,510.40 (annual salary) - $18,204.16 (grant funded) = $27,306.24 (to be funded on BZC000) $27,306.24/$45,510.40 = .60 or 60% OR 100% - 25% - 15% = 60% 25% on BZK000 15% on BZK001 60% on BZC000 NOTES: *Total budget break down should not be less than or greater than 100%. *An EPAF must be completed each time a change is needed in funding. *We cannot process an EPAF for a change that has already occurred. Please work with you financial contact to process a payroll cost transfer.