Risk appetite

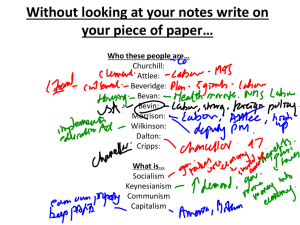

advertisement

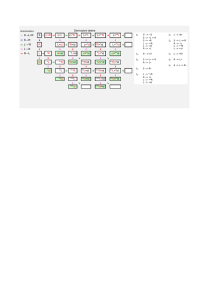

Managing the Risks in a Volatile Environment John Gill, Risk and Resilience Manager, Manchester City Council Session Aims • To present a different way of thinking about risk strategy • Pose some challenges to orthodox thinking about risk • To look at what extreme austerity looks like in practice • To consider the implications for risk appetite • To present some practical case studies of what thinking differently looks like • To consider implications for risk managers and auditors • NB: Opinions expressed are my own and I don’t have all the answers Which of these is most risky? Background • Good presentations make you think… Whether what you think about is what was intended is another matter! • CIPFA Presentation Solid, Sensible Stuff: Good grounding in orthodoxy • A “Road to Damascus” Moment! Orthodoxy in Risk Management Thinking • Communication • Governance • Assurance My Road to Damascus Moment • The right conceptual thinking in the wrong order! • Tension between mainstream theory and local experience of managing risk in severe austerity • Regional discrepancies in applying budget reductions • My organisation particularly hard hit • The figures are startling…. The National Projection Source: “Managing Demand: Building Future Public Services” . RSA 2014 Risk Appetites (1) Risk averse (The Ruminant) • Uncomfortable with uncertainty/ambiguity • Seeks security and resolution • Practical, like facts, established ways of working Risk neutral (The Nomad) • Takes current risks for high future pay offs • Abstract, creative, possibilities and change • Long-term focus Risk Appetites (2) Risk tolerant (The Predator) • Comfortable with uncertainty • Risk is normal • Laissez faire approach Risk seeking (The Aggressor) • Adaptable, resourceful, likes action • Enjoys tackling uncertainty so casual approach to threats • Will see few threats Your Perceptions • Very briefly… • Talk round your table… - Share between you what do you think your organisations’ risk appetites are? - Consider as a group how reasonable it is to talk about one risk appetite? What Austerity Looks Like • This is not “Shroud Waving!” • Loss of budget- reality vs risk • Attempt to present a new reality dispassionately • Variable picture nationally, so my Council as a case study Change in Spending Power 2014/16 The map below shows the distributional impact of the 2013/15 Financial Settlement Budget Context Table shows 40% reduction in Directorate Budgets 2010/16 Resources Available 2010/11 £m 2011/12 £m 2012/13 £m 2013/14 £m 2014/15 £m 2015/16 £m 2016/17 £m 641.5 581.5 545.9 530.8 517.6 466.6 451.0 54.6 52.8 49.7 60.0 53.3 64.3 53.8 70.4 53.8 72.2 53.8 72.1 53.8 73.0 534.1 471.8 428.3 406.6 391.6 340.7 324.2 641.5 581.5 545.9 530.8 517.6 466.6 451.0 Calls Against Resources: Corporate Items (Including contingencies and capital financing) Levies Departmental Costs Total Call against Resources Reduction in Directorate Budgets Reduction as % -210 -40% How the Budget is Spent Workforce Reductions FTE Workforce Reductions Original workforce- circa 10,000 when schools excluded 2011/12 2012/13 2013/14 2014/15 FTE FTE FTE FTE 1,681 Total 344 562 268 2,855 Meeting the Current Gap • Need savings c£60m rising to £100m by 2015/16 • This includes income generation from business rates and council tax • Guided by Budget Principles and agreed approach to finding Savings • But, also uncertainty- demography, levies, investment for growth etc Meaning? • Still not “Shroud Waving” (not least, it’s pointless) • Welcome opportunities to do things differently • BUT, we have moved into completely new territory • Loss of historic evidence base, new strategies, high risk • High opportunity • Fundamental change is the only option Approach to Savings • • • • • Growth – how to create jobs, drive private sector investment in business expansion and create the opportunities for commercial development and wealth creation, alongside neighbourhoods that will be attractive for the City’s growing population Reform - to reduce the demand for services including how work with partners to do this and how the use of ringfenced resource is maximised to deliver the greatest benefit Collaboration i.e. Sharing responsibility with Councils or public agencies for delivery of services whilst retaining democratic control over levels and standards of service and cutting management costs. Efficiency to meet demand at lower cost. Income generation taking all opportunities to generate income consistent with priorities for the growth and support services meeting residents' needs. Opportunities to support business growth and increase the council tax base will be maximised. Budget/Business Plan Principles • • • • • Leadership for Reform – Economic Growth, reduce worklessness and dependency, promote private sector investment. Targeted Services – Provide effective safeguarding and protect the most vulnerable, support effective integration of health and social care and integrated commissioning at neighbourhood level. Work to reduce dependency, manage demand effectively and support residents to be economically active. Universal Services – ensure provision of high standard of services for residents from education to libraries, ensure services provide support to those most in need Neighbourhoods – Budgets should be neighbourhood focused, with a focus on supporting neighbourhoods with a good housing offer, that are clean and are places where people want to live and work, develop a community service focus. Core – Centres of Excellence to drive reform, provide effective support services, protect customer facing services, and maintain the Council’s leadership role within AGMA and the Combined Authority Implications for Risk • An emerging picture• Answers uncertain… but • Agilility becomes everything • Can’t afford to be risk averse • Principle of “do least harm” • Manage anxieties and emotions • Identification of performance “triggers” Implications for Risk (Upside) • Risk and assurance move centre stage • Front end process, informing options appraisal • Absolutely key to communication, governance and assurance • Services want us- part of the solution • “The old conundrum” in dealing with uncertainty Implications for Risk (Downside) • Used as a stick to oppose/delay change (Tharn) • Risk taking without consideration of consequence (reckless culture) • Inconsistent appetite, changing strategy • Risk without reward Some Case Studies • • • • Recruitment and Retention Property Management Looked After Children Strategic Service Delivery Models “m people” • Reductions in staff through voluntary redundancy and natural wastage • A competency framework approach • Making the most of resources by being swift and decisive • Closed front door- open back door • High risk/high reward Corporate Landlord • Expanded Corporate Landlord Function - to deliver economies of scale - to enhance efficiency of space usage - to ensure effective management of a reduced housing stock Looked After Children Early interventions before children and families enter the formal care system • Opportunities to bear down on dependency • Reduce overall demand • Reduce residential care placements • Focus more family based care for a smaller number of service users • But- model’s untested in a Core City Moving from Provider to Commissioner of Services • Within the scale of budget reductions… If we can’t provide, what can we do? • Commissioning provides a totally different risk profile… • A wholesale strategic change, not only to our operational model, but also to our purpose • Assumptions, skills, capacity, the emotional will, performance management Risk Appetite and Context Key Messages • Austerity = uncertainty- we start from a different premise • Opportunities to do things differently • And to innovate. • But, the primary imperative is to reduce cost, whilst protecting that which is essential Key Messages (2) • Risk Management that is accepting that what we are doing is risky… regardless • Risk Management in options appraisal • Risk Management in service business planning • Risk Management in performance management • Risk management to inform service planning Key Messages (3) • If you don’t yet recognise the reality… watch this space. Budget reductions are projected for the next three years • To be risk averse is a limited option when planning enormous change • All transformation modelling has to be risk based • We are in demand • The opportunities are enormous Implications: Auditors/Risk Managers • Being “linear” is difficult- we need to do things differently • Agile, Practical, Creative • End result isn’t always understood at the outset • Tolerate good enough • Understand cost vs benefit… • and the requirement to step into the unknown • Move away from the template approach I’m Done Ranting Questions?