Accounting Principles & Auditing Test - MBAM 207

advertisement

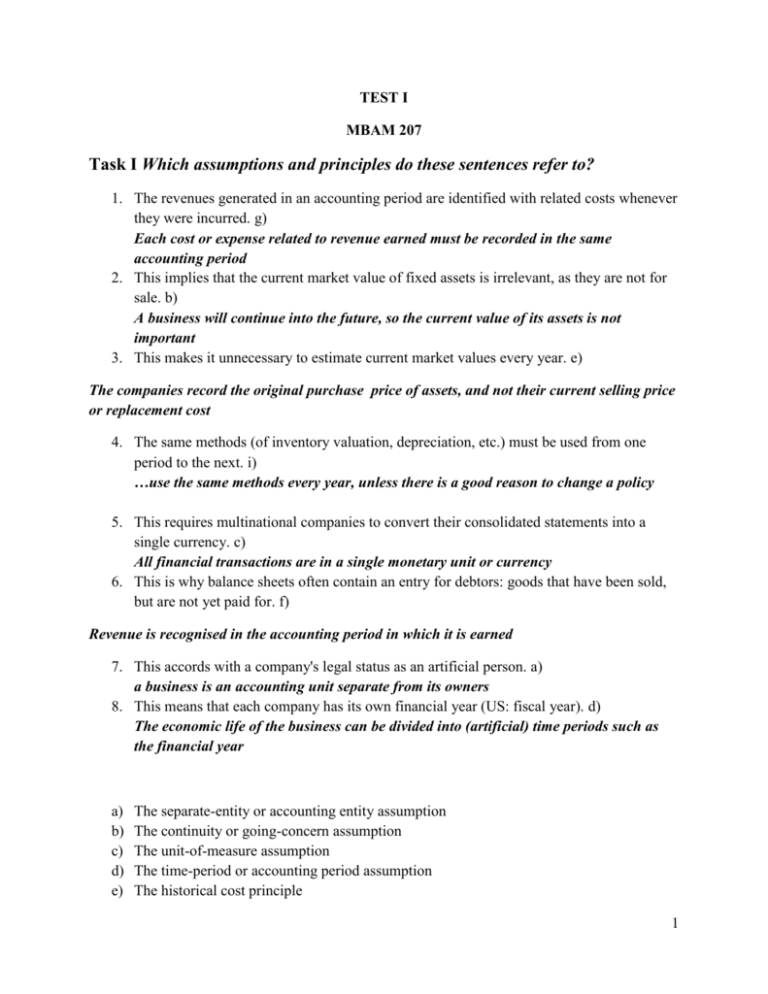

TEST I MBAM 207 Task I Which assumptions and principles do these sentences refer to? 1. The revenues generated in an accounting period are identified with related costs whenever they were incurred. g) Each cost or expense related to revenue earned must be recorded in the same accounting period 2. This implies that the current market value of fixed assets is irrelevant, as they are not for sale. b) A business will continue into the future, so the current value of its assets is not important 3. This makes it unnecessary to estimate current market values every year. e) The companies record the original purchase price of assets, and not their current selling price or replacement cost 4. The same methods (of inventory valuation, depreciation, etc.) must be used from one period to the next. i) …use the same methods every year, unless there is a good reason to change a policy 5. This requires multinational companies to convert their consolidated statements into a single currency. c) All financial transactions are in a single monetary unit or currency 6. This is why balance sheets often contain an entry for debtors: goods that have been sold, but are not yet paid for. f) Revenue is recognised in the accounting period in which it is earned 7. This accords with a company's legal status as an artificial person. a) a business is an accounting unit separate from its owners 8. This means that each company has its own financial year (US: fiscal year). d) The economic life of the business can be divided into (artificial) time periods such as the financial year a) b) c) d) e) The separate-entity or accounting entity assumption The continuity or going-concern assumption The unit-of-measure assumption The time-period or accounting period assumption The historical cost principle 1 f) g) h) i) j) k) The revenue or realization principle The matching principle The objectivity principle The consistency principle The full-disclosure principle The principle of conservatism (or prudence) Task II. Number the following words or expressions with their underlined equivalents in the text: accuracy (1) external (4) Annual General Meeting (9) implemented (15) board of directors (6) ratified (7) checking (13) shareholders (8) deficiencies (10) standard operating procedures (3) determine (5) subsidiaries (16) deviations (2) a synonym (11) directives (14) transnational corporations (12) The traditional definition of auditing is a review and an evaluation of financial records by a second set of accountants. An internal audit is a control by a company's own accountants, checking for completeness, ( 1) and reliability. Among other things, internal auditors are looking for (2) departures from (3) a firm's established methods for recording business transactions. In most countries, the law requires all firms to have their accounts audited by an outside company. An (4) independent audit is thus a review of financial statements and accounting records by an accountant not belonging to the firm. The auditors have to (5) judge whether the accounts give what in Britain is known as a "true and fair view" and in the US as a "fair presentation" of the company's [corporation's] financial position. Auditors are appointed by a company's ( 6) most 2 senior executives and advisors, whose choice has to be (7) approved by the (8) owners of the company's equity at the (9) company's yearly assembly. Auditors write an official audit report. They may also address a "management letter” to the directors, outlining ( 10) inadequacies and recommending improved operating procedures. This leads to the more recent use of the word "audit" as ( 11) an equivalent term for "control": (12) multinational companies, for example, might undertake inventory, marketing and technical audits. Auditing in this sense means ( 13) verifying that general management ( 14) instructions are being (15) executed in branches, (16) companies which they control, etc. Task III. Many words can be combined with ACCOUNT, ACCOUNTS or ACCOUNTING, in a two-word partnership: e.g. BANK ACCOUNT, ACCOUNTS PAYABLE, TAX ACCOUNTING etc. Complete the following sentences with the proper word partnership containing ACCOUNT, ACCOUNTS or ACCOUNTING: 1. Auditors are supposed to make sure that companies follow their stated .......... . accounting procedures 2. Companies can choose from a variety of……………………, but they are not allowed to change them too often. accounting methods 3. Lots of money obtained in dubious or illegal ways is deposited in .................. in Swiss banks. numbered accounts 4. The basic ........... is Assets = Liabilities + Owners' Equity. accounting equation 5. The ........... at the London Stock Exchange usually lasts two weeks. It is followed by an ……………. on which all bills must be settled. accounting period, accounting day 6. The ………………….. is one of the three basic financial statements. profit and loss account 7. .......... consist of money that is expected to be received. The contrary, ........... , consist of money that is owed to other people. accounts receivable, accounts payable 3 8. The role of …………….. is to provide figures and statements that will aid decision-making. managerial accounting Task IV. Classify the following 18 words into 3 groups of six, according to the headings below: , ,,,,,,,,,,,, , ,, Bookkeeping Depreciation Financial Statements double-entry --------- amortization ----------- accounts payable --------- journal --------------- annuity system ---------------- net profit ------------------ posting------------- reducing balance -------- below the line --------------- trial balance voucher scrap value --------------------- reserves ----------------- prudence ----------- straight line method ---------- deferred liabilities ---------- --------------------------- writing off ---------------------- , income statement ----------- Task V. Which of the words in Task IV do the following sentences define? 4 1. A term to describe "extraordinary" items placed after the net profit total in a profit and loss account, which perhaps make the profit appear higher than it really is. (below the line) 2. A way of depreciating an asset which involves estimating the number of years it will be used, and then dividing its historical cost by this number. (straight line method) 3. Money that a company will definitely have to repay in the future, but not during the current financial year. ( deferred liabilities) 4. The American name for what in Britain is usually called a profit and loss account. (income statement) 5. The part of a company's profit that is retained for future reinvestment, rather than distributed as a dividend. (reserves) 5