October 30 Internal Control lesson BAT4M

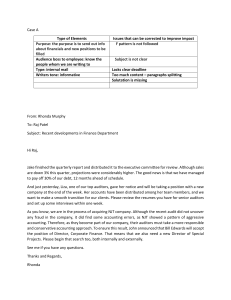

advertisement

CHAPTER 7 INTERNAL CONTROL AND CASH Friday, we will meet in room 217 Performance Review Internal Review: • In large companies, controal activities (including internal review) are monitored by internal auditors. • Internal Auditors are company employees who evaluate the internal control system of the company. (whether the system is effective) • They periodically review the activities of departments and individuals to determine whether the correct control activities are being followed. Performance Review Internal Review: • Internal Review have become so important that CEO and CFO must certify that they have evaluated the effectiveness of the company’s internal control over financial reporting. • Their conclusions must be included in the company’s management discussion and analysis section of the annual report. (disclosure note) Performance Review External Review : • Internal auditors work for the same company they review, but external auditors do not work for the company they review but typically work for CA firms. • External auditors focus on making sure that financial statements fairly present the company’s financial position. (also whether the company is complying with IFRS rules.) Performance Review External Review : • All public companies (their shares are traded in stock exchange) are required to have an external audit. • Auditors check, verify and audit (tracing and vouching) the books of the client. • This is why accounting firms make millions of dollars. • Other Controls 1. Bonding of employees who handle cash: Bonding means getting insurance called fidelity insurance. If one of the employee steals money (or asset) then the insurance compay will compensate the employer for losses due to dishonesty of an employee. When employees know that the company has fidelity insurance, they will think twice before stealing company’s asset because the insurance company will prosecute all criminals. Other Controls 2. Rotating employees’ duties and requiring employees to take vacations. These measures discourage employees from attempting any thefts since they will not be able to permanently hide their improper actions. Many bank embezzlements, for example, have been discovered when the guilty employee was on vacation. LIMITATIONS OF INTERNAL CONTROL Cost / Benefit No matter how well it is designed and operated, a company’s system of internal control can only give reasonable assurance that assets are properly safeguarded and that accounting records are reliable. The concept of reasonable assurance is based on the belief that the cost of control activities should not be more than their expected benefit. Cost < Benefit then they will implement the internal control system. For example, security guard at Wal-Mart Cost is 40000 a year > benefit of 10000 then we LIMITATIONS OF INTERNAL CONTROL Collusion Two or more employees may work together to get around controls. Such collusion eliminates the protection which is offered by segregation of duties. LIMITATIONS OF INTERNAL CONTROL Size of business Size of the business may also limit internal control. For example, in small companies, it is difficult to segregate duties or have independent performance reviews. This is why in small business, the owner does internal review and many other functions. LIMITATIONS OF INTERNAL CONTROL Human element Human factor is an important limit in internal control system. A good system can become ineffective as a result of employee fatigue, carelessness, indifference and lack of training. Classwork / Homework P378 Ex 7.1 P379 Ex 7.2 P383 P7.1