Presentation - ICAI | Online Web TV

advertisement

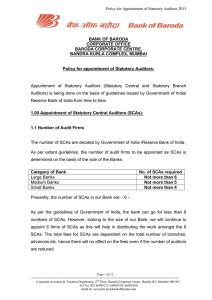

Companies Act 2013 Opportunities for Professionals CA. S. Santhanakrishnan, Chairman, Corporate Laws & Corporate Governance Committee, ICAI 1 2 Change “Some changes look negative on the surface but you will soon realize that space is being created in your life for something new to emerge.” Eckhart Tolle 3 Story of asuras and devas With lot of restrictions on the Statutory Auditors, the Companies Act 2013 prescription for the profession is akin to the directive in the story of Asuras and Devas They were told, that they can eat amrut, but, without folding their elbow joints… Asuras were only trying.. Devas feed each other in a circle!!! 4 There is also a Tamil saying.. Oorar pillaya ooti valatha, than pillai thaane valarum… 5 Opportunities On the whole, this Act has opened up more opportunities for professionals, though Statutory Auditors have been brought under a lot of restrictions!! 6 Audit Rotation Rotation has been mandated for large entities This throws open opportunities to more audit firms.... 7 Other changes which are going to open up avenues for small firms Common Firms which are handling large number of audits will have to spread the work amongst more professionals now Cap financial year of 20 audits per partner Other firms in the same town / region are likely to gain more work 8 Consolidated Financial Statements All companies which have subsidiaries, associates and JVs will need to prepare consolidated financial statements Many small and mid sized groups will not have internal capabilities to compile CFS This opens up opportunities for practicing CAs to undertake consolidation services 9 Fixed Assets and Depreciation Companies are going to be looking at advisory and support for Revising depreciation, esp. where they were following Schedule XIV rates Componentization Effect of revaluation 10 Revision of Accounts Reopening/recasting of accounts –Court/Tribunal order (130)/ Voluntary (131): Who can apply? CG IT authorities SEBI Any other statutory/regulatory authority Board/Company- S 131 Opportunity Advising companies on appropriate steps and process Independent evaluation of the proposed treatments in reopening / recasting of accounts *Sections yet to be notified 11 Internal Audit Mandated for Listed cos All companies with TO Rs 200 cr or more or o/s loans and borrowings from Banks/FI Rs 100cr or more Unlisted public cos with Share capital Rs 50cr or more or Public deposits Rs 25 cr or more Shall appoint a CA /cost accountant / other professionals in practice or not; can be firm of internal auditors; Employee or not AC or Board in consultation with IA to formulate scope, functioning, periodicity and methodology of IA 12 Internal Financial Controls A large engagement opportunity to the profession All companies need to have a system which is also documented so that the Board and auditors can place reliance on the system and its testing for effective operations… 13 Fraud Reporting There are stringent requirements on reporting in respect of frauds This requires the company to set up a mechanism of Investigation into all suspected cases of frauds for an independent evaluation Detailed action plan based on such investigations Independent evaluation and advisory to the AC / Board on matters and the information being reported on frauds to the CG 14 Related Parties 15 Related Party Transactions - 1 Throws open a new area of practice for firms… CAs can advice companies and groups in setting up an appropriate framework systems and process for identification of related parties, related party transactions, evaluation of arm’s length pricing and approvals by the Audit Committee / Board 16 Related Party Transactions - 2 Identification of RTP In many groups identification of RTP itself will require a lot of efforts and action Audit Committees and Boards are going to seek independent confirmation in terms of such processes to ensure that their responsibilities are properly discharged 17 Related Party Transactions - 3 Audit Committees and Boards are also going to seek out professional expertise and independent opinions on determination of arm’s length basis of transactions CAs – especially other than the statutory auditors can look for opportunities unfolding in this regard 18 Valuation Services The Act mandates valuation services to be rendered by registered valuers… Members getting registered as valuers once the process for the same is effective could throw open opportunities… 19 Independent Directors Need for independent directors is bound to grow… As Chartered Accountants provide a pool of financial experts to be on the Board of companies… 20 CSR Another great opportunity for the profession Advisory on CSR activities to be taken up and selection of agencies through which the activities could be undertaken Monitoring and audit of CSR spends… 21 SFIO Opportunities to work on forensic investigations Development of early warning systems for being implemented for online monitoring and tracking SFIO being viewed as a large employment provider for CA professionals 22 Official Liquidator Opportunities to work as provisional liquidator or the Company Liquidator (sec 275) Chartered accountants, advocates, company secretaries, cost accountants or firms or bodies corporate having such chartered accountants, advocates, company secretaries, cost accountants and other professionals may be appointed and having at least ten years’ experience in company matters. *Section yet to be notified 23 NCLT Representation before NCLT is also another area of opportunity which is now being opened up for the members This is also an opportunity for members to work on higher value professional services, as it arises in this area 24 Thank You