No #4

advertisement

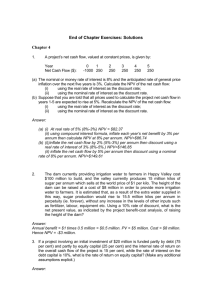

CHAPTER 6 HOW TO ANALYZE INVESTMENT PROJECTS Objectives To show how to use discounted cash flow analysis to make investment decisions such as: Whether to enter a new line of business Whether to invest in equipment to reduce operating costs Outline 6.1 6.2 6.3 6.4 6.5 6.6 6.7 6.8 6.9 6.10 The Nature of Project Analysis Where Do Investment Ideas Come From? The Net Present Value Investment Rule Estimating a Project’s Cash Flows Cost of Capital Sensitivity Analysis Using Spreadsheets Analyzing Cost-Reducing Projects Projects with Different Lives Ranking Mutually Exclusive Projects Inflation and Capital Budgeting Summary The unit of analysis in capital budgeting is the investment project. From a finance perspective, investment projects are best thought of as consisting of a series of contingent cash flows over time, whose amount and timing are partially under the control of management. The objective of capital budgeting procedures is to assure that only projects which increase shareholder value (or at least do not reduce it) are undertaken. Most investment projects requiring capital expenditures fall into three categories: new products, cost reduction, and replacement. Ideas for investment projects can come from customers and competitors, or from within the firm’s own R&D or production departments. Projects are often evaluated using a discounted cash flow procedure wherein the incremental cash flows associated with the project are estimated and their NPV is calculated using a risk-adjusted discount rate which should reflect the risk of the project. If the project happens to be a “mini-replica” of the assets currently held by the firm, then management should use the firm’s cost of capital in computing the project’s net present value. However, sometimes it may be necessary to use a discount rate which is totally unrelated to the cost of capital of the firm’s current operations. The correct cost of capital is the one applicable to firms in the same industry as the new project. It is always important to check whether cash flow forecasts have been properly adjusted to take account of inflation over a project’s life. There are two correct ways to make the adjustment: 1. Use the nominal cost of capital to discount nominal cash flows. 2. Use the real cost of capital to discount real cash flows. Instructor’s Manual Chapter 6 Page 86 Solutions to Problems at End of Chapter 1. Your firm is considering two investment projects with the following patterns of expected future net aftertax cash flows: Year Project A Project B 1 $1 million $5 million 2 2 million 4 million 3 3 million 3 million 4 4 million 2 million 5 5 million 1 million The appropriate cost of capital for both projects is 10%. If both projects require an initial outlay of $10 million, what would you recommend and why? SOLUTION: Year Project A Present Values of A Project B @ 10% 1 $1 million 909,091 $5 million 2 2 million 1,652,893 4 million 3 3 million 2,253,944 3 million 4 4 million 2,732,054 2 million 5 5 million 3,104,607 1 million Total PV 10,652,589 NPV 652,589 Project B is better than A because it has a higher NPV, a result of paying cash earlier. Present Values of B @ 10% 4,545,454 3,305,785 2,253,944 1,366,027 620,921 12,092,132 2,092,132 Investing in Cost-Reducing Equipment 2. A firm is considering investing $10 million in equipment which is expected to have a useful life of four years and is expected to reduce the firm’s labor costs by $4 million per year. Assume the firm pays a 40% tax rate on accounting profits and uses the straight line depreciation method. What is the after-tax cash flow from the investment in years 1 through 4? If the firm’s hurdle rate for this investment is 15% per year, is it worthwhile? What are the investment’s IRR and NPV? SOLUTION: We have to find the incremental cash flows resulting from this investment. There are two methods that we can use to find the after tax cash flow. 1. Find the (incremental) net income, then add (incremental) depreciation. Hence: Annual depreciation (using straight-line method) = $10MM/4 = $2.5MM Pretax income increases by: $4MM - $2.5MM = $1.5MM Net income increase by : 1.5x(1-0.4) = $0.9MM Adding back depreciation (non cash expense): OCF = 0.9 + 2.5 = $3.4MM 2. Add the depreciation tax shield to the after-tax incremental cost saving. Hence, the yearly OCF from year 1 to 4 is: 4x(1-0.4) + 2.5x0.4 = $3.4MM Year 0 1 2 3 4 CFI -$10MM +$3.4MM +$3.4MM +$3.4MM +$3.4MM At 15% discount rate: NPV = -$293,073MM. The NPV is negative, hence the investment is not worthwhile taking. IRR = 13.54%. The IRR is less than the cost of capital (15%) of the project. Again, don’t take the project. Instructor’s Manual Chapter 6 Page 87 Investing in a New Product 3. Tax-Less Software Corporation is considering an investment of $400,000 in equipment for producing a new tax preparation software package. The equipment has an expected life of 4 years. Sales are expected to be 60,000 units per year at a price of $20 per unit. Fixed costs excluding depreciation of the equipment are $200,000 per year, and variable costs are $12 per unit. The equipment will be depreciated over 4 years using the straight line method with a zero salvage value. Working capital requirements are assumed to be 1/12 of annual sales. The market capitalization rate for the project is 15% per year, and the corporation pays income tax at the rate of 34%. What is the project’s NPV? What is the breakeven volume? SOLUTION: Sales revenue will be: $20 per unit x 60,000 units per year = $1,200,000 per year Investment in working capital = 1/12 x $1,200,000 = $100,000 The total investment is $500,000: $400,000 for the equipment and $100,000 in working capital. Depreciation = $400,000/4 = $100,000 per year Total annual operating costs = $12 per unit x 60,000 units per year + $300,000 = $1,020,000 per year The expected annual net cash flow can be derived using the formula: CF = net income + depreciation = (1 - tax rate)(Revenue - total operating costs) + depreciation = .66 x ($1,200,000 - $1,020,000) + $100,000 = $218,800 per year Year CFI 0 -500,000 1 +218,800 2 +218,800 3 +218,800 4 +318,800 At a 15% hurdle rate: NPV = $181,845 In order for the NPV to be 0, what must the cash flow from operations be? n I PV FV PMT Result 4 15 –500,000 100,000 ? PMT = $155,106 Now we must find the number of units per year (Q), that corresponds to an operating cash flow of this amount. A little algebra reveals that the breakeven level of Q is units per year: CASH FLOW = NET PROFIT + DEPRECIATION = .66(8Q – 300,000) + 100,000 = 155,106 = .66(8Q – 300,000) = 55,106 8Q – 300,000 = 55,106/.66 = 83,493.94 Q = 383,493.94 = 47,937 units per year 8 Note that computing the accounting breakeven quantity gives: Breakeven quantity = fixed costs/contribution margin QB = F P-V QB = $300,000 per year = 37,500 units per year $8 per unit Instructor’s Manual Chapter 6 Page 88 Investing in a New Product 4. Healthy Hopes Hospital Supply Corporation is considering an investment of $500,000 in a new plant for producing disposable diapers. The plant has an expected life of 4 years. Sales are expected to be 600,000 units per year at a price of $2 per unit. Fixed costs excluding depreciation of the plant are $200,000 per year, and variable costs are $1.20 per unit. The plant will be depreciated over 4 years using the straight line method with a zero salvage value. The hurdle rate for the project is 15% per year, and the corporation pays income tax at the rate of 34%. Find: a. The level of sales that would give a zero accounting profit. b. The level of sales that would give a 15% after-tax accounting rate of return on the $500,000 investment. c. The IRR, NPV, and payback period (both conventional and discounted) if expected sales are 600,000 units per year. d. The level of sales that would give an NPV of zero. SOLUTION: The initial investment is $500,000. Depreciation = $500,000/4 = $125,000 per year Total annual fixed costs = $200,000 + $125,000 per year = $325,000 per year a. To find the accounting breakeven quantity apply the breakeven formula: Breakeven quantity = fixed costs/contribution margin QB = F P-V QB = $325,000 per year = 406,250 units per year $.80 per unit b. To earn a 15% accounting ROI, the after tax profit (net income) has to be:.15 x $500,000 = $75,000 That means before-tax profit has to be $75,000/.66 = $113,636. To earn this additional profit, the new breakeven quantity must increase by: 142,045 units per year (required profit before taxes/ contribution margin = $113,636/$.80) to a total of 548,295 per year. c. If 600,000 units per year can be sold, then the expected annual net cash flow can be derived using the formula: CF = net income + depreciation = (1 - tax rate)(Revenue - total operating costs) + depreciation = .66 x ($1,200,000 - $720,000 - $325,000) + $125,000 = $227,300 per year n i PV FV PMT 4 15 ? 0 227,300 4 ? -500,000 0 227,300 ? 15 -500,000 0 227,300 NPV = $648,937 - $500,000 = $148,937 Conventional payback period = $500,000/$227,300 per year = 2.2years d. Result PV = $648,937 IRR = 29.09% n = 2.87 years In order for the NPV to be 0, what must the cash flow from operations be? n i PV FV PMT Result 4 15 –500,000 0 ? PMT = $175,133 Now we must find the number of units per year (Q), that corresponds to an operating cash flow of this amount. A little algebra reveals that the breakeven level of Q is units per year: CASH FLOW = NET PROFIT + DEPRECIATION = .66(.8Q – 325,000) + 125,000 = 175,133 = .66(.8Q – 325,000) = 50,133 .8Q – 325,000 =50,133/.66 = 75,959 Q =400,959 = 501,199 units per year .8 Instructor’s Manual Chapter 6 Page 89 Replacement Decision 5. Pepe’s Ski Shop is contemplating replacing its ski boot foam injection equipment with a new machine. The old machine has been completely depreciated but has a current market value of $2000. The new machine will cost $25,000 and have a life of ten years and have no value after this time. The new machine will be depreciated on a straight-line basis assuming no salvage value. The new machine will increase annual revenues by $10,000 and increase annual nondepreciation expenses by $3000. a. What is the additional after-tax net cash flow realized by replacing the old machine with the new machine? (Assume a 50% tax rate for all income, i.e. the capital gains tax rate on the sale of the old machine is also 50%. Draw a time line.) b. What is the IRR of this project? c. At a cost of capital of 12%, what is the net present value of this cash flow stream? d. At a cost of capital of 12%, is this project worthwhile? SOLUTION: a. b. c. d. t ATNCF 0 -24,000 = -25,000 + 2000 x (1-0.5) 1,2,...,10 4,750 = (10,000 3,000 2,500)(1 0.5) + 2,500 IRR =14.82% NPV = $2,838.56 This project is worthwhile because its NPV is positive. Also, its IRR is higher than its cost of capital. 6. PCs Forever is a company that produces personal computers. It has been in operation for two years and is at capacity. It is considering an investment project to expand its production capacity. The project requires an initial outlay of $1,000,000: $800,000 for new equipment with an expected life of four years and $200,000 for additional working capital. The selling price of its PCs is $1,800 per unit, and annual sales are expected to increase by 1,000 units as a result of the proposed expansion. Annual fixed costs (excluding depreciation of the new equipment) will increase by $100,000, and variable costs are $1,400 per unit. The new equipment will be depreciated over four years using the straight line method with a zero salvage value. The hurdle rate for the project is 12% per year, and the company pays income tax at the rate of 40%. a. What is the accounting break-even point for this project? b. What is the project’s NPV? c. At what volume of sales would the NPV be zero? SOLUTION: a. To find the accounting break-even quantity, apply the break-even formula: Break-even quantity = total fixed costs/contribution margin Total fixed costs = fixed costs (cash) + depreciation The additional fixed costs due to the expansion project are $300,000 (fixed costs + depreciation) per year and the contribution margin is $400 per unit. So the accounting breakeven quantity is 750 additional units per year. b. Increase in Sales Revenue (1,000 units at a price of $1,800) $1,800,000 per year Increase in Total Variable Costs (1,000 units at $1,400) per unit) $1,400,000 per year Increase in fixed costs excluding depreciation $100,000 per year Increase in depreciation $200,000 per year Increase in Total Fixed Costs $300,000 per year Increase in Annual Operating Profit $100,000 per year Taxes @ 40% $40,000 per year Increase in After-tax Operating Profit $60,000 per year Increase in Net Cash Flow from Operations: 60,000+200,000= $260,000 per year Instructor’s Manual Chapter 6 Page 90 The initial investment $1,000,000: $800,000 for the equipment and $200,000 for working capital. Using a financial calculator to find the NPV we find: n i PV FV PMT 4 12 ? 200,000 260,000 PV=916,814 NPV = PV – $1,000,000 = $916,814 – $1,000,000 = –$83,186 The NPV is negative, hence the project is not worth taking. c. To find the NPV breakeven value for the incremental cash flow from operations we do the following calculation: n i PV FV PMT 4 12 –1,000,000 200,000 ? PMT = $287,387.55 (Note that the $200,000 terminal value in year 4 is the investment in working capital.) Now we must find the incremental number of units per year ( Q), that corresponds to an incremental operating cash flow of this amount. Incremental Cash Flow = Increase in net profit + increase in depreciation = (1-0.4)x(400 Q – 300,000) + 200,000 = $287,387.55 Q = $445,646 = 1,114.1, the smallest rounded number is 1,115 units per year 400 So the expansion must result in at least 1,115 additional units per year in order to justify the capital outlay. Inflation and Capital Budgeting 7. Patriots Foundry (PF) is considering getting into a new line of business: producing souvenir statues of Paul Revere. This will require purchasing a machine for $40,000. The new machine will have a life of two years (both actual and for tax purposes) and will have no value after two years. PF will depreciate the machine on a straight-line basis. The firm thinks it will sell 3,000 statues per year at a price of $10 each, variable costs will be $1 per statue and fixed expenses (not including depreciation) will be $2,000 per year. PF’s cost of capital is 10%. All of the foregoing figures assume that there will be no inflation. The tax rate is 40%. a. What is the series of expected future cash flows? b. What is the expected net present value of this project? Is the project worth undertaking? c. What is the NPV breakeven quantity? Now assume instead that there will be inflation of 6% per year during each of the next two years and that both revenues and nondepreciation expenses increase at that rate. Assume that the real cost of capital remains at 10%. d. What is the series of expected nominal cash flows? e. What is the net present value of this project, and is this project worth undertaking now? f. Why does the NPV of the investment project go down when the inflation rate goes up? SOLUTION: a. The expected future net cash flows are: CF = (1 - tax rate) (revenue - cash expenses) + tax rate x depreciation CF = .6 x ($30,000 - $3,000 -$2,000) + .4 x $20,000 CF = .6 x $25,000 + .4 x $20,000 = $23,000 in each of the next two years b. N i PV FV PMT Result 2 10 ? 0 23,000 39,917.36 NPV = $39,917.36 - $40,000 = -$82.64 So the project is not worthwhile. c. To find the NPV breakeven value for the incremental cash flow from operations we do the following calculation: N i PV FV PMT Result 2 10 -40,000 0 ? 23,047.62 Instructor’s Manual Chapter 6 Page 91 Now we must find the number of units per year (Q), that corresponds to a net cash flow of this amount. CF = (1 - tax rate) (Revenue - Cash expenses) + tax rate x Depreciation = .6(9Q – 5,000) + 20,000x0.4= $23,047.62 9Q – 5,000 = 15,047.62/.6 = 25,079.37 Q = 30,079.37/9 = 3,342.1, the smallest rounded number is 3.343 statues per year d. Now assume that there will be inflation of 6% per year during each of the next two years and that both revenues and nondepreciation expenses increase at that rate. CF = .6 x (Revenue - Cash expenses) + .4 x Depreciation In year 1: CF1 = .6 x $25,000 x 1.06 + .4 x $20,000 = .6 x $26,500 + .4 x $20,000 = $23,900 In year 2: CF2 = .6 x $25,000 x 1.062 + .4 x $20,000 = .6 x $28,090 + .4 x $20,000 = $24,854 e. To find the NPV we discount the nominal cash flows at the nominal cost of capital. First we must find the nominal cost of capital: Nominal cost of capital = (1.06)(1.1) - 1 = .166 or 16.6% per year The NPV is -40,000 + 23,900/1.166 + 24,854/1.166 2 = -$1,221.60 The project is not worthwhile. f. If all components of the net cash flow increased at the rate of inflation of 6% per year, then the NPV would be unaffected by inflation. But in this case, the depreciation is fixed in dollar terms, so that the depreciation tax saving loses value the higher the rate of inflation. Understanding incremental cash flows 8. Determine which of the following cash flows are incremental cash flows that should be incorporated into a NPV calculation. a. The sale of an old machine, when a company is replacing property, plant, and equipment for a new product launch. b. The cost of research and development for a new product concept that was conducted over the past year that is now being put into production. c. Potential rental income that was forgone from a previously unused warehouse owned by the company, which is now being used as part of a new product launch. d. New equipment purchased for a project. e. The annual depreciation expense on new equipment purchased for a project. f. Net working capital expenditures of $10 million in year 0, $12 million in year 1 and $5million in year 2. g. A dividend payment that was funded in part by a given project’s contribution to the net income for that year. SOLUTION: a. Yes, the sale of the machine is part of the project initiative. Therefore, the proceeds from the sale of the equipment should be counted. b. No, the R&D expenditure is a sunk cost that should not be included in the project evaluation. The cost occurred over the past year and must be borne by the company regardless of whether the project is undertaken or not. Sunk costs should never be considered when evaluating a future decision. c. Yes, this is an opportunity cost that is being borne by the company. If the warehouse would have remained unused and could have produced rental income then it must be considered as a cost. d. Yes, capital expenditures must be incorporated in an NPV analysis. e. Yes, annual depreciation is part of incremental cash flows. However, it is the “depreciation tax shield” that is the incremental cash flow and not the actual depreciation expense. f. Yes, net working capital is factored into the incremental cash flow. However, it is the “change” in net working capital that is taken into consideration. Therefore, year 0 would have -$10 million that must be added to the operating cash flow for that year. Year 1 would have -$2 million that would need to be added to operating cash flow for that year. Finally, year 3 would show a +$7 million that would need to be added. Remember that in the final year of the project the net working capital figure must be reversed. g. No, dividend payments are not incremental cash flows. Whether or not to pay a dividend is the decision of the overall firm and not a cost of an individual project. Instructor’s Manual Chapter 6 Page 92 9. You have taken a product management position within a major consumer goods firm after graduation. The contract is for four years and your compensation package is as follows: $5,000 relocation expense $55,000 $10,000 bonus if annual goals are met $15,000 additional bonus at the end of four years if your team achieves a given market share You are confident in your abilities and assume there is a 65% chance in receiving each annual bonus and a 75% chance in receiving the fourth year additional bonus. The effective annual interest rate is 8.5%. What is the net present value of your compensation package. SOLUTION: Assuming these cash flows are after-tax: Year 0 1 2 3 4 CFi 5000 55,000 + 0.65x10,000 = 61,500 61,500 61,500 61,500 + 0.75x15,000 = 72,750 At 8.5% effective annual rate: NPV = $214,567. Investing in a new project 10. You are in the finance department of a firm and you are evaluating a project proposal. You have developed the following financial projections and you are calculating: a. The incremental cash flows of the project. b. The net present value of the project given a discount rate of 15%. The corporate tax rate is 34% and the financial projections are in thousands. Year 0 Sales revenue Operating costs Investment Depreciation Net working capital Year 1 10,000 3,000 Year 2 10,000 3,000 Year 3 10,000 3,000 Year 4 10,000 3,000 Year 5 10,000 3,000 3,500 350 3,500 400 3,500 300 3,500 200 3,500 0 15,000 300 a. Incremental cash flows (in thousands) Year 0 Initial Investment -15,000 OCF Change in net working capital -300 Total cash flows -15,300 Year 1 Year 2 Year 3 Year 4 Year 5 + 5,810 -50 5,760 + 5,810 -50 5,760 + 5,810 +100 5,910 + 5,810 +100 5,910 + 5,810 +200 6,010 OCF = (1-0.34)x(10,000 - 3,000 - 3,500) + 3500 = 5,810 b. NPV @ 15% = 4,317,098. Instructor’s Manual Chapter 6 Page 93 11. Leather Goods Inc. wants to expand its product line into wallets. It is considering producing 50,000 units per year. The price will be $15 per wallet the first year and the price will increase 3% per year. The variable cost is expected to be $10 per wallet and will increase by 5% per year. The machine will cost $400,000 and will have an economic life of 5 years. It will be fully depreciated using the straight line method. The discount rate is 15% and the corporate tax is 34%. What is the NPV of the investment? SOLUTION: Depreciation expense = 400,000/5 = 80,000 Year1 CF = Net income + depreciation = (1-0.34) x (50,000x15 – 50,000x10 – 80,000) + 80,000 = 192,200 Year 2 CF = (1-0.34) x (50,000x15x1.03 – 50,000x10x1.05 – 80,000) + 80,000 = 190,550 Year 3 CF = (1-0.34) x (750,000x1.032 – 500,000x1.052 – 80,000) + 80,000 = 188,520.5 Year 4 CF = (1-0.34) x (750,000x1.033 – 500,000x1.053 – 80,000) +80,000 = 186,083.62 Year 5 CF = (1-0.34) x (750,000x1.034 – 500,000x1.054 – 80,000) +80,000 = 183,210.80 At 15% discount rate : NPV = $ 228,705.86 12. Steiness Danish Ham, Inc. is contemplating buying a new machine that has an economic life of 5 years. The cost of the machine is 1,242,000 krone and will be fully depreciated using the straight line depreciation method over the 5 years. At the end of 5 years, it will have a market value of 138,000 krone. It is estimated that the new machine will save the company 345, 000 krone per year due to reduced labor costs. Moreover, it will lead to a reduction in net working capital of 172,500 krone because of the higher yield from raw materials inventory. The net working capital will be recovered by the end of the 5 years. If the corporate tax rate is 34% and the discount rate is 12% what is the NPV of the project. Year 0 Initial investment Change in net working capital Terminal value OCF Total incremental cash flows a Year 1 Year 2 Year 3 Year 5 -1,242,000 +172,500 -172,500 +312,156 -1,069,500 +312,156 b +312,156 +312,156 +312,156 +91,080a +312,156 +312,156 +312,156 +312,156 +230,736 Terminal value = Market value – tax on capital gains = 138,000 – 0.34 x (138,000 – 0) = 138,000 x (1-0.34) = 91,080 b Year 4 OCF = (1-0.34) x (345,000) + 248,400 x 0.34 = 312,156 Depreciation Expense =1,242,000/5=248,400 At 12% discount rate, NPV = 9,553 krone. Instructor’s Manual Chapter 6 Page 94 13. Hu’s Software Design, Inc. is considering the purchase of computer that has an economic life of 4 years and it is expected to have no salvage value. It will cost $80,000 and it will be depreciated using the straight line depreciation method. It will save the company $35,000 the first year and it is assumed that the savings after that will have a growth rate of –5%. It will also reduce net working capital requirements by $7,000. The corporate tax rate is 35% and the appropriate discount rate is 14%. What is the value that the purchase will add to the firm? Year 0 1 2 3 4 CFI -80,000 + 7,000 = -73,000 (1-0.35) x (35,000) + 20,000 x 0.35 = 29,750 0.65 x 35,000 x 0.95 + 20,000 x 0.35 = 28,612.5 0.65 x 35,000 x 0.952 + 20,000 x 0.35 = 27,531.88 0.65x35,000x0.953 + 20,000 x 0.35 –7000 = 19,505.28 At 14% discount rate: NPV = $5,245 14. Suppose Hu’s Software Design, Inc. from the previous problem has a choice between two computer systems. The first one will cost $80,000 and will have an economic life of 4 years. Annual maintenance costs would be $10,000. The other alternative would cost $135,000 and would have an economic life of 6 years. The annual maintenance would cost $13,000. Both alternatives would be fully depreciated using the straight line method. Neither computer system will have a salvage value. The cost savings generated on an annual basis are assumed to be the same and the company expects to generate sufficient profits to realize the depreciation tax shield. The discount rate (DR) is 11% and the corporate tax rate is 35%. Which computer should be chosen? SOLUTION: Note that both systems realize the same cost savings, hence those cost savings are not incremental while comparing the two alternatives. Using the annualized capital cost method: 1st computer system: Depreciation = 80000/4 = 20000 Initial Outlay at Year 0 = -80,000 The after-tax incremental cash flows from Year 1 to Year 4 are: -10,000x(1-0.35) + 20,000x0.35 = 500 At 11% discount rate: NPV = -78,449 Spreading this present value of the costs into annual payments: PMT = -$25,286 N 4 I 11% PV 78,449 FV 0 PMT ? Result PMT = -25,286 2nd computer system: Depreciation: 135,000/6 = 22,500 Initial outlay at Year 0 = -135,000 The after-cash incremental cash flows from Year 1 to Year 6 are: -13,000x(1-0.35) +22,500x0.35 = -575 At 11% discount rate: NPV = -137,433 Spreading this present value of the costs into annual payments: PMT = -30,536. N 6 I 11% PV 137,433 FV 0 PMT ? Result PMT = -32,486 Since the first alternative has the lowest annual costs, choose the first computer system. Instructor’s Manual Chapter 6 Page 95 15. Vogel’s Classic Auto’s is doing a booming business exporting re-built vintage American vehicles to Japan. Fortunately, it is an almost perfect world and consequently the owner is certain of all revenues and costs. The problem is the revenues are in Yen and the costs are in dollars. The current rate of exchange is 100 Yen to $1. The risk free rate in Japan is 3% and the risk free rate in the U.S. is 7%. Due to a loophole in the tax code, no taxes have to be paid on the company’s profits. The business has contracts for delivery outstanding for the next 4 years, at which time the owner will retire and close the business. Using the certain cash flows below, determine the NPV of the business. Revenues in Yen Cost in dollars Parts Labor Shipping Other Total costs Year 1 50,000,000 Year 2 60,000,000 Year 3 40,000,000 Year 4 20,000,000 50,000 100,000 75,000 75,000 300,000 60,000 105,000 90,000 75,000 330,000 40,000 85,000 60,000 65,000 250,000 20,000 50,000 30,000 55,000 155,000 SOLUTION: Present Value of revenues denominated in Yen: Since the cash flows are certain, we can use the riskfree rate to discount them: CF0 CF1 CF2 CF3 CF4 i PV 0 50,000,000 60,000,000 40,000,000 20,000,000 3% 159,474,851 The present value of the revenue stream in dollars is: PV$ = 159,474,851Yen / 100 Yen per Dollar = $1,594,749 Present value of cost denominated in dollars: CF0 CF1 CF2 CF3 CF4 i PV 0 300,000 330,000 250,000 155,000 7% $890,932 NPV of the company is: NPV = $1,594,749 - $890,932 = $703,817 //tax should be included in the solution, and american tax is the better way of dealing with problem, Instructor’s Manual Chapter 6 Page 96 Inflation and Capital Budgeting 16. You are a financial analyst at Wigit, Inc. and you are considering two mutually exclusive projects. Unfortunately, the figures for project 1 are in nominal terms and the figures for project 2 are in real terms. The nominal discount rate for both projects is 17% and inflation is projected to be 3%. a. Determine which project to choose. b. You are troubled about the cash flows in real terms. You are concerned that there may be a problem in determining the total cash flow in real terms and the depreciation tax shield. What is it that has you concerned? Project 1 Project 2 0 (100,000) (90,000) 1 30,000 25,000 2 60,000 55,000 3 75,000 80,000 SOLUTION: a. Project 1: The cash flows are nominal, hence we can use the nominal discount rate of 17% to compute the NPV of the project. NPV1 = $16,300 Project 2: The cash flows are in real terms, hence we can either convert them into nominal terms and use the nominal discount rate, or more simply discount the real cash flows given using the real discount rate. Method 1: converting the real cash flows to nominal cash flows. Project 2 (in nominal terms) (90,000) 25,000 x 1.03=25,750 55,000 x 1.032=58,349.50 80,000 x 1.033=87,418.16 At 17% discount rate: NPV = $29,215 Method 2: we calculate the real discount rate as: (1+real rate) = (1+nominal rate)/(1+inflation rate) Hence, the real rate = 1.17/1.03 – 1 = 13.592% NPV2 = $29,215. Note that both methods give the same result. Since NPV2>NPV1, choose project 2. b. The reason why you are troubled about the depreciation tax shield and cash flows in real terms is because depreciation tax shields are always in nominal terms. Therefore, when using real cash flows you run the risk of mixing nominal numbers into the “total cash flow” figures. This could lead to discounting nominal cash flows with a real discount rate. 17. Your next assignment at Wigit, Inc. also entails determining the NPV of a project which is expected to last four years. There is an initial investment of $400,000, which will be depreciated at the straight line method over four years. At the end of four years, it is assumed that you will be able to sell some of the equipment that is part of the initial investment for $35,000 (a nominal figure). Revenues for the first year are expected to be $225,000 in real terms. The costs involved in the project for the first year are as follows: (1) parts will be $25,000 in real terms the first year; (2) labor will be $60,000 in real terms for the first year and (3) other costs will be $30,000 in real terms for the first year. The growth rates of revenues and costs are as follows: (1) revenue will have a real growth rate of 5%; (2) the cost of parts will have a 0% real growth rate; (3) cost of labor will have a 2% real growth rate; and (4) other costs will have a 1% real growth rate from year 2 to year 3 and a –1% growth rate the last two years. The real changes in net working capital for the year 0 to year 4 are as follows: (1) -$20,000; (2) -$30,000; (3) -$10,000; (4) $20,000; (5) $40,000. The real discount rate is 9.5% and the inflation rate is 3%. The tax rate is 35%. Instructor’s Manual Chapter 6 Page 97 SOLUTION: All cash flows were converted to nominal terms Year 0 Revenue Costs: Parts Labor Other Depreciation Income before taxes Taxes Net Income Depreciation add back Operating cash flows Initial investment Salvage Value Change in Net working Total Cash flow from investment *Salvage Value: Revenue growth rate (real) Cost growth rates (real): Parts Labor Other Year 2 Year 3 and 4 Year 1 Year 2 Year 3 Year 4 $231,750 $250,638 $271,065 $293,156 $25,750 $26,523 $27,318 $28,138 $61,800 $64,927 $68,212 $71,664 $30,900 $32,145 $32,779 $33,424 $100,000 $100,000 $100,000 $100,000 $13,300 $27,043 $42,756 $59,930 $4,655 $9,465 $14,965 $20,976 $8,645 $17,578 $27,791 $38,954 $100,000 $100,000 $100,000 $100,000 $108,645 $117,578 $127,791 $138,954 ($420,000) CF0 $77,745 CF1 $106,969 CF2 $149,646 CF3 $206,724 CF4 12.79% i NPV ($34,959.22) ($400,000) $22,750* ($20,000) ($30,900) ($10,609) $21,855 $45,020 ($420,000) $77,745 $106,969 $149,646 $206,724 $35,000 - .35($35,000 - $0 Book Value) = $22,750 5.00% 0.00% 2.00% 1.00% -1.00% Inflation: 3.00% tax rate 35% Real discount rate 9.50% Nominal discount rate 12.79%=(1.095)(1.03) Note that all cash flows as well as the discount rate were converted into nominal figures. For example revenues were calculated in the following manner: Revenue (year 1) = $225,000 x (1 + inflation rate) = $225,000 x (1.03) = $231,750 Revenue (year 2) = Year 1 x (1 + growth rate) x (1 + inflation) Instructor’s Manual Chapter 6 Page 98 18. Finnerty’s Brew Pub is considering buying more machinery that will allow the pub to increase its portfolio of beers on tap. The new machinery will cost $65,000 and will be depreciated on a 10 year basis. It is expected to have no value after 10 years. The improved selection is anticipated to increase sales by $30,000 for the first year and increase at the rate of inflation of 3% for each year after that. Production costs are expected to be $15,000 for the first year and are also expected to increase at the rate of inflation. The real discount rate is 12% and the nominal riskfree interest rate is 6%. The corporate tax rate is 34%. Should Mr. Finnerty buy the machinery? SOLUTION: Because depreciation is always nominal, the depreciation tax shield needs to be discounted at the nominal rate of return. Since Cash Flow = NI (only cash expenses) + depreciation tax shield, unless we convert all the figures into nominal, we need to find each term of the Cash Flow separately, and discount it at its appropriate discount rate. In year 1 : NI = (30,000-15,000) x 0.66 = 9900. This figure is in year 1 $ terms (nominal). To convert this figure to real terms (Year 0 $), we divide by 1.03, we get $9612. Since both revenues and expenses increase at the inflation rate each year, $9612 is also the annual real NI (incremental). We then find the PV of those NI using the real discount rate 12%: n 10 i 12 PV ? PMT 9612 FV 0 Result PV = $54,310 Next, calculate the present value of the depreciation tax shield. Depn tax shield = 6,500 x 0.34 = 2210. N i PV PMT FV Result 10 6 ? 2,210.00 0 PV = $16,265.79 Note: Depreciation is always nominal and must be discounted at a nominal discount rate. Moreover, It is usually discounted at the risk free rate because once an asset is purchased, one is certain what the depreciation will be each year. However, there are two problems with this convention. First, the firm may not earn a profit in a given year and therefore would not have a depreciation tax shield. Secondly, the tax rate could conceivably be changed over time. Finally, calculate the NPV of the project. NPV = -$65,000 + $54,310 + $16,265.79 NPV = $5575.79 19. A. Fung Fashion, Inc. anticipates real net cash flows to be $100,000 this year. The real discount rate is 15% per year. a. What is the present value of these cash flows if they are expected to continue forever. b. What is the present value of these cash flows if the real net cash flows are expected to grow at 5% per year forever. c. What is the present value of these cash flows if the expected growth rate is -5% per year. SOLUTION: a. PV = $100,000/.15 = $666,666.67 b. PV = $100,000/(.15 - .05) = $1,000,000 Note: The formula for a growing perpetuity is PV = C/(discount rate - growth rate) c. PV = $100,000/(.15 - (-.05)) = $500,000 Instructor’s Manual Chapter 6 Page 99 20. Mr. Salles is considering a business venture that would offer guided tours of the romantic Greek isles and the Italian county side. After four years, Mr. Salles intends to retire. The initial investment would be $50,000 in a computer and phone system. This investment would be depreciated on the straight line method, and is expected to have no salvage value. The corporate tax rate is 35%. The price of each tour will be $5,000 per customer and the price will remain constant in real terms. Mr. Salles will pay himself $50 per hour and anticipates an annual increase in salary of 5% in real terms. The cost of each customer during the tours is $3,500, and this cost is expected to increase by 3% in real terms. Assume that all revenues and costs occur at year end. The inflation rate is 3.5%. The risk free nominal rate is 6% and the real discount rate for costs and revenues is 9%. Using the additional following data, calculate the NPV of the project. Year 1 100 2,080 Number of customers Hours worked Year 2 115 2,080 Year 3 130 2,080 Year 4 140 2,080 SOLUTION: Revenues Expenses Labor Variable cost of tours Income before taxes Taxes Net Income CF0 CF1 CF2 CF3 CF4 i PV ($50,000) $29,900 $33,296 $34,209 $28,711 9% $52,211 Year 1 Year 2 Year 3 Year 4 $500,000 $575,000 $650,000 $700,000 $104,000 $350,000 $46,000 $16,100 $29,900 n 4 $109,200 $414,575 $51,225 $17,929 $33,296 i 6 $114,660 $482,710 $52,630 $18,421 $34,209 PV ? $120,393 $535,436 $44,171 $15,460 $28,711 PMT 4,375 FV 0 Result PV = $15,160 Depreciation tax shield = 50,000/4 x 0.35 = 4,375 Note that the depreciation tax shield is a nominal figure and must be discounted at a nominal rate. By using the risk free rate to discount the depreciation tax shield one is making the implicit assumption that the cash flows from depreciation are certain. NPV = $52,211 + 15,160 = $67,371 Instructor’s Manual Chapter 6 Page 100 21. Saunders’ Sportswear, Inc. is planning on expanding its line of sweatshirts. This will require an initial investment of $8 million. This investment will be depreciated on a straight line method over 4 years and will have no salvage value. The firm is in the 35% tax bracket. The price of the sweatshirts will be $30 the first year and will increase in price by 4% per year in nominal terms thereafter. The unit cost of production will be $5 the first year and will increase by 3% per year in nominal terms thereafter. Labor costs will be $10 per hour the first year and will increase by 3.5% in nominal terms each subsequent year. Revenues and costs are paid at year-end. The nominal discount rate is 12%. Calculate the NPV of the project using the following additional data. Unit sales Labor hours Year 1 50,000 20,800 Year 2 100,000 20,800 Year 3 125,000 20,800 Year 4 100,000 20,800 SOLUTION: Revenues Expenses Variable Costs Labor Costs Depreciation Income before taxes Taxes Net Income Depreciation add back Operating Cash Flow Year 1 $1,500,000 Year 2 $3,120,000 Year 3 $4,056,000 Year 4 $3,374,592 $250,000 $208,000 $2,000,000 ($958,000) $0 ($958,000) $2,000,000 $1,042,000 $515,000 $215,280 $2,000,000 $389,720 $136,402 $253,318 $2,000,000 $2,253,318 $663,063 $222,815 $2,000,000 $1,170,122 $409,543 $760,579 $2,000,000 $2,760,579 $546,364 $230,613 $2,000,000 $597,615 $209,165 $388,450 $2,000,000 $2,388,450 CF0 CF1 CF2 CF3 CF4 i NPV ($8,000,000) $1,042,000 $2,253,318 $2,760,579 $2,388,450 12% ($1,790,483) Note that the depreciation is not discounted at the nominal risk free rate. In the first year of cash flows there is no tax shield benefit since there was no profit in that year. By using the nominal discount rate, the implicit assumption being made is that the cash flows are not necessarily risk free. 22. Camille, the owner of the Germanos Tree farm has contracted with the government of his native land to provide Cedar tree saplings to aid in that government’s efforts to reforest part of the country and return the Cedar tree to its past glory. The project is expected to continue in perpetuity. At the end of the first year, the following nominal and incremental cash flows are expected: Revenues Labor Costs Other Costs $125,000 $65,000 $45,000 Camille has contracted with an air freight shipping company to transport the saplings. The contract is for a fixed payment of $35,000 in nominal terms per year. The first payment is due at the end of the first year. Revenues are expected to grow at 4% in real terms. Labor costs are expected to grow at 3% per year. Other costs are expected to decrease at 0.5% per year. The real discount rate for revenues and costs is 8% and inflation is expected to be 3.5%. There are no taxes and all cash flows occur at year-end. What is the NPV of the contract? SOLUTION: Since the discount rate and growth rates are in real terms, it is easier to discount real cash flows. Moreover, since the contract is a perpetuity, the growing perpetuity formula can be used. The nominal revenue, labor costs and other costs must be discounted back at the inflation rate to get the real value of Year 1 cash flows. These results must in turn be input into the growing perpetuity formula as follows: PV (revenue) = ($125,000/1.035)/(.08 - .04) = $3,019,323.67 PV (labor costs) = ($65,000/1.035)/(.08 - .03) = $1,256,038.65 PV (other costs) = ($45,000/1.035)/(.08 - (-.005)) = $511,508.95 Instructor’s Manual Chapter 6 Page 101 The shipping costs actually have a negative growth rate even though the nominal cash flows are constant. This is due to inflation. The easiest way to see this is to find the real value of those cash flows. For example, PV (cash flow 1) = $35,000/1.035 = $33,816.43 PV (cash flow 2) = $35,000/1.0352 = $32,672.88 Hence the real negative growth rate g can be calculated as follows: 1/1.035 = 1+ g, Hence (1/1.035) - 1 = -0.034 = 3.4% Use the growing perpetuity formula (remembering to use the Present value of the first cash flow and not the nominal $35,000): $33,816.43/(.08 - (-.034))= $296,635.35. Sum the revenues and costs to determine the NPV of the project. NPV = $3,019,323.67 - $1,256,038.65 - $511,508.95 - $296,635.35 = $955,140.72 23. Kitchen Supplies, Inc. must replace a machine in its manufacturing plant that will have no salvage value. It has a choice between two models. The first machine will last 5 years and will cost $300,000. It will generate an annual cost savings of $50,000. Annual maintenance costs will be $20,000. The machine will be fully depreciated using the straight line depreciation method and will have no salvage value. The second machine will last 7 years and will cost $600,000. It will generate an annual cost savings of $70,000. This machine will also be fully depreciated using the straight line depreciation method, but is expected to have a salvage value of $60,000 at the end of the seventh year. The annual maintenance cost is $15,000. Revenues in each case are expected to be the same. The annual tax rate is 35% and the cost of capital is 10%. Which machine should the company purchase? SOLUTION: Alternative 1: Yearly cash flow = NI (cash expenses only) + depreciation tax shield = (50,000-20,000)x(1-0.35) + 60,000 x 0.35 = 40,500 Year CFI 0 -300,000 1 +40,500 2 +40,500 3 +40,500 4 +40,500 5 +40,500 At 10% discount rate : NPV = -$146,473 Annualized Capital Cost n i PV 5 10% 146,473 PMT ? FV 0 Result PMT = -$38,639.21 Alternative 2: Year cash flow = (70,000-15000) x (1-0.35) + (600,000/7)(.35) = $65,750 Year 0 1 2 3 4 5 6 7 CFI -600,000 +65,750 +65,750 +65,750 +65,750 +65,750 +65,750 +104,750* *104,750 = 65,750 + 60,000x0.65 NPV at 10% discount rate = -259,888. Annualized Capital Cost n i PV PMT FV Result 7 10% 259,888 ? 0 PMT = -$53,382.42 Alternative 1 should be chosen; its annualized cost of capital is less. Instructor’s Manual Chapter 6 Page 102 24. Electricity, Inc. is choosing between two pieces of equipment. The first choice costs $500,000 and will last five years. It will be depreciated using the straight line depreciation method and will have no salvage value. It will have an annual maintenance cost of $50,000. The second choice will cost $600,000 and will last eight years. It will also be depreciated using the straight line depreciation method and will have no salvage value. It will have an annual maintenance cost of $55,000. The discount rate is 11% and the tax rate is 35%. Which machine should be chosen and what assumptions underlie that choice? SOLUTION: Alternative 1: After tax maintenance cost n i PV PMT 5 11% ? 32,500 Annual maintenance $50,000 DR Tax rate 35% FV Result 0 PV = $120,116.65 11% Alternative 1: Depreciation Tax Shield PMT=(500,000/5)(.35) n i PV PMT FV Result 5 11% ? 35,000.00 0 PV = $129,356.40 Cost $500,000 NPV = -$500,000 -$120,116.65 + $129,356.40 = -$490,760.25 Annualized Capital Cost: Alternative 1 n i PV PMT 5 11% 490,760.25 ? Alternative 2: After Tax maintenance cost n i PV PMT 8 11% ? 35,750 Annual maintenance $55,000 DR Tax rate 35% FV 0 FV 0 11% Result PMT = -$132,785.15 Result PV = $183,973.89 Alternative 2: Depreciation Tax Shield PMT=(600,000/8)(.35) n i PV PMT FV Result 8 11% ? 26,250.00 0 PV = $135,085.72 Cost 600,000 NPV = -$600,000 - 183,973.89 + $135,085.72 = -$648,888.17 Annualized Capital Cost: Alternative 2 n i PV PMT FV Result 8 11% 648,888.17 ? 0 PMT = -$126,092.63 Choose alternative 2; its annualized capital cost is less. Note: The two assumptions being made are: 1) the time horizon is long (the same choice of machinery will be used indefinitely) and there is no expected change in technology that would terminate the use of the equipment prematurely for a significantly greater efficiency; 2) either machine will be replaceable when its economic life ends. Instructor’s Manual Chapter 6 Page 103 25. Refer to problem number 24. Now Electricity, Inc. is faced with the same choices, however now it expects that a new technology will be introduced into the industry in year nine. This will force the company to replace the choice made today at the end of year nine, because the new technology will be so cost effective. All the other necessary information is the same as explained in problem 24. Which choice should be made? SOLUTION: Choice 1 Capital Dep. tax Investment shield Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Choice 2 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 After tax maintenance -500,000 -500,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 Capital Dep. tax Investment shield -600,000 26,250 26,250 26,250 26,250 26,250 26,250 26,250 600,000 26,250 26,250 -32,500 -32,500 -32,500 -32,500 -32,500 -32,500 -32,500 -32,500 -32,500 After tax maintenance -35,750 -35,750 -35,750 -35,750 -35,750 -35,750 -35,750 -35,750 -35,750 Net Cash Flow -500,000 +2,500 +2,500 +2,500 +2,500 -497,500 2,500 2,500 2,500 2,500 CF0 CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 i NPV -500,000 2,500 2,500 2,500 2,500 -497,500 2,500 2,500 2,500 2,500 11% -$782,883.05 CF0 CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 i NPV -600,000 -9,500 -9,500 -9,500 -9,500 -9,500 -9,500 -9,500 -609,500 -9,500 11% -$912,957.85 Net Cash Flow -600,000 -9,500 -9,500 -9,500 -9,500 -9,500 -9,500 -9,500 -609,500 -9,500 Annualized Capital Cost: Alternative 1 n i PV PMT 9 11% 782,883.05 ? FV 0 Result PMT = -$141,389.98 Annualized Capital Cost: Alternative 2 n i PV PMT 9 11% 912,957.85 ? FV 0 Result PMT = -$164,881.71 Choose alternative 1; its annualized capital cost is less. This is the opposite choice as in question 17 because the second investment in alternative two (made in year eight) must be replaced at the end of year nine. Instructor’s Manual Chapter 6 Page 104 Break-even analysis of lease payments 26. Real Estate, Inc. has purchased a building for $1 million dollars. The economic life of the building is 30 years and it will be fully depreciated over the thirty years using the straight line depreciation method. The discount rate is 14 % and the corporate tax rate is 35%. Assume there is no inflation. What is the minimum lease payment the company should ask for? Assume that the lease payment is due immediately. SOLUTION: Step 1: PV of a $1 annuity for 30 years at 14% = 7.0027 This is the annuity factor for a $1 annuity. Therefore, multiplying the annuity factor by (1 - tax rate) x lease payment will give you the PV of the lease payments. PV of after tax lease payments = .65 x lease payment x 7.0027 = lease payment x 4.55176 Step 2: PV of depreciation tax shield: n 30 i 14% PV PMT ? 11,666.67 $1 million/30 = FV 0 $33,333.33 Result PV = $81,697.77 Depreciation Lease Payment = 33.333.33 X .35 = 11,666.67 Step 3: Solve for the lease payment: NPV = 0 = -$1,000,000 + Lease payment x 4.55176 + $81,697.77 Lease payment = $201,747