Source: US EPA Regulatory Support Document

advertisement

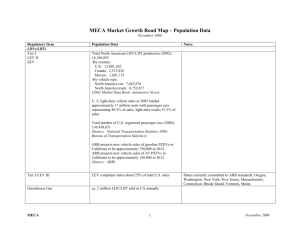

MECA Market Growth Road Map – Population Data May 2005 Regulatory Item LDVs/LDTs Tier 2 LEV II ZEV Population Data Notes Total North American LDV/LDT production (2002): 16,196,853 -By country: U.S.: 12,001,302 Canada: 2,513,836 Mexico: 1,681,715 -By vehicle type: North America car: 7,443,976 North America truck: 8,752,877 (2002 Market Data Book, Automotive News) Total number of U.S. registered passenger cars (2000): 133,621,420 (Source: National Transportation Statistics 2002, Bureau of Transportation Statistics) Tier 3/LEV III Greenhouse Gas Highway Motorcycles ARB projects new vehicle sales of gasoline PZEVs in California to be approximately 750,000 in 2012. ARB projects new vehicle sales of AT PZEVs in California to be approximately 150,000 in 2012. (Source: ARB) To be determined ca. 2 million LDV/LDT sold in CA annually Total sales of highway motorcycles in 2000 was estimated to be 438,000. (Source: U.S. EPA NPRM, 8/02) U.S. sales of all new motorcycle reached 1,050,000 units in 2004 (Motorcycle Industry Council) In 1998, there were about 5.4 million highway motorcycles in use in the U.S. (565,000 of which are dual-sport). Total sales of highway motorcycles in 1998 was estimated to be 411,000, or about 72 percent of motorcycle sales. About 13,000 of these were dual-sport MECA 1 Honda, Harley Davidson, Yamaha, Kawasaki, Suzuki, and BMW account for nearly 95 percent of all motorcycles sold. Dozens of other minor players make up the remaining few percent. Based on available information, over half of all motorcycles sold in 1998 were made by Honda and Harley Davidson, with the two companies maintaining almost equal market shares of about 25 percent each 2003 market share info: Honda-27.4%; Harley-23.7%; Yamaha-17.4%; Suzuki-10.8%; Kawasaki-8.7% February 2005 Regulatory Item Aftermarket Converter OBD Upgrade Converter On-Road HDEs Phase II Population Data motorcycles. (Source: Motorcycle Industry Council) New aftermarket converters manufactured for sale in North America (2004): approximately 3.4 million (Source: MECA) 6-8 million 1984-1994 MY LDVs in CA (Source: conversations with Paul Hughes of ARB) Notes Based on data from engine manufacturers, it was estimated that engine sales in 1995 were: -Light heavy-duty engines: 280,000 -Medium heavy-duty engines: 140,000 -Heavy heavy-duty engines: 220,000 Numbers are projected to grow at an annual rate of two percent without compounding through 2035. Therefore, estimated 2003 sales would be: -LHD: 328,066 -MHD: 164,031 -HHD: 257,765 (Source: U.S. EPA Regulatory Support Document) Market Share for Class 8 diesel engines (Source: Merrill Lynch): Caterpillar Cummins DDC Mack Mercedes Navistar Volvo 2004 30.2% 25.4% 18.3% 9.6% 8.3% 3.4% 4.8% 2003 33.8% 20.5% 16.6% 10.4% 10.3% 4.3% 4.1% 2002 34.0% 23.5% 21.8% 12.3% 1.6% 4.0% 2.8% In April 2005 a report released by R. L. Polk & Co. analyzed new vehicle registration data from 2000 through 2004. Light heavy-duty diesel vehicle (diesel pick-ups) registrations increased from 278,136 in 2000 to 433, 787 in 2004 (56% increase) In February 2005 Merrill Lynch reported Class 8 diesel engine sales for December 2004 were 22, 937 units, a seasonally adjusted annual rate of 259,194 units (Sept.Oct. 2004 seasonally adjusted annual sales rates reported to be over 300,000 units). Class 8 engine sales would be used in HHD applications. Off-Road Engines Nonroad CI Engines MECA EPA anticipates that approximately 800,000 new nonroad diesel engines annually will be subject to the nonroad rulemaking (figure based on annual sales of nonroad diesel engines). (Source: U.S. EPA) 2 February 2005 Regulatory Item Nonroad SI Engines >25 hp Population Data Notes Projected breakdown of the number of engines to be affected annually by EPA’s nonroad rule: Rated Percentage Number of Power Breakdown Engines of 2000 Population <11 hp 6% 48,000 11-25 hp 13% 104,000 25-50 hp 17% 136,000 50-70 hp 12% 96,000 70-100 hp 20% 160,000 100-175 hp 16% 128,000 175-750 hp 16% 128,000 >750 hp 0.3% 2,400 (Source: Percentage breakdown of 2000 population by U.S. EPA; Projection of number of engines by MECA) Total large SI engine sales are about 150,000 per year in the U.S. (Source: U.S. EPA) Sales are distributed rather evenly among several companies, so typical sales volumes for each company range generally from 10,000 to 25,000 engines per year. ARB estimates current lift truck population in CA at approx. 40,000 units (about 30,000 with SI engines, the rest are electric) MECA 3 February 2005 Regulatory Item Recreational SI Engines Population Data Off-Highway Motorcycles -Total sales of off-highway motorcycles in 2001 was estimated to be 195,000. (Source: U.S. EPA Regulatory Support Document, 9/02) -In 1998, off-highway motorcycles comprised 28 percent of total motorcycle sales. (Source: Motorcycle Industry Council) Snowmobiles -Total sales of snowmobiles in 2001 was estimated to be 228,000. (Source: U.S. EPA Regulatory Support Document, 9/02) ATVs -Total sales of ATVs in 2001 was estimated to be 880,000. (Source: U.S. EPA Regulatory Support Document, 9/02) Notes EPA is aware of five major companies that dominate sales of off-highway motorcycles. Four of these companies, Honda, Kawasaki, Suzuki, and Yamaha, are long established, major corporations that manufacture a number of products including highway and off-highway motorcycles. They have dominated the off-highway motorcycle market for over thirty years. The fifth major company, KTM, is also long established but has had a major impact in domestic sales over the last 10 to 15 years. These five companies account for approximately 90 to 95 percent of all domestic sales for off-highway motorcycles. Based on available industry information, four major snowmobile manufacturers, Arctic Cat, Bombardier (also known as Ski-Doo), Polaris, and Yamaha, account for approximately 99 percent of all domestic snowmobile sales The ATV sector has the broadest assortment of major manufacturers. With the exception of KTM, all of the companies noted above for off-highway motorcycles and snowmobiles are significant ATV producers. These seven companies represent over 95 percent of total domestic ATV sales. The remaining 5 percent come from importers who tend to import inexpensive, youth-oriented ATVs from China and other Asian nations MECA 4 February 2005 Regulatory Item Nonroad SI Engines <25 hp Population Data Handheld (Source: PPEMA) -Chain Saws: During 2000, industry shipments of gasoline-powered chain saws fell 10 percent to 2,126,680 units. It was estimated that industry shipments for 2001 would remain at 2000 levels. -Trimmers and Brushcutters: During 2000, industry shipments of gasoline-powered trimmers and brushcutters increased 9 percent to 4,749,500 units. It was estimated that industry shipments for 2001 would increase 2 percent. -Handheld Blowers: During 2000, industry shipments of gasoline-powered hand held blowers increased 15 percent to 1,895,030 units. It was estimated that industry shipments for 2001 would increase 5 percent. -Backpack Blowers: During 2000, industry shipments of gasoline-powered backpack blowers increased 6 percent to 308,450 units. It was estimated that industry shipments for 2001 would increase 2 percent. -Cutoff Saws: During 2000, industry shipments of gasoline-powered cutoff saws decreased 2 percent to 119,720 units. It was estimated that industry shipments for 2001 would remain at 2000 levels. -Hedge Trimmers: During 2000, industry shipments of gasoline-powered hedge trimmers increased 19 percent to 380,900 units. It was estimated that industry shipments for 2001 would increase 5 percent. -Edgers: During 2001, industry shipments of gasolinepowered edgers increased 16 percent to 77,350 units. It was estimated that industry shipments for 2001 would increase 2 percent. Notes Recent (statements made in 2005) EPA estimates for Class 1 (< 225 cc non-handheld) engine production in the U.S. are approximately 9-10 million engines; for Class 2 (> 225 cc non-handheld) approximately 4.5 million engines Nonhandheld (Source: OPEI) -For the 2001 model year, shipments of consumer walkbehinds were forecast to decrease by 1.8% to 6,031,941, while all riding units were forecast to drop 3.8% to 1,650,797. For 2002, consumer walk-behinds were forecast to be down 0.7%, and all riding units would drop 1.5%. MECA 5 February 2005 Regulatory Item Marine SI Outboard/PWC Marine SI Sterndrive Recreational CI Marine Commercial CI Marine Locomotives Diesel Retrofit School Buses Transit Buses (CA) MECA Population Data In 2000, NMMA estimated that 241,600 outboard motors and 92,000 personal watercraft were sold. (Source: National Marine Manufacturers Association) Population of sterndrive boats in 2002: 1,767,100 Population of inboard boats (CI and SI) in 2002: 1,705,700 Retails sales estimates of sterndrive boats in 2002: 68,400 Retail sales estimates of inboard boats (CI and SI) in 2002: 20,800 (Source: National Marine Manufacturers Association) Population of inboard boats (CI and SI) in 2002: 1,705,700 Retail sales estimates of inboard boats (CI and SI) in 2002: 20,800 (Source: National Marine Manufacturers Association) To be determined Total number of Class I locomotives (2000): 20,028 Total number of Amtrak locomotives (2000): 378 Class I locomotive deliveries (2000): 640 Amtrak locomotive deliveries (2000): 4 (Source: National Transportation Statistics 2002, Bureau of Transportation Statistics) Notes In 2001, there were approximately 454,000 total school buses in the U.S. (Source: “Pollution Report Card”, Union of Concerned Scientists, Feb. 2002) In 2001, 6,656 total diesel urban buses (pre-88: 975, 8890: 1656, 91-93: 1435, 94-95: 359, 96-02: 2331) (Source: ARB presentation, “Workshop – Transit Bus Fleet Rule”, El Monte, June 25, 2002) Breakdown of U.S. school bus population by model year and state can be found in the full UCS report: www.ucsusa.org/publication.cfm?publicationID=418 6 Recent statements made by NMMA (April 2005) indicate 2004 sales of sterndrive/inboard gasoline engines were approximately 140,000 units with the following breakdown: 5.0 or 5.7 L V8 – ca. 80,000 engines 4.3 L V6 – ca. 30,000 engines 8.1 L V8 – ca. 9,000 engines February 2005 Regulatory Item Solid Waste Collection Vehicles (CA) Population Data There are approximately 13,000 solid waste collection vehicles statewide (Source: conversation with ARB’s Nancy Steele) In Los Angeles, 683 city-owned vehicles in refuse fleet (661 belong to the Bureau of Sanitation). (Source: ARB report, “Preliminary Assessment of Technology for Diesel Particulate Matter Reduction from Solid Waste Collection Vehicles”, Appendix C, April 2003) Fuel Tanker Trucks (CA) Public HDV Fleets (CA) Ground Support Equipment (CA) Transport Refrigeration Units (CA) MECA ca. 3200 trucks operating in CA (14,000 lb. GVW or greater) 50% of the fleet is 98 MY or newer (Source: ARB workshop presentation from September10, 2003 public workshop) ARB fleet survey currently being updated; data to date shows more than 49 vehicle types with the following distribution of engine ages: - pre-1987: 15% 1988-1990: 12% 1991-1993: 17% 1994-2003: 55% Number of diesel GSE in South Coast (1997 fleet): -pre-90: 396 -post-90: 553 Number of diesel GSE in rest of CA (1999 fleet): ~1,225 (Source: Air Transport Association presentation, “DPF Demonstration/Verification Project”, September 23, 2002) Notes Breakdown by engine manufacturer statewide: Cummins 65%, Volvo - 13%, Caterpillar - 12%, International/Navistar - 5%, Detroit Diesel - 2%, Mack 2%, Other - 1% Breakdown by fleet application statewide: side loader 39%, rear loader - 29%, front end loader - 25%, rolloff 7% (Source: ARB report, “Preliminary Assessment of Technology for Diesel Particulate Matter Reduction from Solid Waste Collection Vehicles”, Appendix C, April 2003) Breakdown of GSE in South Coast (1997 fleet): -diesel aircraft tractors: pre-90: 94, post:-90: 64 -diesel baggage tractors: pre-90: 73, post-90: 97 -diesel cargo tractors: pre-90: 1, post-90: 15 -diesel belt loaders: pre-90: 32, post-90: 59 -diesel cargo loaders: pre-90: 36, post-90: 99 -diesel air conditioners: pre-90: 4, post-90: 6 -diesel air starts: pre-90: 41, post-90: 32 -diesel ground power units: pre-90: 69, post-90: 75 (Source: Air Transport Association presentation, “DPF Demonstration/Verification Project”, September 23, 2002) Existing population: 40,831 (Source: ARB presentation, “Regulatory Approaches to Reduce Particulate Matter Emissions from Transport Refrigeration Units”, March 6, 2003) 7 February 2005 Regulatory Item Stationary Engines (CA) MECA Population Data Emergency standby engines: 11,350 Prime engines: 1,360 (Source: ARB presentation, “Presentation of the Methods and Key Assumptions for Estimating the Costs for In-Use Stationary Engines”, March 6, 2003) 8 Notes February 2005