July 2008 - Wisconsin Bankers Association

advertisement

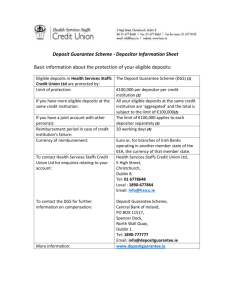

Protecting Municipal Deposits in Wisconsin July 2008 Many bankers regularly field questions about how public deposits are insured in Wisconsin by both their local municipalities and their auditors. Public monies deposited by governmental units in public depositories receive protection in a variety of ways. This article will review all the options available for banks and their public depositors to protect public deposits. Insurance Availability First, there is insurance provided by the FDIC. The FDIC will insure what are called “public unit accounts,” defined as funds owned by cities, counties, states or other government entities of the United States that are deposited by an official custodian. Insurance coverage of a public unit account differs from that of a corporate or individual account in that the coverage extends to the official custodian of the funds, rather than the public unit itself. Each official custodian of time and savings accounts (including interest-bearing NOW accounts) of a public unit is insured up to $100,000. Additionally, demand deposits maintained in an insured institution in the same state as the public unit are separately insured up to $100,000. Consequently, the same official custodian may receive up to $200,000 in FDIC insurance coverage — $100,000 in time and savings deposits and $100,000 in demand deposits. Public unit funds maintained in any out-of-state institution, whether time, savings or demand deposits are limited to a maximum of $100,000 per official custodian. One person may serve as official custodian of more than one public unit. Also, a public unit may be served by two or more official custodians, all of whom would merit separate insurance coverage for the funds in their control. The official custodian must have plenary authority, including control, over the funds owned by the public unit. Similarly, if the exercise of authority or control over the funds of a public unit requires action by or the consent of two or more “custodians,” they will be treated as one official custodian for the purpose of deposit insurance. If a public unit has political subdivisions, the funds of each subdivision will be separately insured if each subdivision was created under express authorization of law, has some functions of government delegated to it by law, and can exercise exclusive control over funds for its exclusive use. Finally, the bank’s deposit account records must indicate that the account contains funds of a public unit. Beyond FDIC coverage, the State of Wisconsin also provides limited protection for public depositors. A 1985 Act prospectively abolished the state deposit guarantee fund by providing that only the current balance in the fund may be used for the payment of losses of public deposits. While there is no longer a separate Copyright © 2008 by Wisconsin Bankers Association 1 fund, an appropriation not to exceed $400,000 above the amount of deposit insurance provided by the FDIC, may be made to any public depositor for losses of the public depositor in any individual public depository in accordance with state law. Such appropriations are available until the fund is exhausted. “Public depositor” for purposes of state law is defined in Chapter 34 of Wisconsin statutes to mean the state or any county, city, village, town, drainage district, power district, school district, cooperative educational service agency, sewer district or any commission, committee, board or officer of this state, a corporation organized under § 39.33, Wis. Stats., (a corporation created by the higher educational aids board), or the housing and economic development authority if the authority elects to be bound by Chapter 34. “Public depository” for purposes of state law means a national or state bank, federal or state credit union, federal or state savings and loan association, savings and trust company, federal or state savings bank or the local government pooled-investment fund. Coverage under state law is limited to $400,000 per public depositor and per public depository. There is nothing in our state law similar to the FDIC's “official custodian” rule whereby a municipality that maintains several different accounts at a bank by different official custodians for several different purposes may be fully covered by deposit insurance. Also, deposit account coverage at the state level will not exist once the present balance in the state deposit guarantee fund is completely exhausted. As of June 30, 2008, the balance of the Public Deposit Guarantee Fund in Wisconsin is in just under $39 million. A history of bank failures in Wisconsin is almost non-existent. Other than the closure of the First National Bank of Blanchardville due to fraud in May, 2003, the most recent failure prior to that was Strong’s Bank of Dodgeville, which failed in 1985. From there, you have to go back to around 1973 when a bank in Algoma failed. The likelihood of massive bank failures in Wisconsin, given this history and the strength of banking regulation in this state, is minimal at best. Balance information for this fund may be obtained from the State Treasurer. Pledging Collateral The 1985 law that prospectively abolished the state deposit guarantee fund also made it possible for a public depository, as a means of protecting public deposits above the level of insurance available, to secure public deposits with assets of the public depository. Under §34.07, Wis. Stats., a surety bond or other security may be required of or given by any public depository for any public deposits that exceed the amount of deposit insurance provided by federal and state government. The Wisconsin Bankers Association (WBA) has forms available for this purpose. A bank wanting to pledge assets to collateralize public deposits must first execute the Public Deposits Security Agreement (WBA 104 (7/00)). This form grants the public depositor a security interest in the collateral identified on the Collateral Register (WBA 104A (7/00)), attached to the Security Agreement. The collateral must be identified on the Collateral Register. Always attach a completed Collateral Register to the Security Agreement. The collateral secures the repayment of public deposits to the extent “the amount of such deposits exceeds Copyright © 2008 by Wisconsin Bankers Association 2 deposit insurance provided by the Federal Deposit Insurance Corporation plus $400,000….” The Security Agreement was drafted to accommodate collateral consisting of securities (e.g., U.S. treasury bills, notes or bonds). It was not drafted to accommodate a security interest in a pool of collateral. The Security Agreement also addresses the issues of substitutions and withdrawals of collateral. Revised Article 8 (and the conforming changes to Article 9), which was effective on July 1, 1998, significantly changed the rules for taking and perfecting security interests in investment property, including stocks, bonds, shares in mutual funds and other securities. These changes to Article 8 necessitated changes to these municipal forms allowing a bank to pledge assets to secure public deposits and to the way in which such security interests are perfected. Under Revised Article 8, secured creditors perfect their security interests in investment property by taking “control” of the investment property. A secured creditor takes control of investment property by either taking possession of it or, if the investment property is in the possession of a third party (the “Intermediary”), having the ability to order the Intermediary to follow the secured creditor’s exclusive instructions. The Intermediary’s agreement to follow the secured creditor’s exclusive instructions is contained in the Public Deposits Control Agreement form (WBA 105 (7/00)). The form states that the secured creditor, who in this case is the public depositor not the bank, can exercise exclusive control over the Collateral if there is an event of default by the bank in its agreements with the public depositor. This Control Agreement should be executed by all the parties at the same time the securities are pledged by the bank to the public depositor. Finally, WBA provides a form for the bank to use for the purpose of substituting collateral as and to the extent permitted by the Security Agreement and Control Agreement. This form is the Notice of Substitution of Collateral (WBA 106 (8/00)). All forms referenced above may be ordered by calling FIPCO customer service at 800/722-3498 or on the web at www.fipco.com. Excess Deposit Insurance Coverage An additional means of providing insurance on public deposits is to offer public depositors the BancInsure Excess Deposit Insurance Bond. Many bankers purchase this coverage on behalf of their public depositors to cover account balances that are not already protected by federal and state insurance and that are not already collateralized. This coverage is insured in the municipality’s name, thereby including it in Category 1 for accounting purposes. Note: The above information is not intended to provide legal or accounting advice; rather, it is intended to provide general information about banking issues. Specific questions, legal advice or other professional assistance should be directed to your professional financial or legal advisor. Copyright © 2008 by Wisconsin Bankers Association 3