Retailers: Are Smart Safes a Bright Idea?

advertisement

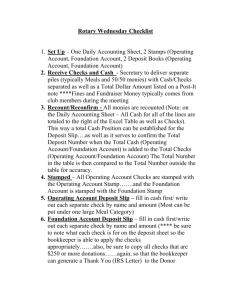

Retailers: Are Smart Safes a Bright Idea? Introductions Tim Smith Corporate Controller Binny’s Beverage Depot William Burback Vice President Global Treasury Management U.S. Bank James Poteet Senior Vice President Business Solutions Brink’s U.S. 2 Binny’s Beverage Depot • Upscale wine and liquor store with selection of 50,000+ items • 28 locations throughout Chicago area • 800 employees • 2011 revenue of $250 million 3 Binny’s Pre-Smart Safe Process 4 Reduce Cash Supply Chain Costs 5 Source: Brink’s proprietary customer research Binny’s Desired Outcomes • Get manager back to managing the business • Eliminate the risk of multiple cash touch points • Improve employee safety and enhance overall risk management • Improve information visibility & quicker cashier balancing • Improve banking relationships through efficiency 6 Measurement Against Desired Outcomes Objective Achieved Manager focus on core business Improve in-store efficiency through elimination of multiple cash touch points and quicker cashier balancing Improve safety and risk Information visibility Improved efficiencies in the supply chain 7 Market Solutions Available to Address the Funds Timing Gap • Remote Deposit Capture (RDC) • On-Site Electronic Deposit – enables customers to deposit checks electronically from the convenience of their office using a PC and a desktop scanner • Checks may be processed as an image check deposit or converted to ACH • Customers are able to make deposits as soon as they are received, eliminating desk float and the need to transport checks to the bank • ACH processing allows customers to further maximize funds availability • Remote Currency Capture (RCC) • Remote Cash Deposit – Armored car smart safe solution with daily credit to bank • Cash deposits are electronically posted to the bank on a daily basis, resulting in better availability of collected funds • Faster availability of cash deposits makes reconciling more efficient 8 How Does Daily Credit Work With a Smart Safe Solution? 9 Added Benefit to Binny’s • Better availability for validated cash and imaged checks • More efficient/timely corporate reconciliation process • Better deposit tracking enabling proactive funds monitoring 10 Why Do Customers Use a Smart Safe? Key Areas of Focus Benefits Reduce store/corporate labor costs • • • Deposit cash as soon as the customer pays Track deposits from the store to the bank Save labor daily hours associated with counting cash Reduce operating and administrative costs • • Automate bank account reconciliation Quicker identification of issues Reduce internal/external theft • • • • No access to safe contents Dual control required for removal Guarantee for cash in cassettes Quicker balancing and reconciliation Reduce employee turnover • Eliminate risk of taking deposits to the bank Employees spend more time with customers Automated cash handling process • • Improve store performance • • Automated oversight & control Frees manager to focus on core business activities 11 Questions and Answers