Executive summary - TU Delft Studentenportal

advertisement

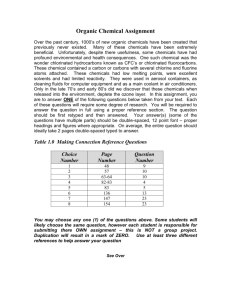

Executive summary Odfjell is a leading company in the global market for transportation and storage of chemicals and bulk liquids. Odfjell consists of two separated profit centers of which Odfjell Shipping (OS) is responsible for the transportation of chemicals with Odfjell parcel tankers, and Odfjell Terminals BV is responsible for the storage of chemicals. The terminal in the port of Rotterdam is called Odfjell Terminals Rotterdam (OTR). Odfjell parcel tankers also transship chemicals at terminals of other companies in the port of Rotterdam. OTR handles, besides Odfjell parcel tankers, also tankers of other companies. In 2008, each tanker spent an average of 8 days in the port of Rotterdam to transship its chemicals at an average of 4 different terminals. Average costs for a single tanker in the port amounts to circa 1.250 euro per hour, depending on the size of the tanker. A unique way of cooperation between the different profit centers could exist in the realization of a drop and swap concept for Odfjell parcel tankers at OTR. Odfjell wants to explore the possibilities of implementing such a concept. With a drop and swap concept, Odfjell parcel tankers can discharge and load all chemicals at OTR and leave the port without visiting other terminals. Barges, which are much cheaper, will be used for transportation of the chemicals from OTR to other terminals and vice versa. However, extra transshipment costs and loss in revenues, due to the use of deep-sea berth capacity and storage capacity, are realized too. Using the database (port tracker 2008) of Odfjell and a model, build in Microsoft Excel, a case study, analyzing the implementation of several drop and swap alternatives, has been executed. Odfjell wants to explore possible drop and swap alternatives and analyze if, and in which way, extra profit can be realized for Odfjell with these alternatives. To compare the different alternatives with the current situation, logistical and financial criteria are formulated. With the financial criteria extra profit for Odfjell due to the implementation of a drop and swap alternative is determined. Logistical criteria are: - The deep-sea berth occupancy at OTR. - The barge berth occupancy at OTR. - The average waiting time for tankers to moor at OTR. Financial criteria are: - The reduction in costs for Odfjell. - The extra transportation costs for Odfjell. - The extra transshipment costs for Odfjell. - The loss in revenues for Odfjell due to the use of extra deep-sea berth capacity at OTR. - The loss in revenues for Odfjell due to the use of extra storage capacity at OTR. Deep-sea berth and barge berth occupancy at OTR must be lower than 85% and 75% respectively, and extra profit for Odfjell must be realized. If one of these boundaries is not fulfilled, the drop and swap alternative is not implemented. In determining the financial criteria, an associated profit center for OS and OTR is assumed. A possible concept is to drop and swap all chemicals transported by specific Odfjell parcel tankers that visit the port of Rotterdam. In total, four different alternatives are analyzed: 1. Drop and swap all chemicals transported by Odfjell parcel tankers of a specific trade lane. 2. Drop and swap all chemicals transported by Odfjell parcel tankers with a specific chemical quantity to transship in the port of Rotterdam. 3. Drop and swap all chemicals transported by Odfjell parcel tankers with a specific number of chemical parties to transship in the port of Rotterdam. 4. Drop and swap all chemicals transported by Odfjell parcel tankers with a specific number of calls to make in the port of Rotterdam. For each alternative, sub-alternatives are formulated concerning the specific trade lanes, chemical quantities, number of chemical parties, and number of calls. Each sub-alternative is analyzed towards the logistical and financial criteria for Odfjell. Loss in revenues depends on the occupation of the deep-sea berths and storage, needed with the extra transshipment of the dropped and swapped chemicals at OTR. During this occupation, used deep-sea berth and storage capacity do not generate revenues for Odfjell. To determine the total loss in revenues for Odfjell per sub-alternative, three future scenarios, dependent on the demand for deep-sea berth and storage capacity at OTR, are formulated: A. Demand for deep-sea berth and storage capacity decreases in the near future. With a reduction in demand for deep-sea berth and storage capacity no loss in revenues is realized with the implementation of a drop and swap alternative. Deep-sea berth and storage capacity are not fully used, which results in free capacity for chemicals that are dropped and swapped. B. Demand for deep-sea berth and storage capacity is equal to the current demand. Loss in storage revenues is realized with the implementation of a drop and swap alternative due to temporary storage of dropped and swapped chemicals. No loss in deep-sea berth revenues is realized because deep-sea berth occupancy is not fully used in this scenario. C. Demand for deep-sea berth and storage capacity increases in the near future. Loss in deep-sea berth and storage revenues is realized for Odfjell with the implementation of a drop and swap alternative. Because of increasing demand, Odfjell has to refuse customers to use deep-sea berth and storage capacity. Storage capacity, for dropped and swapped chemicals, can be organized in two ways: - Use dedicated storage capacity for dropped and swapped chemicals. This storage capacity is used only for dropped and swapped chemicals. - Use non-dedicated storage capacity for dropped and swapped chemicals. Storage capacity for dropped and swapped chemicals is created last-minute. If no chemicals are dropped and swapped, storage capacity is used for other chemicals and no loss in revenues is realized. From the case study, it can be concluded that due to the construction of an extra deep-sea berth at OTR, boundaries concerning the deep-sea berth and barge berth occupancy are fulfilled in each alternative. Also waiting time to moor at OTR in the alternatives is shorter than in the current situation. When the demand for deep-sea berth and storage capacity decreases (scenario A), a drop and swap alternative, which realizes extra profit for Odfjell can be implemented. In this scenario, the alternative that realizes the highest extra profit for Odfjell is, to implement a drop and swap concept for all chemicals transported by Odfjell parcel tanker that need to transship more than 40.000 cbm of chemicals in the port of Rotterdam. Extra profit for Odfjell is circa 2.4 million euro per year, or circa 106 thousand euro per tanker in this scenario. When demand remains as in the current situation or increases (Scenario B and C), implementing a drop and swap alternative does not realize extra profit for Odfjell. Recommended is to investigate possibilities to avoid the loss in revenues due to the use of storage capacity. Interesting could be to store chemicals, which need to be stored at OTR for a longer period (months or even years), at a different, for example more land inward, storage location. This storage location must be less valuable than storage capacity at OTR. Extra profit by implementing drop and swap alternatives have to be compared to extra costs for storing these chemicals on a different, less valuable, location.