CF Estimation and Risk Analysis, Instructors Manual

advertisement

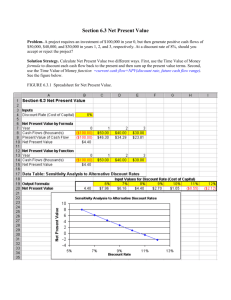

Chapter 12 (11ed-11) Cash Flow Estimation and Risk Analysis MINI CASE Shrieves Casting Company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MBA. The production line would be set up in unused space in Shrieves’ main plant. The machinery’s invoice price would be approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and Shrieves has obtained a special tax ruling which places the equipment in the MACRS 3-year class. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for four years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. The sales price and cost are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm’s net operating working capital would have to increase by an amount equal to 12% of sales revenues. The firm’s tax rate is 40 percent, and its overall weighted average cost of capital is 10 percent. a. Define “incremental cash flow.” Answer: This is the firm’s cash flow with the project minus the firm’s cash flow without the project. a. 1. Should you subtract interest expense or dividends when calculating project cash flow? Answer: The cash flow statement should not include interest expense or dividends. The return required by the investors furnishing the capital is already accounted for when we apply the 10 percent cost of capital discount rate, hence including financing flows would be "double counting." Put another way, if we deducted capital costs in the table, and thus reduced the bottom line cash flows, and then discounted those CFS by the cost of capital, we would, in effect, be subtracting capital costs twice. a. 2. Suppose the firm had spent $100,000 last year to rehabilitate the production line site. Should this cost be included in the analysis? Explain. Mini Case: 11 - 1 Answer: The $100,000 cost to rehabilitate the production line site was incurred last year, and presumably also expensed for tax purposes. Since, it is a sunk cost, it should not be included in the analysis. a. 3. Now assume that the plant space could be leased out to another firm at $25,000 a year. Should this be included in the analysis? If so, how? Answer: If the plant space could be leased out to another firm, then if Shrieves accepts this project, it would forgo the opportunity to receive $25,000 in annual cash flows. This represents an opportunity cost to the project, and it should be included in the analysis. Note that the opportunity cost cash flow must be net of taxes, so it would be a $25,000(1 - t) = $25,000(0.6) = $15,000 annual outflow. a. 4. Finally, assume that the new product line is expected to decrease sales of the firm’s other lines by $50,000 per year. Should this be considered in the analysis? If so, how? Answer: If a project affects the cash flows of another project, this is an "externality" which must be considered in the analysis. If the firm's sales would be reduced by $50,000, then the net cash flow loss would be a cost to the project. Note that this annual loss would not be the full $50,000, because Shrieves would save on cash operating costs if its sales dropped. Note also that externalities can be positive as well as negative. b. Disregard the assumptions in part a. What is Shrieves’ depreciable basis? Answer: Get the depreciation rates from table 11-2 in the book. Note that because of the halfyear convention, a 3-year project is depreciated over 4 calendar years: YEAR 1 2 3 4 Mini Case: 11 - 2 RATE 0.33 0.45 0.15 0.07 BASIS $240 240 240 240 = DEPRECIATION $ 79 108 36 17 $240 c. Calculate the annual sales revenues and costs (other than depreciation). Why is it important to include inflation when estimating cash flows? Answer: With an inflation rate of 3%, the annual revenues and costs are: Units Unit Price Unit Cost Sales Costs Year 1 1250 $200.00 $100.00 Year 2 1250 $206.00 $103.00 $250,000 $125,000 $257,500 $128,750 Year 3 1250 $212.18 $106.09 Year 4 1250 $218.55 $109.27 $265,225 $273,188 $132,613 $136,588 The cost of capital is a nominal cost; i.e., it includes a premium for inflation. In other words, it is larger than the real cost of capital. Similarly, nominal cash flows (those that are inflated) are larger than real cash flows. If you discount the low, real cash flows with the high, nominal rate, then the resulting NPV is too low. Therefore, you should always discount nominal cash flows with a nominal rate, and real cash flows with a real rate. In theory, you could do either way and get the correct answer. However, there is no accurate way to convert a nominal cost of capital to a real cost. Therefore, you should inflate cash flows and then discount at the nominal rate. c. Calculate the annual sales revenues and costs (other than depreciation). Why is it important to include inflation when estimating cash flows? Answer: With an inflation rate of 3%, the annual revenues and costs are: Here are the annual operating cash flows (in thousands of dollars): Net Revenues Depreciation Before-Tax Income Taxes (40%) Net Income Plus Depreciation Net Operating CF 1 $125 79 $ 46 18 $ 28 79 $107 2 $125 108 $ 17 7 $ 10 108 $118 3 $125 36 $ 89 36 $ 53 36 $ 89 4 $125 17 $108 43 $ 65 17 $ 82 Mini Case: 11 - 3 d. Construct annual incremental operating cash flow statements. Answer: Sales Costs Depreciation Op. EBIT Taxes (40%) NOPAT Depreciation Net Operating CF e. Year 1 $250,000 $125,000 $79,200 $45,800 $18,320 $27,480 $79,200 $106,680 Year 2 $257,500 $128,750 $108,000 $20,750 $8,300 $12,450 $108,000 $120,450 Year 3 Year 4 $265,225 $273,188 $132,613 $136,588 $36,000 $16,800 $96,612 $119,800 $38,645 $47,920 $57,967 $71,880 $36,000 $16,800 $93,967 $88,680 Estimate the required net operating working capital for each year, and the cash flow due to investments in net operating working capital. Answer: The project requires a level of net operating working capital in the amount equal to 12% of the next year’s sales. Any increase in NOWC is a negative cash flow, and any decrease is a positive cash flow. Year 0 Sales NOWC (% of sales) CF due to NOWC) f. $30,000 ($30,000) Year 1 $250,000 $30,900 ($900) Year 2 $257,500 $31,827 ($927) Year 3 Year 4 $265,225 $273,188 $32,783 $0 ($956) $32,783 Calculate the after-tax salvage cash flow. Answer: When the project is terminated at the end of year 4, the equipment can be sold for $25,000. But, since it has been depreciated to a $0 book value, taxes must be paid on the full salvage value. For this project, the after-tax salvage cash flow is: Salvage Value Tax On Salvage Value Net After-Tax Salvage Cash Flow Mini Case: 11 - 4 $25,000 (10,000) $15,000 g. Calculate the net cash flows for each year? Based on these cash flows, what are the project’s NPV, IRR, MIRR, and payback? Do these indicators suggest that the project should be undertaken? Answer: The net cash flows are: Initial Outlay Operating Cash Flows CF Due To NOWC Salvage Cash Flows Net Cash Flows NPV = IRR = MIRR = Payback = h. Year 0 ($240,000) Year 1 Year 2 Year 3 ($30,000) $106,680 ($900) $120,450 $93,967 ($927) ($956) ($270,000) $105,780 $119,523 $93,011 Year 4 $88,680 $32,783 $15,000 $136,463 $88,030 23.9% 18.0% 2.5 What does the term “risk” mean in the context of capital budgeting, to what extent can risk be quantified, and when risk is quantified, is the quantification based primarily on statistical analysis of historical data or on subjective, judgmental estimates? Answer: Risk throughout finance relates to uncertainty about future events, and in capital budgeting, this means the future profitability of a project. For certain types of projects, it is possible to look back at historical data and to statistically analyze the riskiness of the investment. This is often true when the investment involves an expansion decision; for example, if Sears were opening a new store, if Citibank were opening a new branch, or if GM were expanding its Chevrolet plant, then past experience could be a useful guide to future risk. Similarly, a company that is considering going into a new business might be able to look at historical data on existing firms in that industry to get an idea about the riskiness of its proposed investment. However, there are times when it is impossible to obtain historical data regarding proposed investments; for example, if GM were considering the development of an electric auto, not much relevant historical data for assessing the riskiness of the project would be available. Rather, GM would have to rely primarily on the judgment of its executives, and they, in turn would have to rely on their experience in developing, manufacturing, and marketing new products. We will try to quantify risk analysis, but you must recognize at the outset that some of the data used in the analysis will necessarily be based on subjective judgments rather than on hard statistical observations. Mini Case: 11 - 5 i. 1. What are the three types of risk that are relevant in capital budgeting? 2. How is each of these risk types measured, and how do they relate to one another? Answer: Here are the three types of project risk: i. Stand-alone risk is the project’s total risk if it were operated independently. Standalone risk ignores both the firm’s diversification among projects and investors’ diversification among firms. Stand-alone risk is measured either by the project’s standard deviation of NPV (σNPV) or its coefficient of variation of NPV (CVNPV). Note that other profitability measures, such as IRR and MIRR, can also be used to obtain stand-alone risk estimates. Within-firm risk is the total riskiness of the project giving consideration to the firm’s other projects, that is, to diversification within the firm. It is the contribution of the project to the firm’s total risk, and it is a function of (a) the project’s standard deviation of NPV and (b) the correlation of the projects’ returns with those of the rest of the firm. Within-firm risk is often called corporate risk, and it is measured by the project’s corporate beta, which is the slope of the regression line formed by plotting returns on the project versus returns on the firm. Market risk is the riskiness of the project to a well-diversified investor, hence it considers the diversification inherent in stockholders’ portfolios. It is measured by the project’s market beta, which is the slope of the regression line formed by plotting returns on the project versus returns on the market. 3. How is each type of risk used in the capital budgeting process? Answer: Because management’s primary goal is shareholder wealth maximization, the most relevant risk for capital projects is market risk. However, creditors, customers, suppliers, and employees are all affected by a firm’s total risk. Since these parties influence the firm’s profitability, a project’s within-firm risk should not be completely ignored. Unfortunately, by far the easiest type of risk to measure is a project’s stand-alone risk. Thus, firms often focus on this type of risk when making capital budgeting decisions. However, this focus does not necessarily lead to poor decisions, because most projects that a firm undertakes are in its core business. In this situation, a project’s stand-alone risk is likely to be highly correlated with its within-firm risk, which in turn is likely to be highly correlated with its market risk. Mini Case: 11 - 6 j. 1. What is sensitivity analysis? Answer: Sensitivity analysis measures the effect of changes in a particular variable, say revenues, on a project’s NPV. To perform a sensitivity analysis, all variables are fixed at their expected values except one. This one variable is then changed, often by specified percentages, and the resulting effect on NPV is noted. (One could allow more than one variable to change, but this then merges sensitivity analysis into scenario analysis.) j. 2. Perform a sensitivity analysis on the unit sales, salvage value, and cost of capital for the project. Assume that each of these variables can vary from its base case, or expected, value by plus and minus 10, 20, and 30 percent. Include a sensitivity diagram, and discuss the results. Answer: The sensitivity data are given here in tabular form (in thousands of dollars): NPV Deviation From Base Case Deviation From Base Case -30% -15% 0% 15% 30% Range WACC $113,288 $100,310 $88,030 $76,398 $65,371 47,916 Units Sold Salvage $16,668 $84,956 $52,348 $86,493 $88,030 $88,030 $123,711 $89,567 $159,392 $91,103 176,060 6,147 We generated these data with a spreadsheet model in the file ch 11 mini case.xls. Mini Case: 11 - 7 Sensitivity Analysis WACC Units Sold Salvage $180,000 $160,000 NPV $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0 -40% -20% 0% 20% 40% Deviation from Base-Case Value A. The sensitivity lines intersect at 0% change and the base case NPV, $81,573. Since all other variables are set at their base case, or expected values, the zero change situation is the base case. B. The plots for unit sales and salvage value are upward sloping, indicating that higher variable values lead to higher NPVs. Conversely, the plot for cost of capital is downward sloping, because a higher cost of capital leads to a lower NPV. C. The plot of unit sales is much steeper than that for salvage value. This indicates that NPV is more sensitive to changes in unit sales than to changes in salvage value. D. Steeper sensitivity lines indicate greater risk. Thus, in comparing two projects, the one with the steeper lines is considered to be riskier. Mini Case: 11 - 8 j. 3. What is the primary weakness of sensitivity analysis? What is its primary usefulness? Answer: The two primary disadvantages of sensitivity analysis are (1) that it does not reflect the effects of diversification and (2) that it does not incorporate any information about the possible magnitudes of the forecast errors. Thus, a sensitivity analysis might indicate that a project’s NPV is highly sensitive to the sales forecast, hence that the project is quite risky, but if the project’s sales, hence its revenues, are fixed by a longterm contract, then sales variations may actually contribute little to the project’s risk. It also ignores any relationships between variables, such as unit sales and sales price. Therefore, in many situations, sensitivity analysis is not a particularly good indicator of risk. However, sensitivity analysis does identify those variables which potentially have the greatest impact on profitability, and this helps management focus its attention on those variables that are probably most important. k. k. Assume that Sidney Johnson is confident of her estimates of all the variables that affect the project’s cash flows except unit sales and sales price: if product acceptance is poor, unit sales would be only 900 units a year and the unit price would only be $160; a strong consumer response would produce sales of 1,600 units and a unit price of $240. Sidney believes that there is a 25 percent chance of poor acceptance, a 25 percent chance of excellent acceptance, and a 50 percent chance of average acceptance (the base case). 1. What is scenario analysis? Answer: Scenario analysis examines several possible situations, usually worst case, most likely case, and best case. It provides a range of possible outcomes. Mini Case: 11 - 9 k. 2. What is the worst-case NPV? The best-case NPV? k. 3. Use the worst-, most likely, and best-case NPVs and probabilities of occurrence to find the project’s expected NPV, standard deviation, and coefficient of variation. Answer: We used a spreadsheet model to develop the scenarios (in thousands of dollars), which are summarized below: Scenario Probability Unit Sales Unit Price Best Case Base Case Worst Case 25% 50% 25% 1600 1250 900 $240 $200 $160 Mini Case: 11 - 10 NPV $278,965 $88,030 ($48,514) Expected NPV = $101,628 Standard Deviation = $75,684 Coefficient Of Variation = Std Dev / Expected NPV = 0.74 l. Are there problems with scenario analysis? Define simulation analysis, and discuss its principal advantages and disadvantages. Answer: Scenario analysis examines several possible scenarios, usually worst case, most likely case, and best case. Thus, it usually considers only 3 possible outcomes. Obviously the world is much more complex, and most projects have an almost infinite number of possible outcomes. Simulation analysis is a type of scenario analysis which uses a relatively powerful financial planning software such as interactive financial planning system (IFPs) or @risk (a spreadsheet add-in). Simple simulations can also be conducted with other spreadsheet add-ins, such as Simtools. Here the uncertain cash flow variables (such as unit sales) are entered as continuous probability distribution parameters rather than as point values. Then, the computer uses a random number generator to select values for the uncertain variables on the basis of their designated distributions. Once all of the variable values have been selected, they are combined, and an NPV is calculated. The process is repeated many times, say 1,000, with new values selected from the distributions for each run. The end result is a probability distribution of NPV based on a sample of 1,000 values. The software can graph the distribution as well as print out summary statistics such as expected NPV and σNPV. Simulation provides the decision maker with a better idea of the profitability of a project than does scenario analysis because it incorporates many more possible outcomes. Although simulation analysis is technically refined, its usefulness is limited because managers are often unable to accurately specify the variables’ probability distributions. Further, the correlations among the uncertain variables must be specified, along with the correlations over time. If managers are unable to do this with much confidence, then the results of simulation analyses are of limited value. Recognize also that neither sensitivity, scenario, nor simulation analysis provides a decision rule--they may indicate that a project is relatively risky, but they do not indicate whether the project’s expected return is sufficient to compensate for its risk. Finally, remember that sensitivity, scenario, and simulation analyses all focus on stand-alone risk, which is not the most relevant risk in capital budgeting analysis. m. 1. Assume that Shrieves’ average project has a coefficient of variation in the range of 0.2 - 0.4. Would the new line be classified as high risk, average risk, or low risk? What type of risk is being measured here? Answer: The project has a CV of 0.57, which is above the average range of 0.2-0.4, so it falls into the high risk category. The CV measures a project’s stand-alone risk-it is merely a measure of the variability of returns (as measured by NPV) about the expected return. Mini Case: 11 - 11 m. 2. Shrieves typically adds or subtracts 3 percentage points to the overall cost of capital to adjust for risk. Should the new furniture line be accepted? Answer: Since the project is judged to have above-average risk, its differential risk-adjusted, or project, cost of capital would be 13 percent. At this discount rate, its NPV would be $60,541, so it would still be acceptable. If it were a low risk project, its cost of capital would be 7 percent, its NPV would be $104,975, and it would be an even more profitable project on a risk-adjusted basis. m. 3. Are there any subjective risk factors that should be considered before the final decision is made? Answer: A numerical analysis such as this one may not capture all of the risk factors inherent in the project. If the project has a potential for bringing on harmful lawsuits, then it might be riskier than first assessed. Also, if the project’s assets can be redeployed within the firm or can be easily sold, then, as a result of “abandonment possibilities,” the project may be less risky than the analysis indicates. Mini Case: 11 - 12