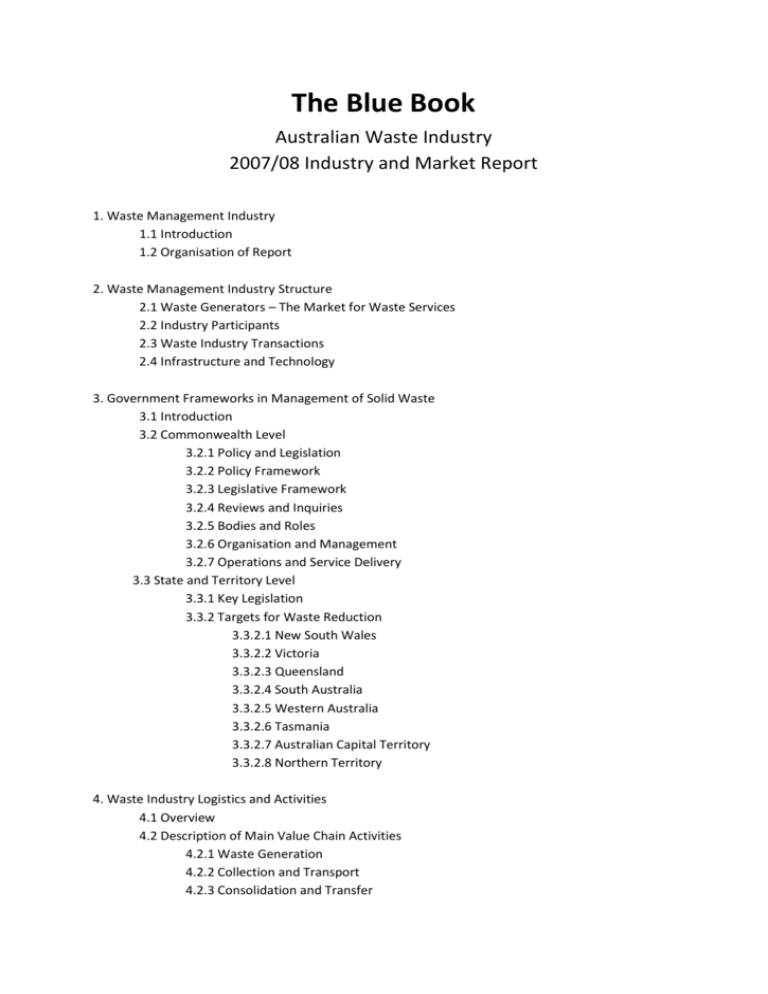

The Blue Book Australian Waste Industry 2007/08 Industry and

advertisement

The Blue Book Australian Waste Industry 2007/08 Industry and Market Report 1. Waste Management Industry 1.1 Introduction 1.2 Organisation of Report 2. Waste Management Industry Structure 2.1 Waste Generators – The Market for Waste Services 2.2 Industry Participants 2.3 Waste Industry Transactions 2.4 Infrastructure and Technology 3. Government Frameworks in Management of Solid Waste 3.1 Introduction 3.2 Commonwealth Level 3.2.1 Policy and Legislation 3.2.2 Policy Framework 3.2.3 Legislative Framework 3.2.4 Reviews and Inquiries 3.2.5 Bodies and Roles 3.2.6 Organisation and Management 3.2.7 Operations and Service Delivery 3.3 State and Territory Level 3.3.1 Key Legislation 3.3.2 Targets for Waste Reduction 3.3.2.1 New South Wales 3.3.2.2 Victoria 3.3.2.3 Queensland 3.3.2.4 South Australia 3.3.2.5 Western Australia 3.3.2.6 Tasmania 3.3.2.7 Australian Capital Territory 3.3.2.8 Northern Territory 4. Waste Industry Logistics and Activities 4.1 Overview 4.2 Description of Main Value Chain Activities 4.2.1 Waste Generation 4.2.2 Collection and Transport 4.2.3 Consolidation and Transfer 4.2.4 Resource Recovery 4.2.4.1 Sorting – Material Recycling Facilities (MRFs) 4.2.4.2 Dry Recyclable Materials 4.2.4.3 Metals 4.2.4.4 Waste Processing with Alternative Technologies 4.2.4.5 Garden Organics Processing 4.2.4.6 Landfills 5. Waste Markets 5.1 Quantities of Waste and Resources Handled 5.1.1 New South Wales 5.1.2 Victoria 5.1.3 Queensland 5.1.4 South Australia 5.1.5 Western Australia 5.1.6 Tasmania 5.1.7 Australian Capital Territory 5.1.8 Northern Territory 6. Shaping Forces and Outcomes 6.1 Protecting the Environment 6.2 Social Attitudes 6.3 Strategic Policy Options 6.4 The Emerging Technologies for Waste Processing 6.5 Main Technology Types 6.5.1 Enclosed Composting 6.5.2 Anaerobic Digestion 6.5.3 Vermicomposting 6.5.4 Pyrolysis/Gasification 6.5.5 Bioreactor Landfill Technology Status and Requirements 6.5.6 Extended Producer Responsibility and Product Stewardship 6.6 Waste Business Drivers and Positioning 6.7 Client Perspectives and Responses 7. Industry Dynamics and Future Value 7.1 Waste Market Shifts 7.2 Estimated Waste Flows – 2014-15 7.3 Estimated Market Value – 2015 7.4 Estimated Capital Investment 7.5 Making Infrastructure Investment Happen 7.5.1 Sites for Facilities 7.5.2 Setting the Signals 8. Market Segmentation and Concentration 8.1 Market Concentration 8.2 Australian Ownership 8.3 Competition in Markets 8.4 Employment in the Industry 8.5 Employment in Industry Activities 9. Major Waste Company Profiles There are companies in here, some are out of date. Do you want them listed? 10. Geographical Service Coverage by Companies 11. Waste Consultants Directory