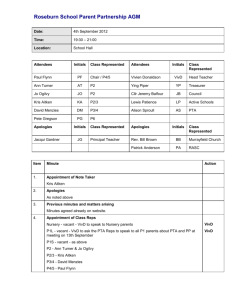

2. Some Benefits of a Vacant Land Tax

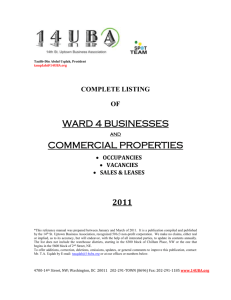

advertisement

The Potential Benefits to Dublin City of a Vacant Land Tax in the Dublin City Council area. Presentation to the Finance SPC 16th May 2013 “We are proposing a recurrent tax on zoned development land where such land is not being developed.”1 1. Summary Dublin City has considerable amounts of vacant land especially in the centre city/inner city area. These extensive vacant lands are a great competitive advantage for Dublin as many of our competitor cities have fully developed centre city areas and have no space for the expansion of uses which need/prefer to locate in centre city areas. Uses preferring the centre city include major employers such as Google, many hotels, student accommodation, and third level colleges. So if we can achieve the development of these extensive vacant lands it would be a key element in our attractiveness as a competitive city. These extensive vacant lands are also a significant challenge or problem for the city, including being damaging to its economic potential and general attractiveness and liveability They can have a serious negative impact on the adjoining area, its businesses, investors, workers, residents and visitors. Currently there is no disincentive to a landowner, including State landowners, leaving a site vacant for many years; the costs of such vacancy are borne by others and the city in general. (In order to incentivize landlords to actively let their properties, 50% Rates are payable on vacant properties.) It should be remembered that many of these significant vacant sites remained undeveloped throughout the decade and more of the boom. The proposal is that a tax be payable on vacant land to incentivize its development or sale to someone who has the interest and access to resources to develop it. A proposal could be made to Government for legislation that would enable the City Council to introduce such a tax on vacant land. 1 Commission on Taxation (2009) 1 2. Some Benefits of a Vacant Land Tax A vacant land tax would have a range of potential economic benefits including encouraging the optimal productive use of city land and preventing dereliction, encouraging economic development and job creation, and with sustainability benefits in encouraging new inner city housing and so far less long-distance commuting. Such a vacant land tax would also address the problem that vacant sites are also a significant economic disbenefit to adjoin businesses and residents who have invested in that particular area. Such a tax encouraging the optimal use of land is particularly appropriate in city areas such as Dublin where there has been considerable public investment in providing services such as public transport (e.g. Luas); and these vacant sites are not delivering the economic return to the public and the city for such considerable public investment. The Commission on Taxation (2009) considered these issues in detail and concluded: We are proposing a recurrent tax on zoned development land where such land is not being developed. This will be a useful policy tool to address the hoarding of landbanks and help to ensure that land is utilised in accordance with its planning categorisation. Ronan Lyons, an economist at Oxford University, set out the benefits of such a tax as follows: “For example, Harrisburg, the capital of Pennsylvania, has a land value tax. Between 1980 and 1995, that tax helped reduce the number of vacant centre structures from 4,200 to fewer than 500, increasing the population by 10%”2. The Tax Strategy Group report (2010) set out the benefits of a land value tax as including: It encourages compact city centre development and the most productive use of high value land ……. Those who have not developed valuable land are encouraged to do so It counteracts any market disincentive to develop the land. According to Adam Forman from the New York based Centre for an Urban Future, the taxation of such vacant land has a proven record of success. “In 1979, Pittsburgh began taxing land at a rate six times higher than improvements [value of the buildings]. In the 2 Ronan Lyons, for Smart Taxes Network, Residential Site Value Tax in Ireland, 2011 2 ensuing decade, building permits increased by 70.4 percent. This expansion occurred while its core industry, steel, was faltering. In the same period, the number of building permits fell by 14.4 percent in similar Northeastern and Midwestern cities. Harrisburg, Penn., also experienced a boost. From 1950 to 1977, the city lost nearly half its population. According to federal criteria, it was the second most distressed city in America. Following the introduction of two-tier property taxation, along with other revitalization policies, Harrisburg made an impressive comeback. In the ensuing decade, the number of vacant sites fell by nearly 90 percent, and the number of businesses more than doubled.” According to the recent Report of the Inter- Departmental Group; Design of a local property Tax; ‘An efficient tax system encourages the allocation of resources so that optimal economic output is achieved. Recurrent taxes on immovable property are the most “growth friendly” of taxes. ‘ 3. Driving Innovation, Productivity, and Competitiveness There is general agreement amongst economists that the density and proximity in urban areas drives productivity and innovation; so these extensive areas of vacant urban land are a significant drag on the city and national economic recovery3. Development Plan Policy (RE14) sets out; “To recognise that cities are crucibles of innovation and that the city centre Z5 zoned area and inner city area including the Docklands is the crucial metropolitan and national resource for innovation, promoting the proximity and diversity of uses that foster innovation.” According to leading Harvard urban economist Edward Glaeser in his book Triumph of the City; ‘the city creates productivity advantages’ and ‘cities speed innovation’. ‘Cities are the absence of physical space between people and companies. They are proximity, density, closeness’ Glaeser continues . More positively, encouraging the development of these extensive inner city lands, provides a great opportunity to boost the productivity and innovation potential of the city. 3 For example see PRODUCTIVITY AND THE DENSITY OF HUMAN CAPITAL; Jaison R. Abel, Ishita Dey, Todd M. Gabe; Journal of Regional Science; Volumepages 562–586, October 2012 3 Also, these extensive central city vacant lands are a great potential competitive advantage for Dublin in attracting international investment. Many of our competitor cities have fully developed centre city areas and have no space for the expansion of uses which need/prefer to locate in centre city areas. Uses preferring the centre city include major employers such as Google, many hotels, student accommodation, and third level colleges. For example, Squarespace, recently announced it is to establish its EMEA Headquarters in Dublin stating: "We are a Manhattan-based company with urban sensibilities. We want to be in a large, vibrant, cosmopolitan city. Dublin was the obvious choice from that perspective." If we can take steps to unlock the blockages to the development of these vacant central city lands, a key scarce resource, it gives us a great competitive advantage to attract highly mobile international investment. 4. Development Plan Challenges and Policies This vacant land tax would be a significant step forward towards addressing key challenges and policies set out in the City Development Plan. It recognises that considerable progress has been made in improving Dublin over recent years and this includes Docklands, Temple Bar and also Smithfield, Heuston etc. However, as the City Plan notes (p31) in its ‘Approach to the Inner City’; there are the problems of ‘isolated clusters’ , ‘a great sense of unevenness’, and a ‘significant number of vacant sites in the inner city that detract from its character and coherence’ . Accordingly the City Plan states; “It is a central aim of the core strategy to consolidate and enhance the inner city in order to augment its crucial role at the heart of the capital city and the city region. The inner city of Dublin is the most connected destination in the country and at international level, and supports a dynamic range of economic, educational and cultural clusters, together with a growing residential population.” (p22). A vacant land tax would address the 3 Core Strategies of the City Plan: A compact, quality, green, well-connected city, which generates a dynamic, mixed use environment for living, working and cultural interaction. A smart city, creating real long term economic recovery A city of sustainable neighbourhoods and socially inclusive communities 4 A Development Plan Objective (RE26) sets out the need to: “To promote and facilitate the transformation of regeneration areas especially inner city areas as a key policy priority and the opportunity to improve the attractiveness and competitiveness of the city, including by promoting high quality investment …..”. Kieran Rose Senior Planner Office of Economy and International Relations 08/05/2013 5