Intermediate Microeconomic Theory (3550)

Intermediate Microeconomic Theory (3550)

Homework 5 - Answers

Due Thursday, October 30, 2008

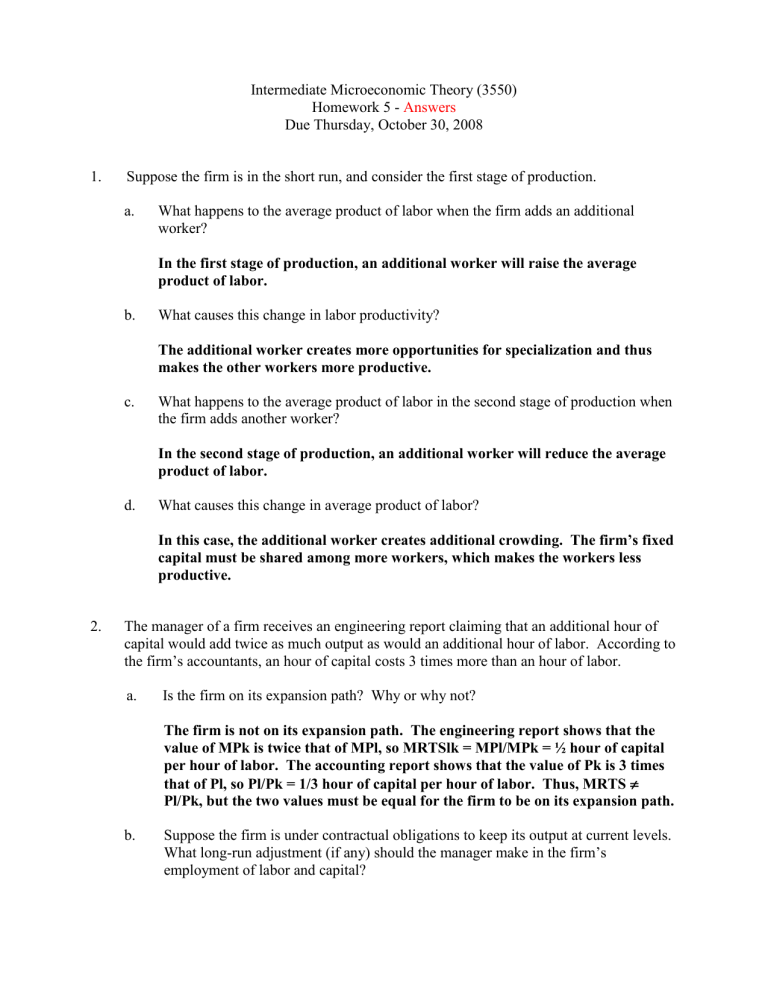

1. Suppose the firm is in the short run, and consider the first stage of production. a. What happens to the average product of labor when the firm adds an additional worker?

In the first stage of production, an additional worker will raise the average product of labor. b. What causes this change in labor productivity?

The additional worker creates more opportunities for specialization and thus makes the other workers more productive.

c. What happens to the average product of labor in the second stage of production when the firm adds another worker?

In the second stage of production, an additional worker will reduce the average product of labor. d. What causes this change in average product of labor?

In this case, the additional worker creates additional crowding. The firm’s fixed capital must be shared among more workers, which makes the workers less productive.

2. The manager of a firm receives an engineering report claiming that an additional hour of capital would add twice as much output as would an additional hour of labor. According to the firm’s accountants, an hour of capital costs 3 times more than an hour of labor. a. Is the firm on its expansion path? Why or why not?

The firm is not on its expansion path. The engineering report shows that the value of MPk is twice that of MPl, so MRTSlk = MPl/MPk = ½ hour of capital per hour of labor. The accounting report shows that the value of Pk is 3 times that of Pl, so Pl/Pk = 1/3 hour of capital per hour of labor. Thus, MRTS

Pl/Pk, but the two values must be equal for the firm to be on its expansion path. b. Suppose the firm is under contractual obligations to keep its output at current levels.

What long-run adjustment (if any) should the manager make in the firm’s employment of labor and capital?

We can conclude that the isoquant is steeper than the isocost since MRTSlk >

Pl/Pk, so the manager should employ more labor and less capital in the long run . c. Sketch an isoquant – isocost diagram that illustrates the situation described in part b.

Label the initial situation A and the post-adjustment situation B. The scale of your diagram does not need to be accurate. (Although we have not finished covering isocost and isoquant diagrams in class lectures, their similarity to budget line / indifference curve diagrams should enable you to complete this problem).

Capital

A

B

Slope = ½ machine-hour per man-hour.

Slope = 1/3 machine-hour per man-hour.

Labor

3. a. State the law of diminishing marginal returns.

A relationship between output and input that holds that as the amount of some input is increased in equal increments, while technology and other inputs are held constant, the resulting increments in output will decrease in magnitude . b. There is a proviso to this law that certain things be held constant. What are these things?

Technology and other inputs must be held constant .

4. What is the relationship between the isoquant map and the production function?

A firm can produce a particular level of output in various ways (by using different combinations of input combinations). Every combination of inputs shown on the isoquant is technologically efficient: each combination shows the maximum output possible from given inputs. Because isoquants show how much output a firm can produce with various combinations of inputs, a set of isoquants graphs the production function of the firm.

5. For a particular combination of capital and labor we know that the marginal product of capital is 6 units of output and the marginal rate of technical substitution is 3 units of capital per unit of labor. What is the marginal product of labor?

MP

K

= 6

MRTS

LK

= 3

MP

L

= ?

If one unit of labor can replace 3 units of capital, labor’s marginal product (MP

L

) must be 3 times as large as MP

K

when the slope (MRTS

LK

) is 3 units of capital to one unit of labor. Therefore, if MP

K

= 6, MP

L

= 18.

6. American Airlines produces round-trip transportation between Dallas and San Jose using three inputs: capital (planes), labor (pilots, flight attendants, etc.) and fuel. Suppose that

American’s production function has the following Cobb-Douglas form:

T = 0.002K

0.25

L

0.2

F

0.55

, where T = seat-miles produced annually; K = capital; L = labor; and F = fuel. a. If American currently employs K = 100, L= 500 and F = 20,000, calculate the marginal products associated with K, L, and F.

MP

K

= (0.25)(0.002)K -0.75

L 0.2

F 0.55

MP

K

= (0.25)(0.002)K -0.75

(500) 0.2

(20,000) 0.55

MP

K

= .1272

MP

L

= (0.002)(100) 0.25

(0.2)L -0.8

(20,000) 0.55

MP

L

= .002034

MP

F

= (0.002)(100) 0.25

(0.2)(500) 0.2

(0.55)(20,000) -0.45

MP

F

= .00014 b.

What is American’s marginal rate of technical substitution between K and L? What is the MRTS between K and F?

MRTS

LK

= marginal rate of technical substitution of labor for capital is defined as the amount by which capital can be reduced without changing output when there is a small (unit) increase in the amount of labor.

MP

K

/MP

L

= .591…….6.25

MP

K

/MP

F

= 8.595………90.82

Capital miles between Dallas and San Jose?

Labor,

Fuel c. Does the law of diminishing marginal returns apply to K in the production of seat-

Given T = 0.002K

0.25

L 0.2

F 0.55

If we hold L and F constant and increase K from 100 to 101, what is the change in marginal product? If MPK is falling, we know there are diminishing marginal returns to capital over this range of capital use.

MP

K

= .1272 when K = 100

MP

K

= .1262 when K = 101, therefore the law of diminishing marginal returns applies. d.

Does American’s production function exhibit constant, increasing or decreasing returns to scale? Explain.

Double all inputs.

If output increases more than double, increasing returns to scale.

If output increases less than double, decreasing returns to scale.

If output increases doubly, constant returns to scale.

Given T = 0.002(100) 0.25

(500) 0.2

(20,000) 0.55

T = (.6687)(3.4657)(232.0419) = 537.76

Double all inputs: 2T = 0.002(200) 0.25

(1000) 0.2

(40,000) 0.55

T = (.7953)(3.9810)(339.7293) = 1075.61

Rounding as I did, 537.76*2 = 1075.52. This is approximately equal to 1075.61, so we can assume constant returns to scale, or slightly increasing at best. e. Does the law of diminishing returns imply decreasing returns to scale? Would decreasing returns imply the law of diminishing returns? Explain.

The law of diminishing returns doesn’t imply decreasing returns to scale.

Getting decreasing returns to scale does not imply the law of diminishing returns is relevant over the range of production. While they may be concurrent, one doesn’t imply the other.

7. Coldwell Banker employs 10 acres of land and 50 tons of cement to produce 1,000 parking spaces. Land costs $4,000 per acre and cement costs $12 per ton. For the input quantities employed, MP

L

= 50 and MP

C

= 4. Explain how Coldwell Banker can produce the same output at a lower total cost.

MP

L

/P

L

= MP

C

/P

C

50/400 < 4/12

Coldwell should use more cement and less land.

This can be shown graphically.

Cement

Coldwell Banker is at point N on isocost line AZ. At point

N, the isoquant has a slope of

A’

A

50/4 = 12.5, which is flatter than the isocost line with a slope of 4,000/12 = 333.33. By operating at point M on the

Z’ Z

Coldwell can produce the same output at lower cost.

M

N

Land

8. True or False. You should quit studying when you reach the point of diminishing marginal returns.

False. You should quit studying when the marginal returns to studying fall below the marginal opportunity cost. The marginal returns might diminish for quite a long time before you should quit.

9. Consider a competitive constant-cost industry in which each firm’s marginal and average costs are given by the formulas MC = 4q and AC = 2q + 50/q, where q represents the quantity supplied by the firm. a. Determine the quantity supplied by each firm in the long-run equilibrium, and determine the firms’ break-even price.

In the long run equilibrium, MC = AC.

4q = 2q + 50/q

2q = 50/q

2q 2 = 50 q 2 = 25 q = 5

Each firm should supply 5 units. The breakeven price is given by

MC = 4q, or $20. b. Suppose the market demand for the good produced by this industry is given by the formula P = 320 – 2Q, where P is the market price and Q is the market quantity. If the industry is in a long-run competitive equilibrium, what will be the market price and quantity?

The breakeven price is $20. Therefore, 20 = 320 – 2Q.

300 = 2Q

150 = Q

The market quantity is 150 units. The market price is $20 per unit. c. If the industry is in a long-run competitive equilibrium, how many firms will be in the industry?

Since each firm produces 5 units and the total market produces 150 units, there must be 150 / 5 = 30 firms.

10. What will it take for you to do better on the second exam than you did on the first? You might thoughtfully consider your response as an opportunity to convey valuable information to me in a serious manner.