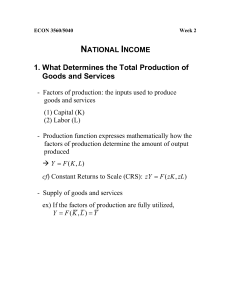

Problem Set 1 Econ 122a

advertisement

Problem Set 1 Mr. Nordhaus and Staff Econ 122a: Fall 2010 Due: In class, Wednesday, September 22 Problem Set 1 Solutions ======================== 1. There are three major statistical agencies of the US government: the Bureau of Economic Analysis, the Bureau of Labor Statistics, and the Census Bureau. This question is designed to help familiarize you with some of these data sources. a. Go to the BEA website (www.bea.gov), and click the following links: “Gross Domestic Product”, “Interactive NIPA Tables”, and “list all NIPA tables”. Take a moment to examine the data that is available through this page. Using table 1.1.1, in which quarters since 2007 did the US experience a decline in Real GDP? In which quarter was this decline the greatest? Using table 1.1.2, which aspect of aggregate expenditure (C, I, G, X, or M) was most responsible for the decline in real GDP that quarter? With the exception of the second quarter of 2008, the US experienced a decline in it GDP from the first quarter of 2008 until the second quarter of 2009. The greatest decline was in the fourth quarter of 2008 with a contraction of 6.8%. In this quarter the decline in private investment was the most responsible component of the GDP with accounting for 6.32 of the 6.8. b. Go to the BLS website (www.bls.gov), and click “Subject Areas”. Take a moment to look at the data available from this page. Click “Consumer Price Index”, and under “CPI databases”, click the “Top Picks” of “All Urban Consumers”. First, retrieve data from “U.S. All items”, and format the data to be shown as monthly percent changes. In which months since 2007 did the US economy experience deflation, according the CPI? The decline in the CPI was: Aug 2007 -0.2 Dec 2007 -0.1 Aug 2008 -0.4 Sep 2008 -0.1 Oct 2008 -1.0 Nov 2008 -1.9 Dec 2008 -1.0 Jul 2009 -0.2 Dec 2009 -0.2 Jun 2010 -0.1 c. One criticism of the CPI is that it includes items whose prices that are very volatile, such as food and energy items, and including such items may cause the index to be unnecessarily volatile in measuring the overall price level. Therefore, economists also look at “All items less food and energy”, which is also known as “Core CPI”. In which months since 2007 did the US economy experience deflation according to this measure? If we take only the "Core CPI" deflation occurred in: Nov 2008 -0.2 Dec 2008 -0.3 Nov 2009 -0.2 Dec 2009 -0.2 2. Use the classical model to predict the impact of the following events on the wage rate, rental rate on capital, and output. a. A flood in Pakistan destroys 20 percent of the capital stock. First, remember that in the classical model capital and labor are exogenous and there is full employment of inputs. A decrease in capital increases the MPK and so the rental rate of capital. The decrease in capital shift the MPL inward decreasing wage rate. Output decreases. MPK MPL R1 R0 W0 W1 K1 K0 L K L b. Foreign countries invest $100 billion of capital in Mexico. This is the opposite as part a). In this case, capital in Mexico increases. So, the rental rate of capital decreases, the wage rate increases and output increases. Output increases. MPK MPL W1 W0 R0 R1 K0 K1 K L L c. Regulations on power plants reduce total factor productivity by 5 percent. The decrease in total factor productivity decreases both, the MPK and the MPL decreasing the rental rate of capital and wages. Output also decreases. MPK MPL R0 R1 W0 W1 K K L L 3. Consider the following actual data on computer and non-computer prices and quantities: Sector Computers Non computers Output (billions 2005$) 1958 2009 0.0000195 156.682 2,577.6 13,156 Price (2005) 1958 2009 10251.56 0.5106 0.18 1.1034 Calculate the Laspeyres, Paasche, and Fisher indexes for output growth between the two periods. [Extra non-credit: construct the Törnqvist index.] For the Lespeyres Index, the weights on the quantities in each year are the old prices, which are $10251.56 for computers and $0.18 for Non computers. 1958 Index = 0.0000195 x 10251.56 + 2577.6 x 0.18 = 464.1679 2008 Index = 156.682 x 10251.56 + 13156 x 0.18 = 1608603 Output growth = 1608603/464.1679 = 3465.56 For the Paasche Index, the weights on the quantities in each year are the new prices, which are $0.5106 for computers and $1.1034 for Non Computers. 1958 Index = 0.0000195 x 0.5106 + 2577.6 x 1.1034 = 2844.12 2008 Index = 156.682 x 0.5106 + 13156 x 1.1034 = 14596.33 Output growth = 5.13 The Fisher Index uses a geometric mean of the Laspeyres and Paasche Indexes. 1958 Index = (464.1679 x 2844.12)1/2= 1148.98 2008 Index = (1608603 x 14596.33)1/2= 153230.9 Output growth = 152300.35/1142.16 = 133.36 4. Consider a Cobb-Douglas production function with three inputs: K is capital (number of machines), L is labor (the number of workers), and H is human capital (the number of years of education per worker). The production function is: Y K 1/ 2 (HL )1/ 4 a. Derive an expression for the marginal product of labor (L). How does an increase in the quantity of human capital affect the marginal product of labor? The marginal product of labor is the extra output that one additional unit of labor will produce. Therefore, to find this, you must take the derivative of the production function with respect to L. 1 MPL 3 1 1 2 4 4 K L H 4 An increase in human capital causes the marginal product of labor to increase. b. Derive an expression for the marginal product of human capital. How does an increase in the quantity of human capital affect the marginal product of human capital? To find the marginal product of human capital, take the derivative of the production function with respect to H. 1 1 1 MPH K 2 L4 H 4 3 4 An increase in human capital causes a decrease in the marginal product of human capital c. What is the income share paid to labor? What is the income share paid to human capital? In the national income accounts of this economy, what share of the total income do workers receive? Income share paid to labor = L x MPL/Y = 1/4 Income share paid to human capital = H x MPH/Y = 1/4 Income share paid to workers = 1/2 d. An unskilled worker earns the marginal product of labor, whereas a skilled worker earns the marginal product of labor plus the marginal product of human capital. Using your answers to parts (a) and (b), find the ratio of the skilled wage to the unskilled wage. How does an increase in the quantity of human capital affect this ratio? Explain. Skilled Wage = MPL + MPH Unskilled Wage = MPL Skilled MPL MPH MPH L 1 1 Unskilled MPL MPL H Therefore, an increase in the amount of human capital decreases the ratio of the skilled wage to the unskilled wage. e. Some people advocate government funding of college scholarships as a way of increasing economic growth? Explain how this might work. Government funding of college scholarships reduces the private cost of attending college. So, this stimulates the investment in human capital increasing H in our production function. f. Derive the logarithmic growth rate of output as a function of the logarithmic growth rate of inputs K, L, and H. 1 2 1 4 1 4 Yt K L H 1 1 1 ln Yt ln K t ln Lt ln H t 2 4 4 1 1 1 ln Yt 1 ln Yt [ln K t 1 ln K t ] [ln Lt 1 ln Lt ] [ln H t 1 ln H t ] 2 4 4