DISCOUNTING AND PRESENT VALUE

advertisement

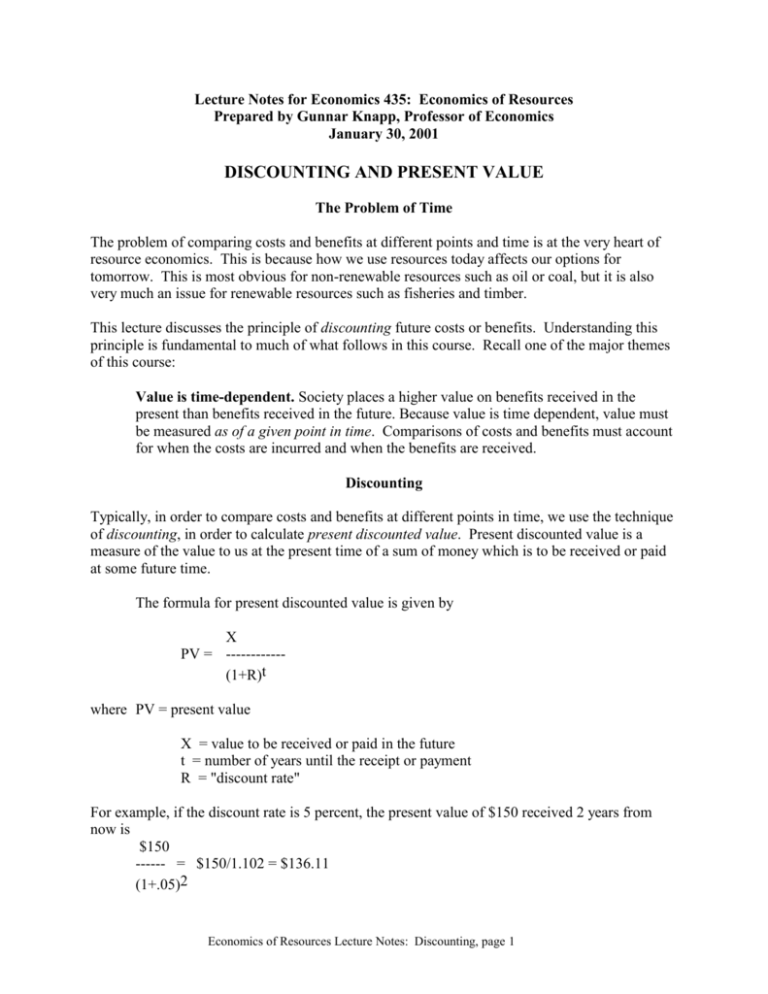

Lecture Notes for Economics 435: Economics of Resources Prepared by Gunnar Knapp, Professor of Economics January 30, 2001 DISCOUNTING AND PRESENT VALUE The Problem of Time The problem of comparing costs and benefits at different points and time is at the very heart of resource economics. This is because how we use resources today affects our options for tomorrow. This is most obvious for non-renewable resources such as oil or coal, but it is also very much an issue for renewable resources such as fisheries and timber. This lecture discusses the principle of discounting future costs or benefits. Understanding this principle is fundamental to much of what follows in this course. Recall one of the major themes of this course: Value is time-dependent. Society places a higher value on benefits received in the present than benefits received in the future. Because value is time dependent, value must be measured as of a given point in time. Comparisons of costs and benefits must account for when the costs are incurred and when the benefits are received. Discounting Typically, in order to compare costs and benefits at different points in time, we use the technique of discounting, in order to calculate present discounted value. Present discounted value is a measure of the value to us at the present time of a sum of money which is to be received or paid at some future time. The formula for present discounted value is given by X PV = -----------(1+R)t where PV = present value X = value to be received or paid in the future t = number of years until the receipt or payment R = "discount rate" For example, if the discount rate is 5 percent, the present value of $150 received 2 years from now is $150 ------ = $150/1.102 = $136.11 (1+.05)2 Economics of Resources Lecture Notes: Discounting, page 1 In this lecture we will discuss why we use this formula, how to apply it, and how to choose the "discount rate." The Concepts of Future Value and Present Value Suppose I can invest as much money as I want at an interest rate of 10 percent, and I can also borrow as much money as I want at an interest rate of 10 percent. If this is the case, I will be indifferent between having $100 now or $110 a year from now. This is because if I have $100 now, I could invest it and have $110 a year from now. Alternatively, if I know that I will have $110 a year from now, I could borrow $100 now and pay it back with 10 percent interest in a year. $100 now has a future value one year from now of $110. $110 one year from now has a present value of $100. In the same way, I am indifferent between having $100 now or $121 two years from now. If I have $100 now, I could invest it and have $121 two years from now (since 100 x 1.10 x 1.10 = 121). Alternatively, if I know that I will have $121 a year from now, I could borrow $100 now and pay it back with 10 percent interest per year two years from now. $100 now has a future value two years from now of $121. $121 two years from now has a present value of $100. In general, as long as I can invest or borrow as much as I want at an interest rate R, I am indifferent between having X dollars now and X*(1+R)t dollars t years from now. Put differently, I am indifferent between having X dollars at some point in the future and having X (1 + r)t dollars now. One of the most important concepts in resource economics--and one which most people never learn or understand, is that value is time-dependent. How much a sum of money is worth must be stated as of a given point in time. Generally, we choose to measure value as of the present time. The interest rate R which is used in the present value formula is referred to as a discount rate. We speak of discounting benefits which are received in the future. An Example: Using Present Discounted Value to Make an Investment Decision Suppose you are offered an opportunity to invest $100 today in return for $70 after 2 years and another $45 after 5 years. Economics of Resources Lecture Notes: Discounting, page 2 Would this be a good investment? Perhaps, or perhaps not. It depends on your discount rate. In this example, the investment would be profitable at a discount rate of 2 percent, but it would not be profitable at a discount rate of 6 percent. We can illustrate this in two ways. One way is by comparing the future value of $100 with the future value of what we would earn from the investment. Another way is to compare $100 now with the present value of what we would earn from the investment. Comparing Future Value at an Interest Rate of 2 Percent If you simply invested the $100 in a savings account at an interest rate of 2 percent, after five years you would have $100 x (1.02)5 = $100 x 1.1041 = $110.41 If instead you made the investment, you would get $70 after two years. You could invest this for another three years and get $70 x (1.02)3 = $70 x 1.0612 = $74.28 You would also get another $45 after five years. Therefore after five years you would have a total of $74.28 + $45 = $119.28 This is higher than the $110.41 you would have if you had just put the money in a savings account. Therefore, investing the money in the machine is a good deal if the discount rate is 2 percent. Comparing Future Value at an Interest Rate of 6 Percent Now, suppose the interest rate you could earn from the savings account was 6 percent. If you invested $100 in the savings account, after five years you would have $100 x (1.06)5 Economics of Resources Lecture Notes: Discounting, page 3 = $133.82 If you made the investment, you would have $70 x (1.06)3 + $45 = $70 x 1.1910 + $45 = $83.37 + $45 = $128.37 In this case, you would have been better off by simply investing the money in a savings account. By calculating the future value in five years, with and without the investment, we can see that the investment is a good deal if the interest rate is 2 percent, but it is not a good deal if the interest rate is 6 percent. Comparing Present Value at a Discount Rate of 2 Percent We can derive the same result more easily by simply calculating the present value of your future returns at both interest rates. At a discount rate of 2 percent, the present value of $70 in 2 years and $45 in 5 years is $67.28 + $40.75 = $108.03, which is more than $100. Comparing Present Value at a Discount Rate of 6 Percent At a discount rate of 6 percent, the present value of $70 in 2 years and $45 in 5 years is $62.27 + $33.62 = $95.89, which is less than $100. Summary Thus the investment is a good one if the discount rate is 2 percent, but it is not a good deal if the discount rate is 6 percent. This example illustrates that this result can be derived either by comparing future values or by comparing present values. However, generally it is easier to compare present values. Continuous Compounding Suppose that you have $100, and you put it in the bank for one year at 10 percent interest. At the end of the year, you will have $110. Now, suppose that instead the bank paid you 5 percent interest after half a year and then added the interest to your principal, and paid another 5 percent on the total at the end of the year. You would have $110.25 at the end of the year. In the first case, your interest was "compounded annually." In the second case, your interest was "compounded semiannually." If your interest were compounded quarterly so that you were paid 2.5 percent on your balance four times per year, you would have $110.38 at the end of the year. We can prepare a table to show the amount of money you would have at the end of the year based on the amount of times the interest is compounded. Economics of Resources Lecture Notes: Discounting, page 4 Rate (percent) Number of times paid per year Total at end of year 10 5 2.5 1 0.1 1 2 4 10 100 $110 $110.25 $110.38 $110.46 $110.51 If we went on like this until we were paying infintesimal rates an infinite number of time per year, we would end up receiving $110.52. This is the limit of the process, and it is called "continuous compounding." The formula for the value of Y dollars which is continuously compounded at an interest rate of r for t years is: FV = Y ert (e is a special number, sort of like "pi," which has a value of approximately 2.7183.) Compare this to the formula using annual compounding: FV = Y (1 + r)t In the example given above, of $100 continuously compounded for one year, the value of ert is: e .1 x 1 = (2.7183) .1 = 1.1051. We can also use "continuous discounting." In this case, the formula for the present discounted value is: X PV = ert = X e-rt Generally, using annual compounding results in money growing only a little less rapidly than with continuous compounding. However, economists prefer to use the formula for continuous compounding when developing economic models because it is easier to use with calculus. Consoles A console is a security or bond which promises to pay a fixed amount of income every year forever. If a console pays $X per year, and the interest rate is r, then the formula for the present value of the console is PV = X / r Economics of Resources Lecture Notes: Discounting, page 5 In other words, if the interest rate is 10 percent, then a console which will pay $50 per year forever is worth 50/(.1) = $500. An intuitive explanation for this is that if you put $500 in the bank, it would pay $50 forever, since 50 is 10 percent of 500. The Market Value of an Asset Which Will Pay Future Returns In a competitive market, the value of an asset which will provide returns at different times in the future is the sum of the present value of these returns. For an asset which will produce future profits, such as land or an oil field, in a competitive market the value of the asset would be the present value at the market rate of interest of these future profits. For example, if the interest rate is 10%, the market value of a bond that will pay $110 next year is 110/1.10= $100. The market value of a console that will pay $100 every year is 100/.10=$1000. As the interest rate declines, the value of an asset providing future profits rents increases since a lower interest rate increases present values. Thus, for example, a lower interest rate will increase the present value (and the market price) of a growing stand of timber, farm land, an oil field, or a limited entry fishing permit. A salmon limited entry permit is similar to a console, in that it permits the holder to earn profits every year in the future. In a competitive market, if the interest rate were 10 percent, the market value of a limited entry permit which produced $10,000 in profits every year would be $10,000/.1, or $100,000. If the interest rate fell to 8%, the market value of the limited entry permit would rise to $10,000/.08=$125,000. Real vs. Nominal Prices So far in this lecture, we have ignored the possibility of inflation. If prices are rising, the real purchasing power of money is declining. Economists distinguish between "nominal" prices, which refer to prices in the currency of the current year, and "real" prices, which refer to prices in the currency with the buying power of a specific reference year. The real price may be calculated as: Real price = (nominal price)/(1+ i) where i is the rate of inflation between the base year for measuring the real price and the current year. For example, suppose that prices are 4 percent higher in 1993 than in 1992 (the inflation rate is 4 percent). Suppose that bicycle prices are rising at the same rate as the average inflation rate, or by 4 percent per year. This means that a bicycle which cost $100 in 1992 will cost $104 in 1993. We can say that the nominal price of a bicycle in 1992 is $100, and the nominal price of a bicycle in 1993 is $104. We can say that the real price, measured in 1992 dollars, of a bicycle in 1993 Economics of Resources Lecture Notes: Discounting, page 6 ($104)/(1 +.04) = $100 (measured in 1992 dollars) If the price of the bicycle had risen to $106, while the average inflation rate was only 4%, then the real price in 1993 would be: ($106)/(1+ .04) = $101.92 (measured in 1992 dollars) Real vs. Nominal Inflation Rates The interest rate paid by money deposited in a bank (or in any other investment) is a nominal interest rate. But if there is inflation, then the real purchasing power of the investment will not be rising as fast as the nominal interest rate. If interest is continuously compounded, then the real interest rate is the nominal interest rate minus the rate of inflation. For example, suppose in 1992 I deposit $100 in a bank which pays a 7 percent interest rate, continuously compounded. In 1993, I will have $100 x e .07 = 1.0725. But if prices are growing at 4 percent, continuously compounded, prices will have risen by e.04, or by 1.0408. The real value of my investment, measured in 1992 dollars, will have risen by 1.0725/1.0408, or 1.0304-which is equal to e.03. In other words, the real value of my investment will have grown at a rate of 3 percent, continuously compounded. Economists, as a matter of course, are used to making this adjustment from current dollars to real dollars. For the remainder of this course, whenever we refer to prices, we will be referrring to real (inflation adjusted) prices, and whenever we refer to interest or discount rates, we will be referring to real (inflation adjusted) interest or discount rates. Note that if the inflation rate is higher than the interest rate, it is possible for the real interest rate to be negative. In other words, if you put your money in a bank which is paying 3 percent interest, but the rate of inflation is 5 percent, then you are earing a real interest rate of -2 percent. Economics of Resources Lecture Notes: Discounting, page 7