Chapter 5: The Rate of Return

advertisement

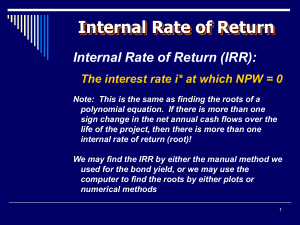

Chapter 5: The Rate of Return For annuity and bonds, we considered the interest rate at which the amount invested is equal to the amounts received. For example, for an annuity the investment at t = 0 was the present value of the regular periodic payments based on a given interest rate. Similarly, for bonds, the initial investment or purchase price was the present value of the coupon and redemption amounts based on the corresponding yield rate. The interest rate in these examples is referred to as the internal rate of return (IRR). Thus, finding the IRR means solving for the interest rate in the corresponding equation of value. That is, with the total values of the payments received and the payments made out are set equal when adjusted to the same point in time using v = ( 1+i )-1 (possibly for t = 0), solving for i gives the IRR. This equation of value can be constructed for any sequence of cash flows. Let A0, A1, …, An represent the payments received at times t0, t1, …, tn, corresponding to the first n interest periods. Similarly, let B0, B1, …, Bn be the payments made out at the same points in time, then at the end of the kth period (t = tk) there is a net amount received of Ck = Ak – Bk. Note Ck may be negative. Also, Ak and/or Bk may be zero for any given period. Example Suppose that for investments of $500 initially and $500 at the end of the first year, I will receive payments of $300 at the end of each six months during the first year and $400 at the end of each six months during the second year. What is my rate of return for this investment? 0 1 2 3 4 Ak 0 300 300 400 400 Bk 500 0 500 0 0 Ck -500 300 -200 400 400 net amounts: -500 300 -200 400 400 Thus, the equation of value 500 500v 2 300v 300v 2 400v3 400v 4 may be written in terms of the net amounts as 500 300v 200v 2 400v3 400v 4 0 . Using my graphing calculator, I solved for the zero of this quartic polynomial and found 1 0.81213556 , and so j 0.2313215 . But the same answer v 0.81213556 . Thus, 1 j may be found by entering these net cash flows into your business calculator and using the IRR button. The result is IRR = 23.13215. This is the rate of return percentage for the 6month period. As demonstrated in the above example, the equation of value based on t = 0 may be written in the form n C v k 0 k k 0. But, as we’ve seen before, an equation of value may be constructed by adjusting all the amounts to any time ti to form an equivalent equation n C v k 0 k k i 0. In many situations, the IRR may be used to compare between two investment opportunities. But we note that solving such polynomial equations may result in multiple solutions. That is, there may be more than one interest rate that satisfies the equation. Example 5.2 on page 270 illustrates such potential pitfalls. Note sections 5.1.3 and 5.1.4 are excluded from the recommended syllabus. Dollar-Weighted Rate of Return The dollar-weighted and time-weighted rates of return are introduced in section 5.2. These are methods for measuring an investment performance on an annual basis. The dollar-weighted rate of return is similar to the IRR but is based on simple interest, not compound interest. That is, sum the initial amount in the fund at the beginning of the year along with each net amount received during the year, all accumulated to the end of the year using simple interest. Setting this sum equal to the fund balance at the end of the year forms the equation of value. Solving this equation for the interest rate yields the dollar-weighted rate of return. Note this value does not differ much from the IRR for this shorter time period. For example, suppose an initial investment of $1000 is made at the beginning of the year. At the end of the first two quarters $300 is deposited and at the end of the second two quarters $500 is deposited. Payments of $400 are received from the fund every six months and at the end of the year the fund has a value of $2100. Find the dollar-weighted rate of return and compare this with the IRR for this same fund. month: Ak Bk net, Ck 0 6 9 12 0 0 400 0 2500 1000 300 300 500 500 -1000 -300 100 -500 2000 The resulting equation of value is given by 3 1000(1 i) 300 1 129 i 100 1 126 i 500 1 123 i 2000 0 Solving this equation algebraically, we find i 1000 300 100 500 2000 300 0.23077 1000 300( 129 ) 100( 126 ) 500( 123 ) 1300 The dollar-weighted rate of return for this entire year is i = 0.23077. Computing the IRR gives j = 0.05378 for the 3-month periods, or i = (1.05378)4-1 = 0.2331. Note that in the calculation above i 300 where 300 equals the total interest earned 1300 during the year and 1300 is the average amount on deposit during the year. Time-Weighted Rate of Return Like the dollar-weighted rate, the time-weighted rate of return is another method for measuring an investment performance on an annual basis. This approach uses the rate of return for each successive portion of a year to determine the overall annual yield. For example if an account earns a 6-month rate of 4%, earns a 3-month rate of 3%, and earns 2% during the remaining 3 months of the year, then (1.04)(1.03)(1.02) = 1.0926 and so the annual time-weighted rate of return is 9.26%. It’s not relevant that the periods were not of equal length, only that we knew the rate j for the length of period indicated. Typically, we will break the year into fractions defined by the points at which transactions occur. Example 5.4 (pg. 281) initial balance transaction new balance first of Jan. 1,000,000 end of Feb. 200,000 1,240,000 end of Aug. 200,000 1,600,000 end of Oct. -500,000 1,080,000 end of Dec. -200,000 900,000 For the first period (1/1 – 3/1), the total interest earned is given by j = current balance – previous balance – payment received + payment paid out = 1240000 – 1000000 – 200000 + 0 = 40000 40000 0.04, or 4% . Thus the percent increase over this time period is 1000000 Similarly, the percent increase for the following 3 periods are found to equal 0.1290, - 0.0125, and 0.0185, respectively. Therefore, the time-weighted rate of return for this year is computed to be (1 + 0.04)(1 + 0.1290)(1 – 0.0125)(1 + 0.0185) – 1 = 0.1809, or 18.09%. For comparison, the dollar-weighted rate for this fund, found by solving the equation 1,000,000(1 i) 200,000(1 56 i) 200,000(1 62 i) 500,000(1 16 i) 1,100,000 0 , equals 0.1739. The time-weighted rate “eliminates the impact of money flows in and out of the fund” and is often used to compare the relative performance of investment fund managers.