Accounting for Goodwill and Intangibles

advertisement

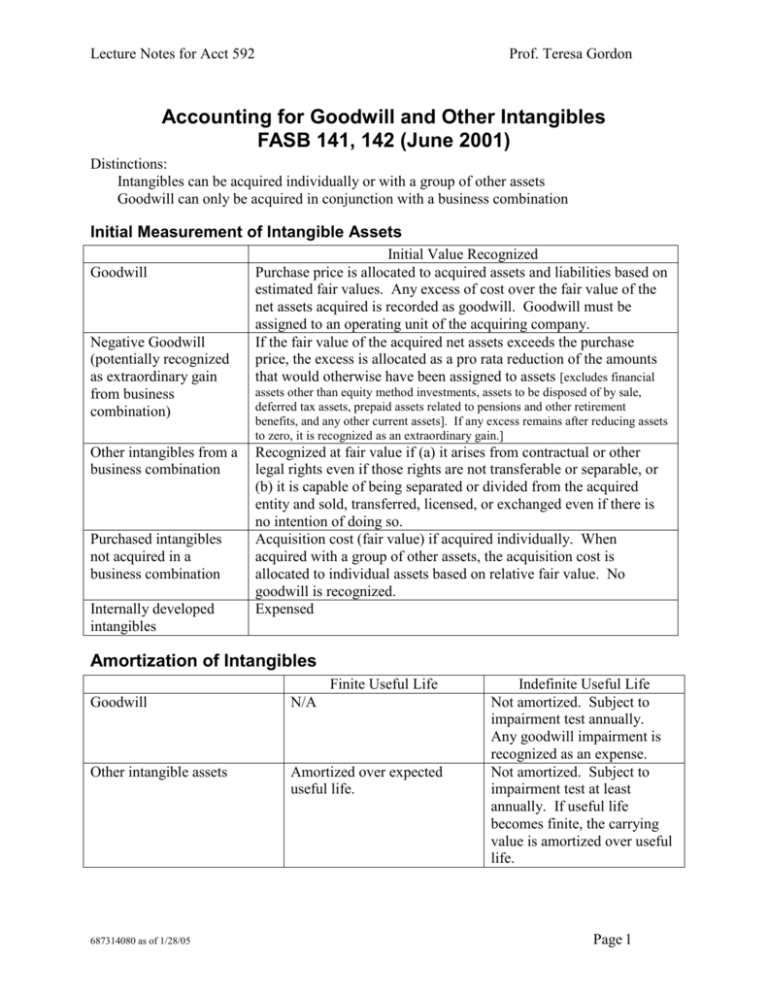

Lecture Notes for Acct 592 Prof. Teresa Gordon Accounting for Goodwill and Other Intangibles FASB 141, 142 (June 2001) Distinctions: Intangibles can be acquired individually or with a group of other assets Goodwill can only be acquired in conjunction with a business combination Initial Measurement of Intangible Assets Goodwill Negative Goodwill (potentially recognized as extraordinary gain from business combination) Other intangibles from a business combination Purchased intangibles not acquired in a business combination Internally developed intangibles Initial Value Recognized Purchase price is allocated to acquired assets and liabilities based on estimated fair values. Any excess of cost over the fair value of the net assets acquired is recorded as goodwill. Goodwill must be assigned to an operating unit of the acquiring company. If the fair value of the acquired net assets exceeds the purchase price, the excess is allocated as a pro rata reduction of the amounts that would otherwise have been assigned to assets [excludes financial assets other than equity method investments, assets to be disposed of by sale, deferred tax assets, prepaid assets related to pensions and other retirement benefits, and any other current assets]. If any excess remains after reducing assets to zero, it is recognized as an extraordinary gain.] Recognized at fair value if (a) it arises from contractual or other legal rights even if those rights are not transferable or separable, or (b) it is capable of being separated or divided from the acquired entity and sold, transferred, licensed, or exchanged even if there is no intention of doing so. Acquisition cost (fair value) if acquired individually. When acquired with a group of other assets, the acquisition cost is allocated to individual assets based on relative fair value. No goodwill is recognized. Expensed Amortization of Intangibles Finite Useful Life Goodwill N/A Other intangible assets Amortized over expected useful life. 687314080 as of 1/28/05 Indefinite Useful Life Not amortized. Subject to impairment test annually. Any goodwill impairment is recognized as an expense. Not amortized. Subject to impairment test at least annually. If useful life becomes finite, the carrying value is amortized over useful life. Page 1 Lecture Notes for Acct 592 Prof. Teresa Gordon Examples of Intangibles Recognized Separately from Goodwill: Marketing-related Customer-related Artistic-related Contract-based Technology-based Intangible Assets Arising from Contractual or Other Legal Rights Trademarks, tradenames Trade dress (unique color, shape, package design) Newspaper mastheads Internet domain names Noncompetition agreements Order or production backlog Customer contracts and related customer relationships including those of financial institutions [SFAS No. 147] Plays, operas, ballets Books, magazines, newspapers and other literary works Muscial works such as compositions, song lyrics, advertising jingles Video and audiovisual material including motion pictures, music videos, television programs Licensing, royalty and standstill agreements Advertising, construction, management, service or supply contracts Lease agreements Construction permits Operating and broadcast rights Use rights such as drilling, water, air, mineral, timber cutting, and route authorities Servicing contracts such as mortgage servicing contracts Employment contracts Patented technology Computer software and mask works Trade secrets such as secret formulas, processes, recipes Intangible Assets Recognized Because They Are Separable Customer lists Noncontractual customer relationships such as bank depositors Unpatented technology Databases, including title plants Trade secrets not protected by law Defined in FASB 142: The excess of the cost of an acquired entity over the net of the amounts assigned to assets acquired and liabilities assumed. The amounts assigned are fair values Goodwill includes all intangible assets that do not meet the criteria for recognition as an asset apart from goodwill. Remember -- You only have goodwill if you've purchased another entire company. Acquisitions of financial institutions are no longer excluded from guidance of SFAS No. 141 & 142 [see SFAS No. 147, Oct. 2002]. Impairment of customer-relationship intangibles are also no longer excluded from the impairment tests of SFAS No. 144. 687314080 as of 1/28/05 Page 2 Lecture Notes for Acct 592 Prof. Teresa Gordon FASB 141 Guidance on Assigning Values to Acquired Assets and Liabilities Balance Sheet Element Marketable securities Receivables Inventories – finished goods and merchandise Inventories – work-in-process Inventories – raw materials Plant and equipment to be used Plant and equipment to be sold Intangible assets recognized (other than goodwill) Land, natural resources, nonmarketable securities and other assets Accounts and notes payable, long-term debt, etc. Liabilities related to pension and other retirement benefits Accruals for warranties, vacation pay, deferred compensation and the like Other liabilities including unfavorable contracts and plant closing expense Goodwill on books of acquired company Deferred income taxes Other intangible assets (whether or not reported on acquired company’s books) Research and development assets assigned to a particular research and development project 687314080 as of 1/28/05 Measurement Fair value Present values of amount to be received determined at appropriate current interest rates, less allowances for uncollectibility and collection costs, if necessary Estimated selling prices less the sum of (a) costs of disposal and (b) a reasonable profit allowance for the selling effort of the acquiring entity Estimate selling prices of finished goods less the sum of (a) costs to complete, (b) costs of disposal, and (c) a reasonable profit allowance for the completing and selling effort of the acquiring entity based on profit for similar finished goods Current replacement cost Current replacement cost for similar capacity unless the expected future use of the assets indicates a lower value to the acquiring entity Fair value less cost to sell Estimated fair value Appraised values Present values of amounts to be paid determined at appropriate current interest rates Measured in accordance with relevant standards (SFAS No. 87 and SFAS No. 106) Present values of amounts to be paid determined at appropriate current interest rates Present values of amounts to be paid determined at appropriate current interest rates No value is assigned New value is determined based on differences between the assigned values and the tax bases of the recognized assets acquired and liabilities assumed in the business combination Recognized at fair value if (a) it arises from contractual or other legal rights even if those rights are not transferable or separable or (b) it is capable of being separated or divided from the acquired entity and sold, transferred, licensed, or exchanged even if there is no intention of doing so. However, an assembled work force shall NOT be recognized as an intangible asset apart from goodwill. Charged to expense if there is no alternative future use (FIN 4) Page 3 Lecture Notes for Acct 592 Prof. Teresa Gordon FASB 142 Guidance on Determining Useful Life of Intangibles Estimate of useful life should be based on all pertinent factors, in particular: 1. Expected use by the organization 2. Expected useful life of similar or related assets (example: mineral rights to depleting assets) 3. Legal, regulatory, or contractual provisions that might limit useful life 4. Renewal or extension provisions under laws, regulations or contracts (if such modifications can be accomplished without materially changing existing terms and conditions) 5. Effects of obsolescence, demand, competition and other economic factors such as known technological advances, legislative action that results in uncertain or changing regulatory environment, changes in distribution channels, stability of the industry, etc. 6. Level of maintenance expenditures required to obtain the expected future cash flows from the asset (high future costs would suggest very limited useful life) If the precise length of the useful life is not known, use the best estimate of the useful life. If no known factors limit the useful life, the useful life is considered to be indefinite. Note that indefinite does not mean infinite. Amortization Procedures For intangibles with a finite life (not including goodwill), the asset is amortized over its useful life to the reporting entity. Method The amortization method should reflect the pattern in which the economic benefits are consumed or used up. If the pattern is not known, use straight-line Residual Value The residual value is presumed to be zero unless at the end of the useful life to the reporting entity the asset is expected to have a useful life to another entity (1) which has committed to purchase the asset for determinable price or (2) the residual value can be determined by an existing market for that asset which is expected to exist at the end of the assets useful life. Evaluate Remaining Useful Life Each reporting period, evaluate estimated remaining useful life changes. If a revision is needed, handle as a change in accounting estimate. That is, amortize the carrying amount over the revised remaining useful life. Impairment Test for Intangibles Being Amortized Follow FASB 121 and write the intangible down to fair value if the anticipated future cash flows from the asset are less than its carrying value. Note that an intangible asset is not written down or off in the period of acquisition unless it becomes impaired (except for certain research and development intangibles associated with a particular project) 687314080 as of 1/28/05 Page 4 Lecture Notes for Acct 592 Prof. Teresa Gordon Impairment Tests for Intangibles Not Subject to Amortization Intangibles other than goodwill Intangible assets not amortized are tested for impairment in value at least annually. The estimated fair value of the intangible is compared to its carrying amount. If the carrying amount exceeds the fair value, an impairment loss is recognized in an amount equal to the excess. After an impairment loss is recognized, the adjusted carrying value becomes the new accounting basis. Once written down, the intangible can not be written up (no reversals permitted). Goodwill At the same time each year, the goodwill of a reporting unit is subjected to a two-step impairment test. [See below for what constitutes a reporting unit.] 1. The fair values of all identifiable tangible and intangible assets (other than goodwill) and all liabilities are determined. If the fair value is greater than the carrying value (including goodwill) of the unit’s net assets, there is no impairment. If the fair value is less than carrying value, the second step is performed to determine amount of impairment. 2. Implied goodwill is the difference between the fair values (without goodwill) determined in step 1 and the carrying value of all net assets (excluding goodwill). In essence, implied goodwill is determined by following essentially the same procedures used when a company is acquired. The only exception is that other intangible assets are recognized based or written up based on the impairment test. When implied goodwill is less than the carrying value of goodwill, an impairment loss is recognized. Note: a. b. c. Detailed evaluation can be carried forward to the next year without change if No significant changes in assets and liabilities in the reporting unit Most recent evaluation indicated substantial margin of implied goodwill over the carrying value of goodwill The likelihood that a current fair value determination would be less than the current carrying value is considered remote Triggering Events for Interim Reviews A test for goodwill impairment should be conducted between annual reviews if events and circumstances indicate that impairment is more likely than not. Examples: Adverse change in business climate Unanticipated competition Loss of key personnel Adverse action or assessment by a regulator Impairment Loss If the carrying value of goodwill exceeds the implied goodwill, the excess is recognized as an impairment loss. The aggregate amount of goodwill impairment losses is presented in the income statement as a separate line item before the subtotal for income from continuing operations. 687314080 as of 1/28/05 Page 5 Lecture Notes for Acct 592 Prof. Teresa Gordon Reporting Unit Given that goodwill is a residual value after all other assets and liabilities have been measured, an impairment test is only conducted for groups of assets that generate cash flows. The annual or more frequent goodwill impairment test is conducted at the level of a reporting unit. Reporting unit: operating segment or one-level below an operating segment (a component) that constitutes a business for which discrete financial information is available and regularly reviewed by segment management. What is a business? A business is a self-sustaining integrated set of activities and assets conducted and managed for the purpose of providing a return to investors. [EITF 98-3] The elements necessary to conduct normal operations will vary by industry and by the operating strategies of the unit. In general, a business consists of inputs, processes and outputs: Inputs Long-lived assets, including intangible assets, or rights to the use of long-lived assets. Intellectual property. The ability to obtain access to necessary materials or rights. Employees. Processes The existence of systems, standards, protocols, conventions, and rules that act to define the processes necessary for normal, self-sustaining operations, such as 1. strategic management processes, 2. operational processes, and 3. resource management processes. Outputs The ability to obtain access to the customers that purchase the outputs of the component unit. Financial Statement Presentation Goodwill Balance Sheet Separate line item Other intangible assets One or more separate lines 687314080 as of 1/28/05 Income Statement Impairment loss on separate line before income from continuing operations Amortization expense and impairment losses presented in income statement line items in the continuing operations section Page 6 Lecture Notes for Acct 592 Prof. Teresa Gordon Other Disclosures Disclosures related to intangible assets and goodwill are much more extensive under the new standards: Research and Development Costs Written Off Amount of R&D assets acquired and written off during period and the line item in which the amount was included on the income statement Intangibles subject to amortization: In total and by any major intangible asset classes: Amount Residual value Weighted-average amortization period Gross carrying amount and accumulated amortization Aggregate amortization expense for period Estimated amortization expense for each of the next five years Intangibles not subject to amortization and impairment losses: In total and by any major intangible asset classes: Carrying amount For each impairment loss A description of the asset and circumstances leading to loss Amount of impairment loss and method for determining fair value Caption in income statement for account in which loss is included Goodwill: Changes in carrying amount of goodwill during the period including Aggregate amount of goodwill acquired Aggregate amount of impairment losses recognized Amount of goodwill included in gain or loss on disposal of reporting unit For each goodwill impairment loss A description of the asset and circumstances leading to loss Amount of impairment loss and method for determining fair value of the associate reporting unit If estimate of loss has not been finalized, explain why and report any adjustments to losses initially estimated in a prior year Business Acquisitions: Material business combinations (not a complete list): Name and description of entity acquired Reasons for acquisition Period for which results of acquired company are included in income statement Cost of the acquired entity, with details Condensed balance sheet of acquired entity with fair values at acquisition Related contingencies Individually immaterial business combinations (not a complete list): Number of entities acquired with brief description Aggregate cost of acquired entities, with details Related contingencies 687314080 as of 1/28/05 Page 7 Lecture Notes for Acct 592 Prof. Teresa Gordon Examples - Amortizing Intangible Assets 1. A company acquires a broadcast license that expires in 5 years. The license is renewable every 10 years if the license holder provides at least an average level of service and complies with Federal Communication Commission (FCC) rules and policies. The previous owner renewed the license twice. The new owner intends to renew the license in the foreseeable future. What is the useful life? Should the cost be amortized or subject only to an annual impairment test? 2. The company in example 1 operates the television station for 10 years (easily obtaining a renewal license as expected). The FCC decides that it will no longer renew licenses. Instead, broadcast rights will be put up for bid. The current license has five years before it expires. What is the useful life? Should the cost be amortized or subject only to an annual impairment test? 3. A direct mail marketing company acquires a customer list and expects to be to derive benefit from the information for at least one year but no more than three years. The acquiring company intends to add customer names and other information to the list in the future. Management’s best estimate of the useful life of the names on the list at acquisition (given the pattern in which the expected benefits will be consumed) is about 18 months. What is the useful life? Should the cost be amortized or subject only to an annual impairment test? 687314080 as of 1/28/05 Page 8