MACE – Wolfe 9-18-14 Fair Value Acquisition Acctg

advertisement

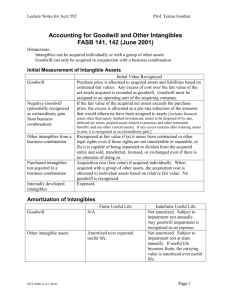

What’s Fair About Fair Value Acquisition Accounting? Presented by W. Michael Wolfe, CPA/ABV, CVA Fesnak, LLP mwolfe@fesnak.com Main Line Association for Continuing Education September 18, 2014 Acquisition Accounting – Topics for Today Evolution of Acquisition Accounting Evaluating the Acquisition Recording the Acquisition Subsequent Impairment Testing What’s Fair About “Fair Value” Acquisition Accounting ??? Fesnak, LLP Acquisition Accounting Skillsets Corporate Finance Business (Enterprise) Valuation Intangible Asset Valuation Negotiating Accounting Fesnak, LLP Acquisition Accounting Evolution of Acquisition Accounting Fesnak, LLP Evolution of Acquisition Accounting Pre-2002 Purchase Method (treated all intangibles as goodwill) Pooling-of-Interests Method (combining of balance sheets) Goodwill amortized up to 40 years 2002 SFAS 141 Issued – Required Purchase Method Accounting (with identifiable intangibles recorded at fair value and the residual recorded as goodwill) Goodwill not longer amortized. Instead tested annually for impairment Finite-lived intangible assets amortized Indefinite-lived intangible assets tested periodically for impairment SFAS 142 Issued – 2 Step Annual Impairment testing required with no amortization of Goodwill allowed SFAS 157 Issued – Concept of “Fair Value” introduced Fesnak, LLP Evolution of Acquisition Accounting 2011 Step 0 Introduced – Qualitative Assessment 2012 Private Company Council (PCC) formed – first agenda items included Purchase Accounting and Goodwill Impairment 2013 AICPA issues “FRF for SMEs” – An optional, non-GAAP accounting framework issued for small/medium sized businesses not needing to comply with GAAP. Private Company Council (PCC) Issues Exposure Drafts on “Accounting Alternatives” for private companies under GAAP for Business Combinations and Goodwill for FASB consideration. AICPA issues Accounting and Valuation Guide - Testing Goodwill for Impairment Fesnak, LLP Private Company Council (PCC) What is the PCC? Formed in 2012 under authorization of Financial Accounting Foundation (FAF) Board A new body established to improve the process of setting accounting standards for private companies Will issue accounting alternatives to GAAP for private companies Will not apply to public companies or non-profits 2 Principal Responsibilities: Work jointly with the FASB to decide whether and when alternatives to US GAAP are warranted for private companies. Act as primary advisory body to FASB for appropriate treatment for private company’s of items under consideration under FASB technical agenda. Issued 2 Exposure Drafts in July 2013 related to Purchase Accounting and GW Impairment. Fesnak, LLP Private Company Council (PCC) PCC Issue No. 13-01A – Accounting for Identifiable Intangible Assets in a Business Combination (Topic 805) Would allow private companies to elect to only recognize those intangibles arising from non-cancellable contractual terms or those arising from other legal rights. PCC Issue No. 13-01B – Accounting for Goodwill (Topic 350) Written into accounting standards early 2014 Test for goodwill impairment only when a triggering event occurs rather than the current annual impairment test Testing will occur at the enterprise level, not at reporting unit level 2 Step approach replaced by 1 Step approach Goodwill will be amortized not to exceed 10 years Effective date - years beginning after 12/15/14. Early adoption is permitted. May not be appropriate for certain companies, especially those contemplating an IPO. Fesnak, LLP FRF for SMEs FRF for SMEs = “Financial Reporting Framework for Small and MediumSized Entities” Issued by AICPA in 2013 Intended to be responsive to the financial reporting needs of small and medium-sized entities Special purpose framework - no official or authoritative status – purely optional Financials prepared under this framework may assert that such financials have been prepared in accordance with the AICPA’s FRF for SMEs accounting framework. RFR for SMEs is NOT GAAP. Intangible Assets acquired in Business Combinations – entities should make an accounting policy choice: Separately recognize Intangible Assets as Identifiable Intangible Assets or Subsume identifiable Intangible Assets into Goodwill Goodwill: Amortize over same period as that used for federal income tax If not amortized for tax, then amortize over 15 years Fesnak, LLP Acquisition Accounting Evaluating the Acquisition Fesnak, LLP Evaluating the Acquisition Read the LOI Discuss evolution of acquisition with transaction team Read the Confidential Memorandum Understand the methodology used to determine the offer and final price including any forecasts utilized Identify the most important asset acquired Read the APA or SPA Purchase price Purchase price adjustments Earn-outs Identify assets acquired/liabilities assumed Review the Addendums (this is where the IP detail usually resides) Fesnak, LLP Evaluating the Acquisition How will the Purchase Price be paid? Cash Notes Earn-out payments Securities Is Purchase Price a Market Participant price? Is there a perception that deal was a bargain purchase? Any warrants/options/puts/calls issued at time of transaction? Fesnak, LLP Acquisition Accounting Recording the Acquisition Fesnak, LLP Recording the Acquisition Objectives: Record assets acquired and liabilities assumed at fair value via a Purchase Price Allocation Pass the review process of the external auditors Tangible assets: Accounts receivable – fair value usually book value Inventory – fair value is not book value! Fixed Assets – fair value may require appraisals Intangible Assets: Identifiable intangibles – Fair value determination of each is required Goodwill – residual value Fesnak, LLP Recording the Acquisition Common Identifiable Intangible Assets: Trade Names/Trademarks (indefinite or finite) Patents (finite) Trade Secrets (indefinite or finite) Developed Software (finite) Customer Relationships (finite) Noncompetition Agreements (finite) Useful life of finite-lived intangibles must be established for GAAP amortization purposes Fesnak, LLP Recording the Acquisition PPA Process Establish the IRR inherent in the Transaction. WACC analysis – should approximate the IRR. Select Risk Rate for each intangible - should be north of IRR. Value the identifiable intangibles. Perform a WARA analysis - should result in lowest returns for tangible assets, higher returns for identifiable intangibles and highest return for goodwill. WARA, IRR and WACC should all agree. Proves that the intangible values are reasonable. Fesnak, LLP Recording the Acquisition Valuation of Identifiable Intangibles Most important intangible should be valued using the MPEEM method (a modified DCF). Other methods should be used for other intangibles. Example methods: Relief from Royalty Cost Replication With and Without Fesnak, LLP Acquisition Accounting Subsequent Impairment Testing Fesnak, LLP Subsequent Impairment Testing Goodwill Impairment Testing Process (ASC 350): Step 0 – Qualitative Assessment – May eliminate need for Step 1 Step 1 – Test for Goodwill Impairment – Compare Enterprise Value to Carrying Value. If EV is less than CV, proceed to Step 2. If not, GW is assumed not impaired. Step 2 – Determine amount of Impairment – Purchase accounting exercise “as if” company was re-acquired. If residual goodwill is less than its carrying value, an impairment charge is recorded. Test by Reporting Unit Test Annually Fesnak, LLP Subsequent Impairment Testing Impairment Testing – Other Intangibles: Indefinite-lived intangibles - ASC 350 contains more procedures than just a goodwill test: Indefinite lived assets (such as trade names) are tested directly for impairment annually (or upon a triggering event). If FV is less than CV, impairment is indicated, and the asset is written down to its fair value Finite-lived intangibles – tested under ASC 360: If sum of undiscounted cash flows is greater than CV, no impairment is assumed to exist. If sum of undiscounted cash flows is less than CV, value is determined by discounted cash flow. If value is less than CV, then impairment is indicated. May be tested with an asset group. Fesnak, LLP Acquisition Accounting Thank You for Attending !!! Fesnak, LLP