48 - Tuition Discounting

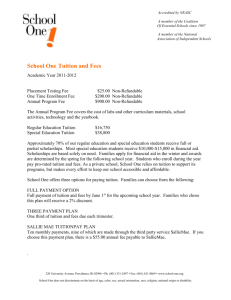

advertisement

Last Updated June 21, 2012 Tuition Discounting Calculation Options During the 2010/11 audit KPMG noted that the tuition discounting query data provided by some campuses utilizing campus defined and maintained queries over-reported refunds. This would result in tuition that would not be properly discounted and the SRECNA would over-report revenues and expenses. Financial Services worked with CMS to understand the cause of the discrepancy and found that while some campuses set a payment priority flag on some aid item types that is less than 999 [priority set for cash payments], as shown in this screenshot, not all aid item types are setup with a priority less than a cash payment. Students sometimes make cash payments even when they know that they have financial aid awards. When this occurs, aid items with a lower priority will bump cash payments out of the students account and apply to the charges due so the reporting of the aid and refunds is accurate. When the priority on the aid item is equal to the cash payment priority, the aid applied after a cash payment will not bump the cash payment and will be reported as a refund, therefore refunds are over-reported. One approach to correct the query results gathered as above would be to create another query that reported student accounts with cash payments that subsequently received financial aid then adjust the results from the original query. On an on-going basis, this issue can be eliminated by setting aid priority less than a cash payment. An alternative approach removes the question of when the awarded vs. applied to the student account by pulling the student account balance and aid then calculating refunds independently in a report. Here is an example of the report: CSU, Office of the Chancellor | Tuition Discounting 1 Last Updated June 21, 2012 Tuition Discounting Calculation Options Starting with the FA Award, first four columns reflect the FA award, fees and waivers exactly as they occurred by term then the excess calculated and reported in the refund or balance due column as appropriate. The FA Award column excludes the agency aid types so there is no adjustment necessary for those awards. The aid amount is reduced by the calculated refund then the resulting discount amount is allocated between the registration fees and housing charges. With this approach, the tuition discount will always be calculated correctly, with no over-reporting of refunds. However, it doesn’t take into account the aid types that are restricted to registration only like Cal Grant A or SUG so all aid is applied equally to both. As a result, there is a risk that the amount discounted in tuition may be too low and amount discounted in housing may be too high (of equal amts). KPMG has reviewed this and will accept the discounting produced by the report method (alternative approach). This alternate method is the preferred systemwide approach for gathering the supporting information for the tuition discounting entry. However, campuses must create and maintain such a report independently as there are no systemwide naming conventions related to item types that allow such a report to be generated. Also, there is a lack of standard business processes in student finance for example, the waiver column may have information for some campuses while others choose not to apply waivers to student accounts rather they do not charge the fee. Attached is a sample report specification from the Long Beach campus. FA Allowance.pdf CSU, Office of the Chancellor | Tuition Discounting 2