Capital Budgeting Techniques: NPV, IRR, Payback

advertisement

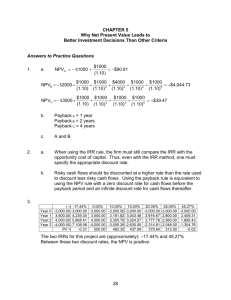

Capital Budgeting Chapter 12 • Capital budgeting: process by which organization evaluates and selects long-term investment projects – Ex. Investments in capital equipment, purchase or lease of buildings, purchase or lease of vehicles, etc. • There are various techniques used to make capital budgeting decisions. Payback • Small businesses use this method because it is simple • Requires calculation of number of years required to pay back original investment • Payback-based decisions: – Between two mutually exclusive investment projects, choose project with shortest payback period – Set a predetermined standard • Ex. “Accept all projects with payback of less than 5 years and reject all others” Payback • Poor method on which to rely for allocation of scarce capital resources because: 1. 2. • Ex.: Payback ignores time value of money Payback ignores expected cash flows beyond payback period. PROJECT A Cost = $100,000 Expected Future Cash Flow: Year 1 $50,000 Year 2 $50,000 Year 3 $110,000 Year 4 and thereafter: None Total = $210,000 Payback = 2 years PROJECT B Cost = $100,000 Expected Future Cash Flow: Year 1 $100,000 Year 2 $5,000 Year 3 $5,000 Year 4 and thereafter: None Total = $110,000 Payback = 1 year -Payback period for Project B is shorter, but Project A provides higher return -Project A is superior to Project B. Net Present Value • Difference between present value of expected future benefits of project to present value of expected cost of project • If NPV is positive (if present value of benefits exceeds present value of cost), then project is accepted. • If NPV is negative (if present value of costs exceeds present value of benefits), then project is rejected. • NPV = PVB – PVC – Where NPV = net present value PVB = present value of benefits PVC = present value of costs Net Present Value • Between two mutually exclusive projects, choose project with highest net present value. • Ex.: Consider Project A and Project B and 12% discount rate PVBa = ($50,000)(0.893) + ($50,000)(0.797) + ($110,000)(0.712) PVBa = $162,820 PVBb = ($100,000)(0.893) + ($5,000)(0.792) + ($5,000)(0.712) PVBb = $96,820 PVCa = PVCb = $100,000 NPVa = $162,000 – $100,000 = $62,800 NPVb = $96,820 – $100,000 = ($3,180) – Project A is superior to Project B because PVBa > PVCa and PVBb < PVCb – Return on Project B is insufficient to justify investment given firm’s cost of capital. Net Present Value Selection of a Discount Rate • To find discounted present value of sum of money to be received in future, choose rate at which money in hand may be invested between now and future period in which money is to be received. – This rate represents individual’s “opportunity cost,” or cost of next-best opportunity. Internal Rate of Return • Discount rate that exactly equates present value of expected benefits to cost (drives NPV to zero) • Find this discount rate by trial and error • Ex.: – Use discount rate of 20% as first estimate of IRR on Project A. NPVa = PVBa – PVCa NPVa = $40,040 – Since NPV is too high, use higher estimate of 40%. NPVa = $1,240 – Use estimate of 41% to get closer to zero. NPVa = $290 Internal Rate of Return • Investment of $100,000 at 41% annual compound rate of return allows withdrawal of that investment as a cash flow of $50,000 at end of 1 year, $50,000 at end of 2nd year, and $110,000 at end of 3rd year. Project A Cash Flow Schedule Year 1 2 3 Beginning investment $100,000 $91,000 $78,310 Annual earnings at 41% 41,000 37,310 _32,107 Subtotal $141,000 $128,310 $110,417 Annual cash flow (50,000) (50,000) (110,417) Ending investment $91,000 $78,310 $-0- Internal Rate of Return • In general, any project with IRR greater than or equal to cost of capital should be accepted. Any project with IRR less than cost of capital should be rejected. • In this case, Project A would be accepted. Internal Rate of Return • Ex. (continued): • IRR for Project B is approximately 8.75%. NPVb = $120 • 8.75% per year is less than cost of capital of 12%. Achieved rate of return on Project B falls short of attainable rate of return on other opportunities. Internal Rate of Return IRR of an Annuity • Project A and Project B do not provide benefits in form of annuity (constant annual cash flow). • If project costing $100,000 and returning $25,000 per year for 5 years is available, calculate appropriate annuity factor: $100,000 = $25,000X X = 4.0 • X represents annuity factor that will cause $25,000, 5-year annuity to have present value of $100,000. • Refer to table of annuity factors in Exhibit 11.4 to find discount rate that has present value of annuity factor equal to 4.00 after 5 years. Internal Rate of Return Personal Computer Applications • Most basic business-oriented electronic calculators, personal computers, businessoriented spreadsheet applications, specialpurpose capital budgeting software packages can do actual calculations or be programmed to solve capital budgeting problems. Profitability Index • Also benefit/cost ratio • Calculated as ratio of present value of benefits of investment to cost of investment PI = NPV(benefits)/NPV(costs) • General rule: All projects with PI > 1.0 should be accepted. • Between two or more mutually exclusive projects having different costs, choose project with highest profitability index. Profitability Index • Investment decisions based on profitability index will be same as decisions made using net present value. • All projects having positive net present value have profitability index larger than 1.0 and therefore are acceptable. Selection of Method • All 3 methods (net present value, internal rate of return, profitability index) result in same accept-reject decision for given investment opportunity. • There are three important circumstances under which methods may yield conflicting decisions. Selection of Method 1. Choosing from among mutually exclusive investment projects with similar costs, but radically differing time patterns of cash inflows. – Ex. One project provides large cash flows in early years and small cash flows in later years compared with another project providing small cash flows in early years but large cash flows in later years. • Project having highest net present value and profitability may have lowest internal rate of return. Selection of Method 1. (continued) – Choice of method depends on which assumption is closest to reality. – Choice should be based on which reinvestment rate is closest to rate that firm will be able to earn on cash flows generated by project. • • If cash flows can be reinvested at cost of capital, select project with higher net present value. If cash inflows can be reinvested at IRR of project, select project with higher IRR. Selection of Method 1. (continued) – General rule: NPV method should be preferred if conflict arises because projects with very high IRRs relative to firm’s cost of capital are rare. In most cases, reinvestment rate will be closer to cost of capital than to IRR and thus, NPV method is normally preferred to IRR method. Selection of Method 2. Choosing from among mutually exclusive projects with widely differing costs. – If project with highest NPV has lowest PI and IRR, in general, give preference to project with highest NPV since this will maximize value of firm. – If project with highest PI and IRR is substantially less expensive than competing project, former is selected because lower-cost project may be perceived as less risky than higher-cost project. Selection of Method 3. Capital rationing where insufficient capital is available to accept all projects having positive NPVs. – Rank-order projects from highest IRR to lowest and select projects that firm has sufficient capital to accept. • In general, NPV method preferred over IRR and PI methods. Dealing With Uncertainty • In practice, uncertainty is often dealt with through simple mechanism of assigning higher discount rate to riskier projects. – How much higher depends on management’s perception of degree of risk and additional compensation required because of that risk Case Study • Droppitt Parcel Company is considering purchasing new equipment to replace existing equipment that has book value of zero and market value of $15,000. • New equipment costs $90,000 and is expected to provide production savings and increased profits of $20,000 per year for the next 10 years. • New equipment has expected useful life of 10 years, after which its estimated salvage value would be $10,000. • Straight-line depreciation Effective tax rate: 34% Cost of capital: 12% • “Machinery Replacement” Problem: Should Droppitt replace current equipment? Case Study • See Exhibit 12.4 1. Effective cost of new equipment: $80,100 – Droppits trades its old equipment in for new equipment by selling it and applying sale proceeds to new equipment. Case Study 2. Calculate present value of expected benefits of new equipment. – All benefits have been converted to after-tax basis before present values are calculated. – Profit increase is multiplied by 0.66 (1.00 – tax rate) to determine increased profit remaining after tax. – Calculate tax benefit resulting from effect of depreciation by multiplying annual depreciation deduction by effective tax rate. – Reflects salvage value of new equipment at end of its expected useful life. • No tax effect here because there is no profit or loss involved. Case Study 3. NPV: $13,068 4. IRR (solved by trial and error using electronic calculator): 15.7% • New machine should be purchased to replace old machine since NPV is positive and IRR exceeds cost of capital.