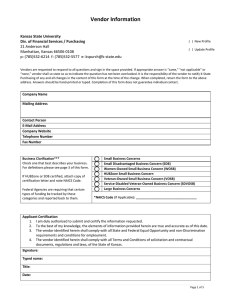

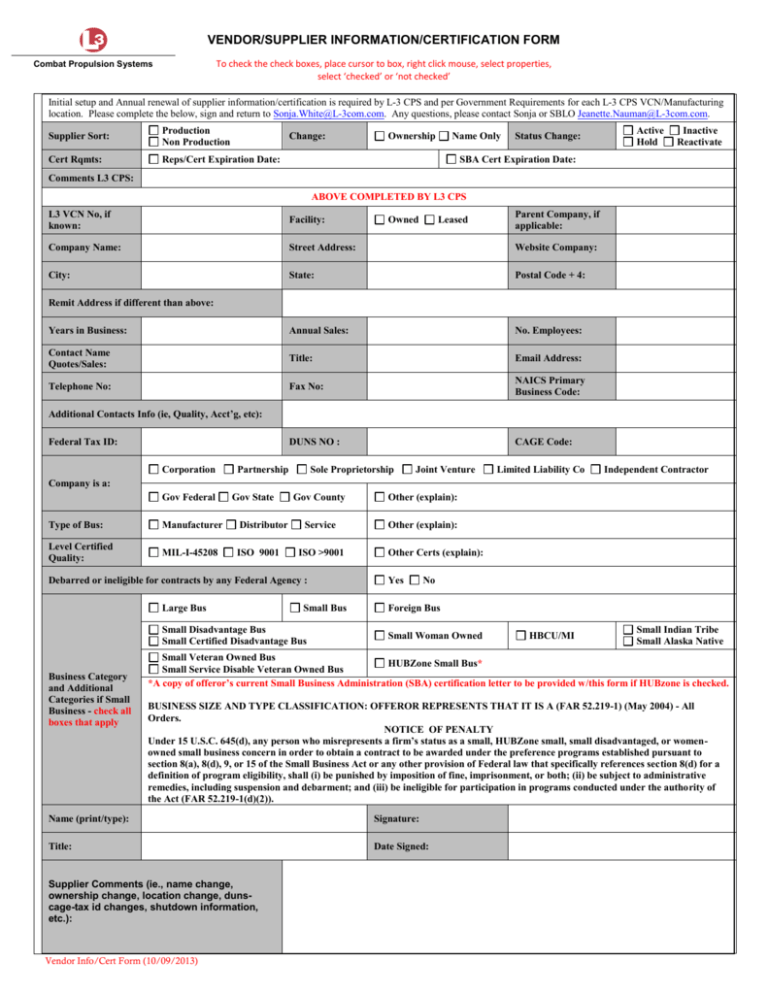

vendor/supplier information/certification form - L

advertisement

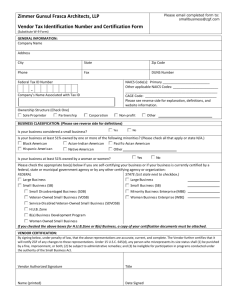

VENDOR/SUPPLIER INFORMATION/CERTIFICATION FORM To check the check boxes, place cursor to box, right click mouse, select properties, select ‘checked’ or ‘not checked’ Combat Propulsion Systems Initial setup and Annual renewal of supplier information/certification is required by L-3 CPS and per Government Requirements for each L-3 CPS VCN/Manufacturing location. Please complete the below, sign and return to Sonja.White@L-3com.com. Any questions, please contact Sonja or SBLO Jeanette.Nauman@L-3com.com. Supplier Sort: Production Non Production Cert Rqmts: Reps/Cert Expiration Date: Change: Ownership Name Only Status Change: Active Hold Inactive Reactivate SBA Cert Expiration Date: Comments L3 CPS: ABOVE COMPLETED BY L3 CPS L3 VCN No, if known: Facility: Company Name: Street Address: Website Company: City: State: Postal Code + 4: Years in Business: Annual Sales: No. Employees: Contact Name Quotes/Sales: Title: Email Address: Telephone No: Fax No: NAICS Primary Business Code: DUNS NO : CAGE Code: Owned Leased Parent Company, if applicable: Remit Address if different than above: Additional Contacts Info (ie, Quality, Acct’g, etc): Federal Tax ID: Corporation Partnership Sole Proprietorship Joint Venture Limited Liability Co Independent Contractor Company is a: Gov Federal Gov State Type of Bus: Manufacturer Distributor Level Certified Quality: MIL-I-45208 ISO 9001 Gov County Other (explain): Service Other (explain): ISO >9001 Debarred or ineligible for contracts by any Federal Agency : Large Bus Small Bus Small Disadvantage Bus Small Certified Disadvantage Bus Business Category and Additional Categories if Small Business - check all boxes that apply Other Certs (explain): Yes No Foreign Bus Small Woman Owned HBCU/MI Small Indian Tribe Small Alaska Native Small Veteran Owned Bus HUBZone Small Bus* Small Service Disable Veteran Owned Bus *A copy of offeror’s current Small Business Administration (SBA) certification letter to be provided w/this form if HUBzone is checked. BUSINESS SIZE AND TYPE CLASSIFICATION: OFFEROR REPRESENTS THAT IT IS A (FAR 52.219-1) (May 2004) - All Orders. NOTICE OF PENALTY Under 15 U.S.C. 645(d), any person who misrepresents a firm’s status as a small, HUBZone small, small disadvantaged, or womenowned small business concern in order to obtain a contract to be awarded under the preference programs established pursuant to section 8(a), 8(d), 9, or 15 of the Small Business Act or any other provision of Federal law that specifically references section 8(d) for a definition of program eligibility, shall (i) be punished by imposition of fine, imprisonment, or both; (ii) be subject to administrative remedies, including suspension and debarment; and (iii) be ineligible for participation in programs conducted under the authority of the Act (FAR 52.219-1(d)(2)). Name (print/type): Signature: Title: Date Signed: Supplier Comments (ie., name change, ownership change, location change, dunscage-tax id changes, shutdown information, etc.): Vendor Info/Cert Form (10/09/2013) VENDOR/SUPPLIER INFORMATION/CERTIFICATION FORM Combat Propulsion Systems To check the check boxes, place cursor to box, right click mouse, select properties, select ‘checked’ or ‘not checked’ GENERAL INFORMATION TO ASSIST IN COMPLETING THE ABOVE (http://www.acquisition.gov/far/ and/or http://farsite.hill.af.mil/VFDFARA.HTM): NAICS Code/Number of Employees: Number of Employees for last 12 months (FAR 52.212-3 (c)(8)(ii)(A)) OR North American Industrial Classification System (NAICS) Code (FAR 19.102) Duns, Taxpayer Identification, Number of Employees, Parent Company: Duns (Data Universal Numbering System) - FAR 52.204-6 There is no charge and can be obtained online, wait is usually 30 business days. DUNS number may be issued to any business worldwide. Now available to individuals along with corporations or other organizations. Taxpayer Identification (TIN) - FAR 52.204-3 Parent Company – A parent company is a company that owns enough voting stock in another firm to control management and operations by influencing or electing its board of directors; the second company being deemed as a subsidiary of the parent company. The definition of a parent company differs by jurisdiction, with the definition normally being defined by way of laws dealing with companies in that jurisdiction Company is a – FAR 52.204-3 (Corporation, LLC, etc) Type of Business: Manufacturer Original Component Manufacturer (OCM) – An organization that designs and/or engineers a part and is pursuing or has obtained the intellectual property rights to that part. Original Equipment Manufacturer (OEM) –An organization that designs and/or engineers equipment and is pursuing or has obtained the intellectual property rights to that equipment. This term is synonymous with OCM Distributor Franchised Distributor – A distributor with whom the OCM has a contractual agreement to buy, stock, repackage, sell and distribute its product lines. Franchised distributors normally offer the product for sale with full manufacturer’s warranty. Franchising contracts may include clauses that provide for the OCM’s marketing and technical support, failure analysis and corrective action, and exclusivity of inventory. Independent Distributor – A distributor that purchases parts with the intention to resell them. Independent Distributors may be franchised for select, but not all, product lines. For purposes of counterfeit risk mitigation, a distributor is considered independent when not franchised for the item to be procured. Services – A supplier that provides services based on a Scope/Statement of Work which may include material and/or labor and/or other direct costs. Small Business Categories: SMALL BUSINESS (SB) – (FAR 52.219.1)(May 2004) .Small Business Concern” means a concern, including its affiliates, that is independently owned and operated, not dominant in the field of operation in which it is bidding, and qualifies as a small business under the criteria in 13 CFR Part 121 and the size standard identified by the NAICS Code identified in above. WOMEN-OWNED SMALL (WOSB) (FAR 52.219.1)(May 2004) – “Women-Owned Small Business Concern” means a small business concern which is at least 51% owned by one or more women or, in the case of any publicly owned business, at least 51% of the stock of which is owned by one or more women and whose management and daily business operations are controlled by one or more women. HISTORICALLY BLACK COLLEGE or UNIVERSITY (HBCU) (FAR 52.226-2)(Oct 2008) – "Historically Black College or University" means an institution determined by the Secretary of Education to meet the requirements of 34 CFR 608.2. For the Department of Defense, the National Aeronautics and Space Administration, and the Coast Guard, the term also includes any nonprofit research institution that was an integral part of such a college or university before November 14, 1986. MINORITY INSTITUTION (MI) (FAR 52.226-2)(Oct 2008) - "Minority Institution" means an institution of higher education meeting the requirements of Section 365(3) of the Higher Education Act of 1965 (20 U.S.C.1067k), including a Hispanic-serving institution of higher education, as defined in Section 502(a) of the Act (20 U.S.C. 1101a). SMALL DISADVANTAGED (SDB) (FAR 52.219.1)(May 2004) – “Small Disadvantaged Business Concern” [whether or not also women-owned] means a small business concern owned and controlled by socially and economically disadvantaged individuals that has received certification as a small disadvantaged business concern consistent with 13 CFR 124.1002. OFFEROR 0 is, 0 is not SBA Certified SDB HUB Zone Small Business Certified (HUB Zone SB) (FAR 52.219-1)(May 2004) - “HUB Zone Small Business Concern” must be a small business according to the definition of FAR 52.219-1 and the NAICS Code size standards, be on the List of Qualified HUBZONE Small Business Concerns maintained by the Small Business Administration, and no material change in ownership and control, principal office, or HUBZone employee percentage has occurred since it was certified by the Small Business Administration in accordance with 13 CFR Part 126. A copy of the offeror’s current Small Business Administration (SBA) certification letter to be provided with this form. VETERAN-OWNED SMALL BUSINESS (VOSB) (FAR 52.219-1)(May 2004) .Veteran-Owned Small Business concern. means a small business with no less than 51% of which is owned by one or more veterans (as defined at 38 U.S.C. 101(2)) or, in the case of any publicly owned business, not less than 51% of the stock of which is owned by one or more veterans; and the management and daily operations of which are controlled by one or more veterans. SERVICE-DISABLED VETERAN-OWNED SMALL BUSINESS (SDVOSB) (FAR 52.219-1)(May 2004) – “Service-Disabled Veteran-Owned Small Business concern” means a small business not less than 51% of which is owned by one or more service disabled veterans (as defined at 38 USC 101(2)) or, in the case of any publicly owned business, not less than 51% of the stock of which is owned by one or more service disabled veterans; controlled, and actively managed by the individual(s) or the spouse/caregiver of a veteran with permanent or severe disabilities. ALASKAN NATIVE CORPORATION (ANC) (FAR 19.701) – “Alaskan Native Corporation” means any Regional Corporation, Village Corporation, Urban Corporation, or Group Corporation organized under the laws of the State of Alaska in accordance with the Alaska Native Claims Settlement Act, as amended (43 U.S.C. 1601, et seq), and which is considered a minority and economically disadvantaged concern under the criteria at 43 U.S.C. 1626(e) (1). This definition also includes ANC direct and indirect subsidiary corporations, joint ventures, and partnerships that meet the requirements of 43 U.S.C. 1626(e) (2). INDIAN TRIBE – (FAR 19.701) “Indian Tribe. means any Indian tribe, band, group, pueblo, or community, including native villages and native groups (including corporations organized by Kenai, Juneau, Sitka, and Kodiak) as defined in the Alaska Native Claims Settlement Act (43 U.S.C. 1601, et seq.), that is recognized by the Federal Government as eligible for services from the Bureau of Indian Affairs in accordance with 25 U.S.C. 1452 (e). This definition also includes Indian-Owned economic enterprises that meet the requirements of 25 U.S.C. 1452(e). Vendor Info/Cert Form (10/09/2013)