Form - ZGF

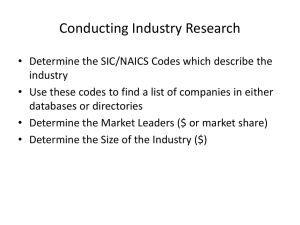

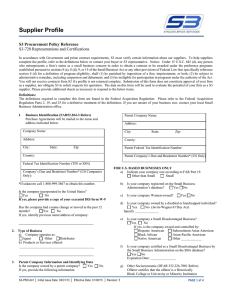

advertisement

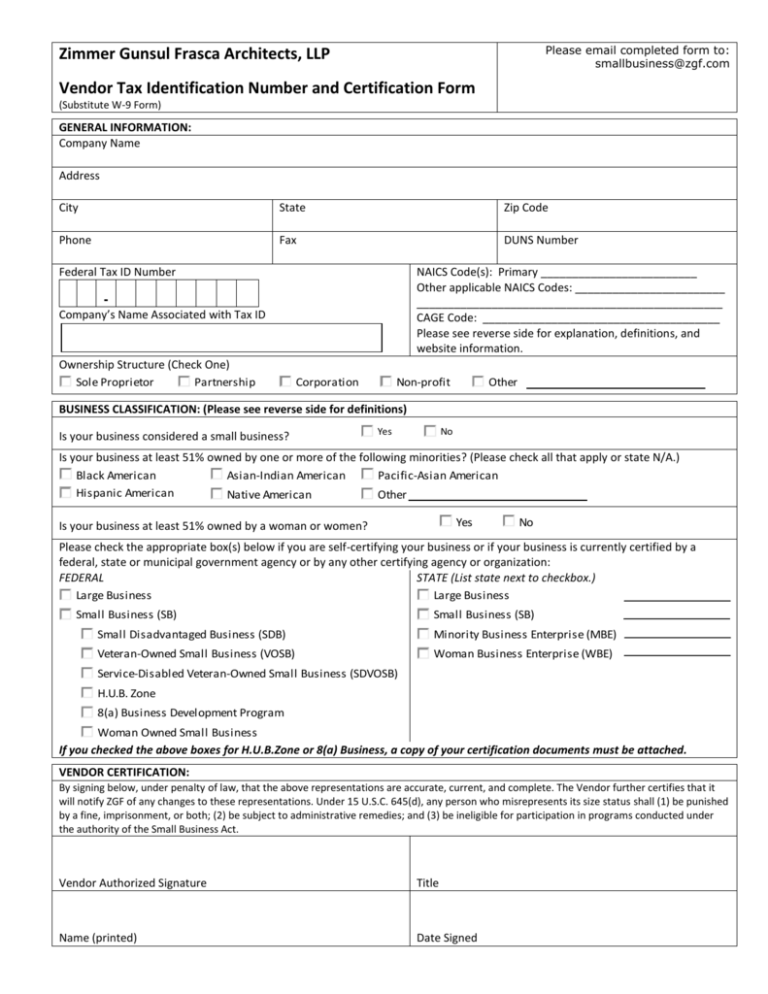

Please email completed form to: smallbusiness@zgf.com Zimmer Gunsul Frasca Architects, LLP Vendor Tax Identification Number and Certification Form (Substitute W-9 Form) GENERAL INFORMATION: Company Name Address City State Zip Code Phone Fax DUNS Number Federal Tax ID Number NAICS Code(s): Primary _________________________ Other applicable NAICS Codes: ________________________ _________________________________________________ CAGE Code: ______________________________________ Please see reverse side for explanation, definitions, and website information. Company’s Name Associated with Tax ID Ownership Structure (Check One) Sole Proprietor Partnership Corporation Non-profit Other BUSINESS CLASSIFICATION: (Please see reverse side for definitions) Is your business considered a small business? Yes No Is your business at least 51% owned by one or more of the following minorities? (Please check all that apply or state N/A.) Black American Asian-Indian American Pacific-Asian American Hispanic American Native American Other Yes Is your business at least 51% owned by a woman or women? No Please check the appropriate box(s) below if you are self-certifying your business or if your business is currently certified by a federal, state or municipal government agency or by any other certifying agency or organization: FEDERAL STATE (List state next to checkbox.) Large Business Large Business Small Business (SB) Small Business (SB) Small Disadvantaged Business (SDB) Minority Business Enterprise (MBE) Veteran-Owned Small Business (VOSB) Woman Business Enterprise (WBE) Service-Disabled Veteran-Owned Small Business (SDVOSB) H.U.B. Zone 8(a) Business Development Program Woman Owned Small Business If you checked the above boxes for H.U.B.Zone or 8(a) Business, a copy of your certification documents must be attached. VENDOR CERTIFICATION: By signing below, under penalty of law, that the above representations are accurate, current, and complete. The Vendor further certifies that it will notify ZGF of any changes to these representations. Under 15 U.S.C. 645(d), any person who misrepresents its size status shall (1) be punished by a fine, imprisonment, or both; (2) be subject to administrative remedies; and (3) be ineligible for participation in programs conducted under the authority of the Small Business Act. Vendor Authorized Signature Title Name (printed) Date Signed If you are self-certifying as a Small Business, please include the NAICS code for the work that you have been contracted to perform. If you are self-certifying as a Small Disadvantaged Business the primary NAICS Codes is required. The Summary Subcontract Report, a breakout report that the prime contractor is required to submit to the Government annually, pursuant to the Federal Acquisition Regulation (FAR) clause at 52.219-9(1)(2)(iii), uses the 6-digit NAICS code. You may wish to review the definitions for the Small Business categories in the Federal Acquisition Regulation (FAR) 19.7 or 52.219-8 www.acquisition.gov/far/html/FARTOCP52.html. If you have difficulty ascertaining your size status, of have other questions please refer to SBA’s website at http://www.sba.gov/category/navigationstructure/contracting or contact your local SBA office. DEFINITIONS: DUNS Number: Information about registration with Dun & Bradstreet in order to get an assigned D-U-N-S number can be found at: http://www.dnb.com/get-a-duns-number.html or http://www.sba.gov/content/getting-d-u-n-s-number NAICS: The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. The U.S. Census Bureau is the authority and the official website for information, reference files and tools is https://www.census.gov/eos/www/naics/. Small Business Enterprise: The two most widely used small business standards are as follows – less than 500 employees for most manufacturing and mining industries and $6.0 million in average annual receipts for most non-manufacturing industries. However, many exceptions exist. To see if you qualify as a small business go to http://www.sba.gov/content/small-business-size-standards Minority: A citizen or lawful permanent resident of the United States who is an ethnic person of color and who is Black American. Person having origins of the Black racial groups of Africa. Asian-Indian American. A person whose origins are from India, Pakistan or Bangladesh. Pacific-Asian American. A person whose origins are from Japan, China, Taiwan, Korea, Vietnam, Laos, Cambodia, The Philippines, Samoa, Guam or the United States Trust Territories of the Pacific including the Northern Marianas. Hispanic American. A person of Mexican, Puerto Rican, Cuban or Central or South American culture or origin, regardless of race. Native American. An American Indian, Eskimo, Aleut or Native Hawaiian. Minority Business Enterprise. A business concern that is an individual proprietorship, partnership, corporation or joint venture (1) which is at least 51% owned by one or more minorities, or, in the case of a publicly-owned business, at least 51% of the stock of which is owned by one or more minorities, (2) whose management and daily business operations are controlled by one or more minorities who own the business, and (3) with its home office in the United States and which is not a branch or subsidiary of a foreign corporation, firm or other business. Woman Business Enterprise. A business concern that is an individual proprietorship, partnership, corporation or joint venture (1) which is at least 51% owned by one or more women, or, in the case of a publicly-owned business, at least 51% of the stock of which is owned by one or more women, (2) whose management and daily business operations are controlled by one or more women who own the business, and (3) with its home office in the United States and which is not a branch or subsidiary of a foreign corporation, firm or other business.