The total sum of squares is defined as

advertisement

Economics 405

Due—October 16 at 6:30 pm.

Problem Set #2

Instructions: Show all of your work and give complete explanations. As noted on the

course syllabus, the problem set will be graded on a credit/no-credit basis. You

must give a substantive answer to each question/problem. Non-attempts and weak

attempts will be docked accordingly. Group work is discouraged. To the extent

that you do work with a colleague, be absolutely sure to give answers in your own

words. Duplicate answers will automatically be assigned a 0.0.

n

1.

The total sum of squares is defined as SST ( y i y ) 2 .

i 1

a.

n

n

n

i 1

i 1

i 1

Show that SST ( y i yˆ i ) 2 ( yˆ i y ) 2 2 ( y i yˆ i )( yˆ i y ) .

( y y ) ( y yˆ yˆ y ) [( y yˆ ) ( yˆ

{[( y yˆ ) ( yˆ y )] [( y yˆ ) ( yˆ y )]}

{( y yˆ ) ( yˆ y ) 2( y yˆ )( yˆ y )}

2

2

i

i

i

i

i

i

i

i

i

2

i

i

i

i

i

y )] 2

i

2

i

i

i

i

Then applying Property Sum.3 (p.708), we obtain:

n

n

n

i 1

i 1

i 1

SST ( y i yˆ i ) 2 ( yˆ i y ) 2 2 ( y i yˆ i )( yˆ i y )

n

b.

Show that the last term on the right-hand-side of a.), 2 ( y i yˆ i )( yˆ i y ) ,

i 1

equals 0. (Hint: First show that

n

n

i 1

i 1

( yi yˆ i )( yˆ i y ) uˆi (ˆ0 ˆ1 xi y ) , then apply the algebraic

properties of OLS in conjunction with the rules of summation.)

By definition, uˆ i yi yˆ i and yˆ i ˆ0 ˆ1 xi . Substituting the residual

into the expression inside the first set of brackets and the predicted value

of y into the second set of brackets, we get the hint. Therefore:

n

uˆ (ˆ

i 1

i

0

ˆ1 xi y ) {ˆ0 uˆ i ˆ1 xi uˆ i yuˆ i } . Recognizing that

ˆ0 , ˆ1 , and y are constants in a given sample and applying Property

Sum.3, we obtain:

2

n

n

n

i 1

i 1

i 1

{ˆ 0 uˆ i ˆ1 xi uˆ i yuˆ i } ˆ 0 uˆ i ˆ1 xi uˆ i y uˆ i

The sum of the OLS residuals equals zero (see p. 40 of the text), therefore terms 1

n

and 3 must both equal 0. Furthermore,

x uˆ

i 1

i

i

0 follows from the second first-

order-condition for the minimization of SSR (see p. 40 or p. 30), therefore the

second term in the expression above must also equal zero. Thus:

n

2 ( y i yˆ i )( yˆ i y ) 2 0 0 .

i 1

n

2.

The OLS estimator of the slope coefficient is ̂1

(x

i 1

i

n

(x

i 1

n

a.

Show algebraically that ˆ1 1

(x

i 1

i

x )( y i y )

i

x)2

x )u i

SSTx

.

See pp. 53-54 in the text or lecture notes from the second half of class on

September 25.

b.

Using the expression in a.), explain why it is unlikely that ˆ1 1 for a

given sample of data.

There is nothing to force the second element on the right hand side of

n

ˆ1 1

(x

i 1

i

x )u i

to add up to zero. ui is the population error.

SSTx

While on average it is equal to zero, any given value can be positive or

negative. Therefore, over a sample of n observations, the sum of the

product of the mean deviations of the regressor and the population errors

can be positive or negative depending on the sample of data.

c.

Given the Simple Linear Regression Assumptions (SLR.1 – SLR.4), show

that ˆ1 is an unbiased estimator of 1 .

Proof is given in Theorem 2.1 on p. 54 of the text and in the lecture notes

from the second half of class on September 25.

3

d.

Under what circumstances is the zero conditional mean assumption not

valid? If the zero conditional mean assumption is not valid, does that

imply that ˆ1 is a biased estimator of 1 ? Why or why not?

The zero conditional mean assumption is not valid when the covariance

between the regressor and the error is not equal to zero. The error contains

factors that determine the dependent variable which have not been

included in the systematic component of the regression model. To the

extent that any of these factors are correlated with the regressor, the zero

conditional mean assumption will not be valid.

If the zero conditional mean assumption is not valid then, E (u | x) 0 .

As a result,

n

E ( ˆ1 ) 1 (1 / SSTx ) ( xi x )E (u i | x) 1 , since the sum term does

i 1

not equal zero when the zcma is not valid. Specifically, if x and u are

positively correlated, then the products inside the sum will tend to be

positive. Likewise, if correlation between x and u is negative, then the

products inside the sum will tend to be negative.

3.

a.

If the errors, ui, have constant variance regardless of the value of X, then

we say that they are homoskedastic. True or false? Explain and illustrate

with the appropriate graph.

True. By definition, the errors are homoskedastic if Var (u | x) 2 . This

says that the variance of the errors is the same regardless of the value of x.

See Figure 2.8 on p. 58.

b.

If the errors, ui, are heteroskedastic, then the OLS estimators, ̂ 0 and ˆ1 ,

are biased. True or false? Explain.

This statement is false. Unbiasedness of the OLS estimators requires

assumptions SLR.1-SLR.4. The homoskedasticity assumption SLR.5 is

not necessary to show unbiasedness of the OLS estimators.

n

uˆ

4.

i 1

2

i

is a biased estimator of the error variance, Var (u ) . Is this

n

estimator biased in the downward direction or the upward direction? Explain.

The claim was made in class on October 2 (the claim’s proof is part of the proof

Show that

n

of Theorem 2.3 on p. 62 of the text) that E ( uˆ i2 ) (n 2) 2 . Therefore,

i 1

4

n

uˆ

2

i

n2 2

2 . The punch line

n

n

i 1

here is that the sample average of the squared residuals biased in the downward

direction, i.e., it would systematically underestimate the true population variance.

Note that with a small sample, this would be a big problem. For example, n = 3

=> (n-2)/n = 1/3 = .333. With a large sample, there wouldn’t be much bias at all.

For example, n = 1000 => (n-2)/n = .998 1.

E(

5.

i 1

n

) (1 / n) E ( uˆ i2 ) (1 / n)( n 2) 2

I obtained a sample of 88 home prices (measured in thousands of dollars). I

regressed the house sale price (price) on house size (sqrft, measured in hundreds

of square feet, e.g., 2300 hundred square feet implies sqrft = 23.0). Here’s what I

found:

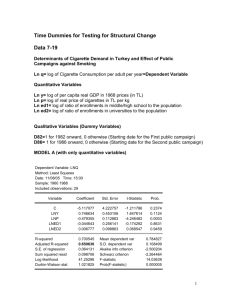

Dependent Variable: PRICE

Method: Least Squares

Sample: 1 88

Included observations: 88

Variable

Coefficient

Std. Error

t-Statistic

Prob.

SQRFT

C

14.02110

11.20414

________

24.74261

0.452828

0.0000

0.6518

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Durbin-Watson stat

a.

0.620797

0.616387

________

348053.4

-489.3087

1.728723

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

F-statistic

Prob(F-statistic)

293.5460

102.7134

11.16611

11.22241

140.7913

0.000000

Write down the fitted model.

^

price 11.204 14.021sqrft

b.

R 2 .621

Determine ̂ . Interpret the value you obtain (be sure to make your

interpretation relative to the standard deviation of the dependent variable).

ˆ

SSR

n2

348053.4

63.617

88 2

The standard deviation of the dependent variable is 102.713, which, for

this sample, implies that the typical amount of deviation from the mean for

a given observation is $102,713 (since the dependent variable is measured

in thousands of dollars). The standard error of the regression, at 63.617,

implies that the typical amount of discrepancy between an observed value

5

and the predicted value based on the regression relationship is $63,617. In

other words, the typical amount of deviation in an observation due to

unobservable factors is $63,617.

c.

It turns out that SSTx 2898.406 . Determine SE ( ˆ1 ) . Interpret the

value you obtain.

SE ( ˆ1 )

ˆ

SSTx

63.617

2898.406

1.182 . The point estimate of 1 is

14.021. The standard error of ˆ1 gives us an idea of how precise the

estimate of the parameter is. The closer the standard error is to 0, the

more precise the estimate. In the problem at hand, we have estimated that

an extra hundred square feet in house size is associated with a $14,021

increase in house price. The standard error of the estimate indicates that

the true impact of a hundred square foot increase in house size on price

could be as much $15,000+ or as little as a bit less than $13,000.

6.

Let ̂ 0 and ˆ1 be the intercept and slope from the simple regression of yi on xi,

~

~

using n observations. Let c1 and c2 , with c2 0 , be constants. Let 0 and 1

be the intercept and slope from the regression of c1 yi on c2 xi .

a.

c

~

~

~

Show that 1 ( 1 ) ˆ1 and 0 c1 ˆ0 . [Hint: To obtain 1 , plug c1 yi

c2

and c2 xi into equation (2.19) from the text. Then, use equation (2.17)

~

~

from the text for 0 , being sure to plug in c1 yi and c2 xi and 1 .]

The formula for the OLS slope coefficient estimator is

( xi x )( yi y ) . In this problem the dependent variable is c y and the

1 i

( xi x ) 2

regressor is c2 xi . Note that the mean of the dependent variable is

c y

i

c1

y

c1 y and, by similar reasoning, the mean of the

n

n

regressor is c2 x . Plugging into the formula for the OLS estimator we get:

1

i

6

~

1

(c x c x )(c y c y ) c c ( x x )( y

(c x c x )

c (x x)

2

i

2

1

1

1 2

2

1 i

i

i

2

2

1

y)

i

i

2

c1c 2

c 22

( x x )( y y )

(x x)

i

i

2

i

c1 ˆ

1

c2

The general formula for the OLS intercept estimator is ˆ0 y ˆ1 x .

Recalling the definitions of the dependent variable and the regressor in the

case at hand and plugging into the general formula, the intercept estimator

is

~

~

0 c1 y 1c2 x c1 y

b.

c1 ˆ

1c2 x c1 y c1 ˆ1 x c1 ( y ˆ1 x ) c1 ˆ0 .

c2

Using the Ceosal1 data from the textbook’s data files, I regressed salary

on roe and obtained

^

salary = 963.19 +18.501roe

R2 = .013

Let c1 = 1000 and c2 = 1/100. What do the results from part a.) imply

regarding the estimated slope and intercept coefficients from a regression

of c1 yi on c2 xi ? With the proposed transformations of x and y, what units

are the variables measured in?

c1 ˆ

1000

) 1 (

)18.501 1,850,100

c2

1 / 100

~

c ˆ 1000 963.19 963,190

~

1 (

0

1

0

Since salary is measured in thousands of dollars, the transformation puts

the dependent variable into dollars. Since roe is measured in percentage

points, the transformation puts the regressor into decimal terms. For

example, if roe = 20.0, then the transformation implies c2xi = .20.

ˆ1 18.501 implies that a 1 percentage point increase in roe raises CEO

~

salary by $18,501. 1 1,850,100 implies that a 1 unit change in c 2 x

raises CEO salary (measured in dollars) by $1,850,000. A 1 unit change

in the transformed regressor, however, is much too large a change to

consider. That would be like going from a return on equity of 20% to

120%! What’s a more reasonable change to look at? A 1 percentage point

change in the transformed regressor would be .01 (e.g., .20 to .21).

Therefore, the predicted increase in salary (measured in dollars) due to a

~

.01 change in c 2 x is c1 y 1 (c 2 x) 1,850,000 .01 $18,500 . If this

looks like the interpretation for ˆ , it should, since they are the same! In

1

7

other words, the transformations employed here do not alter the

fundamental relationship between the dependent and independent

variables.

c.

Use Eviews to actually run the regression of c1 yi on c2 xi proposed in b.

Note that you’ll have to GENR the transformed variables. Attach your

computer output. Does the regression confirm your claim in part b? (It

should.)

Dependent Variable: C1Y

Method: Least Squares

Date: 10/15/07 Time: 06:13

Sample: 1 209

Included observations: 209

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C2X

C

1850119.

963191.3

1112325.

213240.3

1.663290

4.516930

0.0978

0.0000

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Durbin-Watson stat

0.013189

0.008421

1366555.

3.87E+14

-3248.264

2.104990

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

F-statistic

Prob(F-statistic)

1281120.

1372345.

31.10301

31.13499

2.766532

0.097768

The claims in b.) are confirmed.

d.

Compare the R2 of the new regression with the original regression. Which

is greater? Explain.

The R2s of the two regression are the same. This shows that changing the

definitions of the dependent and independent variables by linear

transformation has no impact on the goodness of fit of the model. The

underlying amount of variation in the dependent variable explained by

variation in the regressor remains constant.

7.

Use Eviews to access Wage2 from the textbook’s data files. The variables of

interest are monthly salary (wage) and IQ score (IQ).

8

a.

Use EViews to generate the descriptive statistics table for wage and IQ.

Attach the printout. What are average wage and average IQ in the

sample? What is the sample standard deviation of IQ?

Date: 10/15/07

Time: 06:24

Sample: 1 460

b.

WAGE

IQ

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

1005.246

960.0000

3078.000

233.0000

409.6735

1.316589

6.029875

104.7196

106.0000

145.0000

59.00000

13.82357

-0.295697

2.884268

Jarque-Bera

Probability

308.8473

0.000000

6.960182

0.030805

Observations

460

460

Estimate a level-level model with wage as the dependent variable and IQ

as the regressor. Use your estimated model to determine the predicted

increase in wage for a 15 point increase in IQ. Does IQ account for most

of the variation in wage? Explain.

Dependent Variable: WAGE

Method: Least Squares

Date: 10/15/07 Time: 06:27

Sample: 1 460

Included observations: 460

Variable

Coefficient

Std. Error

t-Statistic

Prob.

IQ

C

8.096739

157.3586

1.332109

140.7054

6.078137

1.118355

0.0000

0.2640

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Durbin-Watson stat

0.074642

0.072622

394.5175

71284974

-3401.435

1.794438

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

F-statistic

Prob(F-statistic)

1005.246

409.6735

14.79754

14.81550

36.94375

0.000000

The fitted model is:

waˆge 157.36 8.097 IQ

R 2 .075

waˆge ˆ1 IQ 8.097 15 121.45 . A 15 point increase in IQ raises

predicted monthly earnings by $121.45. Since R 2 .075 , variation in IQ

scores does not account for much variation in monthly earnings.

9

c.

GENR a new variable that gives the logarithm of wage. Call this new

variable logwage. (Note I want you to perform this step despite the fact

that the data file already contains the logarithm of wage (lwage)). Attach

the descriptive statistics table for logwage.

Date: 10/15/07

Time: 06:47

Sample: 1 460

LOGWAGE

WAGE

6.835596

6.866931

8.032035

5.451038

0.396488

-0.138713

3.399628

1005.246

960.0000

3078.000

233.0000

409.6735

1.316589

6.029875

Jarque-Bera

Probability

4.536122

0.103513

308.8473

0.000000

Observations

460

460

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

d.

Estimate a log-level model, using logwage as the dependent variable and

IQ as the regressor. Attach the printout and write down the fitted model.

If IQ increases by 15 points, what is the approximate percentage increase

in predicted wage? Explain.

Dependent Variable: LOGWAGE

Method: Least Squares

Date: 10/15/07 Time: 06:50

Sample: 1 460

Included observations: 460

Variable

Coefficient

Std. Error

t-Statistic

Prob.

IQ

C

0.007968

6.001208

0.001287

0.135991

6.188747

44.12959

0.0000

0.0000

R-squared

Adjusted R-squared

S.E. of regression

Sum squared resid

Log likelihood

Durbin-Watson stat

0.077172

0.075157

0.381298

66.58771

-208.1892

1.795664

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

F-statistic

Prob(F-statistic)

6.835596

0.396488

0.913866

0.931828

38.30059

0.000000

^

The fitted model is: log wage 6.001 0.00797 IQ

R 2 .077

10

In a log-level model, the percent change in the dependent variable due to a

1-unit change in the regressor is 100 ˆ1 . Therefore, the regression model

here implies that monthly earnings increase by .797% for a 1 point

increase in IQ. Accordingly, a 15 point increase in IQ is predicted to

increase earnings by .797% 15 11.95% (i.e., 100ˆ1 IQ %wage ).