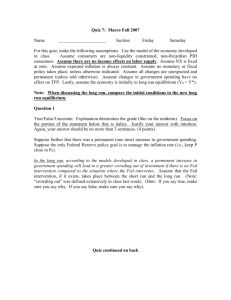

Economics 502 - The Ohio State University

advertisement

Professor S. McCafferty Practice Problems II Solutions 1. Assume the following Balance of Payments statistics for a hypothetical country: Current Account Net Exports Exports Merchandise Services Imports Merchandise Services Net Income from Assets Income Receipts on Investments Income Payments on Investments Net Unilateral Transfers 60 40 20 -40 -35 -5 Capital and Financial Account Increase in U.S.-owned Assets Abroad U. S. Official Reserve Assets Other U.S. Assets Increase in Foreign-owned Assets in U.S. Foreign Official Assets Other Foreign Assets Statistical Discrepancy a.) Calculate the Merchandise Trade Balance. Merchandise Exports - Merchandise Imports = 40 - 35 = 5 b.) Calculate Net Exports. NX = Exports - Imports = 60 - 40 = 5 a.) Calculate the Official Settlements Balance. OSB = Increase in U.S. official reserve assets - increase in foreign reserve assets = -5 - 0 = -5 10 -5 -5 5 -40 0 10 ? 2 d.) Calculate the Capital Account Balance. KFA= 5 - 40 + 0 + 10 = -25 e.) Calculate the Statistical Discrepancy. SD = -(CA + KFA) = -(20 - 25) = 5 2. For this problem, assume that the domestic price level is equal to $12 and that the foreign price level is equal to £ 2.00 (£ is the symbol for British Pounds, the U.K. currency). Also assume, for parts a, that the real exchange rate is equal to 1.5. a.) Calculate the nominal exchange rate of the dollar with respect to the British Pound. Show your calculation. e enom P P enom e For PFor P enom (1.5) £2.0 £ 0.25 $12 $ b.) Suppose that the U.S. and British price levels remain constant. What nominal exchange rate between the U.S. dollar and the British Pound would correspond to Purchasing Power Parity? Explain briefly. e 1 e nom (1.0) £2.0 £ 0.167 $12 $ 3 3. For this problem, assume that the United States is a large open economy. Also assume that U.S. and Rest of the World assets are perfect substitutes. a.) In the graphs below, show the effects of a temporary increase in U.S. government spending. Does this disturbance move the domestic (U.S.) economy in the direction of a current account deficit or surplus? What are the effects on domestic saving and investment? r r SUd .S . d S ROW r1w r0w r0w I Ud .S . d I ROW S, I United States CA moves into deficit. U.S. Savings and Investment both decline. S, I Rest of the World 4 b.) In the graph below, show the effect of this disturbance (the temporary increase in U.S. government spending) on the U.S. real exchange rate. Does the real exchange rate appreciate or depreciate? Explain briefly. e: U.S. Real Exchange Rate NCO: Dollar Supply e1 e0 NX: Dollar Demand The U.S. Real Exchange Rate appreciates. 4. For this question, assume that real money demand is given by: L Y . i Also suppose that real income is equal to 1,000, the real rate of interest is equal to 1%, the expected rate of inflation is zero, and the nominal money supply is 20,000. a.) Calculate the equilibrium price level. P M 20,000 20,000 2. L 1,000 10,000 0.01 b.) Now suppose that the nominal money supply rises to 40,000, but that the expected rate of inflation remains equal to zero. What is the new equilibrium price level? Explain briefly. P M 40,000 40,000 4 L 1,000 10,000 0.01 5 c.) Suppose instead that the nominal money supply remains equal to 20,000, but that the expected rate of inflation rises to 3%. What is the new equilibrium price level? Explain briefly. P M 20,000 20,000 4 L 1,000 1,000 0.2 0.01 0.03 5. Assume that the real money demand is given by: L 0.2 Y 1000 (r e ) Also suppose that real income is equal to 1000 and that growth in real income is zero. Assume that the real interest rate is constant at 10%. Finally suppose that the nominal money supply is currently 100 and that it is expected to grow at 5% per year. a.) If the public fully understands that the inflation process is generated by equality of money supply and money demand, what is the likely value for the expected rate of inflation in this case? e P M Y Y 5% 0% 5% P M Y It is therefore reasonable to assume that if the public understands the inflation process, they will expect inflation equal to 5% per year. Therefore, e 5% . b.) Calculate real money demand in this economy. Md L 0.2 1,000 1,0000.10 0.05 50 P c.) If the money market is in equilibrium in this economy, what is the current price level? P M 100 2 L 50 6 d.) Suppose that the government announces that the growth rate of the money supply is permanently falling to 0%. Further assume that everyone believes this announcement. What is the new equilibrium price level, immediately after the announcement? P M Y Y 0% 0% 0% P M Y L 0.2 1,000 1,000 0.10 100 e P M 100 1 L 100 6. Assume that real money demand is given by: L 1000 0.25Y 10,000i. Also suppose that real income is equal to 4,000, the nominal rate of interest is equal to 10%, and that the price level is 2. Finally, assume that total wealth in the economy is equal to 10,000. a.) Calculate real money demand. L 1,000 0.254,000 10,0000.10 1,000 b.) Calculate nominal money demand. Md Md P L P 1,0002 2,000 P c.) Calculate the velocity of money in this economy. V PY 24,000 8,000 4 M 2,000 2,000 d.) Calculate the nominal demand for non-monetary assets in this economy. NM d Wealth M d 10,000 2,000 8,000 7 7. Assume that the real money demand is given by: L 0.25Y r e Also suppose that real income is equal to 200 and that growth in real income is zero. Assume that the real interest rate is constant at 15%. Finally suppose that the nominal money supply is currently 500 and that it is expected to grow at 5% per year. a.) If the public fully understands that the inflation process is generated by equality of money supply and money demand, what is the likely value for the expected rate of inflation in this case? e P M Y Y 5% 0% 5% P M Y b.) Calculate real money demand in this economy. L 0.25200 50 250 0.15 0.05 0.2 c.) If the money market is in equilibrium in this economy, what is the current price level? P M 500 2 L 250 d.) Suppose that the government announces that the growth rate of the money supply is permanently rising to 10%. Further assume that everyone believes this announcement. What is the new equilibrium price level, immediately after the announcement? P M Y Y 10% 0% 0.10 P M Y 0.25200 50 200 L 0.15 0.10 0.25 M 500 P 2.5 L 200 e 8 8. Use a copy of the diagram below to demonstrate the effects of the following disturbances on the equilibrium price level as predicted by the classical model. a.) A permanent, favorable supply shock. Permanent Increase in A Y and r 0 L P P M PL(Y, r + e, im) P M, Md 9 b.) An increase in expected inflation. e r e L P P M PL(Y, r + e, im) P M, Md 10 c.) A reduction in the money supply. M P P M PL(Y, r + e, im) P M, Md d.) An increase in the interest rate paid on money. i m L P : same as in part (a). 11 9. For each of the following, identify whether the variable in question is procyclical (P), countercyclical (C), or acyclical (A). Also indicate by 'Yes' if there is a significant difference of opinion on any of the cyclical properties and 'No' if there is none. Variable Government Spending Consumption Investment Nominal Interest Rate Real Wages Productivity Real Interest Rate Money Growth Unemployment Inflation Cyclical Behavior P Controversy? No P P P No No No P P A or P P C P or C No No Yes No No Yes 10. For the purposes of this question, assume that a typical business cycle contraction includes all of the following phenomena: 1.) 2.) 3.) 4.) 5.) 6.) 7.) Reduced Real Output Reduced Consumption Reduced Investment Reduced Real Interest Rate Reduced Employment of Labor Services Reduced Real Wage Rate Reduced Average Labor Productivity Assume a standard classical macroeconomic model in which there is complete information. Can a temporary reduction in total factor productivity, A, explain all of these phenomena? Answer YES or NO. Carefully explain which (if any) of the above phenomena this kind of shock CANNOT explain. Use the diagrams provided. In answering this question assume that the nominal money supply is fixed. Answer: NO Reduced Real Interest Rate Cannot be Explained 12 w NS w1 w2 ND N N 2 N1 Y Y1 Y A F (K , N ) Y2 (Y1 / N1 ) (Y2 / N 2 ) N N 2 N1 r Sd r2 r1 Id I 2 S2 I 1 S1 I, S