Week 9 Practice Quiz b

advertisement

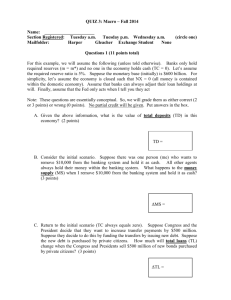

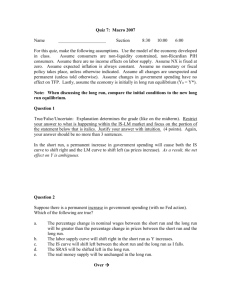

Quiz 7: Macro Fall 2007 Name _____________________ Section Friday Saturday For this quiz, make the following assumptions. Use the model of the economy developed in class. Assume consumers are non-liquidity constrained, non-Ricardian PIH consumers. Assume there are no income effects on labor supply. Assume NX is fixed at zero. Assume expected inflation is always constant. Assume no monetary or fiscal policy takes place, unless otherwise indicated. Assume all changes are unexpected and permanent (unless told otherwise). Assume changes in government spending have no effect on TFP. Lastly, assume the economy is initially in long run equilibrium (Y0 = Y*). Note: When discussing the long run, compare the initial conditions to the new long run equilibrium. Question 1 True/False/Uncertain: Explanation determines the grade (like on the midterm). Focus on the portion of the statement below that is italics. Justify your answer with intuition. Again, your answer should be no more than 3 sentences. (4 points) Suppose further that there was a permanent (one time) increase in government spending. Suppose the only Federal Reserve policy goal is to manage the inflation rate (i.e., keep P close to P0). In the long run, according to the models developed in class, a permanent increase in government spending will lead to a greater crowding out of investment if there is no Fed intervention compared to the situation where the Fed intervenes. Assume that the Fed intervention, if it exists, takes place between the short run and the long run. (Note: “crowding out” was defined extensively in class last week). (Hint: If you say true, make sure you say why. If you say false, make sure you say why). Quiz continued on back As always, for questions 2-4, circle the true answers. The question stems may have more than one true answer (or no true answers). Question 2 Suppose that the central bank conducts a one-time permanent increase in the nominal money supply (from M0 to M1). Which of the following are definitely true? (4 points) a. b. c. d. In the short run, the percentage increase in the nominal money supply will be greater than the percentage increase in the price level. In the long run, the percentage increase in the nominal wage will be greater than the percentage increase in the nominal money supply. In the short run, the percentage increase in the price level will be greater than the percentage increase in the nominal wage. In the long run, the percentage increase in the price level will be greater than the percentage increase in the nominal money supply. Question 3 Suppose there is a permanent increase in government spending (with no Fed intervention). Which of the following are definitely true? (6 points) a. b. c. d. e. f. Between the short run and the long run, both consumption and investment will fall. The labor supply curve will shift right in the short run. The LM curve will shift right in the short run. The SRAS will be shifted left in the long run. The real money supply will be unchanged in the long run. Nominal wages will increase in the short run. Question 4 Suppose there is a permanent decline in consumer confidence. Assume that this decline in consumer confidence was only a change in expectations. In other words, the change is not associated with any actual change in TFP (i.e., TFP is held constant). Instead of having the economy correct itself, suppose the Fed intervenes in the short run to return the economy to its original level of output. If the Fed intervenes, which of the following are true? (Assume that the Fed intervention takes place after the short run). (6 points) a. b. c. d. e. f. Total investment will be unchanged in the long run. The real money supply will fall in the long run. Government deficits will increase in the long run. The labor demand curve will shift left in the short run. The IS curve will shift right between the short run and the long run. Prices will increase in the long run.