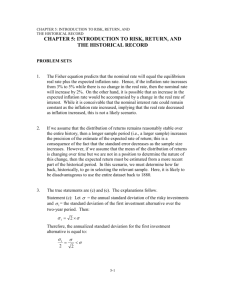

Chap005 - revised

advertisement

CHAPTER 5

Learning About

Return and Risk

from the

Historical Record

Factors Influencing Rates

• Supply

– Households

• Demand

– Businesses

• Government’s Net Supply and/or Demand

– Federal Reserve Actions

5-2

Figure 5.1 Determination of the

Equilibrium Real Rate of Interest

5-3

Equilibrium Nominal Rate of Interest

• As the inflation rate increases, investors will

demand higher nominal rates of return

• If E(i) denotes current expectations of

inflation, then we get the Fisher Equation:

R r E (i)

5-4

Taxes and the Real Rate of Interest

• Tax liabilities are based on nominal income

– Given a tax rate (t), nominal interest rate

(R), after-tax interest rate is R(1-t)

– Real after-tax rate is:

R(1 t ) i (r i)(1 t ) i r (1 t ) it

5-5

Comparing Rates of Return for Different

Holding Periods

Zero Coupon Bond

100

rf (T )

1

P(T )

5-6

Formula for EARs and APRs

1

EAR {1 r f (T ) }T 1

1

(1

EAR

)

APR

T

T

5-7

Bills and Inflation, 1926-2005

• Entire post-1926 history of annual rates:

– www.mhhe.com/bkm

• Average real rate of return on T-bills for the

entire period was 0.72 percent

• Real rates are larger in late periods

5-8

Table 5.2 History of T-bill Rates, Inflation

and Real Rates for Generations, 1926-2005

5-9

Figure 5.2 Interest Rates and Inflation,

1926-2005

5-10

Figure 5.3 Nominal and Real Wealth

Indexes for Investment in Treasury Bills,

1966-2005

5-11

Risk and Risk Premiums

Rates of Return: Single Period

P

1 P0 D1

HPR

P0

HPR = Holding Period Return

P0 = Beginning price

P1 = Ending price

D1 = Dividend during period one

5-12

Rates of Return: Single Period Example

Ending Price =

Beginning Price =

Dividend =

48

40

2

HPR = (48 - 40 + 2 )/ (40) = 25%

5-13

Expected Return and Standard Deviation

Expected returns

E (r ) p ( s )r ( s )

s

p(s) = probability of a state

r(s) = return if a state occurs

s = state

5-14

Scenario Returns: Example

State

1

2

3

4

5

Prob. of State

.1

.2

.4

.2

.1

r in State

-.05

.05

.15

.25

.35

E(r) = (.1)(-.05) + (.2)(.05)… + (.1)(.35)

E(r) = .15

5-15

Variance or Dispersion of Returns

Variance:

p( s ) r ( s ) E (r )

2

2

s

Standard deviation = [variance]1/2

Using Our Example:

Var =[(.1)(-.05-.15)2+(.2)(.05- .15)2…+ .1(.35-.15)2]

Var= .01199

S.D.= [ .01199] 1/2 = .1095

5-16

Time Series Analysis of Past Rates of

Return

Expected Returns and

the Arithmetic Average

1 n

E (r ) s 1 p( s)r ( s) s 1 r ( s )

n

n

5-17

Geometric Average Return

TV

n

(1 r1 )(1 r2 ) x

x (1 rn )

TV = Terminal Value of the

Investment

g TV

1/ n

1

g= geometric average

rate of return

5-18

Variance and Standard Deviation

Formulas

• Variance = expected value of squared

deviations

2

n

1

2

r ( s) r

n s 1

• When eliminating the bias, Variance and

Standard Deviation become:

n

1

r (s) r

n 1 j 1

2

5-19

The Reward-to-Volatility (Sharpe) Ratio

Risk Premium

Sharpe Ratio for Portfolios =

SD of Excess Return

5-20

Figure 5.4 The Normal Distribution

5-21

Figure 5.6 Frequency Distributions of

Rates of Return for 1926-2005

5-22

Table 5.3 History of Rates of Returns of Asset

Classes for Generations, 1926- 2005

5-23

Table 5.4 History of Excess Returns of Asset

Classes for Generations, 1926- 2005

5-24

Figure 5.7 Nominal and Real Equity

Returns Around the World, 1900-2000

5-25

Figure 5.8 Standard Deviations of Real Equity

and Bond Returns Around the World, 1900-2000

5-26