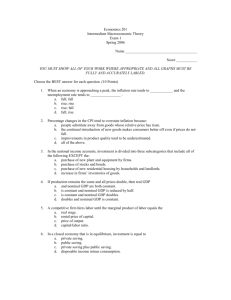

Due Date: Thursday, September 8th (at the beginning of class)

advertisement

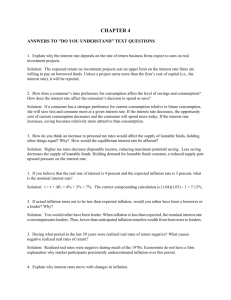

Problem Set 3

FE312 Fall 2007

Rahman

Partial Ans Key

Disclaimer: Note that for problems 6 and 8, YOU REALLY NEED TO USE THE

GRAPHS OF CHAPTER 5 TO ANSWER THE QUESTIONS. These I do not illustrate,

for brevity’s sake (O.K., I’m lazy), but make sure that you can.

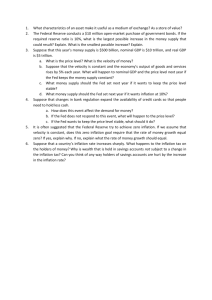

1) Suppose that real money demand is represented by the equation (M/P)d = 0.25*Y.

Use the quantity equation to calculate the income velocity of money.

V = 4.

2) Assume that the demand for real money is (M/P)d = 0.6*Y – 100i, where Y is national

income and i is the nominal interest rate. The real interest rate r is fixed at 3 percent by

the investment and saving functions. The expected inflation rate equals the rate of

nominal money growth.

a) If Y is 1000, M is 100, and the growth rate of nominal money is 1%, what must i

and P be?

i = 4%, P = ½.

b) If Y is 1000, M is 100, and the growth rate of nominal money is 2%, what must i

and P be?

i = 5%, P = 1.

3) Econoland finances government expenditures with an inflation tax.

a) Explain who pays the tax and how it is paid.

Holders of money pay the inflation tax as the purchasing power of their money

holdings declines as a result of inflation generated when the government prints

more money.

b) What are the costs from this tax?

The inflation tax rate is the rate of inflation. If the inflation (tax) rate is expected,

then the costs of expected inflation include shoeleather costs, menu costs, the

costs of relative price variability, tax distortions, and the inconvenience of making

inflation corrections.

Page 1 of 4

Problem Set 3

FE312 Fall 2007

Rahman

4) A macroeconomist threatens to call the Secret Service to have Mr. Biggy Rich

arrested for counterfeiting because Mr. Rich claims he “makes a lot of money.”

a) Explain why the macroeconomist is making this threat based on the

macroeconomic definition of money. Be sure to explain the macroeconomic

functions of money.

Money consists of the assets used to make transactions. Money serves as a store of

value, unit of account, and medium of exchange. In most fiat money economies, the

government maintains a monopoly over the supply of money. If Mr. Rich is “making

money,” i.e., increasing the supply of money, this counterfeiting, which is totally

illegal.

b) Suggest an alternative phrase that Mr. Rich can use that will not result in a charge

of counterfeiting.

Mr. Rich could say he “earns a lot of income,” “has a lot of wealth/money,” “makes

big profits,” etc.

5) Imagine that you are the chairman of the Federal Reserve. Assume, further, that the

money supply has been growing at 3 % per year. You have been called before Congress

to testify about the long-run effects of increasing the growth of the money supply to 10 %

per year. State and then explain the long-run effects of this change on each of the

following (give numerical estimates when possible):

a) the annual rate of inflation

According to the quantity equation: MV = PY

Taking percentage changes of both sides yield:

%ΔM + %ΔV = %ΔP +%ΔY

3% + 0% = 3%

IF WE ASSUME that in the long run, %ΔY = 3%, π = 0%

If MS grows at 10%, π = 10% - 3% = 7%. Inflation rises by 7%.

b) the real interest rate

Real interest rate remains unchanged.

c) the nominal interest rate

i = r + π. Nominal rates rise by 7%.

d) the real exchange rate

By classical dichotomy or PPP, real exchange rate remains unchanged.

Page 2 of 4

Problem Set 3

FE312 Fall 2007

Rahman

e) the nominal exchange rate

%Δε = %Δe + %ΔP - %ΔP*

Since foreign inflation remains unchanged, U.S. nominal exchange rate drops

by 7%.

f) investment (ignore both taxes and uncertainty)

Investment is a function of r, so investment is unchanged.

g) real GDP

Y = C + I + G. Output will not be affected.

6) Using the saving and investment graphs for the small open economy,

begin with a small trade deficit (S less that I at the global real interest

rate r*) and trace through the impact of the following:

a) Cut in taxes {S shifts left, widens the deficit.}

b) Rise in the marginal propensity to consume (MPC) {same as a}

c) Fall in the demand for domestic investment {Investment curve shifts inward, lowers

the deficit}

d) A cut in the taxes of the major economies in the rest of the world {raises r*, lowers

the deficit}

7) Consider an economy described by the following equations:

Y = C + I + G + NX

Y = 5000

G = 1000

T = 1000

C = 250 + 0.75(Y-T)

I = 1000 – 50r

NX = 500 - 500ε (ε is the real exchange rate)

r = r* = 5

a) In this economy, solve for national savings, investment, the trade balance, and the

equilibrium exchange rate.

Page 3 of 4

Problem Set 3

FE312 Fall 2007

Rahman

S = I = 750. NX = 0. ε = 1

b) Suppose now that G rises to 1250. Solve for national saving, investment, the trade

balance, and the equilibrium exchange rate. Explain what you find.

S = 500. I = 750. NX = -250. ε = 1.5

c) Now suppose that the world interest rate rises from 5 to 10 percent (G is again 1000).

Solve for national saving, investment, the trade balance, and the equilibrium exchange

rate. Explain what you find.

S = 750. I = 500. NX = 250. ε = 0.5

8) Suppose that some foreign countries begin to subsidize investment by institution an

investment tax credit.

a) What happens to world investment demand as a function of the world interest rate?

Rises.

b) What happens to the world interest rate?

Rises.

c) What happens to investment in our small open economy?

Falls.

d) What happens to our trade balance?

Rises.

e) What happens to our real exchange rate?

Falls.

Page 4 of 4